Anyone can take advantage of these debt tricks to save money and reach their debt free goals

I shared 15 of my favorite loan tricks last week in a roundup article that instantly jumped to one of the most popular on the blog. The article highlighted some of the best debt tricks to save money on interest and get debt free.

The article was so popular that I wanted to narrow it down to my five favorite debt payoff ideas that everyone should try. These are debt management ideas that anyone can use and some of the easiest you’ll find.

I put my five favorite debt tricks in the infographic below but don’t forget to scroll down for detail into each and how it can work for you!

Feel free to share this infographic or use it on your website. Please refer and link back to:

https://financequickfix.com/favorite-debt-tricks-fast/

My Five Favorite Debt Tricks to Pay Off Debt

Some of my favorite debt tricks involve different ways to pay your debt while others help to save money so you can make extra payments. Try at least a few of the debt payoff ideas below and consider using more than one to really ditch your debt.

Make Bi-Weekly Payments to Save Thousands on Interest

Making half of your monthly mortgage payment every two weeks is one of the most popular debt tricks because it works so well. Most mortgage loans can even be set up to make automatic payments this way.

You won’t even realize you’re making an extra payment each year but it can lead to some huge savings over the life of a loan. Splitting your monthly mortgage payment in two and paying every two weeks can save over $30,000 on a $100,000 30-year loan at 6.5% interest.

The debt trick works with other loans as well, including your credit card and car payments.

Debt Consolidation Can Save Money and Reduce Debt Stress

Most borrowers don’t realize just how much those bad credit loans really cost. Credit card and payday loan companies are counting on the fact that most people don’t add up all the interest they’ve paid on debt.

If more people knew just how much high-interest debt cost, they’d think twice about taking out new loans or charging to those credit cards.

It’s why debt consolidation loans from websites like PersonalLoans and Lending Club have become so popular. Taking out one loan to repay separate, high-rate loans can save thousands even over shorter periods.

A $15,000 consolidation loan at 9% interest lowers your payment by $50 a month and saves $1,813 in interest over 36 months versus the same amount of debt at a 16% rate.

One hidden benefit of debt consolidation is the fact that you have just one loan payment a month instead of many. Too many missed payments happen every month because borrowers just forgot to send in payments for all their loans. Consolidating your debt makes it easier to track your debt each month.

Check your rate on a consolidation loan of up to $35,000 today

Pick the Avalanche or Snowball Method to Pay Off the Worst Debt

This is my single favorite debt trick and can really help motivate you to get debt free. I detailed the snowball and avalanche methods of paying off debt in a previous article about how to rank your debt.

The Snowball Debt Payoff Method works by listing out your debts by lowest amount and then paying them off with any extra payments. While the Avalanche method saves more money, I like the snowball debt method because you get to see debts drop off your list faster. It can be a real motivator to keep making extra debt payments.

Try this Crowdfunding Debt Trick

The crowdfunding debt trick can be a little more work but can basically lower your interest rate on debt to zero.

You won’t be able to use the popular crowdfunding websites like Kickstarter but there are other sites that allow you to post a personal campaign without offering any type of reward.

Sites like GoFundMe and Fundly allow you to start a campaign for any number of reasons including paying off medical debt, financial emergencies or to support a special cause. You will still have to reach out personally to family and social connections for a little help but it can be a great way to get out from under debt fast.

Spending Challenges are a Great Way to Find Extra in Your Budget

Budgeting can seem impossible and there’s usually very little room in your monthly budget for extra payments to pay off debt. That’s where spending challenges come in handy and can really help to change your spending mindset.

Some people try to cut spending on everything for a month, basically only paying for the absolute necessities. These types of spending challenges can be difficult to work through so you might want to try a more focused challenge at first.

Go a month without eating out or take the bus to work rather than driving. Put all the money you save to paying off debt. Cutting back to one car can save the average family as much as $5,000 a year!

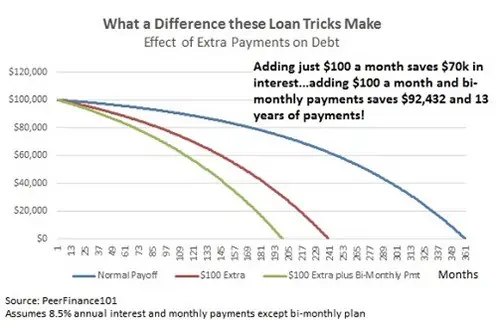

Putting extra money from your debt tricks to paying down loans will save thousands in interest. You’ll pay almost $177,000 in interest on $100,000 of debt at 8.5% interest over 30 years. Add an extra $100 a month or start making bi-monthly payments and Ditch your Debt!

I spend a lot of time talking about debt tricks and ways to pay off debt on the blog because it is such a huge problem for most Americans. My family filed bankruptcy twice before I was 15 and I know how stressful debt can be. Debt is like a noose around your neck, constantly squeezing and keeping you from thinking about anything else. Use these debt payoff ideas to loosen the noose and get out from debt forever!