What could be the difference between having a $100 stock portfolio versus accumulating a $1,000,000 stock portfolio?

Does this sound familiar, you want to grow that million-dollar portfolio but it feels like you’re investing pennies at a time? In this video, I’ll show you how to get started investing with $100, how to grow that portfolio and then show you exactly what’s in the average millionaire’s portfolio…and I guarantee, it’s going to reveal something in the million-dollar stock portfolio that will blow your mind! We’re talking how to invest to get rich, today on Let’s Talk Money!

Growing a $100 Portfolio to Millions is Not Impossible

Nation, one of the toughest parts of investing is feeling like you’ll never reach your goals…like that million-dollar stock portfolio is so far out of reach that you want to just give up.

But you can get rich, even starting from the $100 portfolio we’ll start with today. Warren Buffett bought his first shares at age 11, investing just $114 for three shares of stock in 1941…and his net worth is now over $70 billion!

The world’s richest person, Jeff Bezos worked at McDonald’s in high school and didn’t start Amazon until he was 30 years old!

From Oprah Winfrey to Starbucks founder Howard Shultz and Steve Jobs, there are thousands of rags-to-riches millionaire stories out there. People that started from right where you are now!

Wait…not that last one. The fact is, you don’t have to be born with a silver spoon to get rich!

In this video, I’ll show you how to invest that first $100 and an investing plan to grow it to one-thousand dollars and beyond. Then we’ll compare that $100 portfolio to how the millionaires invest and reveal a secret look into exactly what’s in the million-dollar portfolio. Stick around because towards the end of the video, I’ll also share three rules for getting rich on any budget!

So let’s start with investing that first $100 or thousand or whatever you have to get started. And what’s important here, what I want to do is make sure you don’t start out like most new investors.

I see a lot of investor portfolios, through the portfolio tracker spreadsheet I created as well as just in conversations with you in the community. Through that, I get a first-hand look into the average $100 portfolio.

Track your entire portfolio, see the gaps in your investments and compare two stocks instantly with my Portfolio Tracker spreadsheet.

Download this Portfolio Tracker and Stock Comparison Tool! [Use this Coupon Code for 57% Off]

Here’s what the average beginner investor, $100 portfolio looks like and this is data straight from what I see in the community. Now it doesn’t take an expert to see a problem here.

The fact is that many investors, new or otherwise…this isn’t just the new investors making this mistake, but most investors might have a few stocks outside of tech. They’ve got Disney or GM or maybe some shares of McDonald’s but most of the portfolio, between eighty to 90% or more is in tech stocks!

Now having everything in tech stocks is great if it’s 1998 or 2020. Tech stocks jumped by 44% last year…but what happens when they fall 30% in one month like they did back in February or lose 80% like in the tech bubble crash?

How to Create Your First $100 Portfolio

So instead of that typical portfolio of tech stocks, I want to show you how to create your first $100 portfolio of different assets and stocks. And I’m going to start with just five exchange traded funds, ETFs, which are funds that trade just like stocks. They’re lower risk than stocks because with just these five funds, you’ll have the broad exposure you need to all the big types of investments in stocks, bonds and real estate. That’s going to give you smoother, safer returns and on that, you can use the three-step process I’ll share next for adding individual stocks and growing to a $1000 portfolio and more.

I’ll list out those five ETFs to buy for your beginner portfolio but an important note here is, if you’re starting out with that $100 portfolio or a small amount, you’ll need to do it through an investing app that lets you buy fractional shares. That means you can invest $20 in each of these funds or however much you want without having to buy a full share of the stock, it allows you to invest whatever you can and spread it evenly across this portfolio.

5 Stocks to Start Your Beginner Investor Portfolio

Here’s the list of five funds to start your beginner investor portfolio and really some great funds for any investor.

The SPDR S&P 500 High Dividend ETF, ticker SPYD, holds shares of 78 dividend paying companies with a 4.4% yield and has returned 66% over the last 12 months. It’s a really solid dividend stock fund and is going to give you exposure to all the sectors of the economy.

Another high yield income fund here with the Global X U.S. Preferred ETF, ticker PFFD, owns preferred shares which are like stocks but with more protection than regular stock holders. The fund pays a solid 5.2% dividend yield and has returned 23% over the last year.

