Asking family for a loan is not without risks but can save you in a financial pinch

We all need money from time to time, and it’s not always easy to come by if you don’t have perfect credit. Sometimes asking family or friends for a loan may be your only option.

Even with all the risks, it might also be your best option.

Asking for a loan from friends or family can save you from sky-high interest rates, loan sharks, and a debt trap from which you might never escape.

Borrowing from family has the advantage of flexible repayment terms, low or no interest, and maybe even being able to defer payments and pay them off later. There’s also the stigma and embarrassment of asking for a loan and the risk of not being able to pay it back, though.

Let’s look first at five questions to ask yourself before asking for a loan. Then I’ll share four steps to asking family for a loan that will put everyone at ease.

5 Questions to Ask Yourself Before Asking for a Loan

Asking yourself a few questions will make it easier to ask your friends for the loan and get started right.

1) Why Do I Need a Loan?

Be honest with yourself, do you REALLY need the money? Have you tried to cut a few expenses from your budget?

Whether you plan on asking your family for a loan or going to a bank, this will be the first question anyone asks. Being in debt is no joke. Less than a few hundred years ago, being unable to pay your debts meant hard labor in prison.

2) How Much Do I Need?

The most important thing to remember about debt, beyond rates and payments, only borrows as much as you need. Borrowing more than you need will burn a hole in your pocket. You’re just going to spend the money on something you don’t need, and the debt will haunt you.

Only borrowing as much as you need may mean asking for a loan to pay off all your other debts. This is called debt consolidation and can put your finances back on track. Taking a loan to pay off other debt might seem odd, but it can help by getting your payments under control and saving on interest.

If you’re worried about asking your family for a lot of money, you might try splitting the money you need between a personal loan and other sources. Family and friends might have no problem loaning you a couple thousand, while $8,000 would be out of the question.

The solution would be to borrow two or three thousand from family and friends, maybe multiple people, then make up the difference with a personal loan. The benefit here is that you’re much more likely to get approved for a smaller loan if you have bad credit, and your interest rate will be lower. Your monthly payment on the loan will be lower, and everything will be a little more manageable.

Check your rate for a personal loan – no obligation and instant approval

3) What are the Rates on Loans?

Interest rates are probably the most commonly missed part of getting a loan. Understanding the interest rates on different types of loans will put you in control.

This control means checking out the rates on alternatives like home equity, peer-to-peer, personal loans, and title loans. Some rates might be so high that it’s better just to charge your short-term needs on a credit card, while other loans might come much cheaper.

This will also help you negotiate with your family when you ask for a loan. Family might offer to loan you the money without interest, but you should also offer to pay something, especially on a big loan.

4) How Much Loan Can I Afford?

Just as important as how much loan you need is how much you can afford. It doesn’t do any good borrowing to keep your head above water if it’s only going to delay bankruptcy by a few months.

Always calculate monthly payments on a loan using the interest rate and other loan terms.

Where are you going to find the money to make these payments?

5) What Credit Score Do I Need for a Loan?

Your credit score will be a significant factor in this, but you probably already know that. That FICO score will determine where you can go for a loan, what doors will be open, and who you can ask.

- You need a FICO of 680+ for a bank loan

- You need a FICO of 620+ for a HELOC or Title Loan

- You need a FICO of 580+ for a peer-to-peer loan

- You need a FICO of 540+ for a personal loan

- Family and friends don’t care about your credit score

Check your rate on a personal loan now – borrow up to $40,000

4 Steps to Ask for a Loan

After asking these loan questions, and if you still want to ask your family for the money, there are five steps you can take to make it a more straightforward process. Of course, you’ll still have to get over the pain of asking for a loan but understand that everyone needs a hand occasionally.

1) Ask for advice first, money second

Be honest about your situation and ask if there’s any way your family can help you without lending you the money. For example, maybe a family member or friend needs some help with their business and can give you some part-time work. Perhaps they can lend you their car for a couple of weeks while you save enough to fix yours.

Asking how you can help each other out is easier than asking for a loan, and there are fewer risks.

If you can’t figure out another way, you ask for a loan. You’ll get a lot of respect from trying to work it out another way first.

2) Talk about Why You Need the Money

If you’ve already thought about why you need the money and made sure it’s necessary, odds are your family will see it that way too. So this is an essential step in bringing them over to your side before asking for money.

3) Accept Responsibility

We all make mistakes. We all have financial emergencies that we could have avoided. There’s nothing worse than someone that always blames their money problems on something or someone else.

Did you REALLY get fired because of your boss, or were you not working as hard as you could? Have you only been spending on necessities, or were there a few things you could have done without?

It’s one thing to make mistakes. It’s another thing to deny it and never learn from them. No loan will ever be enough if you never take responsibility for your financial decisions.

4) Make a Plan for Paying the Money Back

Making a plan to pay the money back comes in two parts; understanding how you’ll pay it back and putting it all in writing.

You should already know how you’ll pay the money back from the questions you ask yourself. That’s why they’re so critical.

