The Average Debt in America is Exploding and Americans Just Can’t Help but Borrow More

The chorus after the 2008 financial collapse was that borrowers had heard the harsh message and were taking out less debt. After a 63-year trend of borrowing more money each year, households cut back after the housing bubble threatened to destroy their financial lives.

It seems the lesson has been quickly forgotten.

According to data from the Federal Reserve, total household debt in the United States has surged to $12.84 trillion, up by more than half a trillion in the last year.

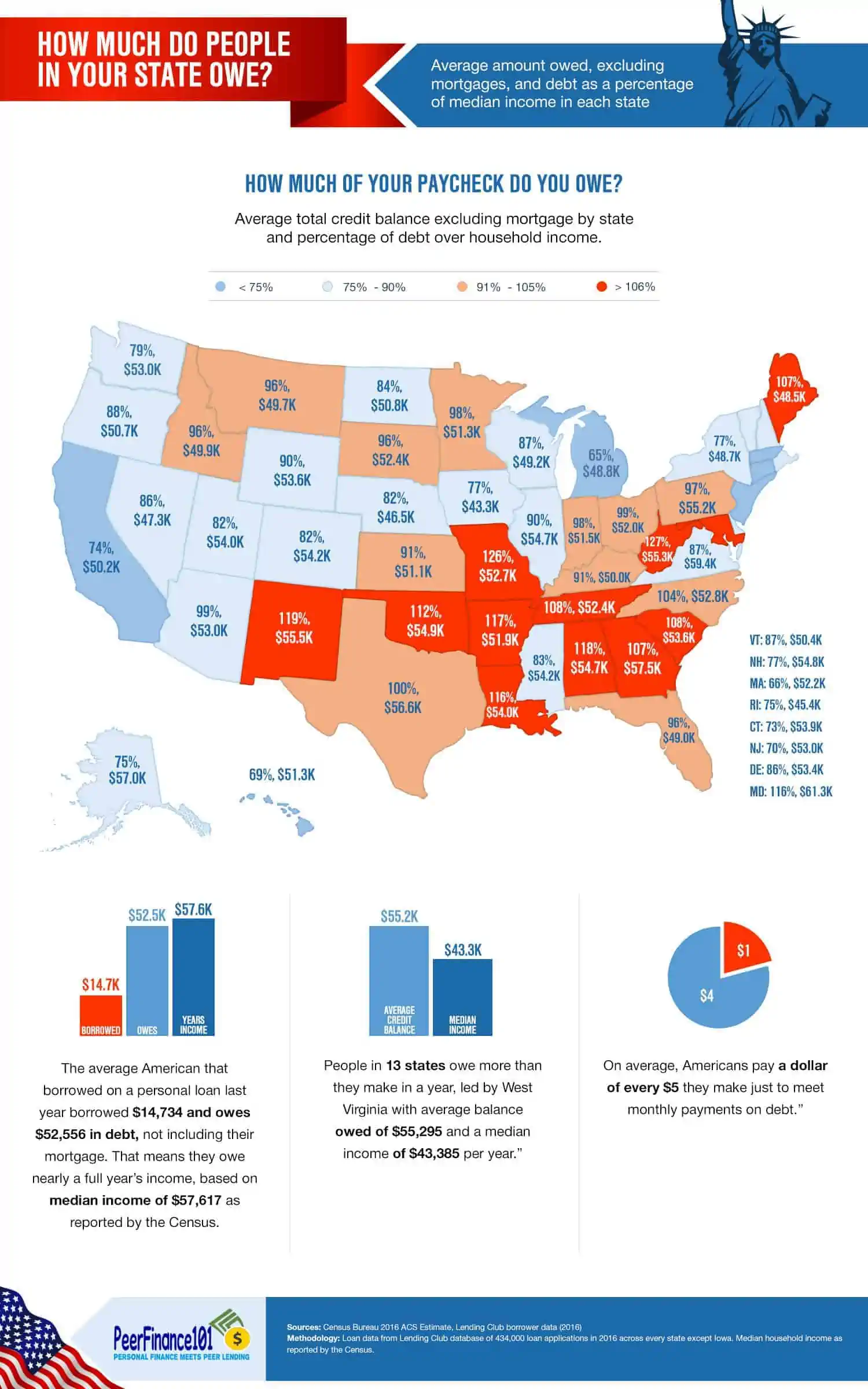

Borrowers in 13 states now owe more than they make in a year and the average household pays a dollar out of every $5 in income just to make monthly payments to debt.

The Average American Debt is Exploding

The graphic shows a pretty dark picture of household borrowing with the total debt owed and the percentage borrowers owe over the median annual income in each state.

It’s not just how much debt you owe but also how much you make to pay off that debt. People in the District of Columbia owe more than any other state but also have one of the highest annual incomes, maybe all those fat politician paychecks. Households in Arkansas actually borrow less than the nationwide average but still might be in trouble because incomes are lower.

Borrowers in thirteen states owe more than their median household income. That’s not to say that the rest of the states are off-the-hook. The average debt-to-income of 91% shows it would take nearly a full-year’s income to pay off household debt for many Americans.

You could argue that historically-low interest rates mean debt doesn’t cost as much as it used to so why not get a loan? A $10,000 loan at 5% only costs about $500 a year in interest.

