A brokerage account also called a taxable investment account allows you to buy and sell securities such as stocks, bonds, ETFs, and mutual funds. Check out this article to find out everything you need to know before investing. A brokerage account is considered taxable because investment income from a brokerage account is a capital gain, which is taxed. In a similar fashion to a bank, account money can be transferred in and out of a brokerage account quite easily, usually by being connected to the individual’s bank account.

Brokerage accounts are different than individual retirement accounts (IRA’s) and 401(k)s as both these types of accounts are tax-advantaged retirement accounts meaning that they have different tax and withdrawal rules.

Before you begin your investing journey, take a look at this video, which is one in a four-part series that I’ve created in partnership with The Motley Fool to help start your investing journey and build out your portfolio. I’ll be putting all four videos into a special playlist on the channel called ‘Ultimate Guide to Start Investing’.

FREE Report! See the 5 Biggest Stock Positions in My Portfolio! Five stocks I’m investing in for the biggest trends of the next decade! Don’t Miss this Free Report – Click Here!

How Does a Brokerage Account Work?

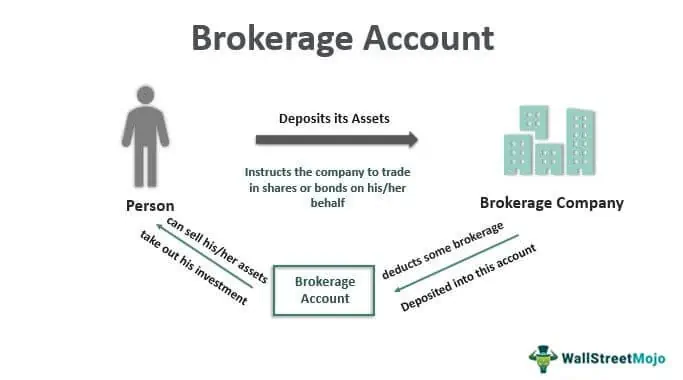

People can use brokerage accounts for both long- and short-term investing. You would initially start by transferring cash from your bank account into the brokerage account and use that money to begin making your first purchases of stocks, bonds, mutual funds, and ETF’s. People will often sign up for brokerage accounts that are offered by their banking institution as it makes the signup and transfer process significantly easier.

Think of it this way, the brokerage account is the middleman between you/your money and the markets. The brokerage account will protect your securities until you give instruction to buy or sell.

It is generally free to sign up for a brokerage account, but you may stumble upon some fees when you begin making transactions. These fees will vary by the brokerage and may include management fees, trading commissions, or fees for the buying and selling of certain assets.

Brokerage accounts are offered by a host of firms and institutions, so it does take some research to find out which one is best suited to you and your investing needs. If you’re not wanting to make the full-time commitment to investing on your own, there are many online brokerages that now offer Robo-advisors.

Is my money safe in a brokerage account?

Brokerage accounts generally have strict protection policies. All cash and securities deposited into a brokerage account are insured by the Securities Investor Protection Corporation (SIPC). This insurance protection will protect each user up to $500,000 including up to $250,000 cash. As you may have guessed, SIPC will only protect you against fraud, hacking, criminal activity, etc. but it will not protect you against poor decisions you choose to make in the stock market. So, if you make a poor investment decision, you’re on your own!

If you’re not quite convinced yet to open a brokerage account online, you may want to consider starting with opening a money market account online. With CITBank, you can experience a convenient and secure all-digital way to grow and access your money and earn competitive interest rates. The best part about CITBank is that you can easily pay people and any bills you may have with no monthly fee.

Open Your CIT Bank Account Today!

Margin Account vs. Cash Account: What’s the Difference?

