Follow this simple process for bad credit home loans at rates you can afford

First let’s start by saying I hate the term ‘bad credit’ and bad credit home loans are no different than regular home loans. The banks have separated ‘good credit’ and ‘bad credit’ by saying everyone below a certain credit score, usually around 640 FICO, without even looking at the borrower’s credit report.

So there might be very little difference between a bad credit home loan and any other type of mortgage loan. It’s all just the nasty labels the banks have used to not have to lend to some borrowers.

It’s somehow more acceptable for the bank to say, “We don’t loan to borrowers with bad credit,” than it is to say they don’t make loans to low-income families or other borrowers.

Anyway, I’ll get off my rant and say that you can get a home loan even with bad credit. It all comes down to a simple process of putting everything together and presenting your case to the bank.

We’ll talk about how to get a mortgage with bad credit first and then some special loan programs for bad credit borrowers as well as some risks.

How to Get a Bad Credit Home Loan

You may be wondering if you even need a bad credit home loan. Why not just rent? Don’t a lot of people say a home makes for a lousy investment anyway?

There may be reasons to rent but with interest rates at historic lows, owning your home is one of the best financial decisions you’ll ever make. Home loan rates are just a couple of percent above inflation, meaning the economics of owning a home have changed.

When you can borrow money at next to nothing, it just makes sense to buy rather than rent.

Getting a home loan on bad credit will be more difficult than if your credit score is in the 800s but it can still be done. Banks are in the business of lending and they want to make loans, you just have to do a few things to convince them.

When you’re ready to apply for a home loan or a personal loan, check your rate here.

1) Start saving for your down payment of at least 20% of the home price. You can get loans with as little as 3% down but the bank will want to make sure you have lots of equity if you are a bad credit borrower. Putting 20% down on your loan also means you won’t have to pay PMI insurance which can save you upwards of $100 a month.

If you’re having trouble saving, check out these 20 Money Saving Tips to Save Thousands a Year.

2) Check your credit report and start improving your credit score. It’s going to take a while to save up the 20% down-payment so you’ll have time to build your credit score as well. Who knows, you might not even need a bad credit home loan by the time you’re done. If you can get your credit score above 640 FICO then a whole new world of lower rates will open up.

Fixing your credit starts with understanding what goes on your report and how to change it.

3) Put all your home loan documents together. When you apply for a home loan, whether on bad credit or otherwise, you’ll need several financial documents. Lender requirements are different but it will include at least two years of tax returns, your most recent pay stubs and any current banking or brokerage statements.

4) Understand how much home loan you can afford. Do you really need that mega-mansion? Do you really need that extra room for a dining table if you always eat in the kitchen or living-room? While owning a home is a great financial decision, spending too much on a house can wreck your finances. Understand how much interest you’re paying with this debt payoff calculator.

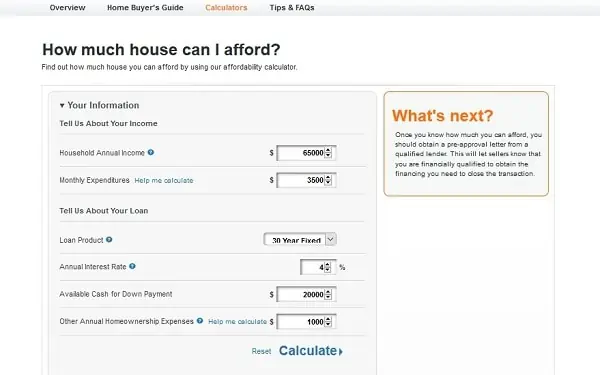

Discover has some handy online calculators to help figure out how much home you can afford and what payments might be on your loan.

5) Get pre-qualified for a home loan. Not only will getting pre-qualified for a loan help to see how much home you can afford but it will help you in the home buying process as well. Home sellers love buyers with pre-qualification letters because it means they won’t have to wait for months to see if their buyer can get a loan.

You’ll want to check out a couple of different banks and compare rates and fees. Not all lenders are created equal and there are a few out there that like to gouge bad credit home loan borrowers with points and fees.

6) Pick the right loan for you. The lower payments on a 30-year fixed mortgage look tempting but they come at the cost of higher interest rates. Variable rate loans seem like a good idea until you have to reset the rate in a few years and payments go up. Understand the difference between different loans and pick one you can afford and at the right interest rate. I like the 15-year fixed loan because it usually means a lower interest rate while payments are still manageable.

Mortgage Programs for Bad Credit Borrowers

If you don’t have the time to increase your credit score or save that 20% down-payment, there might still be a chance to get a home loan. The government has some special loan programs designed specifically to help people in need.

These loan programs won’t help you pay the mortgage and there are some hidden risks like higher payments but they could be your best shot.

FHA Home Loans

The FHA loan program is the most popular mortgage program and the best for most people with bad credit. The program offers some great benefits including lower interest rates and very little down payment requirement.

Most banks can help you with an FHA loan with as little as 3.5% down and even if your credit is less than perfect. Federal Home Loan centers may also be able to help with closing costs.

VA Home Loans

The VA loan program is only for veterans but can mean little or no out-of-pocket costs to buy a home. Any military personnel released from duty with a Certificate of Eligibility from the VA will qualify.

The best part about using a VA home loan is that no down payment is required and you won’t have to pay PMI insurance on the loan. This makes it much more affordable compared to FHA loans.

USDA Home Loans

The USDA home loan program is best for borrowers living outside of major cities. Like the VA loan program, this one requires no down payment and it’s easier to qualify for than a conventional mortgage. Since they are on 30-year terms and fixed-rates, you mortgage payment should be relatively low compared to 15-year loans on more expensive urban-area homes.

Buying a Home with a Foreclosure or Bankruptcy on Your Credit Report

The Great Recession left a lot of people in major financial problems, many of which lost their homes or were forced into bankruptcy.

Those bad credit marks stay on your credit for up to ten years and probably kept you from getting any money at rates you could afford.

Fortunately, most of that is slowly dropping off your report and doesn’t need to keep you from getting a home loan. In fact, you can usually get a home loan even if you have a foreclosure or bankruptcy on your credit.

Lenders want to make loans and will overlook past mistakes if you give them a reason. Following the mortgage process above shows creditors that you’re ready for a home loan despite that messy past. The secret is to not give up after one or two rejections. Keep looking around until you find the lenders that are willing to help you out.

Check your interest rate on a personal loan up to $40,000 – won’t affect your credit

Risks of Bad Credit Loans for your Mortgage or Personal Loans

There are still some risks to bad credit home loans and they can put you in an even deeper financial hole than where you are now. Understand these risks before getting a loan so they don’t hit you later down the road.

- Poor credit means higher rates. Even with rates at historic lows, bad credit borrowers are still being forced to pay 3% and 4% more than other borrowers. It might make more sense to wait a year to improve your credit score.

- That extra mortgage payment can really add to your monthly bills. Make absolutely sure you can handle the extra payment before you take out a loan. Try consolidating your debt first with a debt consolidation loan to improve your credit score and see how much a debt burden you’re paying each month.

- Plan on being in your home for at least five years before moving. Moving around every few years means the fees, mortgage costs and real estate commissions will eat away at any financial benefit to owning your home. Stay put for at least five years to start seeing benefits outweigh the costs.

Bad credit doesn’t have to mean high rates and denied loans. Follow this simple process for bad credit home loans and get the money you need for the home of your dreams. It’s not an overnight process but it is one that can help you get a loan you can afford.