Understand the three most common borrower risks in p2p lending to get the most out of it.

Lara Miller was on the verge of success after six years selling her original line of clothes through 17 retail outlets but her hope turned quickly to frustration in 2006. She had maxed out her credit cards and borrowed from friends and family already but needed $3,000 to launch her 2007 spring line of clothes.

She didn’t have much of a credit history or collateral for a bank loan and it looked like her dreams were going to be out of reach.

It looked like her small business dreams were coming to an end.

It’s not a unique story. Community banks have all but stopped lending to small business and personal loans from banks have dried up since the financial crisis.

Enter Personal Loans and p2p lending. Through the social marketplace for loans, Lara was able to get the money she needed to expand her business. Beyond the loan, she also built a strong network of business connections that has helped her grow since.

Why does this matter to you?

This story is one of thousands being repeated all over the country. Peer lending has grown from nothing to a market of $8 billion in originated loans in less than ten years and hundreds of millions in loans are being funded every month.

Whether for a small business idea, home improvement, debt consolidation or any of a dozen needs, p2p lending could be the solution to your next loan.

What is P2P Lending?

The idea behind p2p lending and online loans could not be simpler. It used to be, if you needed money, you would go down to your local bank to fill out a loan request. Your credit history and other credit score factors would be analyzed and the bank would deny or approve your request and assign an interest rate for the loan.

The bank would then bundle your loan with others and sell the package to an investor. The investor earns a return for buying the loans and the bank receives money to make new loans.

P2P lending is almost exactly the same, except without the bank. The two peer lending sites, Prosper and Lending Club, take applications for loans from borrowers. Your application is assigned a credit rating and interest rate on the same factors used by the bank. Investors go to the lending sites to review applications and invest in the loans.

Simple and Secure Personal Loans! Check your rate without hurting your credit score!

When a loan reaches its requested amount, the money is deposited in your bank account. You make payments on the loan to the peer lending site and it passes those payments on to the investors. For a full review of p2p lending sites and unique features on each, check out our Ultimate Guide to Peer Lending Platforms.

Is P2P Lending too Risky for Borrowers?

Like any new form of lending, borrowers have been hesitant about p2p loans and I get a lot of emails asking if peer lending is too risky. When I send my reply about the risks in peer lending, the usual response is, “but those are the same risks in any type of loan.”

Yes, p2p lending is no more risky for borrowers than any type of loan from a bank or other company. Credit is a tool to accomplish things you wouldn’t otherwise be able to afford. Like any tool, it can build you up but it can also smash your fingers if used incorrectly.

With a little financial sense and financial responsibility, p2p loans can provide you with the money you need to reach your financial goals and dreams.

So what are the most common borrower risks in p2p lending?

P2P lending risk #1: Not taking the time to improve your credit score

Too many borrowers learn how quick it is to get a p2p loan and they jump online to fill out an application. Their loan is assigned an interest rate and funded with the whole process taking less than a week. Then they end up paying hundreds more in interest over the next few years.

What if you could save almost $1,000 with very little effort?

A quick example will help to prove the point. If you’re credit history is fairly good and you have no missed payments, your rate on a p2p loan might be somewhere around 7% or possibly lower. If your credit score is not so good because of missed payments or other factors, you could be looking at a rate of 10% or higher.

On a $10,000 loan over five years, your payments on a 7% rate would be $198.01 per month. You would pay $1,880 in interest payments over the sixty months. That same loan at a 10% rate would cost you $212.47 per month and cost $2,748 in interest. The borrower with the lower rate saves almost $900 in interest over five years.

It takes a couple of months to improve your credit score but there are some very easy steps you can take to do it. The most common is checking your credit report for any mistakes.

Before you assume there are no mistakes on your report, know that the Federal Trade Commission (FTC) has found that at least 5% of reports contain errors and borrowers could increase their score by 25 points or more by correcting them. I’ve started using a credit monitoring service to track changes on my credit report and prevent identity theft.

The process for correcting credit report mistakes is pretty straight forward. You first write to the company that reported the missed payment or whatever the error is that’s on the report. If they do not respond back to you within 30 days, you can write to the credit bureau to have the mistake removed. Most people don’t know that this process works for anything on your credit report.

Miss a payment on that Sears card a few years ago? It’s likely that if the account has been closed, the company isn’t going to take the time to respond to your letter and you’ll be able to get it removed from your credit report.

It might take a couple of months but fixing your credit could save hundreds or even thousands in interest payments. I outline other ways to improve your credit score in another post on bad credit and credit score factors.

P2p lending risk #2: Using peer loans to continue poor debt habits

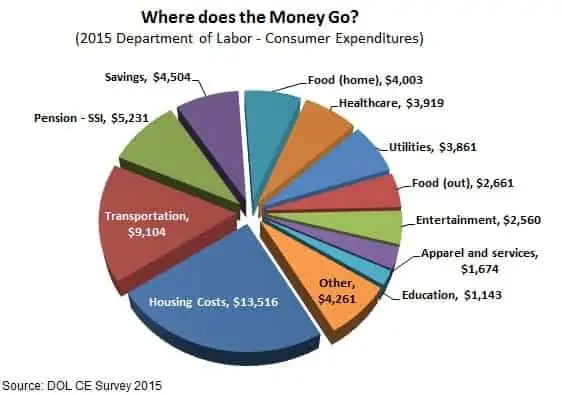

The biggest risk for most when it comes to credit and loans is that shopping is just too much fun. If you regularly spend more than you earn then credit is not the answer and will only become a problem.

If you are paying more than half of your monthly income to make your payments, you most likely have a spending problem.

P2p lending will not solve your money problems if you are a chronic spending and the situation is only going to get worse. If you’ve cut everywhere in your budget and can’t find anymore to save, you may need to look for other ways to make extra money.

At this point, everyone talks about making a budget and following it but then few actually stick with it. One of the best ways I have found to confront spending and debt is to talk about it with friends and family. People are reluctant because they think others are going to judge them but we’ve all been there. Have someone help you see where your spending is excessive and talk about your goals for fixing the problem. It’s likely that they will have goals of their own and you can help each other out.

Don’t think you need to be completely debt free either though. Everyone assumes debt is a bad thing but it’s really just a financial tool to help you leverage what you have. Understanding the difference between being debt free and free of bad debt will go a long way to meeting your personal finance goals.

P2p lending risk #3: Thinking peer loans are easy money

The ease of getting a peer loan does not mean that the loans are different from any other type of loan. Miss a payment or default on a p2p loan and it will go on your credit report just like a mortgage or a car loan.

In fact, besides lowering your credit score, defaulting on a p2p loan will make it harder to get any additional peer loans in the future. There are a lot of investors that will not fund loans by borrowers that have defaulted on previous loans.

A lot of this goes back to using credit responsibly. Peer loans should not be used for everyday spending on things you really don’t need. The best use of p2p loans are to lower your rate by paying off high-interest credit cards, home improvement, or avoiding high-interest auto loans by dealers.

Avoiding the three biggest borrower risks in p2p lending is really no different than any other type of loan. The market for peer lending is booming and can be a great resource for your personal or business needs. Making sure you get the best rate and using the money responsibly will go a long way to helping achieve your financial goals. Used correctly and you may just find yourself using peer loans regularly for all your credit needs.

When you’re ready to apply for your peer loan, check out Personal Loans for the best rates available. The largest p2p lending platform has been able to use its size to offer competitive rates and is now offering business loans as well.