Understand when to buy a car and how to negotiate to save thousands on your next purchase

Car and truck dealers are about to enter full-blown crisis mode in 2020. Prices on used cars are plunging and dealerships will soon be scrambling to keep up sales quotas.

Their pain is going to be your gain and 2020 could be one of the best times to buy a car we’ve seen in decades.

Understanding why this is happening and what you can do to negotiate your best deal will put you in the driver’s seat…literally. Some simple sales data can show you when is the best time to buy a car down to the best day and month to make that deal.

Why 2020 Will Be a Horrible Year for Car Makers

The reason why 2020 will be the best time to buy a car is that the industry is entering the worst crisis in a decade.

Car sales boomed after the recession on the Cash for Clunkers program and super-low interest rates. Car sales hit a record of 18 million units last year as buyers took advantage of discounts and low rates.

Just like every great party, the hangover isn’t as much fun.

Car and truck sales are already down 8% in 2017 versus last years’ sales and this could be the first year to see declining sales since 2008.

Lower car sales are not the worst of the problem. All those new cars bought and leased over the last decade are being traded in. The average consumer keeps their new car for 6.5 years before trading it in and the average lease runs 36 months. That huge wave of cars hitting the used car market means prices are plunging.

The average used car lost 17% of its value over the past year according to Black Book, an auto analytics company. The rate of yearly depreciation on used cars has been increasing and is now almost double the amount seen in 2014. Luxury and compact cars did even worse, losing an average of 20% of their value over the last year.

Think about that. The value of the average luxury car lost 20% of its value over the last year. If it was worth $25,000 in 2016, a buyer could snap it up off the used dealer’s lot for $20k now.

Another problem is that, even as sticker prices on cars have come down, the price to consumers has increased because of higher interest rates. After eight interest rate increases by the Federal Reserve, rates on car loans have been pushed to decade-highs. That means that even as the price of the car has come down, affordability has not because monthly payments are still just as high.

Fortunately there’s more competition for car loans than ever before. Between peer-to-peer websites and personal loans, it’s still fairly easy to get a loan. Rates on personal loans range from 6% to 24% even for bad credit borrowers and shopping your loan around can help make sure you get the lowest rate possible.

Best Websites for a Quick Car Loan:

Maybe the best way to get money to buy a car and avoid being scammed by shady dealers is to take out a personal loan and pay cash. Being able to pay cash for a car will get you a better price on the car, often saving thousands from the sticker price. Here are a few of the personal loan sites I’ve used.

PersonalLoans is the site I’ve used the most and the lender recommended most by readers. Loans up to $35,000 and up to five years to repay. Specializes in bad credit borrowers.

BadCreditLoans specializes in loans to borrowers with really bad credit scores. The site will approve borrowers with FICO scores much lower than any other lender though your first loan might be capped at $1,000 or on a 12-month term.

Let lenders compete for your loan, click to check your rate on a personal loan up to $35,000

Next year is bound to be even worse for dealers.

Auto loan delinquencies have jumped and KAR Auction Services expects nearly two million vehicles to be repossessed this year, double the amount that were repossessed in the worst year of the recession.

All those repossessed cars, cars with liens and trade-ins will continue to drive prices lower in 2020.

How Buyers Win in the 2020 Car Market

If you are thinking about buying a new or used car, you could be in luck. With prices of used cars plunging, new car dealerships will be forced to lower their prices and add extra incentives to meet their quotas. There’s a good chance we’ll see a lot of car dealerships close in 2020 as the price-cutting gets too fierce to make money.

So we know that next year could be the best time to get a new car, but when next year?

I looked at data from TrueCar and at general sales numbers to find when to get the best deals on your next new or used car. I found four rules for when to buy a car that pay off big time.

The first rule of when to buy a car, go car shopping during cold or rainy weather. If everyone else is staying home, dealers are going to be eager to cut a deal.

