Get Ready for 2021 with these Best Stocks to Buy NOW!

In all the chaos and crash of 2020, it has actually been a surprisingly good year to invest. I revealed five stocks back in April, five stocks to buy with the most potential this year and these picks have surged. We’re up between thirty- and 70% in just the last eight months, beating the market by double-digits.

With analyst estimates for economic growth rebounding next year, I think we can beat even those returns and really take your portfolio to a new level!

Putting together our portfolio of stocks for 2021, I wanted to do something different though. We already highlighted five dividend stocks I’m buying for cash flow and return. In this video, I want to add to that list five stocks to buy for even more upside, then on Friday, I’m going to be revealing five penny stocks for those moonshot investments!

I’ll be putting each video inside our Playlist on the channel, the Best Stocks to Buy for 2021, so make sure you check that out for the entire portfolio.

Best Stock Sectors to Buy 2021

We’re going to get started and first I want to show you the sectors with the most upside potential before we get into those five top stocks to buy. Stick around though because after that, I’m also going to reveal ten stocks to avoid, ten stocks analysts think could plunge by ten- to 20% in 2021.

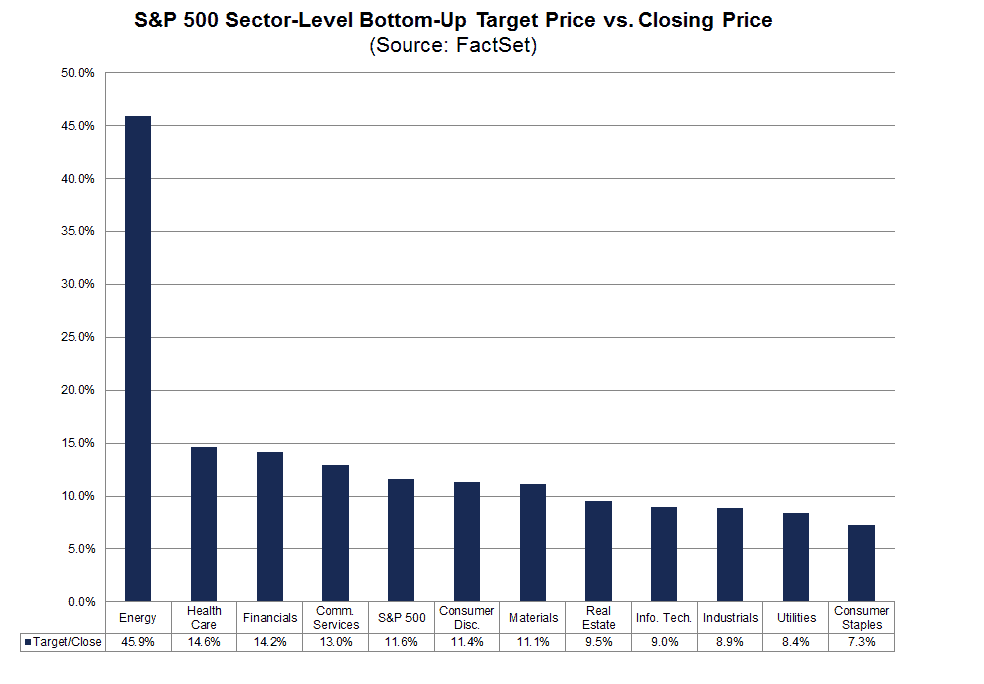

First I want to show you the returns expected in stocks of each sector. I love looking at this higher-level first, seeing which sectors of the economy analysts think do the best because it can really make investing in those individual stocks so much easier.

For example, we see that analysts expect stocks in the energy sector to surge higher, producing a sector-level return of 45% over the next year. Knowing that, we can look for the best stocks to buy in energy to not only get that tailwind from the sector but also an even higher upside shot on the best picks.

