Learn about stocks and get free resources into investing the right way and making money work for you!

Investing and making money on stocks is practically an inalienable right. The founding fathers knew it and you need to know how stocks can work for you. But there are some that want to make it complicated to learn about stocks! In this video, I’ll give you a step-by-step on how to learn about stocks including the best resources and a quick checklist to get started fast! We’re talking learning how to invest in stocks, today on Let’s Talk Money!

Make Money Work for You by Investing in Stocks

There is no better opportunity to make your money work for you than investing in stocks. No other investment is as accessible or has the power to reach your dreams.

But so often, learning about investing seems overly complicated. From economic cycles to valuations and which stocks to pick, trying to understand all of it can seem like a full-time job!

And there’s a reason for that!

Nation, the way media and investing analysis works is on an advertising model. The stock pickers and analysts need you to keep coming back so they can sell more products and other ads.

The best way to do this is to make stocks as complicated as possible, make you dependent on them for your investing ideas.

Learn About Stocks with this Complete Resource List

In this video, I want to break that dependency, show you how to learn about stocks. I’ll share the books, websites and YouTube channels you can use to learn investing. A complete resource list, all absolutely free, that you can use whether you’re a stock market beginner or an experienced trader. Stick around because towards the end of the video, I’ll also reveal a three-step quick-start checklist so you can get started investing while you learn!

I’ll add a clickable index in the video description below if you want to jump to different sections as well as some other stock market for beginners videos so check those out.

And we’re going to start here with the decidedly un-sexy question of…what type of investor do you want to be?

I know, everyone wants to jump right in and learn about stocks, how to pick stocks and make money…but there are different roads to investing in stocks and going down the wrong one is worse than not getting started at all.

If you’re that long-term investor that wants the lower risk and simpler strategy, trading stocks is going to leave you stressed out and broke. On the other hand, if you are more the type that wants to analyze and pick stocks then trying to force yourself into the simpler strategy will leave you frustrated to the point you quit investing.

Long-Term Investing vs Stocks Trading

So the first thing is to decide whether you want to learn about long-term investing in stocks or do you want to trade stocks more frequently? Are you an analytical person that enjoys crunching the numbers and researching stocks? Do you want a simpler, stress-free strategy or do you want to try to make those higher returns?

And there is nothing wrong with just wanting that average market return in the stress-free strategy…in fact, a lot of times it’s going to beat the return on the stock-picker’s portfolio. So if you just want the simpler strategy, you’re best off just investing in a few exchange traded funds or ETFs and I’ll share some resources to learn about that. If you want the higher return potential and higher risk with picking individual stocks, then I’ll show you some other resources for that as well.

But before we get to those resources to learn about stocks, I want to get a feel for where everyone is at in the community. So after you’ve thought about it, scroll down and tell me in the comments, what type of investor are you? Do you want the longer-term strategy for investing or those shorter-term stock picking ideas?

Now I want to share with you the best resources in books, websites and YouTube channels to learn about investing…and I know this isn’t what you usually get when you search on YouTube. I’m not going to try to teach you everything you need to know about investing in ten minutes because…well, it’s just not going to happen. You’re not going to learn about stocks with one video.

Instead, with these resources and the tips I’ll share with each, you’ll have the direction you need to start investing the right way!

Best Books to Learn About Stocks

And let’s start with the best books to learn about stocks because these are by far the best way to start investing for beginners.

New investors spend thousands on courses and hours scrolling websites when they could get a start-to-finish guide on everything they need for less than twenty bucks.

For those of you that want a simple, stress-free investing strategy, John Bogle’s Little Book of Common Sense Investing is the most honest and straight-forward investing guide you’ll ever read.

Bogle founded the Vanguard Group and popularized the hands-off, three fund portfolio. In the book, he shows you why trying to ‘beat the market’ is a losing game and how investing broadly in just a few index funds will make you more money in the long run.

In fact, the book makes investing so simple, you may never watch another investing video again. Which…as much as I’d love to see you in the community, if you want the simplest and least-stressful investing strategy you can find, you’ll find it in this book so I’ll leave a link to it in the video description below.

For those of you that want to pick stocks and go deeper into investing, One Up On Wall Street by Peter Lynch is like the stock investor’s bible.

Now there are some investors, even famous ones like John Bogle, that say you can’t beat the market…for those people, I say Peter Lynch.