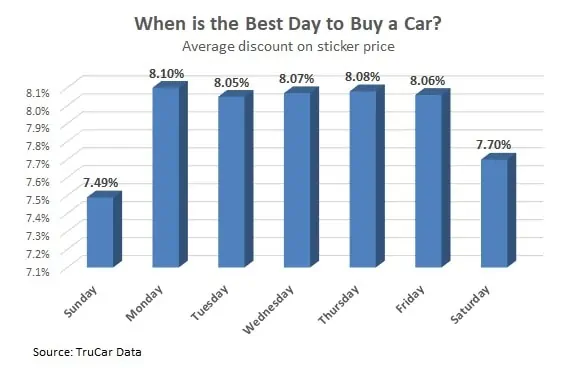

Best Day of the Week to Buy a Car

Mondays and Tuesdays show the biggest discounts according to TrueCar data. Most people do their car shopping on the weekend or are just too tired at the beginning of the week. That means an empty dealership and enthusiastic dealers.

The worst days to buy a car are on the weekend when everyone is out shopping and the dealer can point to other people ready to buy. It’s a lot easier for the dealer to walk away when he knows another buyer is already looking around the lot.

Looking at the graph of the best days to buy a car, you’ll see that there isn’t a huge difference between the days. The difference between the best day (Monday) and the worst day (Sunday) is only 0.6% off the sticker price. This means savings of $122 on a $20,000 car so not something you want to pass up but not something that’s going to make you rich either.

Taking the bigger picture though, buying a car on the best day of the best month and knowing how to negotiate can help you save much more though.

The end of the month and end of the day are also great times to start negotiating for a car. Dealers have monthly quotas they must meet and contests they want to win. The dealer on a dry spell that hasn’t talked to anyone all day is going to be very generous if she can close a deal and go home happy.

One caveat to the data on best time of the month to buy a car is that payday can skew the results in smaller cities. If one company represents a big chunk of employment for a town, the bi-weekly payday and weekend after will be the worst time to buy a car. Better to wait until the next week when all the money is spent and dealers are sitting twiddling their thumbs.

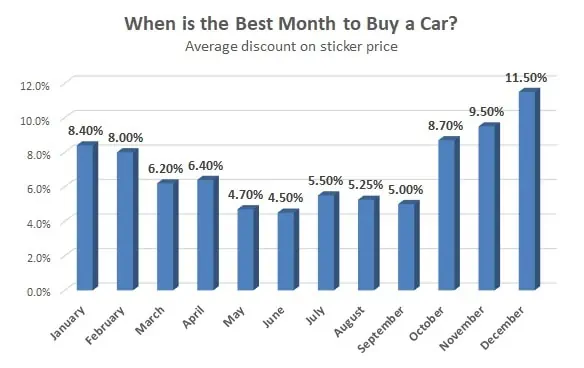

The Best Month of the Year to Buy a Car

October through December also tend to be the best months to get discounts on cars. It’s cold and dealerships are running up against annual sales quotas.

The difference in average discounts for new cars is much greater by month than it was by day. The best month to buy a car (December) can get you a discount of 7% over what you might get in the worst month to buy a car (June). That could mean a savings of $1,400 on that $20,000 car.

So the best time to buy a car may just be on a cold Monday afternoon, late October.

Remember though, these are just average discounts from what we’ve seen in car sales. Just because dealers usually offer bigger discounts in December and on Mondays doesn’t mean they’re going to give you a deal.

All it means is that car dealer might be more willing to negotiate and offer bigger discounts during certain days or months. You still need to compare prices and be ready to negotiate.

Are Holiday Car Sales a Scam?

Holiday car sales are a gold mine for car dealerships. People have been conditioned to these ‘special’ sales for so long that it’s almost a subconscious reaction.

Advertise how ‘crazy’ your Presidents’ Day prices are and buyers will come running!

These aren’t the best times to buy a car because there are so many people out buying. Why is a dealer going to give you the best deal when there are five other couples out on the lot right now?

