A 660 credit score isn’t yet considered good credit but all you need is a little more to ditch that bad credit forever

I’ve done a lot of these credit score reviews around different FICO scores but I’ve gotta say, I’m really excited about talking about the 660 credit score.

That’s because at a 660 FICO, you’re on the edge of having the entire financial world open up. Adding just 20 points to your score, something we’ll cover later in the article, you’ll start seeing loans approved and at the best rates available.

Whether you haven’t used credit much or are fighting back from a bad credit report, you’re on the way to getting the money you need and at rates you can afford.

Is 660 a Good Credit Score?

There’s no definition for what is good credit or bad credit, just what you can and can’t do. Looking it that way, either getting a loan approved or getting good rates, makes it easier to say what is good credit.

And a 660 credit score isn’t quite good credit yet.

The problem is that most banks sell their loans to investors. Investors buy the loans as a safe investment because the money is backed by certain federal loan guarantees. Loans only qualify for those government guarantees if the borrower has about a 670 credit score or higher.

This is called prime lending and it’s the point where you start getting approved for any loan and start seeing rates come down.

Because a 660 credit score is still under that point, it’s called sub-prime lending, then a lot of traditional banks and credit unions won’t touch it. That doesn’t mean you can’t get a loan at a good rate. We’ll cover some loan options for a 660 FICO later but it means you need to know where to look.

Got a much lower credit score?

Why Do I Have a 660 Credit Score?

As with most of the credit score reviews, there’s usually one of two reasons why you have a 660 credit score.

- You’re a younger borrower with only a year or two credit history or you haven’t used credit regularly. There just isn’t much on your report to score.

- You’ve destroyed your credit score by missing payments or defaulting on a loan. We’ve all been there and actually a 660 credit score isn’t that bad so you might have only been late on a few payments.

A credit score can fall as much as 50 points just from being late more than 30 days on a credit card bill. It’s totally unfair that you can spend years building a good credit score only to see it wrecked in a couple of months but that’s how the system works.

Let a loan go to collections or default and it could push your FICO down almost 100 points. That’s enough to put even the best credit borrowers into a bad credit nightmare.

Get your rate on a consolidation loan and save on interest – instant approval

How Many People Have a 660 Credit Score?

Even though a 660 credit score isn’t considered good credit, I’m still a little jealous.

When I ruined my credit in 2008, my score plunged all the way to a 580 FICO. I was broke, broken and couldn’t get a loan for a stick of gum!

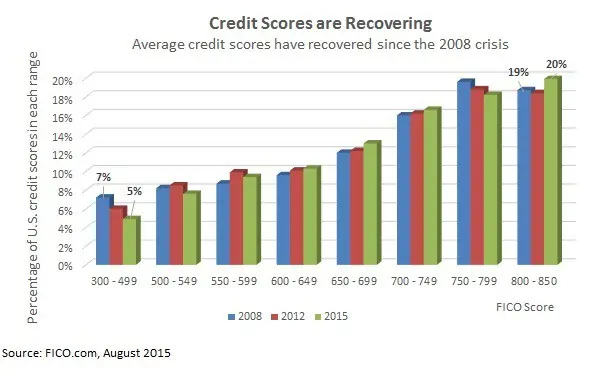

You’re in good company with a 660 FICO because more than one-in-three Americans have a credit score at 650 FICO or below that point. In fact, only about half of borrowers have a score above the range you’re in right now.

Personal Loans for 660 Credit Score

A 660 credit score probably means you’ll still be shut out from getting a traditional bank loan or credit from a credit union. Lending to bad credit borrowers never loosened back up after the Great Recession and most of these old school banks won’t budge an inch.

But there are loan options for a 660 credit score.

After destroying my credit, I was only able to go to a few personal loan sites for debt consolidation and other loans. You’ll have more options than that and will probably get approved at any peer-to-peer loan site as well as installment loan sites.

