Starting an investment plan doesn’t have to be intimidating if you follow these top ten investing basics for new investors

Having worked in investment analysis for nearly a decade, I forget sometimes how intimidating it can be for new investors to get started. Getting started investing is probably the most frequent question I get from readers and one of the most popular on social media.

Why is it so difficult for new investors to get started? Because there is just too much information on the ‘net about investing and not all of it is good.

We recently covered the top 10 investing myths in a prior post, the ten biggest mistakes that even experienced investors make because of errors in the ‘popular’ wisdom. With all the misinformation along with someone screaming out at you from the TV about which stocks to buy, a lot of new investors throw up their hands and give up.

The good news is that investing basics, and getting started investing, is actually pretty easy. Sure, you can spend countless hours pouring over financial statements and analysis but the truth is that you really don’t need to do so in order to meet your financial goals.

Investing can be as simple as you make it and getting started with the ten investing basics below will put you on the right track as a new investor.

Investing Basics #1: Understand what Investing is All About

The most important thing to remember about investing is to understand what investing actually is…and what it is not.

Investing is not gambling and it is not about picking winning stocks that will make you rich. Yeah, sorry about that but it’s a truth that the industry doesn’t want you to know. You see, if investing were about taking huge risks for huge payoffs then you would be glued to every word uttered on TV or online – and that would be worth billions in advertising dollars for the content providers.

Investing is about making money on your money, usually excruciatingly slowly. It is about, instead of spending all your money or taking out loans, buying an asset that will be worth more in the future.

As a stock owner, you actually own a piece of the company. Next time you hear someone on TV shout out about a high-flying stock or a company in a dying industry that might rebound, ask yourself two questions:

- Do I really want to be an OWNER of that company? Is it a company that will be around forever or is it just a fad?

- Does the investing idea sound like a ‘bet’ that the stock will jump or is it based on the idea that the company has solid long-term potential?

Investing Basics #2: TV Pundits and Analysts are NOT there to Make you Money

This is a tough one because I provide investment advice and don’t want to seem hypocritical. There is good investment advice to be found on TV and online but the vast majority of it is there for one purpose… to draw viewers and readers.

Why? Because viewers and readers are worth advertising dollars. That in itself is not a bad thing, providing investment ideas so that people will visit your blog or channel. The problem is the extreme to which many blogs and TV stations have taken it. The line between investing and entertainment has blurred so much that it’s difficult to see the difference anymore.

One successful money manager on TV has been reduced to screaming, leaning on buttons that make all kinds of noises, and throwing things at the camera just to keep his audience entertained.

[linkad]

It’s not investing, it’s an annoying morning radio show.

Sure, it’s a happy coincidence if you make money on their investing ideas but their goal is to be entertaining and persuasive.

It’s ok to check out some ideas in the financial press and on investing websites but before you click that ‘buy’ button on your investment account:

- Does this investment fit with YOUR personal investment plan and tolerance for risk?

- Have you looked at the long-term potential for the stock or are you solely going off the advice of the analyst?

Investing Basics #3: Investing is all about YOU

One of the biggest things missing from the TV stock recommendations is one of the most important in investing…you!

Your investment plan is about your goals and the risk you’ll need to take to earn a return on your money. The problem with following investment advice is that it doesn’t take into account if the advice fits with your plan.

We talked about creating a personal investment plan in an earlier post. With this plan, you’re going to look at how much you need to meet your financial goals and what kind of risk you are able to take. Not making a personal investment plan is like going on a road trip without knowing the destination or how to get there.

Once you have an investment plan based on your needs, it becomes pretty easy to sort through all the stock advice because it’s clearer whether the investment is right for you. You’ll trade in and out of stocks less frequently and save a ton of money in fees.

Investing Basics #4: Diversification isn’t just something you Talk about

Diversification is your number one tool in meeting your investment goals. It’s one of the most talked about ideas in investing but few investors actually do it correctly.

Investment diversification is about owning a wide range of asset classes (stocks, bonds, real estate) and different investments within each asset class. Stocks, bonds and real estate all offer different benefits and react differently to economic factors. Within the asset classes, different investments in sectors like energy or consumer goods offer different benefits as well.

The idea in investment diversification is that, if stocks were to take a tumble, your bond investments would be there to smooth out your total portfolio return. If energy prices dropped, taking stocks of energy companies lower, then your stocks of consumer goods companies might do well.

Everyone talks about diversification but greed and blind hope keep most people almost entirely invested in stocks. The average investor holds just 15% of their portfolio in bonds. The fact that older investors hold a much larger percentage in bonds leads me to believe that most younger and new investors hold next to nothing in fixed income investments.

Holding a diversified portfolio is one reason why real investors don’t have to worry about the next stock market crash. Spread your investments across different asset classes and ideas for truly stress-free investing.

Investing Basics #5: If you can’t beat them, join them

Investors and the financial press talk so much about ‘beating’ the market that new investors take the goal as a given. Everyone is trying to earn returns above that of the general market…and few are actually able to do so.

The first problem here is that investing isn’t even about ‘beating’ the market. It’s about earning the return you need to meet your financial goals, whether that return is above or below the market return.

The second problem is that constantly trying to beat the market has most investors trading in and out of stocks, paying huge fees and losing money over the long-run.

Do yourself a favor though and make investing easy! Invest the majority of your stock allocation in market-diversified exchange traded funds (ETFs). These are funds that hold a collection of stocks and provide diversification across the entire group with just one purchase.