Lynch managed the Fidelity Magellan Fund for 13 years to 1990, producing an annualized return of 29.2% over the period, nearly triple the annual return on the stock market.

In fact, a $10,000 investment at the start of Lynch’s tenure would have grown to over $280,000 at the end of the 13 years versus a return of just $66,000 invested broadly in the stock market.

If there is anyone that can teach you how to pick stocks, it’s Lynch. He starts by showing you the difference between gambling and stock picking and how to pick great companies instead of trying to time the market. The rest of the book is a step-by-step to analyzing stocks and the closest you’ll get to a professional stock picker this side of Wall Street.

Those of you in the Nation are going to recognize a lot of what Lynch says in the book because, apart from the CFA curriculum, I learned more from this book than any other resource.

And that’s actually the last book I’ll recommend before we look at investing websites for beginners. For those of you that want to go even further into picking stocks that Lynch’s book, pick up a copy of the Level one books to the Chartered Financial Analyst designation.

This is actually more of a challenge than anything because the curriculum is A MONSTER that turns men into scared five-year olds!

The CFA is the professional designation for equity analysts, a three-year study program that covers everything you need to know to work on Wall Street. The first level is six books, nearly 8,000 pages covering economics, financial reporting analysis, corporate finance, stock valuation, fixed income, alternative investments and mathematical analysis.

Now instead of buying these, you can go to the library and usually find some of the older editions to save yourself the money but for those of you hardcore investors that also happen to be a little masochistic, these are going to do the trick.

Best Online Resources to Learn About STocks

For those of you cheap skates like myself that want a free website, you can find some of the best investing advice you’ll ever get online.

Sooo, is it too shameless if I plug my own blog first?

My Stock Market Basics is the investing blog I actually started two years before this channel, bringing everything I learned as an equity analyst to help Main Street investors. I post all the videos on the blog as well as additional content giving you the essentials of investing without the hype and false hope. That’s My Stock Market Basics.com.

First though, check out Money QandA.com run by a friend of mine, Hank Coleman. Hank’s site is a little more geared to personal finance but will help you make sure your money is ready for investing.

Hank, or Lt Colonel Coleman to all you hooyahs out there, can take you all the way from savings, retirement planning, insurance and investing so it’s one of those rare all-in-one blogs that actually does a good job of it.

Hank’s investing style is a lot like Warren Buffett’s and Lynch’s, invest in what you know. On the blog, you’ll find some great guides on how to invest in what you know and those long-term ideas.

Last website before we get to some investing channels here on YouTube and that three-step checklist to get started investing, and this one’s from another old friend of mine, The College Investor. Despite the name, The College Investor has something for everyone for younger investors as well as old farts like myself.

Robert takes a realistic and straight-forward approach to investing and encourages new investors to remember that while all the options and tools and strategies can seem overwhelming, the number one driver to investing isn’t WHAT you invest in but how much you invest. Besides how to invest, the site is also going to help you figure out how to manage your money to invest more each month.

One last shameless plug before I share two investing channels here on YouTube, I’d like to personally invite you to get The Daily Bow Tie, my daily market newsletter sharing the most important news, strategies and tips straight to your inbox. It’s totally free, just something I like to do for all you out there in the Nation, so look for the free signup link in the description below.

Marko over at WhiteBoard Finance runs a great channel with videos on stocks, personal finance and real estate investing. Like the name says, he’s got a helpful instructional style showing you everything you want to know in easy-to-understand analysis.

For those of you that want a more stock trading and technical analysis, Thomas Carvo, has some excellent videos on stock analysis. Thomas takes you deep into the technical analysis for stock market strategies and explains everything so anyone can understand.

His tip to all new investors, remember the stock market does not have feelings. Focus on removing your emotions, invest or trade based purely on your analysis and you will be successful.

You’ve got the resources to learn about stocks, now I want to reveal that three-step, quick-start checklist to start investing.

I’m going to make this as simple as possible because the idea here is to get you started investing, get your money started working for you, while you learn about stocks.

Because time is every investor’s super-power. This chart shows how much investing just $150 a month grows to when started at different ages. Even on something as small as $150 a month, you can retire a millionaire if you get started and give yourself enough time.

Nation, I’ve seen too many people wait to start investing. They want to learn about stocks, learn everything they can before getting started and the sad truth is, many of them never end up investing or it’s years after when they could have started.

So first here is just to open an investing account and this is going to take all of about five minutes.

