The one dividend stock you have to buy right now if you are meaning to only invest in one. Just ONE.

I’ve just found a dividend stock that has grown its payout by more than 15% a year and has increased it 36 consecutive quarters. That’s thirty-six dividend payment increases on a stock that has produced a 20% annual return for five years.

I’ll show you that dividend stock to buy but because this channel isn’t about just force-feeding you stocks, I want to show you step-by-step how I found this stock and how to build your own portfolio of top dividend stocks.

You know we love dividend stocks here on the channel, but there are a lot of traps investing in high-yield stocks…a lot of bad stocks in a dividend stock wrapper.

Stocks like San Juan Royalty Trust that, while it may seem like a great deal on a 9% dividend yield, has actually lost money over the last five years because the share price has fallen so much.

In this video, I’ll give you seven criteria to find the best dividend stocks to buy, walk you through step-by-step how to create a dividend stock list. Then I’ll show you how to build a portfolio of dividend stocks, how to put it all together and reveal the top dividend stock that checks all the boxes.

We’re getting started but first, I want to get your input on this, which of the seven criteria do you think is most important when picking a dividend stock? Which of the seven we’ll talk about do you rely on to find that top dividend stock for your portfolio? So scroll down and let me know in the comments.

These seven dividend stock criteria are all equally important but let’s start with the fun stuff first, the dividend and growth info.

How to Find Dividends and Its Growth

And here I like to see a dividend yield of at least 4% annually which I know might not seem like a high yield stock but it’s still more than three-times the 1.3% you get on the broader stock market. And you can find some good dividend growth stories with yields of 3% as well but I wouldn’t go further down than that. With a yield of three- or four-percent or more, I know management is prioritizing shareholder cash return.

Finding the dividend yield is easy enough, it’s usually on a stock’s summary page or you can take the annual dividend payment divided by the stock price.

I also want to see dividend growth of at least 5% a year over the last three to five years. You can find how much a company is growing it’s dividend by looking on Yahoo Finance or any investing app. If you go to historical data and change the time period to five years then show only dividends. This will show you each dividend payment and how much the company has increased it over that period.

And like any of these factors, I like to look for a certain level, for example at least 5% annual dividend growth, but you can play around with these. It’s all to the point of narrowing your list of dividend stocks down to the five or ten best stocks to buy.

You can also use this for our third criteria here, checking the dividend history for missed payments or consecutive increases. Check to see how often the company increases its dividend payout or if its cut the payout in the past. Now 2020 played hell with dividends and a lot of companies played it safe, either not growing their dividend through the year, so you can relax this one a little to expand your list of stocks.

Last criteria for dividend health, I like to look for the payout ratio of the stock. That’s the percentage of earnings a company is paying out to cover the dividend and it’s a great indicator of dividend sustainability and potential for growth. You take the amount the company is paying out as a dividend, for example Apple pays out $0.88 a share annually, and then divide that by the per share earnings which for Apple it’s $5.11 a share or a payout ratio of 17%

Now obviously Apple isn’t really a dividend stock and the low payout ratio reflects the company’s focus on reinvestment and share repurchase rather than payout. If you saw that payout ratio get into the seventy- or eighty-percent range though, you’d have to question if the company could continue to pay that much in earnings and still grow sales. Conversely, for dividend stocks with lower payout ratios, it could be a sign that they can increase that payout and not sacrifice growth.

That’s four dividend criteria and I like to add two more fundamental checks and one for return when looking for dividend stocks.

Finding the Revenue Growth of a Company

The first is, I want to see revenue growth over the last three or five years. A company is going to have a tough time growing its dividends if it’s not making more sales and this is an indicator of competitive advantage as well. To find this, just go to the income statement within the company’s financials and compare this year’s revenue with what it’s booked in the past.

And what’s important here when you’re comparing stocks is to compare companies in the same industry, so for example retailers against retailers instead of trying to compare something like Bed, Bath and Beyond against shares of Tesla. You have to compare growth rates and other factors against similar companies to really show you which are outperforming their peers.

Also on the income statement, I’m looking for companies improving their operating profitability. All you out there in the Nation know, this is my single favorite stock ratio, the operating margin. It’s the percentage of sales left over after paying suppliers and expenses, so a core profitability measure for the business. A company that can grow profitability as well as sales is one with exploding earnings and dividend potential.

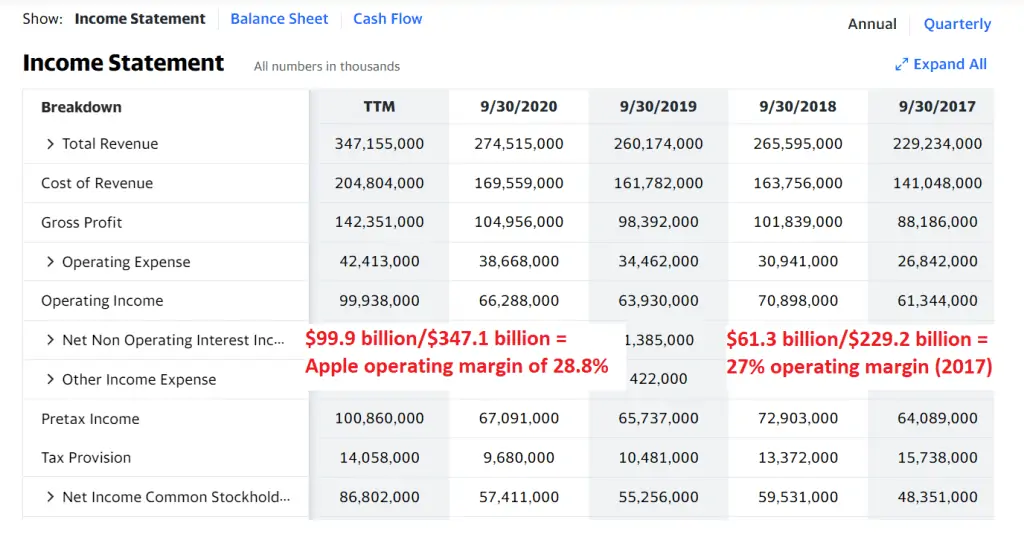

Here you go back to the income statement and find the line marked, Operating Income, and divide that by the total revenue. Apple booked almost $100 billion in operating income over the last year on $347 billion in sales for a 28.8% margin. That’s just slightly higher than the 27% margin posted in 2017, so a little more profitable.

