The most common credit card questions readers ask and how to find your answers

Few topics in personal finance are as confusing and misunderstood as credit cards. The problem is that a simple Google search means you’re either on a website trying to sell you into a credit card or a blogger preaching the debt-free lifestyle.

That means any answers you get are one-sided and incomplete.

But that doesn’t mean your biggest credit card questions don’t have an answer. A lot of these questions are going to be personal and ones only you can answer but I can help you with the facts and different perspectives.

I’ve included an index of the credit card topics below and the 35 most common questions about credit cards I get on the blog. I’m always adding to the list so leave them in the comments or drop me an email.

Credit Card Basics

Questions about Getting a Credit Card

Questions about Credit Card Debt

Comparing Credit Cards

Questions about Paying Off Credit Cards

Questions about Credit Card Problems

How to Manage Credit Cards

Credit Card Basics

There are some questions that come up in every conversation about credit cards. These are the basic themes to understand before even thinking about getting a credit card.

How do Credit Cards Work?

Credit cards are a loan, that’s how credit cards work. Let’s get that out of the way and cleared up.

So many people treat credit cards as easy cash but treating them as a loan you need to pay back solves a lot of problems down the road. This loan is revolving debt, meaning it doesn’t have a fixed payoff date or payment, but it is money that needs to be paid back.

When you use a credit card, the lender makes you a loan usually on 0% terms for up to 28 days. If you pay the loan in that time, you pay no interest. If you don’t pay the loan off completely then the interest rate kicks in and is charged on a daily basis.

What are Benefits of Having a Credit Card?

Bloggers spend so much time talking about the dangers of credit cards but there are benefits as well.

- Credit cards are a legit source for emergency cash. More than two-in-three households report they couldn’t cover a $500 emergency expense from savings. Emergency healthcare costs and car repairs happen whether you have the money or not and credit cards can save you from late fees and defaults that will ruin your credit.

- Payment history is the single biggest factor in your credit score but how do you build credit when nobody will give you a loan…because of your credit score? This is one of the biggest benefits of getting a credit card, building your credit score.

- Most credit cards offer free services like the ability to get your FICO score free each month and credit monitoring.

- We’ll talk about rewards programs more later but, managed correctly, they can offer excellent benefits like cash back and other rewards.

How Many Credit Cards Should I Have?

It can be extremely easy to build up a wallet full of credit cards. There’s a lot of money in credit and it’s no longer just the big banks that issue cards. From store cards to alumni groups and those targeting bad credit borrowers, it seems everyone has a card to offer you (and a special deal).

But you really don’t need more than a few credit cards. Having more than one card doesn’t give you any more financial flexibility. You can ask for a credit limit increase on one card and most are accepted just about anywhere.

- I have one card for business expenses, to keep personal spending and business separate.

- We have a family card for regular spending like groceries and that can be used for emergency expenses.

- You could have separate cards for regular spending and emergencies. It doesn’t matter too much as long as you only use your emergency card when absolutely necessary.

Too many cards can be tough to manage, especially if you have different payment dates. Most people can get by with just one card though we like having more than one for different rewards programs. We get cash back for our son’s 529 education account from the regular card and airline travel points on the business card.

Will My Credit Card Make Me Overspend?

YES!

I’d like to be fair and say it depends on you, but the fact is people with credit cards tend to overspend compared to paying only in cash.

It’s a fact that our brains react differently to paying with cash or credit. When you pay with cash, you do that mental accounting to work out your balance. That keeps you from spending more than you have in savings. People don’t usually do this same mental bookkeeping when using credit.

That doesn’t mean you have to overspend when using a credit card. Using your card only for something you can pay off immediately with savings will mean keeping that cash balance.

Questions about Getting a Credit Card

Most people get their credit cards through pre-approved offers in the mail. It might surprise you though that this is the worst way to get a card, choosing among the best offers instead of reaching out to create your best opportunity.

Ask these questions before getting a credit card.

How Do I Apply for a Credit Card?

Applying for a credit card is too easy. You can do it online, by phone…or by mail if you’ve invented a time machine and are trapped in the 80s.

You’ll usually find a credit card offer on the website if you have a specific rewards program you like. This is how we found our UPromise card which gives us cash back into a 529 account.

