Hey Bow Tie Nation, here is a really important video that I know is going to change how a lot of you think about dividend stocks. You know I’m a big fan of dividends but every dividends video, I always get a lot of comments about returns, questions about why I invest in dividends instead of the higher returns in growth stocks.

And it’s a totally valid question, growth stocks do often outperform dividends. For example, the Invesco QQQ Trust, a fund of tech stocks, has beaten the Vanguard Dividend Appreciation Fund, ticker VIG, by nearly 10% over the last year…so why are dividend stocks so important? Why not just invest in growth instead? Why do I think dividend stocks are a better investment when you need to live off your portfolio?

But to answer that, I have to take you back to 1986. My mom and I are at Kmart late September, finishing up some back-to-school shopping and she tells me to go look at jeans while she does something else.

Now I’m not sure if she’s getting early onset dementia at 34 years old or what but a ten-year old boy is not going to look at clothes while his mom does some mystery shopping.

So I do my best Miami Vice, a loose follow as she makes her way over to the toys, my heart beating faster knowing I’m about to see what I’m getting for Christmas a full three month’s early. She asks a store associate something and he leads her over to aisle five…action figures.

What she does next is, after the birth of my kids, probably the single best moment of my life. My mom picks the GI Joe Terror Dome off the shelf and proceeds to lay-away.

You see, my mom had just remarried in January and for the first time I could remember, we were a two income family and swimming in cash! Like not quite Different Strokes or Silver Spoons living but definitely Who’s the Boss money. I got new clothes for school that year…I mean, they were still garage sale clothes but these were nice garages…like really NICE!

I had been asking for this Holy Grail of the GI Joe pantheon for months and most years, I would make the big ask like this in hopes of getting the consolation prize, something smaller like a couple comic books. But this year…I was getting the grand prize!

Learning the Value of Financial Security During a Crisis

And here I was about to add the Terror Dome, the pride of COBRA, to my arsenal of action figures and this thing was AWESOME. A fortress of terror complete with the Firebat jet and pilot…the battles would be epic!

Then, in one of the defining moments of my childhood, in late October…the world ended. Not the actual world of course but my ten-year old world and hopes of late-night GI Joe raids deep into COBRA territory, because within two weeks of each other, both my parents got laid off from the transit authority.

Now, my dad was able to get a temp job as a janitor but we lost one of the cars and started falling behind on other bills. And I remember vividly, my mom and I are sitting in her old cream-colored ’78 NOVA…not the sweet muscle car of the early 70s but the grandma coupe it would later become, we’re in the car about nine pm one night waiting for dad to get off work, and she turns to me and says, “let’s talk about money.”

And that was it. Not only was I not getting the Terror Dome for Christmas but I instantly learned the value of financial security and having money you can count on in a crisis.

So when people ask me why I invest in dividend stocks, when they point out that growth stocks often produce higher returns over time, that’s the point I flash back to…that five seconds sitting in the car back in 1986 when I learned that you just can’t put a price on financial stability.

And that’s the power of dividend stocks, that consistency, that security to pay the bills even when you can’t. In this video, I’ll show you how to create a dividend ladder to live off your dividend stocks. I’ll reveal three passive income dividend investments and five stocks to buy, then show you a plan for starting small, investing just a few hundred a month that will grow into a dividend portfolio you can count on.

Why Invest in Dividend Stocks and the Power Behind It

The idea here is going to be to highlight different types of passive income dividend investments then five dividend stocks as an example for a dividend ladder portfolio. We want to pick dividend investments that are going to be reliable and produce a consistently high dividend yield to live on.

And we’ll first look at the special structure dividend investments; the REITs and BDCs. These are special types of companies that get a tax break if they spin off at least 90% of income as dividends. The result is you get a great dividend stock with a high yield but there is a downside. A lot of investors just focus on that dividend yield and they end up loading up exclusively on these types of stocks. The problem is, if something happens to the sector, so the market for commercial real estate or for small business lending, then you can see your entire portfolio sell off all at once.

