An interview with a personal finance blogger uncovers money challenges, successes and three personal finance myths

Our PeerStory this week is from David Bakke, Editor at Money Crashers Personal Finance. David runs an excellent money blog with a broad range of advice from careers to real estate, small business and lifestyle. I talked to David about his personal finance challenges, money mistakes and three personal finance myths everyone makes.

PeerFinance101 is about helping each other out with personal finances. From peer lending to sharing stories about managing debt, investing and anything related to meeting your financial goals.

Every week, we share the story of one of our readers. Read the PeerStories and you’ll see that your own personal finance challenges are not so unique but you might just find some unique ways of dealing with them.

What has been your greatest personal finance challenge? Has there been any particular time that you just thought, “This is impossible, I give up?”

My greatest personal finance challenge occurred several years ago when I fell into roughly $35,000 of personal debt. There were times when I wanted to give up as I was paying it off, but I didn’t. I stayed the course until my debts were gone for good.

Thirty-five grand is a lot of money but I bet David isn’t alone. Student loans in America have reached a record $1.35 trillion and delinquencies are rising fast. More than 11% of student loans were in default this month, more than three times the rate of delinquencies on home and auto loans. I have a feeling a lot of people are going to start looking at their student loans soon as one of the biggest personal finance challenges of our time.

What has been your greatest personal finance success? Any particular time that you surprised yourself by your decision and did really well?

My greatest personal finance success was getting rid of that debt. It took me approximately two years, but through an effective personal budget and a realistic pay down plan I was ultimately able to reach my goal. I was never surprised by my decision to tackle this challenge – it was something I had to do in order to be able to set and meet my long-term financial goals.

The story sounds a lot like our first PeerStory from a college friend of mine. She was able to pay off a $20,000 mountain of student debt and credit cards over a couple of years through budgeting and a little help from a friend.

I had been saving this for an upcoming post but want to share two of my favorite ways to pay off debt. The first, called the debt avalanche, is the more common approach. You list all your debts by interest rate from highest to lowest. You make the minimum payments on all but use any extra cash to pay off the highest rates first. This method saves you money in interest rates and ultimately will save you time because you’ll pay everything off sooner.

The debt snowball is not as popular but I actually prefer it in certain situations. Instead of listing your debts by rate, you list them by amount from lowest to highest. You pay the minimums each month and use extra cash to pay off the smallest debts first. It will cost you more over the long-run because you’re not focusing on the higher-rate debt but there is a big advantage to the snowball, motivation! Seeing those debts fall off your list when they get paid is great and can keep you moving in the right direction. While the debt avalanche may cost less if you can pay everything off, it does no good if you lose faith and never pay those debts.

Get the full details on how to pay down debt with a snowball or an avalanche – plus 21 steps to fix your credit score while paying off debt!

What are the three tools everyone needs to reach their personal finance goals?

Couldn’t agree more. I started our 5-Week Personal Finance Fix with Budgeting and Setting Realistic Goals. It isn’t the sexiest topic in personal finance but it is absolutely where everything needs to start. The post highlights the four reasons most budgets fail and four ways to making a budget you can keep.

How do you decide the line between sacrificing and saving today for financial happiness tomorrow?

I’m not sure I understand this question, but generally speaking I would say that you’re much better off sacrificing and saving today for financial happiness tomorrow. You probably need a lot more than you think in order to enjoy a decent retirement, mainly because healthcare costs are on the rise and programs like Social Security and Medicare might not be there for you when it comes time to call it a career.

My question was a little vague but what I was getting at is how do you decide how much saving is enough without sacrificing enjoyment today. I would say the majority of financial blog advice revolves around saving and investing for tomorrow. That’s great and you’ll find just as much here on PeerFinance101, but you also need to decide how much enjoyment you really need to sacrifice today to get to your sandy beaches. I’m not sure I would want to trade 15 to 25 years of retirement ease for a lifetime of misery because I saved every penny.

It’s a question I hope to tackle in more detail in a coming post. It will depend on what retirement looks like to you and where you’re already at in your saving but there comes a point where you have to say, “Hey, I’ve gotta have fun today also.” I agree with Dave too that retirement costs are rising quickly and it may be smart to add in a little cushion to your retirement savings.

What are three personal finance myths that many people hold but just aren’t true?

One myth is that credit card debt is a necessary part of life. It isn’t and in a lot of cases you can get your balances paid off without a ton of sacrifice.

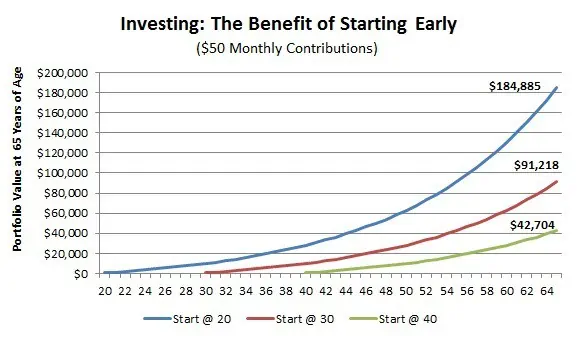

Another myth is that it’s OK to delay retirement savings until you’re older. Through the power of compound interest, the earlier you start the better off you’ll be. Just $50 a month invested in your 20s can grow to nearly $200,000 by the time you reach 65 years old. Wait ten years and you’ll have less than half that amount.

A final myth is that your monthly bills are fixed amounts and there’s nothing you can do about them. In fact, there are plenty of ways to pay less for cable TV, Internet, cell phone, and home energy. Verizon Fios offers one of the most affordable package plans for cutting the cord and still getting TV, internet and phone. KlowdTV is also another popular choice of cord-cutters to lower their monthly bill.

It’s all a matter of doing the research.

I’m not quite as agnostic as David on credit cards. I regularly open new cards for the initial bonus air miles and book free trips but you have to use the cards wisely and cancel before annual fees start piling up.

I also hear a lot of people say they will start investing and saving for retirement when their debts are all paid. It’s painful because a lot of these people will never get around to paying off all their debt and will never save for retirement. It’s why the average person approaching retirement (age 55 – 65) has just $255,000 in retirement savings. You should absolutely pay off those high-interest credit cards as quickly as possible but don’t wait to pay off all your loans before planning your financial future.

I want to thank Dave for taking the time for a PeerStory and some great insight into personal finance challenges and the three personal finance myths. What has been your biggest money mistake, personal finance roadblock or myth you’ve had to overcome?