To apply for a credit card; you’ll need some basic contact information as well as your social security. You’ll fill out your employment information, monthly debt payments and income. This is used by the card issuer to determine your credit limit while rates are usually set by your credit score.

How Long Does it Take to Get a Credit Card?

It takes less than five minutes to apply for a credit card and approval is usually immediate. If you’re denied a card, you’ll get a letter within a few weeks telling you why.

If you are approved for a card, you’ll usually get the card and other documents within a couple of weeks. Your card will sometimes come separate from an activation code to make sure someone can’t steal it from the mail.

When you do get your card, make sure you write down the number and customer service contact with the rest of your passwords. If your card is ever stolen, you’ll need to reach customer service as soon as possible to report it.

If you do get denied a credit card, you have the right to get a free copy of your credit report. Take the opportunity to get your free report even if you’ve already gotten it once this year.

How Do I Get a Credit Card on Bad Credit?

Getting any kind of credit can be like a cruel joke. You only get credit when you don’t need it…and when you need it, it’s not available.

- You have no credit history. This includes young borrowers and those that have closed their accounts and don’t use credit regularly.

- You have bad credit. Usually a credit score below 520 FICO will make it difficult to get any cards.

- You’ve recently filed bankruptcy or have other serious negative marks on your credit report. It’s usually at least six months to a couple of years after a bankruptcy before you’ll be able to get a new credit card.

Bad credit usually won’t keep you from getting a credit card though the rate may be higher than you can afford. If you are denied a card, there are a few alternatives you can try.

- Apply for a secured card which works like a debit savings account. These cards allow you to spend up to the amount you’ve saved and help build credit.

- You can also get approved as an authorized user on another’s card. This will report payments on your credit report as well so you build history.

What is an Annual Fee and Where do I Find Mine?

Annual fees on credit cards are an additional charge, usually from $50 to $150, beyond the interest rate you pay. My first reaction is to say you should never apply for a card that charges an annual fee.

Most reward program cards have annual fees though so it’s not as simple as just avoiding any card with a fee.

For example, our 529 cash back card doesn’t charge a fee but my business card for airline miles does. A popular ‘card hacking’ strategy is to open cards for the initial rewards bonus and then cancel before the first annual fee, but this can be hard to track sometimes.

Your best bet is to think realistically about how much the rewards are worth to you versus the annual fee. If you can honestly say that you get more from the points or cash back than you pay on the fee, then it still might be a good move.

Any annual fee must be clearly stated on your credit card application. Call customer service if you can’t find it an make sure to set an email reminder just before it’s charged. Sometimes you can get the fee waived if you call in to cancel the card.

What Does it Mean to be Pre-Approved for a Credit Card?

Credit card issuers buy access from the credit bureaus to offer these pre-approvals. The card companies will do a soft-pull of your credit, a way to check your report without affecting your score, to extend an offer.

If you accept the pre-approval, the card issuer will do one more check on your credit for final approval and to set your interest rate.

Questions about Credit Card Debt

Credit cards can be like weapons of financial destruction. There are a lot of benefits to plastic spending power, but credit card debt can also ruin your financial life. Asking these questions about revolving debt can help you manage your credit.

What Happens if I Miss a Payment?

Missing a credit card payment isn’t the end of the world but you do need to be on top of it. The late payment won’t affect your credit score until it’s 30 days late and you might be able to get an extension if you call the card company.

If you don’t call the card issuer then a late fee of between $27 to $35 will be added to your bill. This doesn’t mean you’re off the hook for that payment and your interest rate will usually reset to 24% or more.

Missing a payment also means any introductory rates or special offers will expire.

What if I Can’t Pay My Credit Card Bills?

Missing payments on your credit cards will destroy your FICO and make it more expensive to get any loans. That’s why it’s important to contact your credit card issuer as soon as you start having trouble paying the bill to work out some kind of a plan.

Not paying your credit card for six months and not working out a plan will usually mean the debt gets sold to a collection agency. This is the worst thing that can happen because not only will you still owe all the charges and fees but now there are two bad accounts on your credit, the card issuer and the agency.

Never let a debt go to a collections agency. This is the start of all those annoying phone calls and a path that only leads to bankruptcy.

