Know the investing mistakes you should avoid or stop doing and how to invest your money effectively.

I lost everything. Thousands of dollars lost because of three little mistakes that almost all beginner investors make! In this video, I’ll reveal how to invest in stocks, those three mistakes that lose your money and an investing strategy so simple, you won’t believe it works. We’re talking how to invest, today on Let’s Talk Money!

Money Lessons I Learned in the Marine Corps

Nation, let me take you back, back to 1999 and a fresh young Lance Corporal Hogue was getting to his first duty station. He saved nearly everything earned during boot camp, and the rich Marine that he was, pockets overflowing with money…and if you’ve ever seen how much our enlisted warriors get paid…you know it’s not much.

I knew the Marines was never going to make me a millionaire, so I had better invest that money, get it working for me so I could retire to those sandy beaches some day instead of storming them in battle.

And it was a great year to get started investing! Stocks in the Nasdaq were up 85% by the end of the year and the only question was whether I wanted a two-story beach-front condo or something bigger!

Now, you already know how this story played out. I lost nearly everything over the next year. My faith in the stock market as easy money was shattered and it took years before I got back into stocks.

Nation, the fact is. Making money in stocks is EASY! Stocks have tripled in the last decade for almost a 13% annualized return. That’s without doing any stock-picking, without finding those best of breed names we talk about on the channel. Just investing across the stock market.

Now the question everyone should be asking…how do I not lose my money in stocks once I’ve made it.

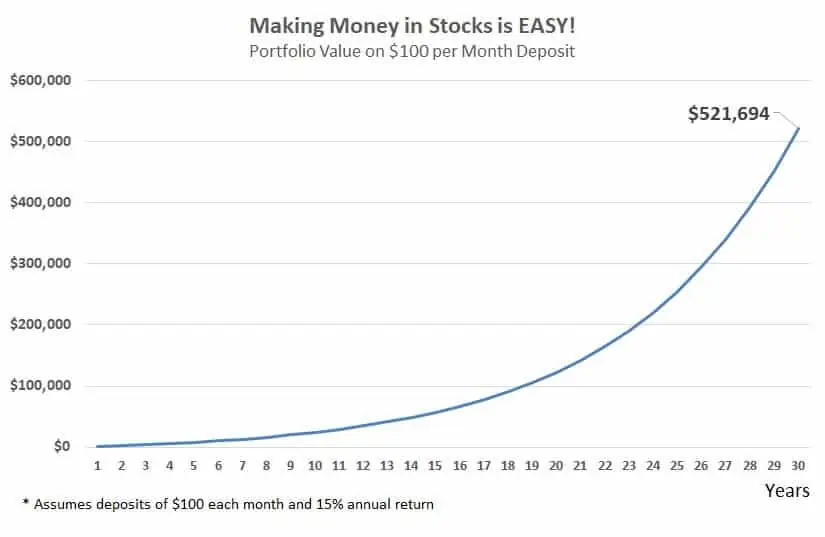

Think about it. Investing just $100 a month at a 15% annual return means having over half a million dollars in 30 years. That’s trading one cup of coffee a day for $521,000 and simply putting that money in stocks.

But that’s not what happens is it?

The average investor makes between 2% to 4% a year according to an annual survey by DALBAR research because they make all the worst investing decisions. They fall into those same investing mistakes I made oh so, so many years ago.

3 Investing Traps to Avoid

In this video, I’ll show you those three investing traps everyone makes as well as how to invest the right way. I’ll then reveal my favorite investing strategy, one that will take the stress out of investing and will make sure you keep making money!

And it’s the perfect time for this video. Everyone wants to ask this question, How NOT to lose money, after the market has started crashing! Instead, why not start BEFORE the panic, before the next stock market crash wipes you out like it did me? Give me ten minutes and I’ll help you protect your hard-earned money in the market.

Let’s get to those three mistakes and how to invest in stocks so you don’t lose money but first, I want to get your input on this. What has been the biggest mistake you’ve made in investing? What’s that one do-over you wish you could have? So scroll down and let me know in the comments, what’s that investment you wish you could do over?

The first lesson on how to invest is to limit the amount you have in any single stock to 5% or less.

Investors love to get emotional about shares of a company. Just ask an investor what they think of Tesla or Apple or their favorite dividend stock…and God help you if you say something bad about it!

The problem with this is they also have a tendency to go all-in on these stocks. How many times have you heard someone say, “I’ve got all my money in tech stocks,” or “I just put thirty grand in Tesla ahead of earnings.”

You might not even realize it until it’s too late. You buy into a company and get really excited about it…but the share price starts dropping. No worries, you buy another chunk to dollar-cost average your investment. Now the shares only have to rebound a little for you to make your money back and then some.

What happens though is that before you know it, you’ve got 20%, 30% or more of your money in this stock. This was my biggest mistake in 1999, having nearly everything I owned in just a few high-flying tech stocks. If I had spread my money out across some funds and other stocks, like in the strategy I’ll reveal later, the losses wouldn’t have been nearly as bad.

Limiting the money you’re going to invest in a single stock means avoiding these apocalyptic losses where you wipe out years of gains.

So the lesson I learned is 5%, no more than 5% of my wealth in any single stock. This means I might start with an investment of 2%, so if I have $100,000 in stocks, I might invest two grand in a stock. That leaves room, that remaining few percent to the 5% limit, to buy more of the stock if I do want to dollar-cost average lower.

