Avant is unique among personal loan sites with its 24-hour loans process and other features for bad credit loans

I’ve received a lot of emails about strict lending requirements on personal loans on sites like Lending Club and SoFi. As fast as the market for unsecured personal loans is growing, it can still be tough to get a loan if you have bad credit or no credit history.

That’s why I wanted to review one of the best peer to peer lending sites for bad credit borrowers. Avant Credit is one of the largest peer loan site for personal loan for bad credit borrowers and famous for their 24-hour loans process.

Avant’s lower credit score requirement and no minimum income policy has made it popular among new borrowers. It offers more flexibility in loans and payments than other personal loan sites but are its extra features enough to compensate for higher rates?

It’s why I’ve used Avant Credit for a personal loan myself to fix my credit score and pay off credit cards with a debt consolidation loan.

What does Avant and other personal loan sites do?

Avant is an online lender for unsecured personal loans. An unsecured personal loan is money borrowed with no collateral and is paid back in equal monthly payments of usually up to five years. Personal loans are also called installment loans because of the monthly installment payments.

Personal loans can be taken out for any reason from paying off debt, buying a home, medical expenses or even to take a hard-earned vacation. The majority of personal loans are used to pay off high-interest credit card bills and other debt consolidation. Installment loans are not like credit cards where you continually pay back and borrow money. Installment loans are also unlike payday loans where you have to pay the money back within a week or refinance the loan.

Avant personal loans are available for up to $35,000 and for terms of between two to five years. Avant has made personal loans to more than 350,000 people with an average household income of between $40,000 and $100,000 per year.

What makes Avant different from other personal loan sites is its easier credit standards for borrowers. Avant will lend to borrowers with a credit score as low as 580 on the FICO scale, well below the 640 FICO requirement on most other personal loan sites.

Check your rate on a personal loan – Click to qualify today for up to $35,000

A feature of almost all personal loan sites is no prepayment penalty for paying off your loan early. This means you can make extra payments to your loan and pay it off early, avoiding high interest charges, without having to pay a penalty like you might with your mortgage.

Avant Quick 24-hour Loan Process

Avant is one of the fastest personal loan sites I’ve seen with a 24-hour loan process that can fund to your bank account within one business day. Some borrowers report receiving their unsecured loan within the same day.

The quick loan process is similar to other personal loan sites. You first create an account with your contact information and how much you would like to borrow. Avant will do a ‘soft check’ of your credit report. This is to verify the information you provide and make an interest rate offer on your loan. The credit check is not like a ‘hard inquiry’ and does not affect your credit score.

Part of Avant’s quick 24-hour loans process is the fact that you can do everything online for your personal loan. After checking your credit, Avant will show you your loan with an interest rate and monthly payments. If you agree to the loan terms, you can sign the contract online.

Since Avant is not a peer lender, you don’t have to wait for your loan to be funded by investors. This is a big factor in the speed of Avant’s 24-hour loan process because it acts as its own lender.

Why Get a Loan on Avant?

We’ll highlight a few of the costs and benefits of getting a quick personal loan from Avant. There are no origination fees for personal loans so your only cost is the interest on your loan. This is a big advantage over other personal loan sites that charge 5% of your loan as a fee. That could amount to a difference of $500 on a $10,000 personal loan.

Not only does Avant provide personal loans to borrowers with bad credit, as low as a 580 FICO score, it also doesn’t require a minimum income. There is no credit history required and the lender doesn’t limit borrowers to a maximum debt-to-income ratio, though these factors will be taken into account on the loan interest rate.

One of the best benefits to all personal loans is the opportunity to help build your credit score. Personal loans are reported on your credit report as non-revolving debt and your monthly payments help build credit history.

The fact that they are non-revolving debt is important but overlooked by most borrowers. The credit rating companies take into account different types of debt when factoring your credit score. Revolving debt like credit cards where you can continuously borrow and have no fixed pay-off date hit your credit score harder than non-revolving debt. You’ll build a better credit score faster with a personal loan than you will using other types of credit.

The biggest drawback to Avant and its fast 24-hour loan process is the interest rate on personal loans. Personal loans on peer lending sites like PersonalLoans.com start as low as 5.3% and go up to 29% depending on your credit score. A loan on Avant is going to be slightly more expensive with rates starting at 9.9% and can be as high as 36% for bad credit borrowers.

The 5% you’ll save from not paying an origination fee helps to lessen the cost of an Avant personal loan. It does look like rates are coming down on personal loans from Avant. Interest rates were once as high as 65% but have come down. The company hopes to lower rates further as it grows and develops its unsecured lending business.

