Get higher rates on your money and a $25 bonus with Capital One 360 Savings

I’ve got to admit, for someone that works fully in the digital economy, it took me a long time to switch to online bank.

It’s not that I liked going to a physical bank. I just never thought about switching to an online bank.

When I finally did open a Capital One 360 savings account, I wish I had made the change years earlier. Not only am I saving hundreds on ATM fees, I’m earning ten-times the interest on my savings.

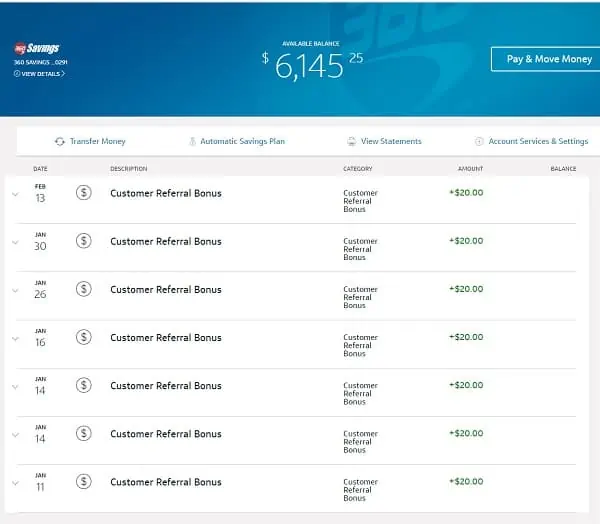

Update: I’ve now had my Capital One 360 Savings account for a year and wanted to update the post. The account is great, super easy to use and I’ve actually collected more than $480 from the Capital One 360 Bonus Cash program [more on that below]!

Use this Capital One 360 review to learn how online banking works, the benefits and get a $25 cash bonus when you open an account.

How Does Online Banking Work?

Before opening an online banking account, I was a little hesitant about not having a bank location I could go to if I had problems. With online banking, you have access to your account through the website or an App on your phone but there are usually no physical bank locations.

You set up direct deposit just like any bank account so your check goes directly into your account. You can also direct withdrawal from your account to pay bills.

If you get a physical check for work or something else, you take a picture of the front and bank on your phone, that’s how you deposit the check. You don’t have to drop it off or mail it anywhere.

For any other bank services including loans or customer service, you call in to the online bank’s customer service line or through email. Because that’s the only way to reach the bank, most have extended phone hours and a full staff to answer questions.

Research by McKinsey finds that more than half of the costs to banking are from having those physical branches, everything from staffing to utilities and property costs. Because online banks don’t have these costs, they’re able to pay higher interest rates on savings and sometimes lower rates on loans.

The average interest rate paid on savings at traditional banks is right around 0.1% – that’s just a tenth of a percent. Most online banks pay a 1% rate on balances under ten thousand and as high as 2% on accounts above that amount.

That means $4,600 more in interest collected if you had $10,000 in an emergency fund savings account over 20 years.

In fact, using an online bank may be the only way to protect your savings account from losing money. That 0.1% earned on savings at a regular bank is more than 2% under the rate of inflation. That means every day you hold money in a regular bank, you’re able to buy less with it because inflation is eating away at the value.

I know it can feel weird to move your banking online. It certainly took me long enough but besides those features you only get with an online bank account, you could be losing money every day you wait.

Capital One 360 Services

I originally switched to online banking through Capital One 360 to save on ATM fees. I live in Colombia and the bank I’ve had for ten years recently started charging a $4 fee for foreign ATM withdrawals.

That meant I was spending over $20 a month just to take money out of my account…$240 a year just to use my own money.

Many online banks offer to reimburse your ATM fees but I found that my Capital One 360 account came with a lot of other services and benefits.

Cap One offers all the traditional banking services including checking, savings, Capital One CDs, loans and that ATM fee reimbursement.

Since it’s a fully-insured bank, deposits up to insured up to $250,000 by the FDIC…way more than I’d ever have in a savings account.

Capital One also has longer customer service hours than I had at my traditional bank. I can talk to someone by phone from 8am to 8pm eastern or by email.

Cap One is actually using a mixed-model for its online banking with physical locations in eight states. The branches are set up like coffee shops but offer some banking services with a small staff. It’s actually a kind of weird experience at first, going to get a cup of coffee and talking to a bank teller. I went to one of the locations in Texas but haven’t needed anything more than customer service by phone.

Capital One 360 Checking

I have both a savings and checking account with Capital One 360 to make things easier. I also have an emergency fund and some other accounts, no fees for having different accounts.

Having the checking account is probably the biggest difference I see from my old bank account.

There are no fees for the Capital One checking account and no minimum balance. I had to keep at least $25 in my old account or paid a fee if the balance fell below.

My Cap One checking account even pays interest on my balance, something I never got from my old checking account. The rate is a little lower than some of the online banks I’ve seen for large accounts (Capital One pays a 0.2% rate on accounts less than $50,000 and 1% on accounts over $100k) but the small-account rate is better.

How Does the Capital One 360 Bonus Work?

