Don’t let a financial emergency derail your long-term plans, follow these ideas to avoid falling behind

You’ve spent years skimping and saving, investing for the future, and learning to be financially responsible. You work hard at work and even harder to secure a better financial future. Then, the worst happens. A financial emergency strikes, and you’re wiped out.

It’s not that uncommon of a story and sets too many good people back to zero, some without enough time to build their finances before retirement. A few of these financial emergencies hit nearly everyone at some point in their lives. You might not be able to avoid them, but read on, and you might be able to stop a financial emergency from being a financial ruin.

Financial Emergency #1: Losing your job

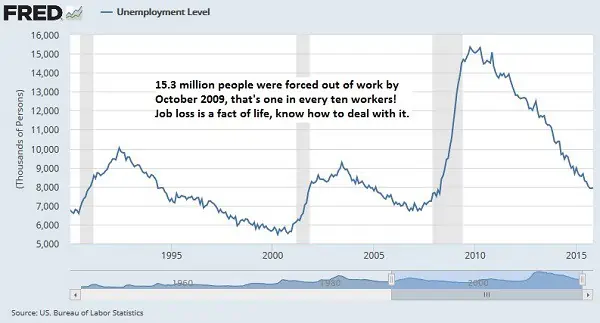

The sudden loss of your job is the most common financial emergency. An average of 55,939 people were laid off or fired every day in 2014; that’s more than 20 million people over the year. No matter how careful you are at your company or how well you do your job, there are many factors which you have no control over. Any of these factors can cause unexpected disruption or the loss of your job. It’s an excellent idea to be prepared for such circumstances, even if you believe you’re in no immediate danger and your company is in sound financial health.

The rule used to be to have three months’ worth of living expenses in a financial emergency account. This includes money for rent or mortgage payments, utility bills, and anything else you can’t live without. After what we saw in the Great Recession, where people were out of work for much longer than usual, you might want to consider having six months’ worth of expenses in your financial emergency account. Finding a new job takes time, even if you have an excellent track record and an impeccable background. Try to calculate how long it might take to find a new job in such a circumstance and what you could do for money in the meantime.

Financial Emergency #2: Death in the family

No one can ever be fully prepared for accidents or circumstances that might lead to the sudden death of a close relative. Have you ever considered what you would do in the event of the death of someone in your family? What would your family do if they lost you?

Beyond emotional pain, have you considered what economic responsibilities you might leave behind? Beyond possibly being expected to cover debts or caring for additional relatives, there are possible immediate costs such as funeral expenses, burial expenses, probate settlement charges, and other outlays. For most people, insurance policies can relieve some of the burdens in this financial emergency, but not necessarily all of them. The New Year is an excellent time to look at your insurance policies and determine what kind of expenses and debts you might leave behind. Make sure you have all the necessary legal forms, like a living will and power of attorney.

Financial Emergency #3: Illness or Injury

The sudden loss of a close relative can be difficult, but your health may be even more critical. If you were suddenly injured or ill, do you know how you could financially bear the cost, particularly if you were prevented from working? Do you know how much your deductibles are on your health insurance?

Long-term illness or debilitating conditions can affect almost anyone unexpectedly and could be the worst financial emergency you could face. Not being able to work can almost definitely cause a total loss of income and cost you the savings you have accumulated. Besides the financial stress, you have to deal with the physical and emotional pain of a debilitating illness. Health and other insurance can cover many of these instances, but all of your costs may not be covered. Look carefully at deductibles and other expenses that may not be indemnified.

Talk to your friends about what they are doing for this financial emergency and what more can be done. Check out our prior post on how much insurance you need for health, life, and property.

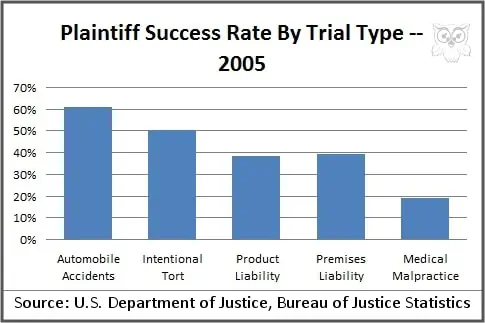

Financial Emergency #4: You get sued

Let’s face it, Americans love to sue. I’m no better. I’ve once thought while sitting at my desk at a job I hated, “what if those boxes fell on me? How much could I sue for?” You can never know when a person or business may feel violated or wronged by your behavior or a negligent act. It’s just a fact of life in a litigious society, and data shows that plaintiffs have a pretty good chance of taking your money.

One way to protect yourself is by living modestly or discreetly. The chances of someone suing the driver of a Hyundai are much less than those of someone suing the driver of a Rolls Royce. Announcing that you can pay a large settlement, you might open yourself up to the schemes of opportunists.

But why should you have to hide your financial success for fear of being sued? One of my favorite lines from the movie Schindler’s List is the advice that every man needs three things in life, “A good doctor, a forgiving priest, and a clever accountant.” To this list, I would add a savvy lawyer.

If accidents do occur, always apologize and try to settle with the other person amicably. Try not to anger, provoke or harass those with deep pockets, malevolent natures, and ample resources. Lawsuits can cost money, time, and emotional distress; avoiding them is one of the wisest actions you can take.

Financial Emergency #5: Debt strikes back

I’ll be the first to admit shopping is fun! I work hard and like to spend my money just as much as anyone, but not being able to put a lid on spending can lead to financial nightmares. Debt has a way of sneaking up on you. Get over your head and open another credit card to get you over or take out a short-term loan from a payday lender. Like a financial emergency of your health, you might not even see it coming.

Like a disease, debt should be dealt with early and effectively before it has a chance to wreak havoc on your life. Debt collection and bankruptcy can leave you penniless and even cost you a job.

Do you have large outstanding debts such as credit card debt or school loans? We all run into short-term financial emergencies and have trouble at times. The worst thing you can do is avoid thinking about how you will pay your bills and hope they’ll go away. If you are unable to pay your bills, talk to creditors quickly to see if you can skip a month and not get reported as a missed payment on your credit.

Consider a personal Loan for debt consolidation to cover a few months’ expenses. For some borrowers, online peer lenders like Avant and Lending Club provide unsecured personal loans at rates starting from 6%. Credit standards are slightly higher on Lending Club,

with a minimum credit score of 660, but rates tend to be lower. Avant

can accept borrowers with scores as low as 580 with rates just a few percent higher. There’s no prepayment penalty on personal loans, so plan a budget to pay off the loan within a year, and you won’t have to worry as much about interest.

If you’ve experienced a financial emergency in the past or are concerned about one possibly happening in the future, don’t wait until it’s too late. Check out our step-by-step guide to getting your finances in order and how to plan for the future.

Jessica Kane is a professional blogger focusing on personal finance and other money matters. She currently writes for Checkworks.com, a leading supplier of personal and business checks.