To avoid that, we also want some regular dividend stocks, ones with higher yields than the market but still that normal corporate structure and for these, I like to look for yields between 4% to as high as 6% but you’re not looking for double-digit yields here. You want a company that can produce that consistent dividend but is still holding something back from earnings to grow the company and eventually grow the dividend.

Within dividend stocks, I’m also looking for the dividend growth rate, so how much the dividend payout has grown over the last three or five years. This is a great way to build your portfolio because you know besides a strong dividend yield, you’re also getting a stock that is going to pay you a higher dividend in the future.

Dividend Stock Strategy You Need to Follow

Finally before I show you those five stocks, I want to highlight another dividend stock strategy, one we’ve talked about on the channel before, the covered call strategy. This is where you own a stock and sell call options against it, collecting cash flow besides the dividend.

And the reason I like to use this strategy is because it can give you a way to boost your dividend yield another couple of percent on stocks you really like but maybe don’t meet the criteria for higher yields. For example, you might really like shares of Apple but it only pays a half a percent dividend yield…definitely not something you can live on, but I can sell these call options expiring in January 2023 for $8.75 each. I collect that money now, effectively giving me another 4% annualized cash boost and I still have a 27% upside return potential to the $190 strike price.

Dividend Ladder: 5 Dividend Stocks for Financial Security

Let’s look at examples of each of these types of passive income dividends, five stocks with an average yield of 6% plus a return of 24% annually over the last decade.

First up is one of the best real estate stocks for return and yield, Arbor Realty Trust, ticker ABR, with its 7.7% dividend.

Arbor is a direct lender to multi-family, senior housing, healthcare and other commercial real estate properties. Multi-family projects make up about 83% of the portfolio so that’s a little on the high side but these are agency-backed loans so definitely on the safe side.

Arbor has grown that dividend by 16% annually over the last five years and on sales growth of 20% a year. With the rise in residential prices, rents on multi-family should be rising as well and loan growth should continue higher.

The shares have produced a 28% annual return over the last five years could continue to produce in the range of fifteen- to 20% annually.

Main Street Capital, ticker MAIN, is another favorite among dividend investors for its 6% yield and solid price return.

Main Street is a business development corporation, specializing in loans and equity investment into mid-sized businesses, with shares producing an 18% annual return over the last decade. The company has regularly increased its dividend, now at $0.205 per share along with special dividends of over $4 per share distributed since 2013.

The company had 182 portfolio investments as of the second quarter with the largest representing just 3% of total fair value so a hit to any of these investments isn’t going to hurt the shares much.

One thing you always want to watch for with BDC stocks is to compare the effective yield on the company’s investments with the dividend yield. In this case, Main Street earns a weighted average yield of 9.7% on its loan investments and pays out 6% in monthly dividends. The average yield above the committed dividend yield is a must for dividend sustainability.

One of my favorite dividend stocks for cash return and growth has been AllianceBernstein, ticker AB, and its 6.7% yield.

AllianceBernstein isn’t one of the larger wealth managers at just $105 billion in assets but it is one of the best managed. That high dividend yield has steadily grown with a 14% growth rate over the last five years and the shares have produced a 24% annual return over the last decade.

Now one thing to understand about Bernstein though, it pays out 100% of its adjusted earnings so that dividend tends to be pretty volatile up and down.

Still though, the company has a history of growing revenue with 9.7% sales growth over the last three years on a shift to higher fee alternative investment management. Clients stick around here with an average client tenure of 12 years.

Next here is possibly one of the best opportunities in dividend stocks, OneMain Holdings, ticker OMF, with its 4.8% yield.

OneMain is a consumer lender with over 100 years of operating history, serving over two million customers and originating more than $155 billion in loans.

And despite the share price nearly doubling in the past year, the industry for consumer loans has actually been pretty tough. With households saving as much as 33% of their income during the pandemic, loan demand dried up for banks and other lenders. We’re now seeing that come back though and I really like the direction the company is taking.

OneMain has an impressive 20% market share on a market opportunity that approaches half a trillion dollars. The Trim app acquisition puts it in the financial wellness fintech space for growth outside credit and makes it a more diversified business.

