Ranking of the Five Safest Investments that Still Grow Your Money

When the stock market crashes 35% in less than a month, it’s time to start looking for safe investments to take the stress out of investing.

But what are the safest investments and do you have to give up on a return that’s going to meet your financial goals?

We’re not talking about CDs and savings accounts. It might be safe money but investments like that will actually destroy value after inflation. I’m talking safe investments with high returns that won’t make you lose sleep.

I’m Joseph, your Bow Tie guru and these are the five safest investments you can make and still earn a solid return.

Investing in the Safety of Bonds

Number five, investment grade bonds.

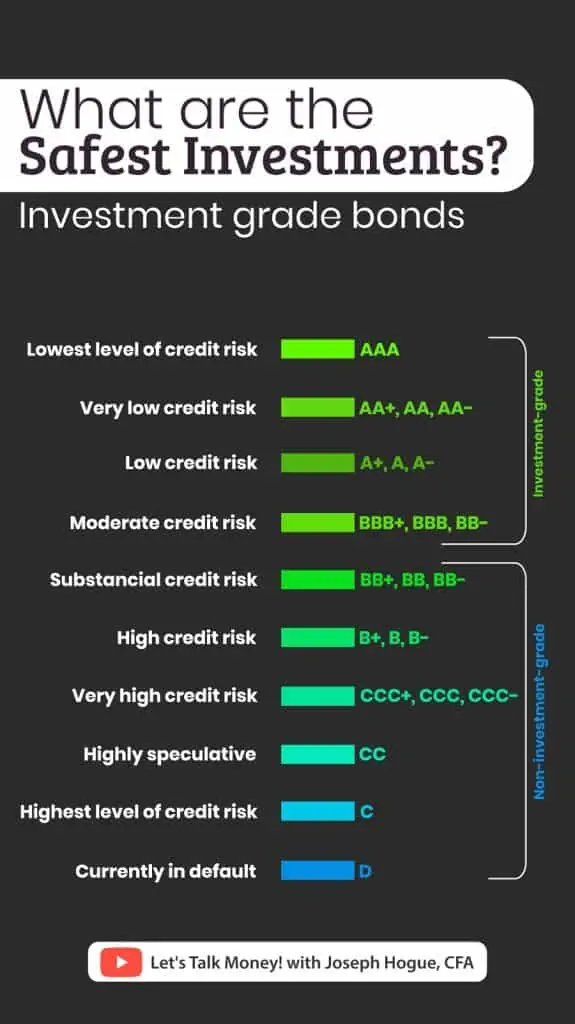

Bonds are debt borrowed by a company or government and paid back through interest payments twice a year. There are lots of types of bonds from corporate to domestic and foreign governments but the best are those issued by companies with good credit ratings, called investment-grade.

These bonds rated triple-B or higher by the rating agencies are extremely safe with less than one bond out of 100 defaulting on the investment. Individual bonds produce a return from 3% to 6% depending on the company and terms while bond funds offer a dividend yield of 3% and a total return around five percent.

You can buy individual bonds through any stock investing platform but fees can add up. For most investors, it’s much better to invest in a bond fund like the Vanguard Long-Term Bond ETF, ticker VCLT, or the iShares Investment Grade Corporate ETF, ticker LQD. You’ll be able to buy or sell these just like stocks with little or no fees and will never have to worry about rolling over the money.

How Safe are Preferred Shares?

Number four on our list of safest investments, preferred shares.

Preferred shares are a special type of stock with rights that go beyond the normal shares. Preferred shares have a set dividend yield and a payment that must be paid before regular stockholders get any of their dividends. These investments usually offer a much higher dividend as well. For example, Bank of America issues preferred shares paying between six- to seven-percent dividends while its common stock pays a dividend yield under three-percent.

Preferred shares are also higher up on the list of liquidation, so if a company files bankruptcy, preferred shareholders get paid before common stockholders but after creditors.

