This TaxAct vs TurboTax review shows some strong features on each for your federal income taxes – which is right for you will depend on your tax needs

The last weeks in March are always the biggest for federal income tax filing. Millions of Americans will scramble their W-2s and other docs together to beat the April tax filing deadline.

That means the tax prep software companies are out in force with offers and discounts. TaxAct is offering its usual free federal tax filing and a 5% discount on already rock-bottom prices. Not to be outdone, TurboTax also offers its own discounts and deals.

I’ve used TaxAct since 2012 and it’s tough to beat the price. Being able to offer readers of the blog another alternative sounded great though so I thought I would check it out. I tried out both TaxAct vs TurboTax through a few different filing situations.

I’ve got to say that TurboTax was able to handle some of my unique tax situations like having a Form K-1 from some MLP investments better than TaxAct. It still seemed like TaxAct was a little easier to use and better for basic tax needs.

But you’ll only know if TurboTax versus TaxAct is right for you if you know the features of each.

TurboTax Review

TurboTax has an easy-to-use interview style process that starts with several questions to determine your need for different tax forms. I changed up my answers to some of the questions and it seems the tax software genuinely guides you into the least expensive edition offered. If you end up needing a higher level while filling out your taxes, you’re prompted to upgrade.

TurboTax offers the free federal return for those that can file the 1040EZ (for simple returns)while state tax returns will cost you $27.99 to file. The free version does not include schedules that many people will need including itemized deductions, capital gains, rental income or the self-employed schedule.

One of the only faults I could find during my TurboTax review was the price. It’s one of the more expensive tax prep packages online, starting at $34.99 and going up from there. With my home business status, I would need to pay for the most expensive $80 package.

The free federal tax offer (for simple returns) does include the earned income tax credit and deduction checking. Still, many people will be able to get away with the free TurboTax version.

Most filers will need at least the $54.99 tax edition for the Schedule D forms on investment gains and losses. The Premier tax edition will also cover rental property and tax deductions on Schedule E.

Tax filers opting for the $29.99 Plus edition can get part or all of their federal tax refund as an Amazon gift card with a 5% bonus from TurboTax. It’s a cool little feature and can pay for the tax software if you’re expecting a large refund.

Click through for special pricing on TurboTax

Top Consumer TurboTax Complaints

I’m always a little skeptical about consumer complaints websites, especially reviewing products like tax software services. Tax return software is extremely competitive and I wouldn’t doubt that many of the reviews are fake and provided by competitors. Look through enough reviews though and you start seeing common complaints come up though so it is helpful to find weaknesses in the products.

- There seem to be more TurboTax complaints about longer wait times for customer service compared versus TaxAct. The complaints seem to pile up in January and February so wait times may not be as bad a little later in the tax filing system.

- There are a few TurboTax complaints that the software isn’t helpful if you need to file an extension on your taxes or missed a deadline.

Pros and Cons of TurboTax

- Easy to use and can handle any tax situation

- Free to start your return (for simple returns only)

- Takes less time than other tax software services

I liked the TurboTax software and will probably use it in the future but there were a few things I think they could improve on.

- More expensive at the higher levels, so for entrepreneurs and other special situations

- Wait time on customer service was longer but may be due to higher volume of calls in March

TaxAct Review

Over the four years I have been using TaxAct to do my own taxes, I have only had one complaint which we’ll get to below. The process for doing your taxes is very similar to what I saw in my TurboTax review, starting with a brief interview to determine your filing needs.

Remembering back on my first time using TaxAct, it did take me a little longer to get around the tax software and it helped that I had a good understanding of all the schedules anyway. It does seem that TaxAct gives up a little detail and advice to be able to offer a less expensive product. Some of the extra tutorials and explanations on TurboTax would have been helpful had I not known my way around tax forms.

The mobile version of TaxAct seems a little slower than the TurboTax app and mine froze up a few times, though my phone is pretty old and may not meet the right specs for the app.

I’ve filed with the TaxAct Plus package in previous years but this year it does not offer Schedule C for self-employed individuals. The Premium package is still cheaper than the TurboTax Home & Business edition that I would need but it sucks that TaxAct is changing the features in the different editions. State returns are still $14.99 for the Premium version, the same as Plus pricing.

While there is an explanation before each section, TaxAct is better for those that have a good understanding of their taxes and the different forms. There isn’t as much guidance or tutorial help in the blog library as there is with TurboTax though you could probably use the free blog resources on TurboTax to answer any questions you have while paying the cheaper price for TaxAct. Overall TaxAct helped me find lots of tax tips that lowered the amount I owed.

Top Consumer TaxAct Complaints

- A common TaxAct complaint and one I’ve had for several years is the inability to see your federal tax return after a certain amount of time without paying extra. TaxAct charges $9.99 to keep your federal tax return available to you and $20 to keep both federal and state returns viewable. You can always just save your returns in hard-copy or pdf after you file but it seems weak that TaxAct won’t let you back into the system later without the fee.

- Another TaxAct complaint is the continuous pop-ups on the free federal tax filing program and the restrictions on the offer. Several of the features that were free in prior years like importing old returns and direct deposit now require you to pay the upgrade fee. The complaint is pretty standard across most tax return software though, that’s how they make money.