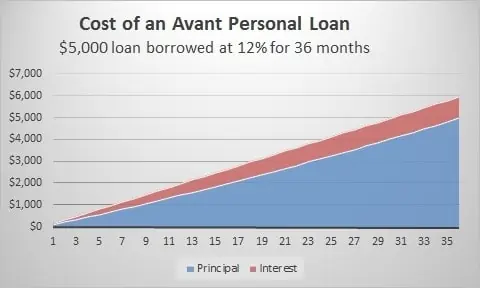

The graphic helps to show the cost of an Avant personal loan for a $5,000 loan at a 12% rate over 36 months. Note that shorter-term loans and lower amount loans will be offered a lower interest rate so you should only ask for as much as you need and try paying it off as quickly as possible.

On a three-year loan for $5,000 the interest will cost you another $1,000 if you take the entire 36 months to pay off the loan. Pay it off in two years and the interest will cost just $650, so you can see the importance of paying off personal loans as early as possible.

Why I Prefer PersonalLoans.com versus Avant Credit

I’ve used bot PersonalLoans.com and Avant Credit for personal loans and usually recommend one over the other. It depends on your needs and there are reasons to like Avant Credit but I tend to prefer Personal Loans for peer to peer lending.

What sets Personal Loans.com apart versus Avant is that the site has a network of lenders that compete for your loan. You can get a peer loan, a personal loan or even a traditional bank loan on the website. This often means lower interest rates as lenders compete for your loan.

Loans are available on terms of six months to six years and from $500 to $35,000 which is a bigger range compared to Avant. Whichever peer to peer lending site you choose, check out your rate on Personal Loans to make sure you get the best rate for your loan.

Get Lenders to compete for your loan – Click to check your rate today

| Peer to Peer Lending Site | P2P Borrower Fees | Minimum Credit Score | Loan Rates | Notes |

|---|---|---|---|---|

| Personal Loans Click to Check Your Rate | 5% | 580 | 9.95% to 36.0% | Three options including P2P Loans, Bank Loans and Personal Loans. |

| BadCreditLoans Click to Check Your Rate | No Fees | 520 | Vary by state | No fees and lowest credit requirements with p2p lenders. |

| Payoff Click to Check Your Rate | 2% to 5% | 660 | 6% to 23% | Specializes in loans to payoff credit cards. Low origination fee and no hidden fees or charges. |

| Upstart Click to Check Your Rate | 0% to 8% | 620 | 5.67% to 35.99% | Best for graduates and no credit peer loans. |

| SoFi Loans Click to Check Your Rate | No Fees | N/A but probably around 680 FICO | 5.99% to 16.49% (fixed rates) 5.74% to 14.6% (variable rates) | Low student loan refinancing rates. |

| Lending Club Click to Check Your Rate | 1% to 5% | 640 | 5.95% to 32% | Best combination of low fees and low rates. |

How to Get 24-Hour Loans and the Best Rates on Peer Lending

One of the biggest problems in peer to peer lending is that interest rates can get pretty high for bad credit borrowers. If you can increase your credit score before the loan, you can save thousands in interest payments.

The problem is that waiting the three months or more for your credit to improve isn’t an option. Fast 24-hour loan sites are popular because they are still the best alternative to payday lenders and their sky-high rates.

There is one way to get the best of both worlds, quick 24-hour loans and lower interest rates.

You need cash now, there’s no way around it and you’ll need to apply for a peer loan today. That doesn’t mean you can’t start working on your credit score and then refinance your loan at a lower rate within a year. Many peer to peer lending sites offer refinance services with lower fees or you can just take out a second loan to pay off the first.

The trick is to borrow only the bare minimum you need on your first peer loan and for a shorter-term like a year or two. Pay the loan off within a year and you can reapply for a new loan at a lower rate with your higher credit score.

In fact, the rate for peer loans usually goes down for your second loan even if your credit score is the same. Peer lenders see that you paid off an earlier loan and know that you will pay off this one so they offer lower rates. It’s a trick most borrowers don’t know about but it works every time.

Avant Personal Loans Frequently Asked Questions

What if I cannot make a payment on my personal loan?

The first thing to do if you are going to miss a payment on your personal loan is to contact Avant customer service. They may be able to adjust your payment due date to give you a little more time. This will avoid the $25 late payment fee and will keep it off your credit report. Avant also has a great feature in late-payment forgiveness. If your next three payments are all on-time, the site will refund your late payment fee.

What are the fees for an Avant personal loan?

There are no loan origination fees on Avant, compared to a 5% origination fee on other personal loan sites. The only additional charge is the interest you will pay on your loan. There is a late payment fee but no check processing fee.

Will applying for a personal loan hurt my credit score?

Creating an account and applying for a personal loan will not affect your credit score because Avant will do a ‘soft’ check of your credit. Your credit score will not be affected until you agree on the loan terms and get your personal loan funded.

Is my financial information safe with Avant personal loans?

Avant secures its information on Amazon Web Services, one of the largest cloud computing services in the world. All financial information for personal loans is encrypted with the same technology used at banks and brokerage firms.