Bonds aren’t your get rich investments but you’ll be glad you have them when stocks crash and the Vanguard Long-Term Corporate Bond ETF, ticker VCLT, is one of the best. The fund holds over 2000 bonds across every sector and in super-safe companies for a 3.4% dividend yield and an 8.5% return over the past year which is really strong considering it’s mostly a safety investment.

Those of you in the Nation will recognize this one as one of my favorites, the iShares Multi-Asset Income ETF, ticker IYLD, paying a 4.3% dividend and this one is a fund of funds so it holds all kinds of great income investments in bonds, dividend stocks, mortgage loans and emerging markets.

Now to give your starter portfolio the growth it needs, the Vanguard Growth ETF, ticker VUG, a fund of 276 large growth stocks like Apple, Amazon and Tesla producing a 45% return over the last year.

Just this simple group of five funds is going to give you a great mix of stocks, bonds, dividends and growth. You don’t necessarily have to have the same amount in each but it’s a great way to get started on your portfolio.

Now that’s how you get started investing and that’s whether you’re starting with one-dollar or a hundred, but one of the most important drivers to investing success is having a goal for your money. So to make that commitment to yourself, scroll down and share with the community, what’s your goal for investing. Why do you want to get rich and how is that motivating you to invest?

FREE Report! See the 5 Biggest Stock Positions in My Portfolio! Five stocks I’m investing in for the biggest trends of the next decade! Don’t Miss this Free Report – Click Here!

Before comparing the million-dollar stock portfolio, and that’s actual portfolios of millionaires, before comparing that against the hundred-dollar portfolio, I want to give you a three step strategy to growing your portfolio to $1000 and beyond. Using that initial $100 portfolio of stocks, you can use these three steps to start growing it!

Step one, start adding individual growth stocks. With those five funds, you’ve got a lot of safety and dividends but not quite as much in the high growth you’re going to need for that get rich portfolio.

That was actually intentional on my part. I wanted to get you started with those safer dividend funds because most investors have no problem adding the individual growth stocks themselves. In fact, they usually have too many of them. But starting with the funds, you’ll start with all the safety and dividends you need so you can switch your focus to growth.

Step two is, you’re going to be receiving a lot of dividend checks through those funds and you want to reinvest that money. After you’ve got those funds and a list of 10 or 15 growth stocks, I would start investing new money and the reinvested dividends about equally across all of them. That way, you’re growing both parts of your portfolio, the cash flow dividend investments as well as your growth stocks.

Step three is going to go against everything you hear from investment gurus…only invest what you can afford! Maybe that doesn’t sound like an investment strategy but it’s one of the most important pieces of advice you’ll ever hear.

Nation, the most demoralizing, frustrating thing and I see this all the time with new investors is they get gung ho about growing their portfolio and push all their money into it. Then an emergency expense comes along and they end up having to sell stocks to pay for it. Or people budget every penny to invest but they’re miserable because they aren’t having any fun and they end up burning out on investing.

It’s when this happens that you feel like you’re not getting anywhere and you just give up!

So make sure you’re budgeting for a little fun as well. Build an emergency fund of a couple thousand and set a reasonable amount you can invest each and every month!

Now I want to get to that million-dollar portfolio, what’s in it and how it’s different but to help you put together a custom investing plan that’s personalized for your goals, I’m doing a free webinar sharing the strategy I developed working in private wealth management. It’s a goals-based investing strategy that will put you on the right track.

Free Webinar – Discover how to create a personal investing plan and beat your goals in less than an hour! I’m revealing the Goals-Based Investing Strategy I developed working private wealth management in this free webinar. Step-by-step to everything you need for this simple, stress-free strategy. Reserve your spot now!

A Look at the Million-Dollar Portfolio

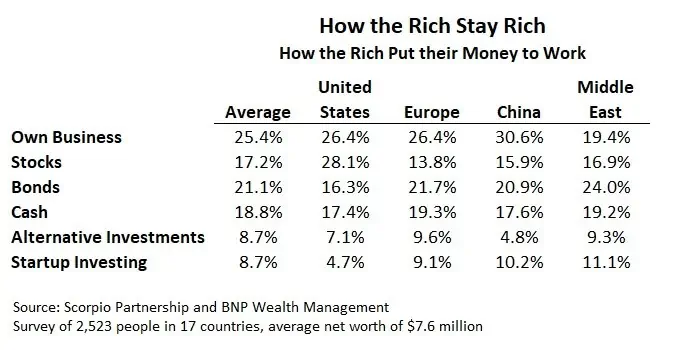

Let’s look at the million-dollar portfolio and this is from an actual survey of the investments of millionaires around the world. The survey is of 2,500 people with an average net worth of $7.6 million in 17 countries by Scorpio Partnership and BNP Wealth Management.