That bounce in energy is from the apocalypse in oil prices we saw this year. The price of crude has rebounded to about $45 a barrel and with the production cuts we’ve seen at a lot of the drillers, if OPEC plays nice and keeps its own supply off the market, then we could see $50 a barrel oil again next year which would be a big sentiment boost to these shares.

Now just looking at the graph, it seems analysts expect returns in energy to dwarf everything else, but I don’t want you just going all-in on the sector. There are a lot of other sectors here with some great potential and I think some individual stocks that can easily produce returns of 20% or more.

So you’ve got expectations for stocks in healthcare and financials to both produce around 14% returns on average. This is followed by an expected return of 13% on communication services and 11% in consumer discretionary and materials.

I really like healthcare and financials here. Both have underperformed the market this year. Healthcare with a 8.6% return and stocks in the financials sector; so think banks, brokers and insurance companies, they’ve posted the second-worst return after energy stocks.

And healthcare, it might seem counterintuitive with all the focus on health this year, but the hospitals and doctors here have really been playing triage with their services. All the high-profit elective surgeries and other services have been put on hold to care for virus patients so earnings have plunged.

That could change in 2021 and healthcare is one of my favorite long-term themes for investing. We’re getting older and spending more money on our health so this is one with some great demographic forces behind it.

For the financials sector, if you’ve been watching the channel, you know this is another one of my favorite themes for 2021 and we’re already up 33% in shares of Citigroup in our 2021 portfolio.

And the optimism here is a function of two catalysts. First, the banks have taken tens of billions off their earnings to hold as cash in what’s called a Loan Loss Provision Account. This is a special cash reserve the banks use to cover estimated loan defaults if the economy gets bad and it’s meant earnings have just cratered this year. If we get any kind of an economic recovery though in 2021, I think they reverse what we’ve seen, they move that cash back into earnings and surprise on the upside along with big increases in dividends.

The second catalyst for financials is interest rates and how they make money. For banks, it’s the difference in rates paid on deposits, so short-term rates, and what they collect on long-term loans.

The interest rate on the 30-year Treasury plunged to a record low of 1.2% this year so even with short-term rates near zero, banks just aren’t making any money. And it’s not just banks in the financials sector but insurance companies sit on mountains of cash to pay claims but aren’t getting any kind of a return on safe investments.

Now analysts expect the long-term rate to edge back up to around 1.7% next year and if it can even get back to around 2% so where it was in 2019, that would be a boon to earnings for the banks.

Top Stock Picks for 2021

Those are the sectors I’m watching for 2021 returns but you want the goods right? You want the individual stocks to buy for those double-digit returns!

In that April video, we looked at those top 10 stocks with the widest difference between the average analyst estimate and current prices and it helped produce those returns of 50- and 70% so I thought I’d go back there.

But right now…all the stocks with the highest return potential are in energy. Some of these shares have actually already come up big time. For example, we’ve got a 44% return on shares of Diamondback, ticker FANG, and a 54% return on Devon Energy, ticker DVN, in our Bow Tie Nation portfolio.

So the fact that a lot of these top 10 stocks are already closer to their price targets AND they’re almost exclusively in energy…doesn’t help us much.

I think there’s still some good upside left in shares of Diamondback and I’ll detail that in our five stock picks, but again, I don’t want you to be 100% in one sector. As well as energy stocks might do in 2021, I wanted to give you a list of five stocks across different sectors that will give you those double-digit returns but also some diversification.

So I researched both Morningstar and Credit Suisse for top recommendations as well as some of my own favorites for a short-list of the five best. Don’t forget, stick around after these five stocks for the 10 worst stocks to avoid losing your money!

First on our list of best stocks to buy, tech leader Broadcom, ticker AVGO, and surprisingly, not only does this one offer a great upside but also a 3.2% dividend yield.

Through acquisitions, Broadcom has patched together one of the broadest leaderships in tech from smartphone components to wired infrastructure and storage to semiconductors. If you want one tech stock that is going to benefit from the strongest trends like robotics, Internet of Things and 5G, this is it.