Best of all though is that preferred shares enjoy some of the growth benefits of regular stocks. Most preferred stock is convertible into regular stock if the share price reaches a certain point. Basically the company is saying, Here enjoy this high dividend yield if the stock price goes nowhere and a potentially higher return if the shares take off!

Just like with bonds, you can buy preferred shares on any investing platform but the best strategy is through funds holding a portfolio of preferred shares. You get instant diversification across the preferred shares of hundreds of companies along with the high dividend yield. Examples include the iShares Preferred and Income Securities ETF, ticker PFF, which pays a 5.6% dividend yield and a total return around 6% annually.

Investing in Safety Stocks

Third on our list of safe investments, stocks of companies in safety sectors.

There are some sectors of the economy considered safer than others. It might be because they sell products everyone needs like food or personal products or electricity. There might also be high barriers to entry that keep out new competitors. For example, because of government regulations, you can’t just start up a new electric company in your city. Even without these regulations though, the high cost of factories and equipment tend to protect companies in sectors like consumer staples, utilities and telecom.

Since companies within these sectors sell something we need to buy whether the economy is growing or not, sales and profits tend to be smoother than you see in the rest of the market. For example, shares of the Consumer Staples Sector ETF, ticker XLP, fell just 20% during this year’s stock market crash versus a 30% loss in the broader S&P 500 during the period.

Despite being less risky compared to the overall stock market, these safety stocks can still produce a solid return. Shares of the iShares U.S. Telecom Fund, ticker IYZ, pay a 2.7% dividend and have produced a 7% total return over the last 10 years. Shares of the Utilities Select Sector SPDR, ticker XLU, pay a 3.3% dividend and have returned 10.9% a year over the last ten. And shares of the Consumer Staples fund pay a 2.7% dividend and have produced a strong 11.2% annual return over the last decade.

With these investments, you can pick individual stocks in the sectors or the entire sector through one of the funds. You’ll get a little more diversification and safety with the funds, each of which holds dozens or more companies, or the potential for higher returns in individual stocks.

Dividend Stocks for Income Safety

Second on our list of safe investments, dividend stocks.

As a company grows, it has to make a decision about what to do with profits. Newer, fast-growing companies may choose to put all earnings back into the company for growth. As a company matures though, growth opportunities slow and it may decide to return some of those earnings to investors in the form of dividends.

Not only are dividends an almost immediate cash return on your investment, dividend-paying companies tend to be safer than stocks of companies that don’t pay a cash yield. The companies tend to be older with more stable cash flows and are heavily concentrated in those low-risk sectors like consumer staples and utilities.

In fact, during the 2020 market crash, shares of the Vanguard Dividend Appreciation Fund, ticker VIG, fell 25% versus the drop of 30% seen in the S&P 500 index of large companies and well under the 40% crash in the Russell 2000 index of small companies.

Dividend stocks can still produce outsized returns even compared to the rest of the market. The Vanguard Dividend Appreciation fund with its 1.8% dividend yield has provided a 12.4% total return annually over the last decade. Other funds like the Schwab U.S. Dividend Fund, ticker SCHD, provide a higher 3.5% dividend and comparable total return.

Building a Safe Portfolio of Investments

Number one on our list of safest investments, a portfolio mix of all five strategies!

Any time you mix different asset classes or types of stocks, you’re going to lower the risk in the overall portfolio. It’s the very core concept of diversification and critical to lowering the stress factor in investing.

Combining the four safest investments; bonds, preferred shares, stocks of safety sectors and dividend stocks in a portfolio can still give you a total return of eight- to nine-percent a year along with dividend yields of three- and four-percent.

Through that combination, you’ll also smooth out the ups-and-downs of the individual investments. Your bonds and preferred shares will continue to pay out even if stocks sink. Your safety and dividend stocks will run higher when the economy is good. You get the best of both worlds, safety and return!

These five safe investments will not only protect your money but help you grow it to reach your financial future. Add in a mix of income stocks and some growth investments and you’ll be on your way!