- What’s the monthly payment on the loan?

- Is this the last loan you’ll need in a while? How long will the money last?

- Do you have any other bills coming up that might make it hard to pay off the loan?

- Does making monthly payments mean making extra money or can you do it with your regular job?

Even if your family or friends agree to easy loan terms like no interest or flexible payments, you should still put everything in writing. This step will allow everyone to relax and understand precisely what’s happening.

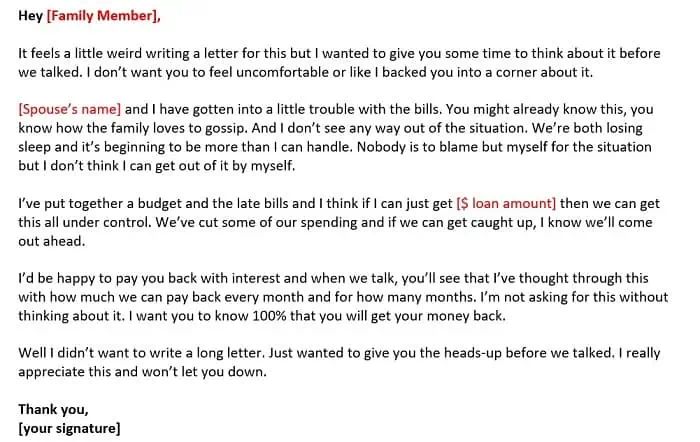

Example Letter to Borrow Money from Family

Most people go with talking to their family when borrowing money, but it’s not the best way to do this. It puts your family member on the spot and can make them defensive if they don’t know what to say.

You can try two alternatives, each including a letter for borrowing money.

- Ask them for the money, explaining why you need it and what you’re willing to pay. Then tell them you don’t need an answer right now. Instead, give them the letter that explains everything and ask them to talk to them again in the next few days.

- Give them the letter first, ask them to read it and that you’d like to talk about it tomorrow. This gives them a little time to think about the situation before facing it.

I’ve drafted an example letter you can use to borrow money, but there’s so much in it you’ll want to personalize. Don’t feel like the letter needs to be long or fancy. You’re just giving them the details and facts of why you need the money, exactly how much you need and how you’ll pay it back.

You don’t have to use this example letter exactly. It’s just a template you can work from, something I’ve found works pretty well at breaking the ice with family before you ask for money.

Alternatives to Asking for a Loan

After asking yourself those five loan questions, you might decide to ask your family for the money isn’t the best option. Several other options for cash take less than a few minutes and don’t come with the embarrassment of being in debt with family.

I’ve taken out four peer-to-peer loans, several after destroying my credit score. These are loans from an online site, but the money comes directly from investors. It’s basically like asking family for a loan, but it’s total strangers, and you can do it from home.

Get a peer loan in minutes – instant approval and won’t affect your credit

Rather than asking family for the money, you might ask them to co-sign for the loan. This still puts them on the hook if you can’t make payments, but they don’t have to come up with the money to make the loan.

Asking a family member or friend to co-sign a loan is a good backup when you ask for the money. Some family members might genuinely want to help you but don’t have the money to lend. Being a co-signer allows them to help without busting their budget.

Some family members might have the money but aren’t quite sure they want to help. When asked for a loan, the old excuse of not having the money is an easy out and one that stops the conversation. However, if you come back with the idea of them acting as a co-signer to your loan, it takes power out of their no-money excuse.

A title loan is a money you get against an asset like your car or anything else worth at least a few thousand. Since the lender has some collateral against the money, rates are usually lower than an unsecured personal loan.

If you own your home, even if you still owe on the mortgage, you might be able to get a Home Equity Line of Credit (HELOC) instead of asking your family for a loan. This loan is just a short-term loan against the difference between the value of your home and the amount you still owe.

Things to Remember Borrowing from Family and Friends

Always be completely honest and open when borrowing money from family and repaying the loan. For example, if you’re going to be a few days late on a payment, don’t wait to tell them.

Is there only one person you intend to ask for money, or are there multiple? Sometimes asking one family member to fund you a large sum of money can be difficult. A more comfortable option may be to ask multiple family members for small sums of money that add up to the total amount you need to borrow.

If you run into a problem with repayment in the future, your relationship is less likely to be permanently damaged over a small amount of money than a lump sum.

Keep Your Family Updated on the Loan

Don’t forget to thank your family for helping you out, not just after getting the money but also in the future. They helped you out when nobody else would, which deserves your appreciation.

Please don’t feel you must be indebted to your family for their help. The financial support doesn’t mean you should feel less than the rest of the family or like a loser. We all run into tough spots, and family is supposed to be there to help. Helping a family member with a small loan doesn’t make them Mother Teresa or Gandhi. It’s just what families do.

Asking for a loan doesn’t have to be embarrassing or risky for you and your family. Following these simple steps and questions will help make everything go smoothly. Asking your family for a loan is a big decision but also offers some advantages and a chance to get your finances back on track.