Management is guiding to double the customer base by 2025 and generating $1.5 billion in capital growth. That would build on the stock’s 25% annual return we’ve seen over the past five years including $14 a share in cumulative dividends paid.

In that covered call strategy, the yield on Progressive Corporation, ticker PGR, is misleading here because it actually pays out a total of around 5% yield.

Progressive is the third largest auto insurance company in the U.S. and has more than 20 million policies across auto, home and commercial. The company pays out a special dividend each January that accounts for the majority of cash return with the annual dividend growing by 32% annualized since 2019 on sales growth of 16% a year.

I’ll show you how to set up the covered call strategy with this example, a strategy that can boost your dividend yield by 2% on shares of Progressive. You’ll first go into the options menu, and we’ll use Yahoo Finance here but you can find it on any investing app.

Dividend Ladder: Setting Up the Covered Call Strategy

The first thing you’ll do is pick which month you want your options to expire. I like using the January months because I can lock-in that premium for up to a year or more and collect more money. I’ll pick the January 22 options which will expire in about five months from now.

Next you pick the price at which you would be willing to sell your shares. Since it’s only five months to January, I don’t think Progressive would go much higher than another 15% so that gives us a price around $110 per share.

And I see here, at the $110 strike price, I can sell these call options to another investor and receive about $0.90 a share now. That’s an instant return of about nine-tenths of a percent, almost one percent, for five months so if I annualize that, it’s like getting an additional 2.2% annual yield on the stock.

Now there’s more to that covered call strategy, so I’m going to link to a full video in the description below, but essentially I’ve just increased the yield on this stock that already pays a 5% dividend by another 2%, plus I’ve got the upside price return potential!

So we’ve got a five stock dividend portfolio with annual returns averaging 24% over the last decade and a 6% dividend yield but more importantly, I’ve picked these to create a dividend ladder for constant cash flow.

I’ll show you a plan for building your dividend portfolio and living off dividends next but a dividend ladder is consciously picking your dividend stocks so you receive that cash flow every month or at least regularly.

Dividend Ladder: How to Build Your Dividend Portfolio

You see, most dividend stocks only pay out every three months but that’s just not how bills work, right? You’ve got bills to pay every month so unless you want to save out parts of that quarterly cash flow, the best strategy is creating that kind of a ladder effect on your dividends.

And it’s easier than you might think. You can find which months a dividend stock pays by going to the Historical Data tab on Yahoo Finance or this dividend history will be available on any app. So here we are on Arbor Realty and we’ll change the time period to five years to get a good look at its history. Then we’ll change it to show only dividends and click apply.

Here you see the ex-dividend date for each dividend and it’s not the same day each year but usually within a week. We see that Arbor Realty tends to go ex-dividend in February, May, August and November with the dividend paid out about two weeks after.

So if we want to create that dividend ladder then we’d want to pick stocks that not only produce a strong yield and return but ones that will pay out in different months.

And if we look through the five stocks; we get good coverage throughout the year for dividends. Progressive pays out its annual special dividend in January and Main Street Capital is a monthly payer so you know you’re getting at least one dividend check each month. The other three will produce checks in seven more months so you might have to plan a little for the lighter months but you know you’re not too far from a dividend payout.

Again, these are only examples and feel free to add or subtract stocks from your own dividends list. The important point is to be aware of when those dividend payments come out so you can plan your bills around them and have that sense of financial security.

If you want to go a step beyond this, I’ve put together another video highlighting a 12 stock dividend portfolio that pays out every week. Twelve dividend stocks planned to put cash in your pocket every week, so look for the link to that in the video description.

Before I reveal that plan to live off your dividends, I want to personally invite you to get the Daily Bow-Tie, our daily market newsletter with all the news, trends and investing strategies you need to know about. It goes out every night before the market opens to give you time to plan your investing day so I’ll leave a link to that in the video description below.

Now I want to reveal that plan to grow a dividend stock portfolio and live off your dividends but understand, I’m not going to promise you rainbows and unicorns here. I can’t perform miracles.