But you also have to wonder why household debt has increased so much over the last few years. The economy isn’t zooming higher but is chugging along at a decent rate. Unemployment is at a nearly two-decade low.

Why are people borrowing so much and could it lead to another financial crisis if the economy slows?

Complete Debt Payoff Course from budgeting tricks to debt consolidation and boosting your credit score! FREE video series on our YouTube channel, Let’s Talk Money! Watch the series and ditch your debt!

Why Do Americans Borrow so Much Debt?

We’ve always been a consumer nation. Consumer spending drives more than 70% of the economy.

The problem lately is that wages just aren’t growing like in the past. The Bureau of Labor Statistics reports that hourly compensation has increased just 2.2% a year since 2009. That’s about half the annual increase before the financial crisis.

To put it in perspective, if you make $35,000 a year then a 2.2% increase means you’re only making about $65 more a month than you did last year.

So we hear about how the economy is recovering, most Americans have jobs and there’s no lack of new stuff to buy…we just don’t have any extra money to buy it.

Americans are tired of waiting for wages to increase to be able to enjoy the shopping they did in the past. Interest rates on everything from car loans to credit cards are still low, so why not get a loan to make up the difference?

Of course, the problem is when the economy slows down and companies start to lay off employees. Missed payments are already starting to increase, especially on auto loans where lenders have been extending loans for seven- and eight-years to qualify more borrowers.

Getting a Loan without Getting in Trouble

Getting a loan isn’t bad. I see a lot of debt-free blogs telling people to pay off all debt and cut up the credit cards. I guess I’m more of a debt agnostic. It’s ok to borrow money as long as you know how to do it right.

That means borrowing only when you must or when it makes financial sense.

- Borrowing to buy a home offers rewards beyond the money and you can deduct the interest from your income for taxes.

- Most businesses borrow to invest and buy equipment. Getting a loan makes sense if you can turn it into a higher rate of return and business growth.

- Using credit cards to pay for normal expenses can be a way to build your credit score and earn reward points. Just make sure you pay the card off every month to avoid interest payments.

Sometimes, there’s just no way to avoid going into debt. Emergency expenses happen and usually when you can least afford them.

What’s important is understanding the interest rate and your options on loans. Payday loans and cash advances are rarely a solution. Even at seemingly low fees, you’ll be stuck in a cycle of borrowing more every couple of weeks to keep ahead of your bills.

If you do need to take out a large loan, one you can’t pay off within a month or two, borrow long-term and enough that you only need to borrow once. Those extra fees will add up so you don’t want to be in the situation of borrowing every year. Take out a three- to five-year loan to pay off other high-interest debt and get caught up and then make a plan to pay off your debt.

How Much Do People Borrow in Your State?

The table below shows the average loan amount, total credit card balances, total debt excluding mortgages and the percentage of income households are paying each month to make debt payments. I got the data from online-lender Lending Club from its 2016 database.

The data is from 434,000 loans made in every state except Iowa, with numbers averaged for each state. Those households that took out a personal loan last year borrowed $14,734 on average and owe $52,556 in total debt, including almost $17,000 in credit card debt.

Average American Credit Card Debt

The total debt the average American owes is bad enough but within that figure is a whopping $16,943 in credit card debt. If you consider the average credit card rate is 16% and well above 20% for bad credit borrowers, that means the average American is paying around $225 a month in interest.

How much are your credit cards costing you each month? Find out with our credit card payoff calculator.

Just over two hundred dollars a month, doesn’t seem too bad…does it? Invest that money at a modest 8% annual return though and you’d have over $330,000 at the end of 30 years!

That’s nearly twice the average 401K balance for retirees according to Fidelity, all from just saving the interest from the average credit card balance. Yep, paying off credit cards each month could solve the retirement crisis in America!

Just as with the average debt, Americans in some states have it worse than others. The average American living in Washington D.C. tops the chart with $20, 736 in credit card debt and paying more than $50 extra each month in interest. Even those from the least credit indebted state, Arkansas, don’t get off so easily though with nearly $14,000 in card debt.

The Average American is in Trouble

It’s easy to look at the average household debt and say it’s someone else’s problem. Even if you don’t owe much or anything on your own credit, financial literacy is everyone’s problem.

That crushing weight of debt is not only causing social and emotional problems but a financial burden that is ballooning state-paid resources. We’re just starting to see the effects of this and it’s only going to get worse.

Is the Average Debt a National Emergency?

We look at these numbers as an individual problem but there’s a missing point that may be even more sinister.

All this debt comes from buying things, buying things for which we don’t have the money and can’t afford. That credit and those things purchased don’t just materialize out of thin air.

The average American saves just 2.4% of their income. That shouldn’t come as any surprise looking at the debt numbers. What we don’t see in these numbers is the average savings of the typical Chinese household, 37% as of 2016.

How does this have anything to do with you or me or a national emergency?

While we are waiting in lines three-hours long on Black Friday to buy the newest iPhone made in China, the Chinese are using all that money we send them to buy up U.S. Treasury bonds…money borrowed the U.S. government. By most estimates, China holds about $2 trillion of these bonds or about 10% of U.S. debt!

Borrowing money isn’t necessarily bad, especially if you can use it to buy assets or if your interest rate is below the return you get on the money. After years of paying down debt, it does look like Americans are borrowing more than they can handle again. Make sure you know how to borrow responsibly and your options to pay off the debt.