But whenever I see a company built on that acquisition model, so buying up all these other companies, I run straight to the financial statement to make sure it’s not getting in over its head in debt.

Broadcom has $43 billion in debt which is about twice the equity but also has over $8.3 billion in balance sheet cash so leverage is quite a bit lower than first glance. The company generates over $6 billion in operating earnings a year against just $1.7 billion in interest, so another metric that gives me assurance on the leverage.

What I really like about the company besides the catalysts I’ll highlight next is that not only is the company growing sales at a solid pace, it’s learning how to be more efficient to boost earnings. Sales grew by 8.3% last year but the company was able to grow those operating earnings by 13.5% which is an amazing spread given Broadcom’s size and the recent acquisitions.

The release of the Apple 5G should help boost sales and many of the company’s products are primed to benefit from the work-from-home trend. The big catalyst here I think could be that transition to 5G.

With the new 5G technology, you can get thousands of devices on a local network versus the dozens of devices you could cram onto a similar 4G network. That’s going to drive the IoT revolution but it also means network congestion and a spike in demand for the kind of RF filters that Broadcom excels in.

Earnings are expected 17% higher over the next year to $24.93 a share though I think it gets closer to $26 in per share earnings. The shares can trade between 18 to 20 times earnings with good sentiment which puts us at a price target of $500 per share.

Anthem, ticker ANTM, is a smaller health insurer but still one of the largest with over 42 million members in 23 states and it’s the largest single provider of Blue Cross Blue Shield coverage.

Now UnitedHealth is by far the larger insurer but here’s why I like Anthem just a little more and why I’m putting it into our 2021 portfolio. Anthem is in just 23 states versus UnitedHealth’s national coverage, but at 42 million members, it’s a close second to the 49 million covered by UNH.

And it’s because, in the states where it operates, Anthem has a much deeper market share, upwards of a third the market. It’s got an exclusive license with Blue Cross in 14 states, which is arguably the most trusted franchise in health insurance.

This all works to give Anthem a lot more negotiating power with providers, helping to lower costs, pass some of that savings on to customers and keep some of it for higher margins.

With the election behind us and most likely split control of Congress next year, the uncertainty around healthcare stocks has cleared up. We could see marginal changes to regulation but I think the worst is off the table and again, healthcare is one of my favorite sectors in both the near-term and longer.

Revenue grew at a 7% pace over the last three years which the company was able to turn into 20% annual earnings growth. For the coming year, earnings are expected lower by just over 1% to $22.48 per share but management has a strong history of beating expectations. On a price-to-earnings of 18-times, a multiple the shares traded at just last year, I think this one can get to $404 per share.

Fedex, ticker FDX, is one we highlighted a few weeks ago as a best of breed in the industrials sector and I wanted to add it to our best overall portfolio as well.

Fedex is the world’s largest global express shipping company and the demand picture is just amazing. I mean, most companies have to figure out a way to create demand for their product before they can expand operations but for Fedex, that demand is booming already.

eCommerce sales spiked 37% in the third quarter and hit 16% of total retail this year from just under 12% previously. The trend to shopping online has been boosting sales for Fedex for years but gave it supercharged growth this year and the momentum is just going to keep going.

Were it only for that ecommerce shipping, I might say the shares are expensive here but we’ve got another catalyst that isn’t fully baked into the shares yet.

With the Covid vaccines coming out, we’re about to have a very big distribution problem. Not only do we need to get those vaccines to 7.8 billion people, and Fedex is already ramping up for that, but the two earliest from Pfizer and Moderna need to be kept at very cold and very specific temperatures.

The problem is, for example, Pfizer is distributing its vaccine in special deep freeze boxes of 1,000 doses. Now those doses have to be kept at that temperature and used within a certain timeframe after opening the box but you’ve got a lot of rural towns that won’t be able to distribute all 1,000 doses.

So to avoid the waste, I think you going to see local governments using a lot of that express delivery to move these boxes around to where they need them.

