Getting a life insurance quote online is easier than you think.

Let’s face it, getting life insurance probably ranks somewhere between root canal and stubbing your toe, but it isn’t nearly as painful as it used to be.

It used to be you had to find an agent you thought you could trust, usually by asking friends and family. Then you would sit down to excruciating sales pitches from each agent talking about how death was right around the corner for all of us and you better sign up fast!

Fortunately, that’s all changed with the rise of online quotes for life insurance and the ability to shop your policy around instantly.

In this video, I’ll guide you through the exact process to get life insurance online and get a quote within minutes.

We’re building a huge community of people ready to beat debt, make more money and make their money work for them. Subscribe and join the community to create the financial future you deserve. It’s free and you’ll never miss a video.

Join the Let’s Talk Money community on YouTube!

My Experience Getting Life Insurance

Now I remember the first time my wife and I looked to get a life insurance quote. We called around to our friends to get recommendations on an agent, scheduled to see a few agents and then sat through that hard-sale pitch with each. You know the one, right? They want to scare you into getting insurance right now and won’t take no for an answer.

The whole process took more than a week and was just a pain all the way through.

Of course, that was almost a decade ago and getting life insurance online has made everything a lot easier. Getting a quote and shopping around for insurance can literally take less than five minutes.

That’s why I’m teaming up with Quotacy, the country’s leading broker, to walk you through the process of getting life insurance online. Over the past two videos, we’ve answered some of those most common life insurance questions and misconceptions. We’ve looked at how much life insurance actually costs and some easy questions to determine how much you really need.

Now, I’m going to show you how that online process works for getting a life insurance quote and how to make it as easy as possible.

Quotacy has built out that online process to really take the guesswork out of insurance. The application takes less than five minutes and then gets shopped around to 20 carriers for the best policy.

In fact, you’ll be able to get estimates on your premium in seconds with their pre-application process. The team at Quotacy works on salary instead of commission so it’s there to find you the best policy, not the one with the fattest kickback.

Click to get your instant quote and shop your policy around for the best rate with Quotacy

Two Questions Before Getting Life Insurance Online

First, there are really two questions you want to ask yourself before you get a life insurance quote.

How much life insurance do I need.

We talked about this in our second video and looked at that general rule of about 10-times your salary. So if you’re making $40,000 a year then you’d want a policy around $400,000 but there are also some other factors to consider here to think about.

If you’re older then maybe your family wouldn’t have as many years to replace that income so you can make due with a smaller policy. Like we talked about last video, if your current salary is just barely enough to pay the bills, maybe you want a little larger policy to help your family save some money and pay those college expenses. Don’t just follow the rule-of-thumb, really think about how much your family would need to keep the same quality of life.

The next question before going online to get a quote is how long do you need life insurance?

Unlike health insurance where you need that constant protection, you don’t need life insurance your entire life. While some people use a life insurance policy as a way to leave an inheritance, the main purpose here is to replace your income and protect your family’s quality of life. That means you really only need protection for as long as you plan on having an income.

We’re talking about term life insurance here so anywhere from five years to 40 years. For example, I’m 43 this year and have a 20-year term life policy to protect my family for that time I would probably be working.

Another consideration here is do you want a single term policy that might be less expensive to start or do you want to lock in the rate on a longer policy. Like we saw in our last video on how much insurance costs, premiums on a 15-year policy will be lower but then you have to renew it and risk rates increasing later.

On the other hand, rates on a 25-year policy will start out higher but you’ve got that rate locked in for much longer.

That pre-application quick quote takes less than 30-seconds to compare different terms so it’s something you can play around with to see which works best on price and term.

How to Get a Life Insurance Quote Online

Now I’m going to show you the actual application process I used to get a life insurance quote online with Quotacy.

I gotta be honest, when I first talked to Jeremy Hallett at the company, talking about the application process, he told me it was five pages which kind of freaked me out a little. When I actually went through it, it’s not five pages but five screens with a few questions on each. WAY different and it actually took less than three minutes to fill out the application.

So here we are on the Quotacy pre-application page. In the other two videos, we used this to get that quick estimate on premiums but now we’re going to go through the full application to get an official quote.

