Having a 630 credit score puts you on the edge of unlocking all the benefits of good credit

Credit scores are a mystery to most people, but they affect your life in more ways than you might imagine. Having a bad credit score can keep you from more than just getting the money you need.

But what is a bad credit score? Is a 630 credit score considered bad credit?

The credit reporting bureaus aren’t saying. Neither are the lenders. The gatekeepers to the financial world benefit by keeping you in the dark.

Understanding exactly what goes into your credit score and how to fix it will help you get the financial respect you deserve. Let’s look at the 630 FICO score and what it means to your finances.

What is a 630 FICO Score?

Understanding your 630 credit score means knowing how credit scores are calculated and how they affect your life.

Credit scores are calculated by the FICO corporation (formerly Fair Isaacs) based on everything in one of your three credit reports. This means your entire credit history from the time you started using loans and credit cards.

From this information, FICO calculates your score on a scale from 350 to 850 though it’s rare for anyone to have a score outside of the 450 to 800 FICO range. A 630 credit score isn’t exactly in the middle but it’s pretty close.

That doesn’t mean a 630 FICO is a good credit score though.

Is a 630 Credit Score Considered Bad Credit?

While your credit score will rise and fall over time, there’s one score you need to work to when thinking about good or bad credit.

That’s the cutoff for prime lending, a FICO around 660, which is the point where you’ll qualify for certain federal loan guarantees. Qualifying for these programs is important because it makes it easier for banks to sell your loan to investors and is generally the point where traditional banks and credit unions decide whether to approve your application or not.

That doesn’t mean you can’t get a loan with a 630 credit score but it will make it difficult. We’ll get to the loan options on a 630 FICO later in the article.

So a 630 credit score isn’t terrible credit, I’ve had a score as low as 580 before and it wasn’t fun. I couldn’t get a loan and the few credit cards that would approve my application demanded super-high interest rates.

Fortunately though, a 630 credit score isn’t too far from good credit. You’ll be able to increase your score that 70-points within a year of regular payments on a loan or other credit. When you get over that 660 to 700 range, you’ll start to notice the rates on loans go way down. You’ll also start getting approved for any loan you need.

How Many Americans Have a 630 Credit Score?

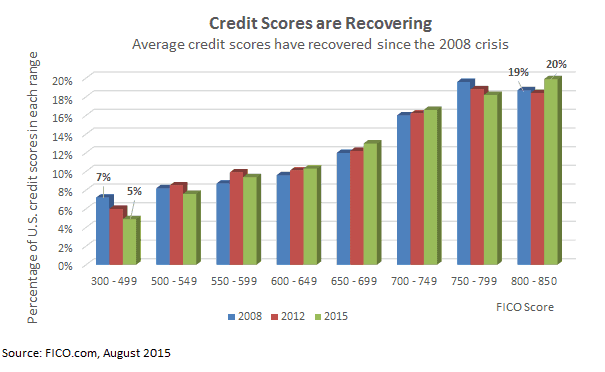

One of the worst parts about owning this website is that I see how bad the situation is for most Americans. Two-in-three households say they don’t have enough saved to cover a $500 emergency expense and only about half of Americans have what’s considered a good credit score.

About one-in-ten people have a credit score around 630 FICO and a third of Americans have a score below this point.

That means one-in-three people can’t get the money they need or at least can’t get it at rates they can afford. They’re also at risk of not getting a job because of their credit and face paying higher premiums on everything from insurance to cell phones and cable TV.

Loan Options for a 630 Credit Score

Just because banks and credit unions won’t approve your loan application doesn’t mean you’re completely locked out of credit. It just means you need to know where to look when applying for money.

I started using peer-to-peer loans and personal loans after destroying my credit score in 2008. I hit rock-bottom with a score of 580 FICO but was still able to get consolidation loans and a loan for home improvement, so I know it’s possible.

In fact, I’ve seen people with a credit score as low as 520 get approved on some p2p websites.

Of course, that doesn’t mean interest rates are going to be as low as those you see advertised on TV. Even at traditional banks, those rates are for only the best credit scores above 800 FICO.

But rates on peer-to-peer loans are still generally below credit card rates. That’s why using them in debt consolidation is so popular (and how I saved $6,500 when I consolidated my debt).

There are a few sites that specialize in bad credit loans that I’ll mention here. I’ve used PersonalLoans twice before but have also used others like BadCreditLoans and Upstart.

I like PersonalLoans because it’s a loan aggregator, networking different lenders to shop your application around for the best deal. You can apply for a peer-to-peer loan, personal loans and even traditional bank loans with one application.

Upstart is a new online lender with a unique application process that takes into account your education and degree. That means it’s especially helpful for new graduates that might not have much credit history, or a good credit score, but will be able to repay a loan.

Online lenders do a soft-pull of your credit for pre-approval and to estimate an interest rate. This doesn’t affect your credit score and is a great opportunity to apply on different sites to make sure you get the best deal available.

| Peer to Peer Lending Site | P2P Borrower Fees | Minimum Credit Score | Loan Rates | Notes |

|---|---|---|---|---|

| Personal Loans Click to Check Your Rate | 5% | 580 | 9.95% to 36.0% | Three options including P2P Loans, Bank Loans and Personal Loans. |

| BadCreditLoans Click to Check Your Rate | No Fees | 520 | Vary by state | No fees and lowest credit requirements with p2p lenders. |

| Payoff Click to Check Your Rate | 2% to 5% | 660 | 6% to 23% | Specializes in loans to payoff credit cards. Low origination fee and no hidden fees or charges. |

| Upstart Click to Check Your Rate | 0% to 8% | 620 | 5.67% to 35.99% | Best for graduates and no credit peer loans. |

| SoFi Loans Click to Check Your Rate | No Fees | N/A but probably around 680 FICO | 5.99% to 16.49% (fixed rates) 5.74% to 14.6% (variable rates) | Low student loan refinancing rates. |

| Lending Club Click to Check Your Rate | 1% to 5% | 640 | 5.95% to 32% | Best combination of low fees and low rates. |

How Do I Fix My Bad Credit Score?

Bad credit isn’t forever. In fact, it doesn’t take long at all to fix a bad credit score once you know the process.

First is understanding why you have a 630 credit score, either because of bad marks on your credit report or just lack of credit history. If your bad credit score is simply a matter of never using credit, then getting a credit card can help you increase your score within a year.

If your credit score is low because you’ve missed payments or defaulted on loans, it might take a little longer to improve your score but you can still get good credit within a couple of years.

- Consider consolidating your debt to lower the rate and payments

- Stick to a budget that allows you to make all your payments on time

- Negotiate any bad marks off your credit report by agreeing to pay the balance

- Make extra payments on your loans to lower the overall debt-to-income

Your credit score will start increasing almost immediately and refinancing your loans after about a year will lower your rate and payments even further. It can take time to build good credit but just one missed payment to destroy it so make sure you protect your FICO.

Having a 630 credit score doesn’t mean you’re forever doomed to bad credit or high interest rates. More than one-in-three people have lower credit scores and there are ways to increase yours. Understand what makes up your credit score and how to get back on track.