If you don’t think you can afford your credit card debt, consider a debt consolidation loan to lower the payments. This means taking out a personal loan, usually at a lower rate and on terms up to five years, to make the debt more manageable.

Check your rate on a personal loan up to $35,000 – won’t affect your credit

What’s the Difference between APR and Interest Rate?

Most people go right to the interest rate when thinking about a credit card but that’s not really the true cost of the debt.

The annual percentage rate (APR) is the actual rate you pay on your charges. The APR includes all the extra fees added to the card as well as the way the interest rate is calculated.

Use this credit card interest calculator to see how much you’re paying.

Interest is calculated on a daily basis, so you’re stated interest rate divided by 365 days. This daily rate is multiplied by your average daily rate for the amount of interest you actually pay each month.

One very important fact about credit cards that almost everyone misses is that paying off most of your charges each month won’t save you from paying interest on them.

If you don’t pay your statement balance in full at the end of the month, you will owe interest. The way this interest charge is calculated on that average daily balance means you could pay off almost all your debt but because those days you had a higher balance are used, your interest charges will be much higher than just your rate times the ending balance.

Do I Pay Interest on Every Purchase I Make on My Credit Card?

You will never owe interest on a credit card if you pay your statement balance in full by the due date. This is usually ten to 14 days after the statement closes each month.

When your statement comes in the mail or you receive it online, it’s a good idea to pay it off immediately. Any part of that statement balance left to the due date will mean not just interest owed on the remainder but also on much of the debt you already paid off.

Here’s how that works.

- Your credit card issuer keeps track of the charges on your card every day. It averages these at the end of the month for what’s called the ‘Average Daily Balance’.

- If you don’t pay your statement balance in full, the interest rate is applied against that average daily balance.

- That means you pay interest on charges you might have already paid off.

For example, let’s say you charged $5,000 on your card on the first of the month. You pay half of it off on the 15th but leave that over $2,500 on your card. You receive your card statement on the 28th and the payment is due on the 5th of the next month. You pay off $2,000 of the debt but leave the remaining $500 balance.

Since you didn’t pay off the full statement balance on the card, you’ll owe interest on the average daily balance (ADB). That ADB is ($5,000 times the first 15 days + $2,500 times the next 13 days) divided by the 28-day period or $3,839 for the period and that’s the amount on which you’ll pay interest.

That’s a lot more than just paying interest on that $500 remaining balance and a big reason to pay your statement balance in full.

Why Does My APR Go Up if I Make Payments on Time?

While making payments on time and building a solid credit history will cause your credit score to go up over time, there are other factors that could push your FICO lower in the short-term.

Don’t worry too much about little changes in your credit score. Moves of five or ten points can be from a variety of reasons and your score should rebound if you’re not doing anything to hurt your credit.

It’s the bigger moves of 30 points or more that should worry you. This means you’re either doing something to hurt your credit or someone else might be.

- Check your credit report to make sure there are no mistakes or accounts that you didn’t create.

- Even if you’re making regular payments, your credit score can fall if your total debt owed keeps going up.

- Your credit score will suffer when you close accounts or when accounts drop off your credit report after paying off the debt. This is because the average age of credit on your reports decreases.

How Do I Lower My Interest Rate on a Credit Card?

The biggest factor in your credit card rates is your FICO so that’s where you should look first to decrease your score. There are a few things you can do after building a higher score.

- If you’ve had a card for a while and your score has increased, negotiate a lower rate or tell them you’re going to change cards.

- Look for a new card that offers a 0% introductory rate and free balance transfers but make sure the post-teaser rate is lower as well.

- Paying off your statement balance each month means your interest rates really don’t matter. You’re not paying interest anyway.

Watch this video to see how I negotiated my debt to save $6,500!

Comparing Credit Cards

There are thousands of credit card programs and sometimes it seems just as many providers. Like any financial choice, understanding and comparing your options will make sure you get the best deal available.

How is a Credit Card Different from a Debit Card?

Debit cards are linked to your checking account and you can only spend as much as you have cash available. That means it’s not a loan like a credit card so there’s no interest rate. There are also no payments so no late fees to worry about either.

Debit cards might claim to be reported on your credit report, but they don’t help your credit score. You’re not making any payments so there’s no way to build up a payment history.