Before you go applying for any loans, remember that boosting your credit score just 10 or 20 more points will open up a lot more options and probably lower rates. We’ll get to some ways to increase your credit score next and I’d highly recommend waiting for a loan if at all possible.

Two of my favorite personal loan sites for a 660 credit score are SoFi and Upstart. SoFi has a strict credit score requirement that is generally higher than most sites but the rates on loans are hard to beat. Upstart uses a unique lending model that takes into account your education so it’s perfect for borrowers with little credit history.

I couldn’t use either of these two lenders after destroying my credit score because of their credit score requirements.

For borrowers on the edge but not quite where they can qualify for good credit loans, I recommend PersonalLoans and Payoff.

Both of these two sites specialize in bad credit loans at affordable rates. I used PersonalLoans for debt consolidaton and again for a home improvement loan. Payoff specializes in loans to pay off high-rate credit cards to lower your payment.

Either of these two sites will almost definitely approve a 660 credit score as long as you have a job and meet the other loan requirements.

Check your rate on a loan up to $35,000 – won’t affect your credit score

On the off chance you can’t get approved on one of these sites, or if you just want more options and to check rates on other sites, I recommend NetCredit for very bad credit borrowers. The website has some of the easiest loan requirements and some great features like longer terms and flexible payments.

Since all these sites do a soft-pull of your credit to pre-approve and estimate your rate, I recommend applying on at least a few before accepting any loan. The soft-pull won’t hurt your credit score and you’ll make sure you’re getting the best rate possible.

| Peer to Peer Lending Site | P2P Borrower Fees | Minimum Credit Score | Loan Rates | Notes |

|---|---|---|---|---|

| Personal Loans Click to Check Your Rate | 5% | 580 | 9.95% to 36.0% | Three options including P2P Loans, Bank Loans and Personal Loans. |

| BadCreditLoans Click to Check Your Rate | No Fees | 520 | Vary by state | No fees and lowest credit requirements with p2p lenders. |

| Payoff Click to Check Your Rate | 2% to 5% | 660 | 6% to 23% | Specializes in loans to payoff credit cards. Low origination fee and no hidden fees or charges. |

| Upstart Click to Check Your Rate | 0% to 8% | 620 | 5.67% to 35.99% | Best for graduates and no credit peer loans. |

| SoFi Loans Click to Check Your Rate | No Fees | N/A but probably around 680 FICO | 5.99% to 16.49% (fixed rates) 5.74% to 14.6% (variable rates) | Low student loan refinancing rates. |

| Lending Club Click to Check Your Rate | 1% to 5% | 640 | 5.95% to 32% | Best combination of low fees and low rates. |

How to Fix a 660 Credit Score

If you can wait just three to six months for a loan, there’s a good chance you can increase a 660 credit score into that prime lending range and get even lower rates. I realize this isn’t always possible for most people but it’s something to consider.

In fact, a debt consolidation loan alone can be enough to boost your credit score. That’s because you pay off credit card balances, which the credit score companies hate, and replace it with non-revolving debt with a fixed payment and payoff date.

A few other ways to boost your credit score that last mile include:

- Disputing bad marks or collections on your credit report to get them removed.

- Negotiating with creditors to have bad marks or collections removed if you pay the amount owed.

- Getting added as an authorized user on someone’s credit card and making on-time payments.

- Using your credit card regularly and making monthly payments…but only charge as much as you can pay off each month.

- Paying down your high rate debt with the debt snowball or avalanche method.

You won’t be able to see your credit score when getting your free annual credit report but most credit cards offer free score monitoring as a bonus. You’ll get monthly updates any time your FICO increases and will know exactly when to apply for a loan.

Having a 660 credit score isn’t quite good credit but it isn’t bad credit either. You’re so close to getting any loan approved and the best rates that it won’t be more than a few months until you’re there. Consider a small personal loan if you absolutely need the money now and then refinance it or pay it off when your credit score increases.