Holiday car sales aren’t the worst time to buy a car either and you should still go out to look at prices. Dealers know that there will be a lot of buyers out that weekend, but they also know all the other dealerships are advertising discounts. They know they’ll have to give out some deals to get people to buy.

The very best thing you can do when buying a car is to give yourself some time. Visit a few dealers to see their prices over a few months…but don’t buy! Keep a list of all the prices you see over a few months to give you an idea of what is a great deal and what is just hype.

It all comes down to using the information to negotiate the best deal possible. Understand when car dealers are most willing to negotiate, when the fewest people are out buying cars. Understand what prices have been lately and how far a dealer will go to meet their monthly or annual sales quota.

How Much Car Can You Afford?

Whether you get a good deal on a car or not, and I hope you use this to get a great deal, a bigger decision is how much car you can actually afford.

Dealers are going to try talking you into the most expensive car possible.

That’s how they make their money, off a percentage on the car you buy. If you tell them your budget is $5,000 – they’ll show you cars for $7,500 or higher. If you tell them your budget is $7,500 – they’ll show you cars for $10,000 or higher.

They’ll talk about all the extra features and comfort you get by going just a little higher in price. Then they’ll talk about how easy it is to get a loan and how cheap rates are. Of course, they don’t care about the loan. They’re just going to sell it to an investor later.

Then you’ll be stuck with payments you can’t afford. The car gets repossessed and another dealer turns around to sell it for another huge profit.

The price you pay for a car is important but just as important is the monthly payments. Are you going to be enjoying that car for 11 months until it gets repossessed or will you enjoy it for years?

So you absolutely have to look at that monthly payment and how it fits into your budget. There’s no rule here but leave yourself some room in your budget after including the payment.

WARNING: Car dealers are offering loans of 84-month and 96-month loans instead of the 60-month loans we’re used to seeing. Since the loan is spread out over more years, the payments are lower…but you’re paying thousands more in interest!

If you can’t afford the payments on a 60-month loan, you can’t afford the car!

A better option than taking the dealer financing for a car might be a personal loan from sites like PersonalLoans. I’ve used the website twice, once for debt consolidation and once for a home improvement loan.

Getting a personal loan doesn’t put your car at risk compared to a car loan. Miss a car loan payment and your car gets repossessed. This won’t happen with a personal loan and the rates can be cheaper as well.

Check your rate on a personal loan before your next car – won’t affect your credit score

How to Negotiate the Best Deal on Your New Car

Going to buy a car at the right time is only half the battle. There are also things you can do to negotiate the best deal possible.

Dealer financing isn’t bad at new car dealerships. You can usually get a good rate but you pay for it with the higher price of new cars. Interest rates on used car lots tend to be much higher, especially for bad credit borrowers refinancing loans or buy-here, pay-here dealers.

You should never pay the amount listed on the window…ever. Dealers pride themselves on negotiating but would be happy to take as much of your money as possible. The average discount below the manufacturer’s suggested retail price is 8% though this will vary depending on model and other factors.

Make sure to check the Blue Book value for new and like-new cars before you go to the dealer. A lot of buyers go to the dealership ‘just to look around’ and plan on going back home to discuss and look for more information. Without knowing all the facts beforehand, they fall into a slick trap by the dealer and end up driving home in a new and very expensive car.

Dealers like to use the trick of commitment to sell you a car. They’ll spend hours talking to you about a car, letting you test drive it and ‘pre-approving’ your credit. After all that time spent, many buyers feel like they have to buy a car or they just wasted their time.

Turn the trick against the dealer. Don’t be afraid to just walk away after hours of the dealer’s time and let them know you’re ready to do it. Mention you have an appointment to be somewhere and must leave at a certain time. This puts them in countdown mode and the discount offers will just keep getting better. Don’t get scammed by refinancing terms and shady car dealers.

If you can wait a few months, 2020 could be the best time to buy a car in more than a decade. Prices should continue to fall and dealers will get increasingly desperate to make a sale. Use the data to determine the best month to buy a car and how to use the information. Understand when to buy a car and how to negotiate your best deal.