What is a Secured Card and How is it Different from a Credit Card?

Secured cards are a lot like debit cards but they can help you build your credit score. Like a debit card, your secured card is backed by money you put into an account, but your card still works like credit. You borrow the money charged and then make a payment at the end of the month.

If you don’t make a payment at the end of the month, the remainder of your balance due might be taken out of the cash you put on the account or you might just be charged interest. In this way, the money you put on the account is more like a security deposit that cash against which you use on the card.

Since you have monthly payments on a secured card, it can be a good way for bad credit borrowers to build credit history.

What is a Balance Transfer?

A balance transfer is exactly what it says, transferring the balance from one debt to another credit card. Transferring to a new card usually brings the benefit of a 0% introductory rate for six months to a year and no transfer fees.

Balance transfers are popular ways credit cards get you to switch and can seem like great deals for borrowers. Managed correctly, they can save you a lot on interest if you weren’t able to pay off your card’s balance each month. Be aware that your interest rate will increase after the teaser period and any missed payments will reset it higher even if you’re still within that first six months or year.

Watch this video for my two favorite credit card payoff strategies!

How Does My Credit Score Affect My Interest Rates?

Your credit score is the primary way credit issuers assign rates. Credit card companies need to assess how likely people with ranges of scores are to repay. That means, within each credit score range, the people that pay off their cards have to pay higher rates to make up for those that default.

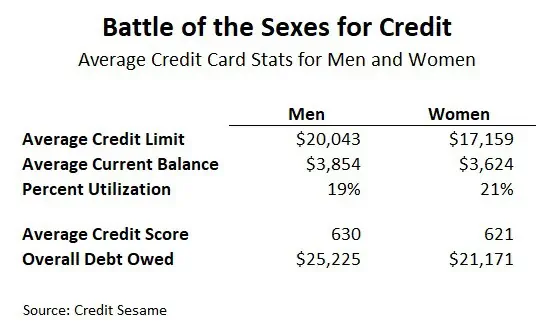

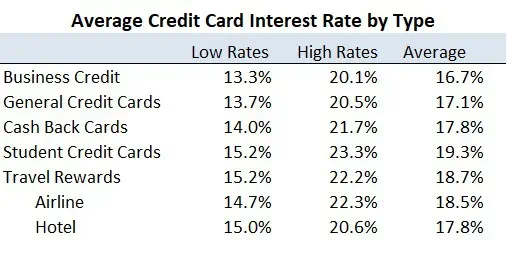

There’s no formal scale for FICO scores and interest rates but generally you’ll get offers for lower rates as your credit score increases. I pulled data from a consumer survey and other public information to average the rates on cards for different scores.

These interest rate averages will change depending on other rates in the market but are a good rule for different credit score ranges. Credit rates tend to start around 12% even for the best scores and ranges to 36% for those with bad credit.

What are the Types of Credit Card Rewards?

There are primarily two types of credit card rewards programs, cash back and points.

Cash back cards are exactly that, you receive cash back in a certain percentage of your purchases. That percentage usually starts around 2% on all purchases though you might earn more if you spend to different levels. You might also earn a higher percentage if you shop at certain retailers or buy certain products.

Cash back rewards can be a way to get an easy discount on things you’d buy anyway but it’s a strong incentive to overspend. You always have to ask yourself if you would have bought the product anyway or are simply buying it for the cash back.

This is especially true for special products that might be more expensive than others but get you to spend on that one or two percent reward.

The other types of rewards programs are for points. You accumulate a certain number of points whenever you use your card, usually one point for every dollar you spend. You can then redeem your points for products from approved retailers.

- Your points will generally go farther when spent on specific companies. This is especially true for the primary company that sponsors the card as in airline miles.

- Make sure you check all the restrictions and blackout days on points purchases.

- Points cards make it more difficult to calculate the true value of your points. You’ll need to compare how much you save on purchases versus how much you spent to accumulate the points.

- There may also be special programs for student credit cards.

On my airline miles card, I generally get around $0.02 per point when redeemed for air travel. That would equal the 2% cash back you get on most cards. If I spend the points on something else, I might only get $0.015 per point so it’s something you really need to watch and plan carefully.