Some of my favorite ETFs include:

- SPDR S&P 500 (SPY) – holds the stocks in the S&P 500

- iShares MSCI Emerging Markets (EEM) – holds stocks of companies based in developing countries

- iShares Russell 2000 (IWM) – holds stocks of smaller companies

- Vanguard FTSE Europe (VGK) holds stocks of European companies

Just these four funds are going to give you diversification across large and small companies as well as international diversification and exposure to emerging market growth.

Investing Basics #6: How Many Stocks is Too Many?

One of the problems with constantly watching the financial media is that an investor can pick up ten great stock ‘ideas’ every day. They end up spending hours analyzing each and a portfolio of hundreds of individual stocks.

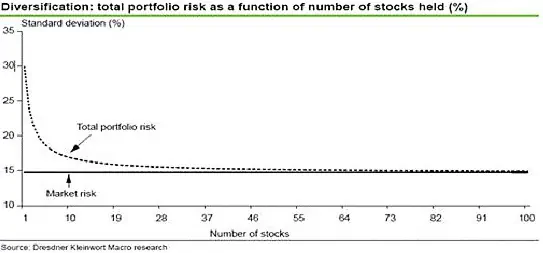

You really don’t need that many stocks to diversify your portfolio and buying into that many stocks means your best returns are going to be averaged out by the bad investments. Research by Dresdner Kleinwort found that the risk in a portfolio matched the market risk after about 30 stocks.

What does this mean? Holding a large portion in a few ETFs will give you exposure to hundreds of companies and all the diversification you need. Use the rest of your portfolio, say around 35%, to invest in ten individual companies. Limiting yourself to ten individual stocks will mean picking only those with the most potential over the long-run.

Investing Rule #7: Don’t Supersize your Portfolio

Nearly all brokers or stock investing websites will offer accounts on margin. Margin is just borrowing money to invest more than your portfolio value. If you have $100 in the account, you might be able to buy three times that in stocks.

Investors are tempted by the upside potential on margin investing. A 5% return on your $100 means an extra $5 at the end of the period. That same 5% return on your $100 and $200 in borrowed money means an extra $15 at the end of the period.

Don’t do it! Just don’t!

Investing on margin works the other way as well. That relatively minor 5% loss when the market hits a weak patch becomes a much bigger loss when you’re using margin. When the stock market lost 50% of its value over the 17 months to March 2009, someone trading on margin would have easily lost everything.

Those borrowed funds aren’t free either. Stock trading sites will charge upwards of 8% or more a year in interest fees, eating away at any gains you make during good times and amplifying your losses during bad times.

Resist the temptation to buy on borrowed money. It’s gambling and that’s not what investing is about.

Investing Basics #8: Go West young man…Way West!

We’ve already hit on the idea of diversification but even the most diversified stock investors still fall short in one category, investment in international companies.

While the United States used to be the engine of global economic growth, today the U.S. accounts for just a fifth of the global economy. This fact seems to be lost on investors that have an average of 85% of their investments in companies based here in the red, white and blue.

Sure, U.S. companies get about a third of their sales from customers in other countries so you are getting some international diversification by investing in large American firms. The fact is, there are other reasons to invest in international companies and you need more diversification than that provided by foreign sales to U.S. companies.

- Business cycles don’t match up from country to country so international diversification means you benefit from growth in one country when others might be slowing

- Stocks of foreign companies are not as popular with investors so prices are not usually as expensive as those of U.S. companies

Investing Basics #9: Easy does it

Too many new investors get excited about investing and put every spare penny into the account. They end up putting more in investments than they can afford and need to withdraw money to pay for other expenses.

This sets up the idea that it’s easy and ok to regularly sell investments and withdraw money, an idea that will cost you big time over the long-run.

Just as bad, new investors get excited about the idea of making lots of money on their investments and hover over the computer screen watching daily fluctuations. The euphoria of seeing a percent or two gain in one day leads to depression when stocks decline on another day.

All this just distracts the new investor from their long-term investing goals. A lot of new investors end up getting discouraged or burn out on investing, withdrawing all their money and closing the account.

- Deposit only as much in your investing account as you can have locked away for a very long time. A good place to start is between 5% and 10% of your overall budget but your own needs will dictate how much you save.

- Understand that investing is about long-term (greater than five years) goals and that weekly, monthly or even yearly results may not mean much. Watching your investments on a daily or weekly basis is way more stress than you need.

Investing Basics #10: It’s about What you Put In

Returns are great and a big chunk over a lifetime of investing, but investing is just as much about what you put in as well.

To be truly successful and reach your financial goals, you need a plan for regular deposits into your investment account. Putting money in every once in a while or just when stocks are going up isn’t going to cut it.

That’s because a big portion of your overall portfolio is going to be the deposits you make.

In fact, on a regular basis of deposits and a 7% annual return, it’s not until the 20th year that your earnings amount to more than your deposits. Even after 30 years, deposits account for nearly a third of the overall portfolio value.

Investing is a lot better than a savings account but it is still about regularly putting more money to work. Build regular deposits into your budget and watch your wealth grow steadily over decades.

Investing isn’t really that complicated and these ten investing basics are all you need to make you a successful investor. Focus on these ten and don’t make investing more complicated than it needs to be. I’d love to hear how keeping a simple investing strategy and investing basics have helped you invest and succeed. Leave your comments below or email me to share with the community.