The company beat Q3 earnings estimates by 81% and earnings are expected to jump 37% over the next four quarters to $15.51 per share. Between the long-term trend to ecommerce and the year-long boost from the vaccine, the share price can keep going to a price target of $350 per share.

All my Bow Tie citizens out there are probably tired of hearing me talk about Macerich, ticker MAC, but I hear a lot of people talking about Simon Property Group and I truly believe, if you’re looking for a rebound play or the mall operators, I would rather be in Macerich than SPG.

Macerich owns 29 class-A regional malls along with another 19 malls as part of a partnership and 12 non-mall properties. It’s a total of over 50 million leasable square feet and averages $800 in sales per square foot, which is well above the average for mall property and speaks to the quality of assets.

The company sold over $4 billion in lower quality malls over the last eight years so really went into this thing already positioned for quality. Sales per square foot were only down 10% in the third-quarter and occupancy held at 91% which is really amazing considering the retail apocalypse.

And again, on that comparison with its larger competitor Simon Property Group, I like Macerich here because it doesn’t seem to be getting mixed up in the retail business like Simon Property which is bidding for a lot of the bankrupt stores like JC Penney. Instead, Macerich is focusing on staying a landlord and finding new tenants like Amazon.

Even on a lower dividend payment, cut this year to protect cash flow, the shares are still trading at a 5.5% yield, which is why I also included this one in our dividend portfolio. Macerich is paying out just 25% of its funds from operations to cover the dividend so once some of the uncertainty comes out of the economy, that dividend jumps back up.

Now with any of these rebound stocks, especially the mall operators, you want to look at the balance sheet to make sure the company has enough cash to pull through this thing. Macerich has increased cash to $530 million which is enough to cover 19 months of its total operating expenses! So plenty of cash and more than enough liquidity if it need to borrow against those high-quality properties.

Funds from operations this year are expected 34% lower to $354 million so even after that big jump in the shares recently, the stock is still trading at 4.6-times FFO. I’m not saying this one gets back to $27 a share anytime soon but I think you get a nice double-digit return over the next year plus a per share dividend that could double from here.

Diamondback Energy, ticker FANG, is one of the sole energy stocks where I think you can still get a twenty- or 30% upside return even after the run.

Shares have doubled since the March low but the average analyst target of $55 could still mean a 35% upside beyond the 3.7% dividend yield.

Diamondback has aggressively cut rigs to bring costs down and protect cash flow. Capital spending is down 35% from its original 2020 plan and operating costs are looking really good. Management reported cash operating costs of just $8.16 per barrel in the second quarter, which was among the lowest in the industry. Those costs came down 20% in the second quarter alone and should help to beat this quarter as well.

The lower costs have helped management commit to its $1.50 per share dividend and the company is one of the best positioned for an eventual rebound in oil prices.

Earnings cratered to $4.15 per share over the last four quarters but management was able to beat expectations by an astounding 69% last quarter. Analysts are expecting earnings to continue lower to $3.58 per share over the next year but even on this lowered guidance, the shares are still just 11.5-times on that price-to-earnings basis.

Diamondback traded for 14-times earnings last year and I think it can get back to that multiple for a $50 price target. Beyond that though, earnings are expected to rebound to $5.38 per share in 2022 for a potential $75 price target, so years of upside possible in this one!