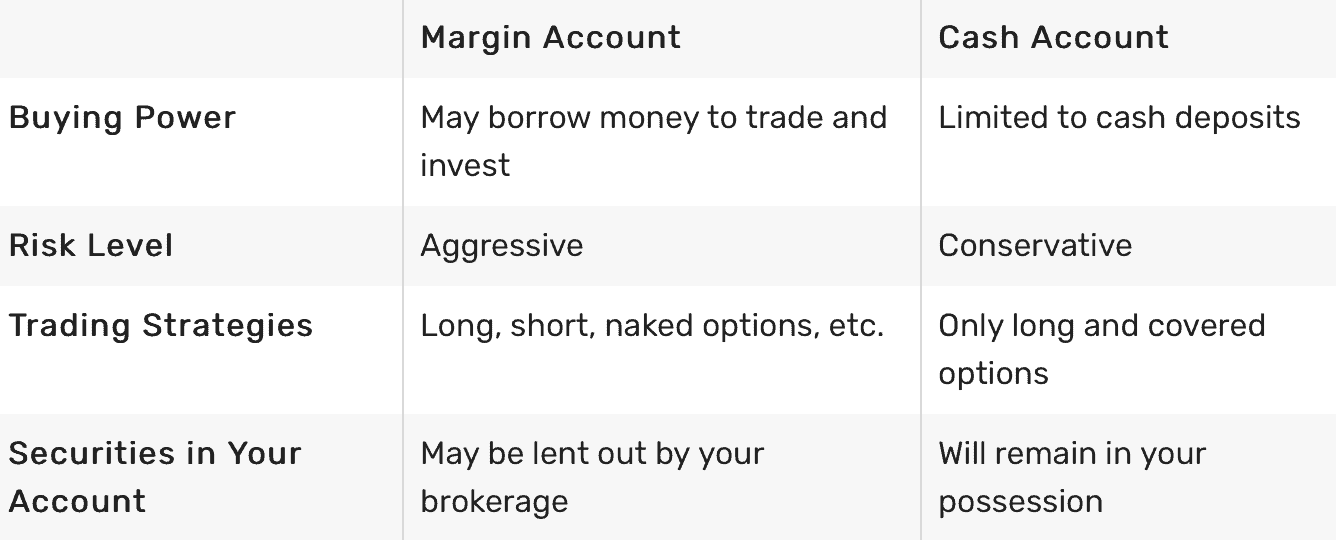

People often get confused when opening their first brokerage account because you will quickly stumble across the question “do you want to open a margin account or a cash account?” and most people don’t know the difference! Let’s dive into it.

What Is a Brokerage Cash Account?

When you open a cash account with a brokerage, you are restricting yourself to only be able to make transactions using available cash or long positions. You cannot borrow money using a cash account, you must have the cash to pay for it on hand. For example, if you have $500 cash in your brokerage account, you can only buy $500 worth of securities.

What Is a Brokerage Margin Account?

A margin account is essentially just the opposite of a cash account. A margin account will allow you to borrow money and then use it to purchase securities and make investments. This means that the collateral for the loan being given is the investment itself. The catch is that you will pay an interest fee on the loan and if the firm wants to cover any sort of account deficit they see, they can technically sell any of your investments without providing advanced notice. It can certainly be dangerous playing around with debt if you’re not an experienced trader or investor, but on the other hand, a loan can allow you to execute far more complex trades that you may not have been able to do without it. High risk, high reward.

Can I set up a brokerage account for a minor?

Most brokerages will not allow for a minor to set up a brokerage account independently, however, they will often allow a parent or legal guardian to set up a custodial brokerage account.

When a parent or legal guardian opens a custodial brokerage account for a minor, they need to be aware that they are entering into a fiduciary relationship, meaning that it is now the adult’s responsibility to manage and invest within the account and all decisions made, must be in the child’s best interest. The child will be able to officially take over and have full access to this account when they are the legal age to do so. In many states, this is either 18 or 21. At this point, the account is transferred to the young adult, and they are now responsible for its management.

For more info on how to invest for your children, check out this list of helpful tips to invest your children’s savings for a bright future

How do I open a brokerage account for myself?

Setting up a brokerage account can usually be done online in a simple 15-20 process. When first signing up, you want to be sure that the brokerage you are choosing is well suited to you and your needs. Some things you may want to consider researching are the brokerage fees, limits, taxes, and features.