And you have to stick with that rule. If you keep buying and hit that 5% limit in a stock, it doesn’t matter how much you love the company, do not buy a single share more.

I know it seems like this is going to limit your gains in winning stocks but please believe me, this rule is going to save your ass! Ignore it and eventually you’re going to chase that losing stock all the way down and lose tens of thousands, wiping out a big chunk of your portfolio.

Another investing lesson I learned the hard way is to always evaluate a stock on its future potential, not on what’s happened in the past.

Nation, I see a lot of new investors out there chasing stocks purely on looking at the rise in shares over the last year, reasoning if a stock price is going up…it must be a good investment.

There is a strategy called momentum investing where you invest based on that technical analysis and patterns…but it’s on that analysis.

FREE Report! See the 5 Biggest Stock Positions in My Portfolio! Five stocks I’m investing in for the biggest trends of the next decade! Don’t Miss this Free Report – Click Here!

And I know this is a tough one because it’s so much easier to just invest in the stocks you hear about on the news, the ones already going up. Who has time to spend hours a month or even each week to actually analyze a stock to find the best investments?

But this is the same trap investors fall for before every crash. In 1999 when I was starting to invest, it was the assumption that all internet stocks were going to change the world. That analysis didn’t matter, all you had to do was invest in what’s going up.

Now I promised to keep this video to about 10 minutes and I want to get to that simple investing strategy but I’m going to link in the video description to my 10-step process for analyzing a stock, make sure you watch that next. It’s the exact start-to-finish process for picking stocks I developed as an equity analyst and it WILL make you a better investor!

Another big mistake investors make is seated in what’s called loss aversion, a sub-conscious avoidance of even acknowledging losses or mistakes. Have you ever been down so much in a stock that you just didn’t want to look at your portfolio? Have you ever held on to a stock, despite losing 20- or 30-percent because you just didn’t want to take the loss?

You cannot get hung-up on how much you paid for a stock or how much you’ve lost. If you thought shares of that $10 stock were going to $15 but then new information came out that affect your reasoning, you have to look at those shares again and honestly decide if you still want it in your portfolio.

And Nation, I know it sucks to take a loss on an investment but you’ve got to constantly be re-evaluating your stocks with all the current information, both the good and the bad. If the shares are no longer a good investment, if that upside potential no longer meets your return requirement, then you need to look for a better investment.

This doesn’t mean sitting in front of CNBC or your investing platform 24 hours a day. Barring any shocking headlines, you can re-evaluate your stocks once every three months after earnings are reported. In that strategy I’ll share later, I’ll show you how to make this easier and less time-consuming, going back to analyze your stock picks.

The point is, it’s not how much you paid for a stock. It’s not the price targets analysts had on shares when you bought it. Whether you’ve lost money or not, none of this has anything to do with keeping that investment. The only thing that matters is an impartial assessment of the future stock price and whether that growth is enough to hold or invest in something else.

The third lesson on how to invest before we get to that bonus investing strategy is always have a defined point when you’re going to sell a stock.

This one ties in with that last rule to help you avoid holding those losing stocks as they burn your portfolio to the ground.

Selling those losers is one of the hardest things to do and part of it is because of shifting expectations. For example, maybe you buy a stock at $100 and expect it to go to $150 a share. Then the shares fall to $80 each and now maybe you only think the fair value is $105 a share.

That’s not much above what you bought it for but it’s still a 30% increase from the new, lower price.

When you buy a stock, bullet point out the reasons down to your target price and competitive advantages the company has over its peers. Then bullet point out a set of reasons you might sell the shares.

This is going to help you avoid that idea of shifting expectations for a stock. If one of your rules is that you sell a stock that has lost 15% then that takes all the risk out of the decision. It reduces the possibility to zero that you’ll follow any stock down to bankruptcy.

If you write out one of your reasons for investing is because of big potential in a new project, and the company ends up scrapping the project, then that avoids you looking for an excuse for holding onto the shares. You formalized your reasons for buying the shares and what would make you change your mind. It takes all the guesswork out of investing and keeps you from making some of those big money-losing mistakes.

How to Invest Effectively to Not Lose Money

Now I want to share that bonus investing strategy with you, a strategy that’s going to make investing as stress-free as possible and the one I use. The core-satellite strategy is where you put 40% to 60% of your money into broad funds or ETFs. We’re talking about funds that cover the asset classes like stocks, bonds and real estate. Maybe you invest in a fund of dividend stocks or one with international companies.

These funds are going to give you those market returns, diversify your portfolio for a smoother ride.

Then you take the rest, that 50% or so of your money, and invest in a small handful of individual stocks, maybe 7 to 12 stocks. By limiting your portfolio to less than a dozen stocks, you solve a lot of the problems that lose investors’ money.

You’re not constantly looking for new stock picks. That’s going to save you hours plus mean you’ll only be investing in the very best stocks you find. It makes it much more practical to keep up with your stocks, keeping up with the research and where the company is going. That’s something you can’t do if you’re investing in 20 or 30 companies.

Using these lessons for investing in stocks along with the core-satellite strategy and you will avoid making the worst of those investor mistakes that lose money. You’ll get those market returns plus the instant diversification from that core part of your portfolio. You’ll get the potential upside for a few extra percent return on your handful of individual stocks and you’ll know when to sell to avoid losing money.