Pros and Cons of TaxAct for Filing Income Taxes

- Less expensive option for filing taxes

- Easy software and doesn’t change much year-to-year so even easier after first year

- Free to start and see how much your return will be

About the only complaint I had with TaxAct is that it doesn’t seem to cover some of the more unique tax circumstances I’ve seen with my own business and with clients. Most people will be just fine and will benefit from the lower price though.

TaxAct vs TurboTax: How the Two Measure Up for Federal Tax Returns

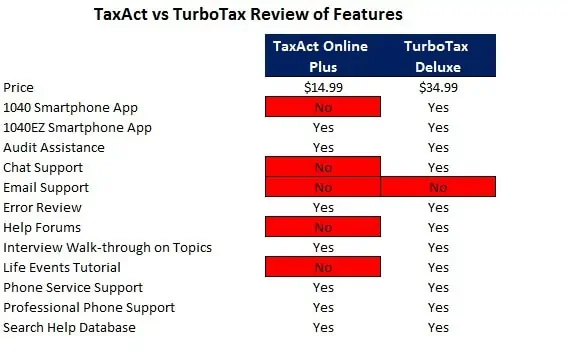

If money wasn’t important, I would probably be leaning to TurboTax vs TaxAct at this point but then I would probably just pay someone to do my taxes. TurboTax does offer several features on its lower-cost editions that don’t come on the comparable TaxAct edition.

It’s tough to make a direct comparison since none of the levels are priced the same. There are four paid versions of TurboTax and only three on TaxAct. I think most people can probably get by with the Deluxe version of TurboTax while they’ll probably need the Premium version of TaxAct.

When it comes to price in the TaxAct vs TurboTax grudge match, it looks like TaxAct gets the win. After the free federal income tax offer, TaxAct offers range from $9.99 through $21.99 for the premium version. The Plus version of TaxAct, the most popular level is priced at $14.99 and includes tools for investors and itemized tax returns. After the free tax version (for simple returns) of TurboTax, the prices jump from $34.99 through $79.99 for the Home & Business edition.

Both tax prep websites offer a selection of tax calculators and tools for you to check out before you pay for the software. While the TaxAct menu of tax tools includes some good resources like a tax bracket calculator and two health care tax calculators, TurboTax wins out in the TaxAct vs TurboTax resources battle.

TurboTax calculators and resources seem more detailed with 12 separate resources versus eight on TaxAct. TurboTax tools will help you find extra benefit assistance available, exemption checking on the Affordable Care Act, and several deduction finders. If you end up using TaxAct, you might want to check out some of the tools on TurboTax anyway just to make sure you catch everything.

Rounding out its advantage in free tax resources, TurboTax offers a larger library of videos and articles to help you get the biggest refund on your federal income taxes. TaxAct also offers a library of tax law changes and checklists but not nearly as varied as its competitor’s resources.

TaxAct vs TurboTax Guarantees

Both tax software sites offer several price and refund guarantees but how do the TaxAct vs Turbotax guarantees match up?

Max Refund Guarantee: Both tax prep sites offer to refund your money if you get a larger refund or a smaller tax due using another tax software product. If you use the free edition to file your federal income taxes, TaxAct will refund you $4.99 while TurboTax promises a payment of $14.99 plus a refund of how much you paid for the state income tax software.

Of course, the fine print for both tax refund guarantees is that you must input the same information on both tax software providers. To get your refund, you’ll have to provide copies of both federal tax returns within 60 days of filing. If you’re only using the free federal edition, I wouldn’t think it’s worth it to spend the time filling out both tax returns. If you’ve got a complicated federal tax situation and suspect one tax software missed something, it might be worth the effort.

100% Tax Calculations Guarantee and Audit Support: TaxAct and TurboTax both offer to pay any penalties and interest from the IRS if you’re assessed due to a problem in the tax software calculations. This one would probably apply to thousands of people if something went wrong in the software so you’ll likely hear about it if something goes wrong. TurboTax also offers an Audit Support guarantee with one-on-one guidance from an expert and one-year support for any audit questions.

Satisfaction Guarantee: Both TaxAct and TurboTax offer money back guarantees if you are not totally satisfied with their tax software but it only applies to the point before you print out your return or until you e-file your tax return.

TaxAct vs TurboTax Review: Which is Best for You?

TaxAct may be a better choice if you have very basic tax needs, even slightly beyond the free 1040EZ federal filing. If you only need the most basic schedules and do not need much guidance then it’s hard to beat the $9.99 price on the first paid level of TaxAct. TaxAct may also be a better choice even if you are in a more complicated tax situation but understand all the forms and schedules.

TurboTax is more expensive but may be a better choice for people that need to fill out multiple schedules and that need more guidance in getting their largest refund possible. TurboTax seems a little easier to use and offers more explanations about how to use the tax software.

Do Your Taxes The EASY Way. Use TurboTax Federal Edition today. Start Now.

If you’ve got some time, why not get the best of both worlds in the TaxAct vs TurboTax match-up? You can use either federal income tax software free until you come to the point of printing or e-filing your return. Why not start on the TurboTax software to help you through the forms and then run your numbers through TaxAct? You’ll be able to take advantage of better guidance on TurboTax and the lower price on TaxAct.