The initial application will not take very long but will ask you some personal questions for security purposes. Some of the things they may ask you to provide can include:

- A Social Security number or a Tax Identification Number

- A driver’s license, passport, or other government-issued ID

- Your Employment Status

- Your annual Income

- Your Net Worth

- A basic overview of your investment objectives (risk tolerance, timeline, etc)

Once you have chosen your brokerage and gone through the initial application, you will need to deposit some money to begin investing. To do this you will either need to initiate a deposit or a funds transfer directly from your bank account into the brokerage account. Sometimes you can do this through a wire transfer as well, which your bank can help you out with.

Following these steps, there are many brokers that will require you to verify a transaction for security purposes. If this is the case, you will need to wait until they deposit a small sum (usually only a few cents) into your account. You would then confirm this transaction occurred before proceeding forward.

Where Can You Get Brokerage Accounts?

There are so many firms, institutions and private providers that offer brokerage accounts. The following are some of the most popular for 2021.

- TD Ameritrade

TD Ameritrade is one of the largest top-ranked brokerages, as it provides a wide variety of trading/investing tools and features for both beginner and advanced traders as well as no account minimums and extensive research capabilities. Charles Schwab has recently acquired TD Ameritrade, but this merger is expected to take a few years. The one problem people have had with this platform in the past was that it has experienced numerous website and platform outages in 2020. Hopefully these have been cleaned up now, as they reportedly have not experienced an outage since!

- Robinhood

Robinhood has become very popular amongst the younger generation as they offer no fees for stocks, ETFs, cryptocurrencies, and options. Robinhood also offers IPO investing, fractional shares, and margin investing. In addition to all this, both the app and website are extremely user-friendly and easy to navigate. Some negatives that people have reported for Robinhood is the lack of research and trading tools they provide as well as no offerings of retirement accounts, joint accounts, education savings accounts or mutual funds.

- Fidelity Investments

Fidelity Investments has evolved rapidly over the years and is now considered to be one of the best brokerage platforms in the world. This brokerage is specifically known for its fantastic research (specifically in ETFs), $0 commissions, and top-notch mobile app for ease of use. The complaints about Fidelity have been that they do not offer commodities, options, or futures and non-U.S citizens or residents cannot use this brokerage. Seems like Fidelity Investments may be worth looking into!

I keep hearing about Robo-advisors… how do they work?

Robo advisors have been around for several years now and are mainly used by more hands-off investors who are either new to investing or don’t have the time for it. A Robo-investor can take the task of investing off your hands by using algorithmic investing mixed with the occasional human assistance. Before the Robo-advisor takes it away, you will be asked a series of questions regarding your financial goals, risk tolerance, timeline, and any other specifics they may need. The Robo advisor will then use that information provided to create a diversified portfolio that fits your individual needs. These portfolios will generally hold a mixture of stocks, ETFs, and mutual funds.

Most Robo advisors generally charge a percentage fee, although some may also charge an additional flat fee for advice. The fees have a wide range depending on the brokerage, but you can expect the fees to be anywhere from 0.05% to 0.65% with an annual fee as well.

Some of the top Robo-advisors for 2021 can be found on the following brokerage platforms:

- SoFi

- Betterment

- Vanguard

- Wealthfront

- Stash

Can I have a brokerage account managed by a human instead of a robot?

Yes of course! Many full-service brokers and financial advisors offer brokerage accounts that are fully managed and run by licensed financial professionals. These managed accounts will be significantly more expensive than the Robo-advisors as they provide far more in terms of getting to know you, your goals, and offering advice on things you may have not expected such as estate and retirement planning. These advisors will generally charge an annual fee of just over 1% from the assets under their direct management.

If you are feeling overwhelmed by various costs, it may be worth looking into acquiring a low-cost personal loan from peer-peer lenders through personalloans.com

You can also click to check your rate on a personal loan up to $35,000 – Won’t affect your credit score.

Read the Entire How to Invest Series