Bonus cash programs are nothing new but I found the Capital One 360 bonus to be extremely easy to qualify. I was able to open and fund the account in a few minutes and the bonus $25 was credited to my account within a day.

What really drew me to the Capital One bonus program though is that you aren’t limited to just one bonus. You get a $25 cash reward when you open an account and can get another $20 bonus every time someone you know opens an account! To date, I’ve collected over $480 in cash bonuses from referring friends and family.

That’s almost $500 free money and on top of the high interest savings rate!

Capital One 360 is offering a $25 bonus for opening new accounts. Use the link below to get your $25 bonus.

Open an Account in less than 5 minutes and get your $25 bonus

One of the best benefits to the Capital One checking account is the overdraft options. The bank offers three ways to set up your checking account to avoid non-sufficient funds fees.

- You can have all overdrafts auto-declined so you never go over your balance

- You can set up your checking to auto-draft from savings to cover charges

- You’ll also have a one-day grace period to put money in your checking to avoid overdraft fees

Capital One 360 Savings Account

The rate on the Capital One 360 savings account is one of the highest I’ve seen at 0.85% for accounts under $10,000 and 2% for accounts over this amount.

Pros and Cons of a Capital One 360 Savings Account

What I like about the bank is the ease of having multiple accounts and linking them all together. I have an emergency fund, a business savings and a sinking fund account – all with no fees and that earn interest.

While I initially signed up to avoid those ATM fees, it wasn’t long before I found out customer service is one of the biggest benefits to Cap One.

First, I was having trouble with taking a picture of my driver’s license to open the Cap One account. My smartphone is so old, the image just wasn’t coming through and the website wasn’t able to accept it.

The customer service rep stayed on the phone with me for over 20 minutes while we figured out how to open the account. This was at 6pm at night so I know he was getting frustrated but didn’t show it at all.

We ended up using the webcam on my computer and had no problem uploading the image.

Compare that with the last time I needed to contact customer service at my old bank. The challenge questions to get into the account online had locked me out. I sat on hold for 30-minutes twice on the phone before being disconnected and nobody was answering my emails. I ended up having to write a nasty post on LinkedIn, tagging the bank manager and a few others that worked at the bank, just to get someone to respond.

The savings rate on a few other online banks might be higher than Capital One but I think the increased services makes up for it. For example, CIT Bank pays a 1.5% rate on savings but doesn’t offer a checking account, which is a non-starter for me.

Overall the pros of my Capital One savings account have far outweighed the downside. It was a pain to work through the check-verification but customer service helped me get through it.

Cons of Capital One 360 and Online Banking

This isn’t to say there aren’t some cons to online banking and Capital One 360. I’ve had the account open for just over a month and it seems to take longer transferring funds compared to other accounts like the one I have with ETrade.

It usually takes a day or two to transfer funds from an outside account and then another day with the funds on hold before they clear. Transfers into my Capital One 360 account earn interest while waiting to clear but the entire process still takes a few days.

There’s also the getting used to the fact that there are not physical bank locations in most states. Right now the bank has branches in eight states including Connecticut, Delaware, Louisiana, Maryland, New Jersey, New York, Texas, Virginia and D.C. with some cafes available in a few other states.

You also have access to over 45,000 ATMs across the country and fee reimbursement for out-of-network machines.

Open a Capital One 360 account and get a $25 cash bonus using this link

Capital One 360 Money Account for Teens

A new type of account offered by Cap One that could be really interesting is their MONEY checking account for teenagers.

Just like their other accounts, there are no fees or minimum balances to open a MONEY account. What’s cool here is that, as the parental name on the account, you get real-time text alerts on spending.

I’d be honest and tell your kids that you’re watching the account so they don’t think you’re spying on them, but it’s a great way to track their spending and make sure they’re being responsible with money.

Cap One also offers a Kids Savings account for younger children and can be a great way to get them started saving.

Capital One 360 CDs

The online bank also offers Certificates of Deposit (CDs) for investment on terms from six months to 60 months and rates around 3% and higher. This might be a good option for some of your emergency fund, maybe in the shorter-dated CDs, but the rate paid on savings account is high enough that the difference really isn’t that big.

I would stick with the regular savings and checking account and have immediate access to the money rather than CDs.

Who Can Benefit from a Capital 360 Account?

Finding a good fit for this particular account is a no brainer since I can simply suggest this banking option for those who love doing their banking transactions online and those who do not really care that much on getting the best interest rates. What makes it even more attractive is there are no fees required when opening or maintaining this account so it’s relatively budget-wise. And it’s really convenient for those who do not like getting out of the house just to transact in the physical bank.

Switching to online banking with a Capital One 360 savings and checking account has been a learning experience but one I wish I had made years ago. The interest rate is many times higher and customer service is excellent. Getting used to banking online, I don’t even miss not going into a physical bank location anymore…and the $25 signup bonus was nice too!

Read the Entire Money Savings Series

- 16 Easy Money Tax Tips for Year-Round Savings

- 20 Money Saving Tips to Save $7,500 a Year

- Five Easy Money Hacks that Nobody Thinks of – that will Work Today

- How to Invest Money the RIGHT way

- 7 Ways to Save Money [Save $500 a Month EASY!]