In fact, it will take me longer to explain some of the investing apps and which is best for you longer than it’s going to take to open an account.

I’ll leave links to each of these in the video description. For those of you that want a simple investing strategy that’s easy to manage, I like M1 Finance for its automated investing tool and easy fractional share investing. With M1, you pick the funds or stocks in your portfolio, tell the platform how much you want in each and it’s going to automatically invest your money across each investment.

For stock trading and the deep research I need for analysis, I have an account on Webull. Besides an easy mobile app for investing, I love the stock simulator which gives you a million dollars to paper trade, test out your ideas and strategies before investing your own money.

My oldest accounts and where I have my retirement investments is on ETrade, a great platform for research and different types of investments including stocks, bonds and futures trading.

After you’ve got an investing account, it’s time to put something in it so here you’re going to decide how much you can set aside each month. Again, this can be as little as $50 a month. The important point here is to commit to starting and get that first month’s savings into your investing account.

Once you’ve funded your investing account and committed to putting something in every month, it’s time to put that money to work!

Start Investing with a Three-Fund Portfolio

Before you decide exactly what stocks you want to buy or how you want to invest, you can start investing in a simple three-fund portfolio. This gets your money working for you in a diversified portfolio of stocks and bonds while you figure out what your long-term investing strategy will be.

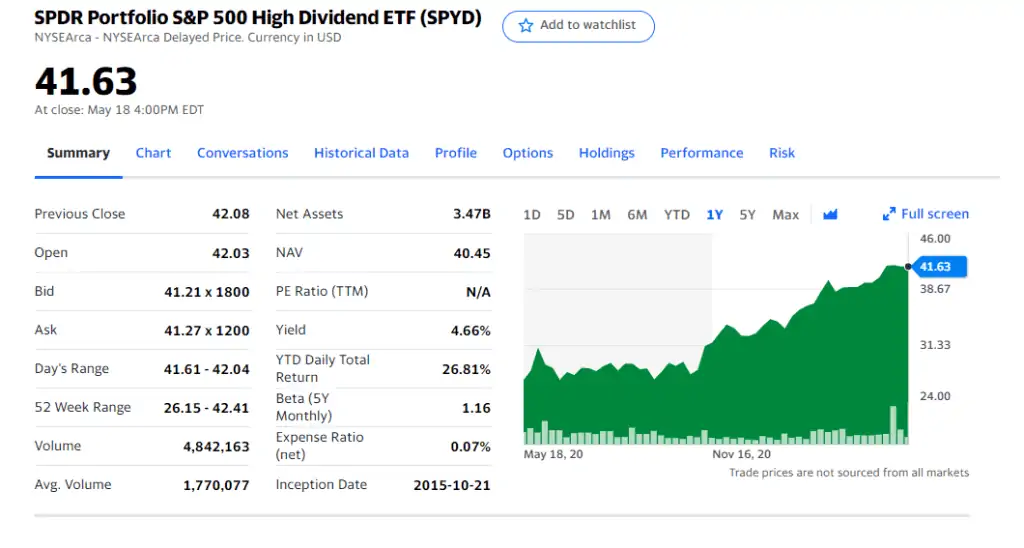

First here is the SPDR S&P 500 High Dividend ETF, ticker SPYD. This fund pays a 4.7% dividend yield, more than twice the average yield on the stock market, and has produced nearly a 10% annual return which means you’re getting a high dividend yield and price appreciation on this one.

With the SPYD, you get exposure to more than 78 stocks of large, dividend-paying companies and it’s spread out across sectors for that safety in diversification.

To give your portfolio a little more growth, add the Vanguard Growth ETF, ticker VUG, a fund of 276 large growth stocks like Apple, Amazon and Tesla producing a 45% return over the last year.

I also want to add one bond fund here for safety against a stock market crash, so investing in the SPDR High Yield Bond ETF, ticker JNK.

The name here is a little misleading. Bonds rated below BBB are called non-investment grade or junk bonds. They are higher risk than investment-grade bonds but the default rate on these is still just 2.2% – so still very much safer than stocks and a great dividend yield of 4.9% on this fund.

The fund holds over a thousand bonds and is well diversified across sectors so even though these are lower-rated bonds, you’ve got the safety of being spread across the economy.

Until you feel comfortable investing in individual stocks or adding some other ETFs, just invest your money across these three. That’s going to give you a strong start in a portfolio of stocks and bonds, get your money started working for you while you learn about stocks!