Understanding car loans and what credit score you need to buy a car will help you get the best deal possible.

Car sales have plunged over the last few years and that’s good news for anyone trying to buy a new or used vehicle. The credit score you need to get a loan has decreased and rates are still low.

That doesn’t mean you can ignore your credit score though. Understanding the credit score you need to buy a car will not only help you get approved but also get the lowest rates available.

The average loan for a new car rose to $30,157 last year while the average for a used car loan was $19,340 for the year. Loan terms have been increasing over the last few years with the average now just over 70 months.

Let’s look at what credit score you need to buy a car and how to get a loan even on bad credit.

What Credit Score do Car Lenders Use?

Researching for what credit score is needed for a car loan, I reached out to the three credit bureaus and FICO to ask which credit score is most often used by lenders.

Remember, you have several credit scores because there are three credit bureaus. These three companies; TransUnion, Equifax and Experian, all collect information from your creditors and put it into a credit report. Not all creditors report to all three companies so the information you have on one credit report might not be the same as what’s on the others.

That means when a lender pulls your credit for a loan, they might see something entirely different depending on who they use.

Fortunately, most lenders use the FICO score as one of the biggest factors in your loan. FICO uses information from your credit report to assign a score from 300 to 850 and reports that 90% of car lenders use their score. FICO has created a special car loan credit score called FICO Auto Scores that uses specific factors to the auto credit industry.

Want to get your credit report for FREE? I reveal the ONLY truly free source in this video!

Minimum Credit Score for a Car Loan

I pulled car loan data to find the average credit score for loans and then reached out to separate companies for the minimum FICO to qualify for a loan.

The average credit score for a car loan is 714 FICO for a new car and 655 for used but that’s average so it’s going to be much higher than the minimum.

Car sales have been tumbling over the last couple of years. The Cash for Clunkers program and low rates after the financial recession saw record numbers of sales and now there just aren’t as many people looking to buy a car. That means the entire industry, from manufacturers to dealers and lenders are scrambling to reach more customers.

That mad dash to sell more cars has meant that the credit score you need for a car loan has fallen. It used to be, you couldn’t get in the door to the lender unless you had a 600 FICO or higher. Now almost half of all used car loans are going to subprime borrowers and I’ve seen loans get approved on a 480 credit score.

Some of the lenders I reached out to are specifically for car loans while others are personal loans. Since you can use money from a personal loan for any purpose, it really doesn’t make a difference. I’ll share some tricks to get a lower rate later in the article but make sure you always compare car loans before agreeing to one.

- PersonalLoans is my most often recommended personal loan site. I’ve used them several times and the site does a great job of shopping your loan around.

- BadCreditLoans is another lender that specializes in poor credit but is only available in a limited number of states. I like the no-fee promise and no penalty for early payment.

There are several other peer-to-peer loan sites you might want to try but these are generally the ones that accept the lowest credit scores. SoFi and Upstart are also good lenders for higher credit scores, above 680 FICO, and may get you a better rate if you qualify.

With credit score requirements coming down, it’s not usually the minimum credit needed but the rate you can afford that is important when buying a car. An affordable rate will help you keep up with payments and avoid falling into a debt trap.

Can I Get a Car Loan on Bad Credit?

You can definitely get a car loan with bad credit. As mentioned, auto lenders and everyone else in the industry are pushing to open up to more customers. That means easy financing and programs to approve borrowers.

Not to be a downer, but the better question might be, “Should I get a car loan on bad credit?”

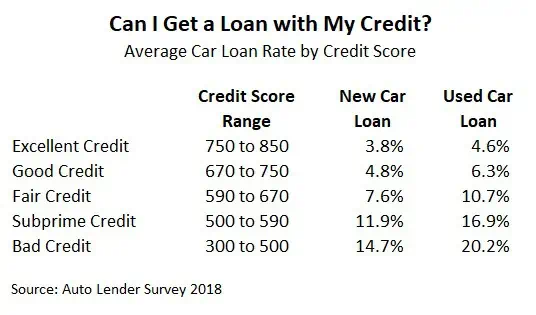

I’ll show you the average rates on car loans in a table below but bad credit borrowers might be looking at rates as high as 30% on loans for a used car. The table shows the average rate on bad credit is around 20% but remember, that’s the average and might not be the rate you get on your score.

With that in mind, you have to look at the monthly payment and make sure you can afford the loan. One more warning and I’ll stop being a killjoy. The trend lately has been to extend the loan terms out to 70 and even 90 months so people can afford the monthly payment.

Before you sign up for a 90-month car loan, understand that it’s going to lock you into those payments for almost eight years. That’s longer than most people keep their cars.

Average Car Loan Rates by Credit Score

I used published rates on car loans as well as some data to find the average rates by credit score. Understand that these are only averages so the rate on your car loan might be different but you can use this as a guide. One final note, interest rates on personal loans will be a little higher since it’s an unsecured loan versus a traditional car loan secured by the title.

With the Federal Reserve holding off this year an more interest rate increases, these rates should be relatively stable through most of the year.

Check your rate on a personal loan up to $40,000 – won’t affect your credit

I think where a lot of people get in trouble is they see their rate but really don’t look at the payment. Let’s look at two examples to get an idea of the monthly payment on different loan rates.

We’ll use the traditional 60-month car loan on a $15,000 loan for a used car. For the borrower with fair credit and a 10% rate, the payment would come to $318.71 per month. For the bad credit car loan at 18% annually, the payment would be $380.90 a month.

Neither of these payments are too bad but you can see how a higher rate will make the car more expensive. Make sure you find the estimated monthly payment on any loan disclosure and that it’s within your budget.

How to Get a Car Loan on Bad Credit

There are some tricks I’ve used to get a better deal on loans even with bad credit. The best thing you can do is to give yourself a month or two before applying for the loan. This will give you time to boost your credit score and get a better rate. I know waiting isn’t always an option so I wanted to share some other ideas on getting a car loan with bad credit.

- Pay off your credit cards or at least pay them down to less than a third of your limit

- Do not close any credit accounts or apply for a loan within a few months of your car loan

- Consider using a debt consolidation loan to pay off credit cards or other small loans to clean up your credit report

- Make sure you shop around for your car loan. Apply to at least three lenders to make sure you’re getting the best rate available

- Don’t go to buy-here, pay-here dealers. These are the highest rates and are basically set up to take back the car as soon as they can.

Average credit scores needed for a car loan have come down and rates are still affordable for most borrowers. Take advantage of low car sales to get a car loan on bad credit but make sure you understand the risks like the monthly payment and longer loan terms. Spend a couple of months to increase your FICO if you can and get the best deal possible!