Top 10 Stocks to Avoid for 2021

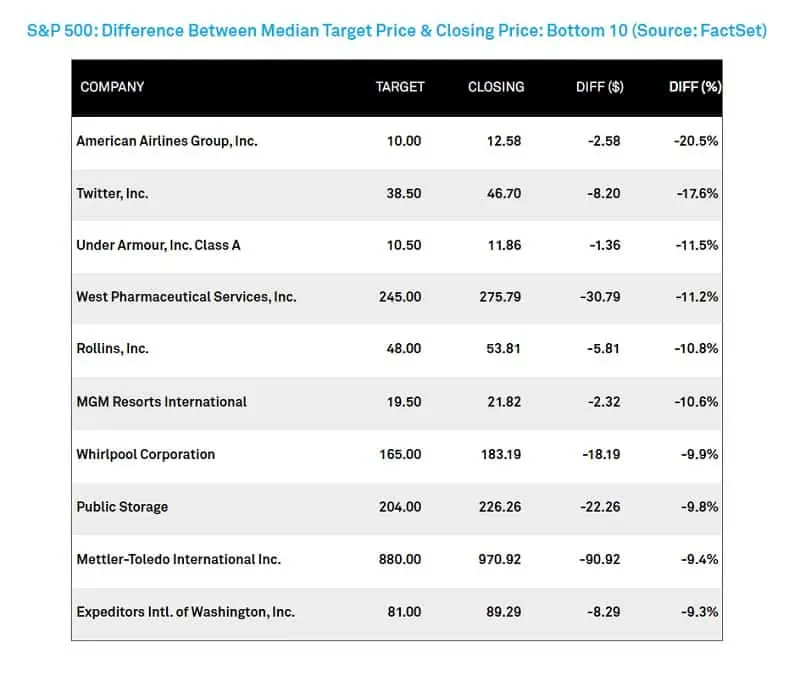

Now that we’ve seen five of the best stocks to buy according to analyst estimates, but not losing money is just as much a part of investing as making it so let’s look at the 10 stocks to avoid, ten stocks analysts think could fall the furthest to their price targets.

Here FactSet has polled analysts to find the average target price and the ten with the greatest downside compared to the current share price.

And it’s interesting that American Airlines tops the list here with a 20% downside to the average estimate because it wasn’t that long ago most analysts were bullish on the stock. I would agree here though. We did a video on airline stocks a few months ago. All of them are in trouble but AAL is probably the most indebted and the worse off of the major carriers in terms of the seat capacity it needs to become profitable and just the likelihood it gets there over the next year.

A lot of the stocks to avoid on the list though are mostly just a function of the stock price outrunning those targets. You’ve got runaway stories like Twitter which is up 50% over the last year, West Pharmaceuticals up 85% and Rollins up 50% so these stocks may still be good companies but they zoomed past the price targets so analysts are a little weary of valuations and a pullback at this point.

UnderArmour, ticker UA, is interesting because even after an 18% loss on the shares this year, it’s still 37% too expensive according to the average analyst.

Earnings were absolutely crushed over the last four quarters for a loss of $0.29 per share versus posting a gain of $0.33 per share in the prior year. Earnings estimates are only slightly better, expecting the company to only lose $0.15 a share over the next year.

This probably shouldn’t be a surprise. UnderArmour is very closely leveraged to college and pro sports. The lack of games has taken the players and the apparel out of the public eye. Really the primary marketing channel for this company has just disappeared.

But the balance sheet looks good here. All you out there in the Nation know how important that is right now. For these hardest hit companies, especially in retail, I’m looking to make sure they have enough cash set aside and not too much debt so they can survive until sales come back.

UnderArmour has $870 million in balance sheet cash against about $1.9 billion in long-term debt and capital lease obligations which is pretty good considering the year it’s had. I don’t see any existential risk here with the stock, which means, as sports and exercise get back to normal, this one has a chance to surprise to the upside.

The stock has just been a nightmare for anyone trying to call a bottom so I think you still have to be cautious but if there’s any of these first five that I’d go with, it would be this one.

Public Storage, ticker PSA, is another interesting stock on the list. It’s up just 7% this year so not like the shares have outrun their target and it’s still about 10% above the target. I like the company and have owned it since 2010 in a retirement portfolio. It produces very stable cash flows and a 3.5% dividend yield right here but I’d agree it’s probably fair value at this point. I wouldn’t be selling because I like the space as a part of my long-term REIT holdings but I wouldn’t be buying here either.

This year was a blow-out for higher returns if you knew which stocks to pick. Next year could be just as good but market leadership will surely change from this year’s winners. Make sure you know how to pick the best stocks to buy for 2021 and get ready!