You see plenty of dividend videos here on YouTube making it seem like you can live off your dividends within a few years and a lot of investors think there is some fairy-tale, magic make-believe land where everyone gets free money for nothing.

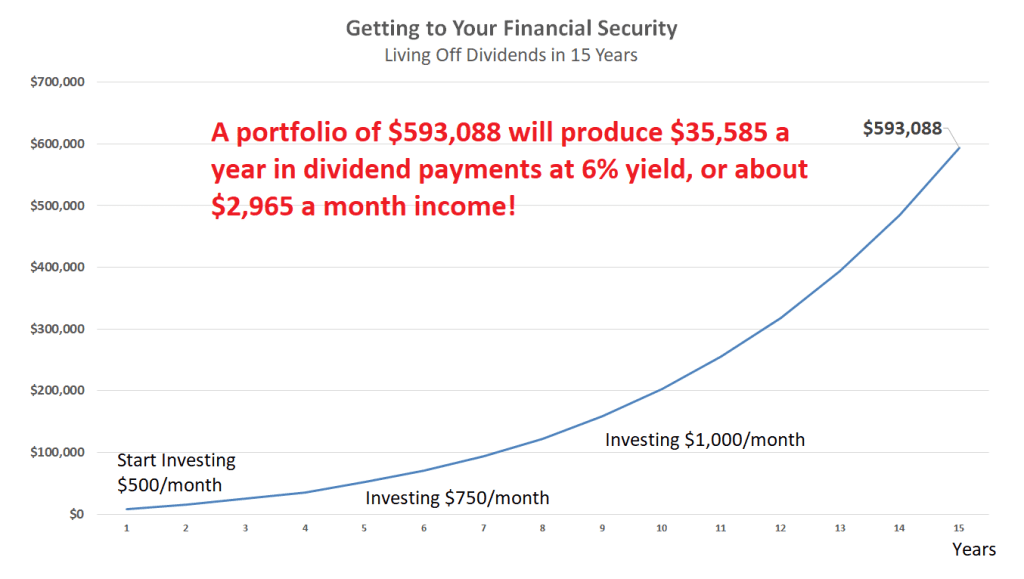

I gotta burst your bubble here folks because if you think you’re going to live off dividends after investing a few thousand bucks…it just ain’t going to happen. Even on the 6% average dividend yield in our five-stock example, which is an extremely high dividend more than three-times the market average, to create $3,000 a month in dividends, you would need to build a portfolio of $600,000 in the stocks.

But before you throw up your hands and click out, it is completely possible to build to that amount in ten or fifteen years. I’ll show you how to do that next and at that 6% dividend yield, it’s going to produce that $3,000 monthly income for life. Every year, you’ll be able to count on $36,000 in dividends and more as the dividend payouts and your portfolio grows.

And if you’re still watching, half of you are wondering how the hell anyone can live off $3,000 a month income…all my New York and Californian Bow Tie brothers and sisters, but you can use this strategy for any amount. To find the amount of dividends you’ll collect each month, just take the amount you have invested and multiply that by the dividend yield of your stock or portfolio. So in our example with a 6% average dividend across the five stocks, if we have a $500,000 portfolio then five hundred grand times 0.06 gives us $30,000 a year and divided by 12 months gives us $2,500 a month income.

And the secret to this strategy is reinvesting your dividends every month, every quarter whenever they get paid to grow your portfolio to that point where you can start living off the cash flow.

Grow Your Portfolio by Reinvesting Dividends

As an example, if you need that $3,000 in monthly income to live off or at least supplement other income, you gradually build to that $600,000 portfolio. Here if you start with investing $500 a month, and I’ve tried to start with a level most people can achieve, that gives you four years before you need to increase the monthly investment to $750 a month and then four years before increasing it one more time to a thousand a month. That alone gets you to $593,000 within 15 years on a reasonable return.

And honestly, 15 years is not a long time folks. I know it may seem like a long time compared to other videos that promise overnight riches but THIS is realistic. This is something you can do, not have to chase after the riskiest stocks that lose your money and not have to break your budget investing. This is a real plan for creating that dividend ladder and living off your dividends.