How fast will my personal loan be funded?

Avant has a unique 24-hour loan process because it funds its own loans, compared to peer lending on other personal loan sites where investors must fund loans. This means your personal loan can show up in your bank account within one business day.

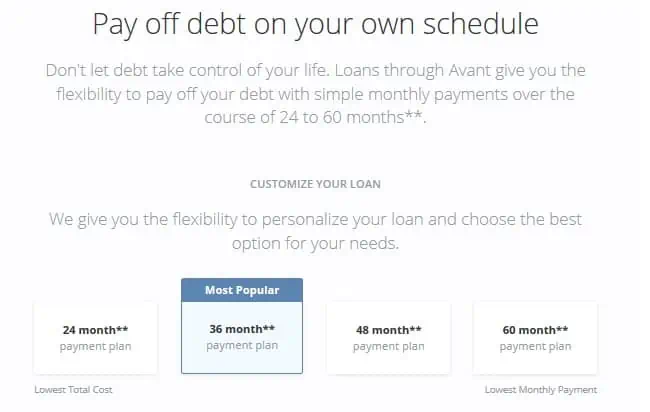

What are the differences in loan terms?

The graphic below provides good information on the trade-off between longer time to repay your loan and lower rates on your personal loan. While your monthly payment will be lower with a long-term loan, your interest rate will probably be lower and you’ll pay less interest with a short-term loan. Personal loans for 36-month terms are the most popular trade-off between lower payments and lower cost.

How does the Avant Quick Loan Process Stack Up against other Personal Loan Sites?

Again, the biggest drawback of the Avant loan process is the higher rate you might get for your personal loan. There’s no guarantee that rates will be lower on other personal loans sites but you might want to check out your rate on PersonalLoans.com and Lending Club

before deciding on a loan. You can check your loan terms on all three personal loan sites without hurting your credit. You will have to pay a loan origination fee on other lending websites so make sure you factor that into your decision.

Loans on Avant are available for shorter-terms than on peer lending sites, allowing you to better customize your personal loan needs. The shortest term available on most other unsecured loan sites is three years. There is no prepayment penalty on most installment loan sites so loan length may not matter as much if you are going to pay it off early.

The biggest factor in the popularity of Avant personal loans is the easier credit standards. Most other personal loan sites require minimum income and a credit score of at least 640 on the FICO scale. If you have late payments or a bankruptcy on your credit report, you may not be able to get a loan on one of the other lending sites. This makes Avant and its 24-hour loan process a huge help for anyone that needs to turn their finances around but has limited options.

Even on slightly higher rates compared to other personal loan sites, Avant is still much cheaper than payday lending. Fast loans from payday lenders may look attractive but the rate they quote is on two weeks instead of years. The actual interest rate is up to 700% a year! These are some of the worst ways to borrow money.

A personal loan from Avant beats out borrowing or spending on your credit cards as well. The average rate on credit cards is 17.5% and rates are much higher for bad credit borrowers. Not only can you save money through a debt consolidation loan, paying off your credit cards, but the loan is on fixed terms so you know when you will pay it off. Personal loans help to build your credit score by replacing revolving debt with non-revolving debt on your credit report.

Customer support on Avant is excellent though I have heard good reviews for most personal loan sites. Customer support is available 7-days a week by phone, email and chat.

One of Avant’s best features is its late fee forgiveness policy. If you miss a payment, the company will charge a $25 late fee which is pretty standard for personal loan sites. If you make three consecutive on-time payments though, Avant will refund your late fee.

Avant also offers personal loan refinancing which I haven’t seen on any other unsecured loan websites. You may refinance your loan twice, potentially getting a better rate as you improve your credit score. Since there are no origination fees, it’s a great offer.

Getting a Lower Rate on Avant Personal Loans

Besides your credit score and financial factors, you can also lower your rate on a personal loan by changing around your loan needs. Shorter-term loans of two or three years will offer lower rates. Loans of smaller amounts like $5,000 will also offer lower rates compared to larger personal loans.

One of the best ways to lower the amount of interest you pay on your personal loan is to pay the loan off early. It might not always be easy to do this but you should try prioritizing the loan payoff above lower-interest debt. Even paying an extra $20 a month on your personal loan can mean hundreds in savings on interest.

Avant Personal Loans Review Summary

Avant is known among personal loan sites for its fast 24-hour loan process and easier lending requirements but interest rates are higher than on other websites. The 5% you’ll save by not paying an origination fee will help lower the total cost of your loan but you will still likely pay slightly more interest.

Great features like late-fee forgiveness and loan refinancing at lower rates help to make Avant a major contender among personal loan sites, especially for borrowers with bad credit who might not have many options.

Compare possible loan terms on Avant as well as other sites before you make your decision and try to improve your credit score before applying. Pay your personal loan off quickly by adding a little extra to the monthly payment and only borrow what you need.