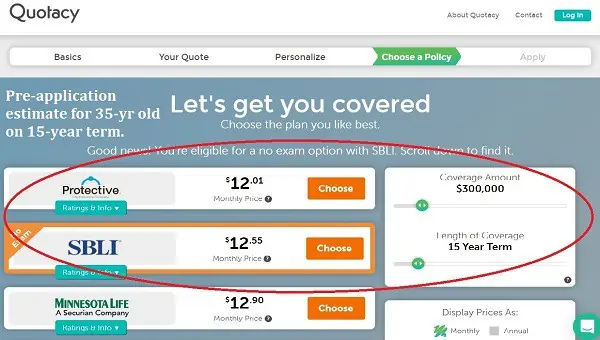

The first thing you do is fill out your zip code, date of birth and gender here. Then you’ll pick your term and coverage level you want and you can already see it’s building out an estimate on the right. To get a more accurate quote, you’ll put in your height and weight, whether you smoke and if you’re on any medication for blood pressure or cholesterol. Then a quick question about family history with heart disease or cancer and you’re to this quick quote page showing some of the top carriers.

Now you want to compare these policies because some of the quotes might include benefits you don’t get with the lowest premium. One of the brokers from Quotacy will call after the application and can help you pick the right policy but it’s a good idea to start comparing not just on price here.

We see here that the SBLI policy is a little more expensive but has that no exam option which is convenient. We can also play around with the coverage amount and term here to see how that affects the premiums. Here we see 12 carriers listed but Quotacy works with many more and the team will help you compare quotes across all of them.

I’m going to scroll back up and look at Principal because they’re based in Des Moines, so a little home-town pride there. You can see all the riders and waivers offered, you see their ratings and customer service details and some advice from Quotacy here. We can do that with any of these quotes to do a little initial comparison so I’ll look at AIG here as well and we see how they compare.

Now I’ll pick one here but understand your team lead that reviews your application, they can help you find the right policy so this isn’t going to lock you into any particular carrier yet. So we’ll click continue to get started.

One of the things I really like about the Quotacy online process is the transparency. They tell you exactly what’s going to happen and where you’re at in the process. You see here the application takes less than five minutes and a dedicated agent is going to review it and reach out by email within one business day. This is where you can contact them by phone or email to answer any questions and make sure you’re getting the best rate on the right policy.

Then the agent is going to email a document you can sign online and you’ll connect by phone within a day to verify information and set up a free exam if the policy requires it.

Getting into the application, I love that it tells you at the top exactly how long you have left to go though it usually takes less than this. This first screen is just basic contact information like your name and address. At no point in the application do they ask for personal information like your social security number or credit information, it’s all really basic and easy.

This next screen is for your job information and a lot of this is more to help you decide what kind of policy you need rather than qualifying for a policy. Knowing your annual income, net worth and whether you already have insurance is going to help the team understand better how much coverage you might need to protect your family.

This next screen is really short and includes some lifestyle questions like travel plans, whether you’re in the military or a pilot. It’ll ask you if you plan on living outside the US so I’ll note that I live in Colombia. I love this one on hazardous activities, “skydiving, racing and climbing” yeah, not so much.

Almost done here, and you can see it’s estimating less than a minute to go. This last screen is drug and alcohol information. Most of this isn’t going to disqualify you for insurance but the carrier needs to know about it so be honest here. It’s not going to get you into any trouble legally if you say you use marijuana or drink a lot so just work through the questions.

This last page is a big, long list of medical conditions but most people will be able to just scroll through. Now Quotacy specializes in that 40% of the population that isn’t perfect health and people with special needs so marking yes on these conditions if you have them isn’t going to disqualify you or mean you can’t get insurance.

And that’s it. That was about 3 minutes for the walk through but only because I was explaining it as we went. The entire online insurance application actually took me less than that to complete. Life insurance is no longer something that takes hours, sitting through a sales pitch from some agent while they scare you into the most expensive policy.

Quotacy makes it easy to get your pre-application quote to see how affordable life insurance can be and then the team works with you to shop your policy around. I’m leaving a link in the video description below so you can learn more so make sure you check that out.