What is a Credit Card Introductory Rate?

The introductory rate is also called a teaser rate because it’s so low as to entice you into applying for the card. The teaser rate is usually from 0% to 6% depending on your credit and usually lasts from six months to a year.

During your introductory period, you’ll generally pay the teaser rate on purchases as long as you make the minimum payment each month.

- Miss or pay late on one payment and your rate will usually reset to the highest possible, often 24% or higher.

- Credit issuers will often allow you to transfer balances from other cards and apply the teaser rate. Understand that if you don’t pay the balance off before the end of the teaser period, you may own interest accrued over the entire period.

- Always read in your application or ask customer service about the rate your card will reset to after the introductory period.

Questions about Paying Off Credit Cards

These are my favorite credit card questions because it means you’re on the right track. Paying off credit card debt isn’t as simple as sending in your monthly payment. Answering these questions will help you save money and get out of debt faster.

When Should I Pay My Credit Card Bill?

Other than ‘before the due date’ there’s a lot of leeway in when you pay your credit card bill.

Your bill is usually due 21 to 28 days after your monthly statement closes. Depending on the way you make payments, you might want to pay it at least a few days in advance to make sure the money is credited to your account.

Your credit issuer will usually email you a notification when your statement closes. I usually pay my cards when I get the email, but this actually isn’t the financially ‘smart’ thing to do. Since you pay no interest or fees on the money until after the due date, you can use the money for other things during those three weeks until your bill is due.

On the other hand, it’s going to cost you a mountain in fees if you miss your payment due date. I pay mine when received because I usually have the money available in savings anyway and might as well get the payment out of the way while I’m thinking about it.

I know others that pay off their cards every week with an electronic ACH from checking. While this helps keep them from overcharging on the card, it seems like a lot of unnecessary work to me.

How Do I Change My Credit Card Payment Due Date?

Most card issuers will allow you to change the date on which your credit card payment is due. You might change all your cards to come due on the same day so you don’t forget any. Conversely, you might change your due dates so they aren’t all on the same part of the month and coming from the same check.

Changing your payment due date is as easy as calling customer service and asking them to change it. I’ve changed due dates on two cards and never had a problem getting the date I wanted.

How do I Pay Off My Credit Card?

You always need to make the minimum payment on your credit cards but there are a few strategies to pay off your debt faster.

- List your credit cards and other debt in order of highest interest rate first. Make all the minimum payments then put any extra money to the highest rate debt on the list to pay it off faster. This is called the debt avalanche method and saves the most money in interest.

- List your credit cards and other debt in order of smallest amount owed first. Make any extra payments to the debts with the lowest amount owed to get it paid off faster. This is called the debt snowball and while it won’t save as much money as the avalanche it can be extremely motivating to see accounts drop off your list more quickly.

- Remember that interest charges are calculated on the Average Daily Balance so if you can’t pay your entire balance at the end of the month, make your payment as soon as possible to lower that ADB and the amount of interest you’ll owe.

How Much Do I Have to Pay on My Credit Card Each Month?

When you check your credit account online, you’ll see three numbers to make a payment.

- The first number will be the minimum payment, usually from $25 to 2% of your statement balance.

- The second number is usually your statement balance, the amount of charges and fees on your card at the end of the billing period.

- The final number will be the amount of charges and fees on your card at the moment. This includes any charges from the end of the billing period as well.

You absolutely must pay your minimum payment on the card. This is the amount you have to pay to avoid late fees. You should pay your statement balance if at all possible. Paying your statement balance will avoid any interest rate charges on the card.

You can pay the total amount on your card but there’s really no incentive to do so. You won’t owe interest on the charges beyond your statement balance until the next month so it’s like an interest-free loan until then.

How Do I Get a Credit Limit Increase?

Just ask! Credit issuers will usually increase your credit limit upon request and at least once or twice a year. They may be slightly less willing if you have a history of maxing out your card and missing payments but otherwise all you need to do is call customer service and ask.

Increasing your credit limit is actually a way to get a quick boost in your credit score as well. It increases the amount available relative to what you owe and makes your credit utilization ratio look better.

Questions about Credit Card Problems

There are some situations so urgent that you need an answer right away. These are the questions you can’t wait for customer service to pick up.