Now an increase in profitability probably isn’t quiet as important here, especially if the company is really growing sales or the dividend, but all these are going to work together to help you find the very best dividend stocks to buy.

Finally here before I reveal the top dividend stock from these criteria, I also like to look at the total return of a stock; the return from both the share price and the dividends.

How to Find the Total Return of a Stock

To find this, again we go to the historical data tab and we’ll change the time period to five years but keep it on showing historical price. We’ll also switch to monthly prices to make the table a little more manageable.

Now here you want to look at the adjusted close column. That’s the stock price adjusted for any dividends or splits, so an all-inclusive measure of return. And if we scroll down, we see that five years ago, Apple was trading for just $26.50 a share or a five-fold increase on your investment. We can get the annualized return here by taking this to the exponent of 0.2 and we see Apple has produced a 41% annual return…which is absolutely amazing!

So even though we’re looking for dividend yields here, do not neglect that total return, especially to make sure the company isn’t destroying value with a lower share price. In fact, I like to see a total annual return of at least 10% or about twice the dividend yield.

Now, as much as I love dividend investing, you’ve got to have growth in your portfolio as well so I’m revealing the top five growth stocks in my own portfolio, five disruptive companies for double-digit returns. I’ll leave a link in the video description above, it’s a totally free report so click through and check that out.

I’ll reveal that top dividend stock idea next but I also want to highlight some criteria for building your complete dividend stock portfolio. They say you shouldn’t put all your eggs in one basket…which I don’t know why you would carry two baskets of eggs, but you definitely don’t want all your money in just one dividend stock.

And you want to focus on two ideas here that are going to create a top rate dividend portfolio, a mix of different stocks for that diversification and safety and a dividend ladder approach that will give you constant cash flow.

Diversifying Your Dividend Stock Portfolio

For the diversification side, look for dividend stocks from different sectors and industries as well as different structures. Nation, I know those high dividend yields on REITs and BDCs are attractive but do not invest all your money in just a few of these special types of companies. It’s going to set your portfolio up for a crash if something happens to the industry or a change in tax law.

If you’re not sure what industry or business type a company is in, you can go to the Profile section on Yahoo Finance and it will tell you the sector and industry. For example, popular dividend stocks in MLPs are going to say Oil & Gas Midstream, your Business Development Corporations or BDCs will say Asset Management here, and the third type of popular dividend stock these REITs are another to watch.

Again, it’s not that any of these particular types of companies are bad but they all react similarly to things like interest rates and the economy so having all your stocks just in these high-yield groups can set you up for a crash.

You also want a mix of total return and high yield stocks. Yeah, this is a dividend video and we all love those 6%-plus dividend yields but price return is just as important over the long-run. Just don’t forget to look at that graph of the stock price to make sure that management is growing the company and not just paying out everything as dividends.

For that ladder strategy, this is where you want at least five to 10 dividend stocks in your portfolio, paying out in different months of the year. To find when a company pays its dividend, you can go to Yahoo Finance and click on the historical data tab. We’ll change the time period to five years and then to show only dividends and click apply.

This shows you when each dividend was paid and while it’s not the same day every year, it’s usually within the same week so using this information, you can pick your dividend stocks strategically to make sure you get a dividend check every single month! Getting those constant dividends isn’t an absolute must if you don’t need them right away but it’s a great way to build your portfolio for the future.

Before we get to that top dividend stock, there were a lot of strong candidates from the list, and obviously I wouldn’t say put all your money in just one stock. Building out that portfolio in different sectors and laddering your dividend payments means investing in a handful of these like AbbVie, ticker ABBV, Citizens Financial Group, ticker CFG, Arbor Realty, ABR, and AllianceBernstein, ticker AB, all producing great yields and fundamentals that meet our dividend list criteria.

The One Dividend Stock You Have to Buy Now

But the top dividend stock that met all of our criteria is one you might not have heard of, Cogent Communication Holdings, ticker CCOI, with its 4.5% dividend yield.

Cogent carries a fifth of the world’s internet traffic over its network, primarily corporate traffic and colocation through its 54 data centers. The company operates more than 60,000 miles of fiber cable providing services to 210 major markets.

Now demand for office internet traffic is down over the last year but recovering and overall internet traffic growth is supporting the business. Cogent’s advantage comes from its low-cost position. It built its network through leases more than a decade ago when rates were cheaper. Its leased network has an average remaining life of 20 years from over 200 network suppliers so Cogent is basically just spending on maintenance and small equipment upgrades now, and generating $160 million in annual operating cash flow.

Checking back on our list of dividend criteria; Cogent has grown the dividend by 15% annually over the last five years and has increased it every quarter since 2015!

Revenue has grown at a 7% annual pace in the five years through 2020 and the operating margin of 19% is an improvement of 8% over the period. That is a huge increase in profitability so even if revenue growth is a little slower, it’s still able to increase profits at a faster pace and shares have produced a 19.6% annual return over the last five years.