What this shows is really amazing and goes against everything people think about millionaire investors. Look at the Average column here and you see, millionaires only have, on average, 17% of their money in stocks. That’s less than two of every ten dollars of millionaire net worth invested in stocks!

WHAAA? It’s crazy because here everyone thinks that stocks are the way to get rich. That millionaires are rich because they have these huge stock market portfolios.

Even in the U.S. where millionaires invest more in stocks, the market is still less than a third of their net worth. Instead, and again we’re looking at the Average column here, millionaires have the most money in their own business, a quarter of their total wealth, followed by bonds and cash.

In fact, together bonds and cash make up almost four of every ten dollars of net worth, pretty close to half the net worth of the rich is tied up in the safety of bonds and cash.

We see another 8.7% in each of these alternative investments, which are investments like hedge funds and private equity, and then in investments in startup companies.

This really turns everything we think about millionaires on its head and is really important for your own plans to get rich.

Nation, you know I love talking stocks here on the channel but the fact is, even at a really great return of 12% a year which is on the high end of what you can expect from stocks, that’s still going to take decades to get rich. In fact, investing a thousand dollars a month, which is more than most people can afford, it would still take you 22 years to reach that million-dollar portfolio. But if you invested half that amount in your own business for a 35% return, you reach that millionaire status in almost half the time, just 14 years. Investing less and making more because of that higher return you’re going to get on your own business.

And if you think a 35% annual growth isn’t possible in a startup business isn’t possible…I’ve grown my online business from zero to over $50,000 a month in five years. Just to last October, That’s a 135% annual rate of growth and no signs of slowing down!

Click to reserve your spot at the FREE YouTube Quick-start Webinar! I’m sharing three strategies that helped me grow my YouTube channel and double my business income and I guarantee they WILL work for you. Seats are limited for the webinar so make sure you reserve yours.

So bringing this back to the millionaire’s portfolio and what we can learn from it. Millionaires have the biggest chunk of their money tied up in their own business, earning those higher rates of return. But because small businesses are riskier and sometimes need cash to survive, millionaires have just as much invested in ultra-safe investments like bonds and cash. Investments they can sell quickly if their business needs cash because that’s the real growth driver here in this wealth, keeping that business alive, growing and making you a millionaire!

Now I want to bring all this together to reveal those three rules for getting rich on any budget, three steps to become a millionaire no matter where you start!

The first rule, invest regularly every month. You see those posts about how much you’d have if you invested $1000 in a stock 10 years ago, those dreamy what-if investments…people want to think it takes just one investment to get lucky and strike gold but how likely is it you’re going to pick the next Amazon to get rich or even have that big lump sum to invest right now?

Instead, I want you to think of your investments like a savings account…one with a spectacular yield but a savings account that you put money in every single month. The power in this is, you don’t have to time the market to get the best prices and you don’t need to come up with thousands of dollars to get rich. A thousand dollar investment in Netflix after its 2002 IPO would be worth over half a million but who had a thousand dollars right after one of the biggest stock crashes in history?

Look at this though. Investing just $50 a month over that same period and you’re a millionaire! Your investment would be worth more than a million dollars and you did it on that easy fifty-bucks a month!

Our next rule for getting rich, don’t have all your money in one type of stock or even stocks in general. This chart by VisualCapitalist shows the asset classes by performance over the last decade. The worst performing each year are on the left with the best on the right.

And what becomes immediately clear is that no asset class; not stocks or real estate or commodities, none have consistently topped the list. If you only invested in gold which had a great year last year, you would have booked negative returns in four of the last nine years. Even large cap stocks, those biggest and most popular names, only made the top three in six of the nine years.

So have some stocks, have some bonds and real estate and within each of those have some different kinds of investments to smooth out those returns and always have exposure to the best each year.

Third here to become a millionaire…do what the millionaires do! We’ll always be talking stocks here in the Nation, but it’s not always the best way to get rich. Spend a little time creating those assets, that business idea that is going to make you rich over the long-run.

Get The Daily Bow-Tie – my FREE daily email newsletter sharing market updates, trends and the most important news! Market Updates for the Smart Investor!