If I Buy Something with My Credit Card but it Doesn’t Work, Can I Get a Refund?

Many cards now offer buyer protection against damages to purchases they make on a card. Check your card application or call customer service to get the details for your card.

Some cards offer as much as three to six months’ protection on purchases from damage or theft. If the store won’t issue a refund, you can apply for one directly through the credit card.

What if there are Charges on my Credit Card I Didn’t Make?

Always check your monthly statement for charges. You have two months to report any fraudulent charges on your card for the right to a refund.

After reporting the false charges, the card issuer may contact the seller to verify but your money will be credited back to the card usually within three to five days.

What if My Credit Card is Stolen?

Always keep your card information and customer service number safe with other personal data at home. If your card is stolen, report it immediately and you won’t be responsible for any charges. Card issuers can usually have a new card mailed to you within two weeks.

Can I Use My Credit Card Outside the Country?

Most credit cards can be used internationally but be sure to call customer service ahead of time to put an out-of-country alert on your card. This will tell the card issuer that you’ll be using it internationally and will avoid problems.

Forget to call customer service and they may think any international charges are a stolen card and stop your card.

How to Manage Credit Cards

A lot of bloggers will tell you to avoid credit cards at all costs, just cut them up and never look back. I’m more of a debt agnostic and want you to get the benefits of credit cards without the downside risk. That means knowing how to manage your cards and not getting trapped in a cycle of debt.

Can I Use My Credit Card to Get Cash at an ATM?

Most credit cards can be used to get cash from an ATM but understand it will be more expensive than a regular credit charge.

Getting cash from your available balance is counted as a cash advance which usually charges an immediate rate, up to 3% of the amount, plus normal interest charges. You’ll be given a four-digit pin when you receive your card to use at ATMs but think twice about using it for this purpose.

Your credit issuer might also send you checks you can use against your card balance. These are usually treated as cash advances and charged that immediate fee as well.

What is an APR?

The Annual Percentage Rate (APR) is the true cost of all interest and fees on your credit card. Since there may be additional fees on the card and your interest is calculated on a daily basis, the actual rate you pay is higher than the stated interest rate at the top of your statement.

The Truth in Lending Act requires that credit issuers show you in plain English the APR for your card and must have it where you can easily find it on the statement.

What Kinds of Purchases Should I Make on My Credit Card?

There are two things to remember when charging something to your card. First, it’s a good idea to only charge as much as you can pay off at the end of the month. This will avoid paying any interest fees and you may even get a discount through cash rewards.

Second, be careful of charges that are considered cash advances where you’ll owe an immediate fee on top of the normal rate. This will include any cash withdrawn from ATMs but also may include paying your mortgage with the card.

I use one card for all my business expenses to easily track how much I’m spending. We have another card just for emergencies and for everyday spending like groceries, gas and other needs.

Are Credit Card Rewards Programs Worth It?

Credit card companies are smart! Don’t think they are just giving you money without thinking about it.

Managed correctly, card reward programs like cash back or points can totally be worth it. If you pay off your balance EVERY SINGLE MONTH then you never pay interest charges and the points you earn are a discount on your purchases.

The card companies know that most people won’t keep a perfect record on paying off their statement balance and they’ll be able to collect more in interest than they pay out.

It’s a judgement call. How much do you spend on the card and how much are those rewards worth versus the amount you pay in interest and fees? Don’t just estimate this amount but actually look back on the last year’s worth of interest payments and points redemption to see how much you’re really earning.

How to Cancel a Credit Card

Cancelling a credit card is as easy as calling customer service. Don’t think that the card issuer will cancel the card just because you’re not using it. You have to call up and cancel.

Customer service is probably going to offer all kinds of incentives to keep you using the card. This is actually a great way to get a lower rate or renew the introductory rate on your card for a period. If you truly want to close your account, stick to it and don’t accept any offers.

After closing your account, you’ll continue to make normal payments on your card balance until it’s paid off. The card issuer is going to keep charging interest on the balance as well.

I’m always adding to this list of credit card questions so use the comments section below to add yours to the list. The most important point from this list isn’t the answers but the idea that you find your own answer to each question. That could mean using credit cards as a financial tool or neglecting them altogether if you think you can’t avoid the problems.