You asked, they answered! Your top budgeting questions and how to save money answered by the top experts in personal finance.

Wherever your financial goals may take you, it all has to start with budgeting and saving money. You can invest like a rockstar but aren’t going to get far if you can’t put enough money away to grow with your investments.

That need makes for a lot of questions about budgeting and how to save money. It’s not taught in schools and not something that comes up in casual conversations.

You’re in luck!

I reached out to some of the best personal finance bloggers I met at the FinCon financial bloggers conference recently to get their responses to your budgeting questions and how to save money. While many of the questions are similar, the responses are completely unique and a great way to get different perspectives on these key concepts in personal finance.

Don’t stop with your questions about budgeting and saving money. Check out the first post in the series where we surveyed the Top 10 Questions about Debt and last week’s post on investing and money questions.

Questions on How to Save Money and Getting Started

These three answers on budgeting and how to save money are a great place to start with your financial plan. With the average family in America making just $50,000 a year, it’s tough to find place in your check to save money.

That doesn’t mean you can neglect saving though. Avoid putting money away and one financial emergency can put you in a debt hole from which you’ll never get out. Check out the answers to these three budgeting questions to help build your emergency fund.

Doug Nordman, The-Military-Guide

My most popular reader question is “How do I reach financial independence?!?”

The answer is straightforward but challenging.

- Track your expenses for a few months,

- Spend your money on the things that bring you value, Cut out the wasted spending.

- Save as much as you can and invest in the military’s Thrift Savings Plan and other passively-managed index funds with low expenses.

- When your net worth is 25x your net annual expenses then you’re financially independent, even without a military pension.

Doug’s advice is geared to those in the military but works for anyone. The idea that your net worth should be about twenty-five times your expenses comes from the rule of thumb that you can withdraw 4% of your savings every year in retirement. It’s a good general rule to get you started saving.

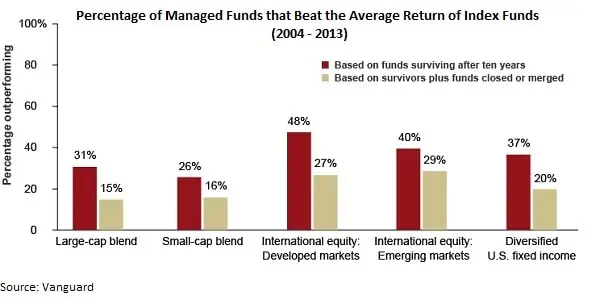

The advice to passively-managed index funds is a good one that can help you get instant diversification in your investments and avoid the high fees charged on mutual funds. The graphic below shows that an average of just 21% of actively-managed funds ended up outperforming index funds over the decade through 2013.

I’ve gone a step beyond index funds by investing on Motif Investing. Motif is a new investing site that lets you build your own stock funds and save money investing. You can group up to 30 stocks and buy them all with one trade. You get instant diversification and don’t have to pay the annual fees like you do with index funds.

Check out this Motif Investing review for more info on how to save money investing and meet your retirement goals.

Paul Vachon, Frugal Toad

I get asked the question, how to make sure you’re saving enough for retirement, all the time. My advice is to start with 70-80% of your current living expenses and adjust it for any planned expenses you think you may have in retirement.

Many people plan on traveling during retirement yet fail to appreciate how expensive this can be. Build a realistic retirement budget and use this to calculate how much you will need to fund your lifestyle for required number of years you plan on being retired. One of the best ways to do this is to use finance software such as Quicken which has a retirement planner that will calculate how much you will need to save each month to meet your retirement savings goal.

Readers ask me where to start on budgeting and saving money all the time. Most people are making the decisions all on their own and get super nervous if they’re making the right choices.

First off, relax. Even if you don’t pick the absolute best investments or get the best rates on debt, just getting started puts you better off than if you had done nothing.

- Start by taking a financial inventory – credit score, debt, balances, and assets. I recommend TransUnion’s free credit score tool and monitoring service.

- Define where you want to go – Think of your finances as a map

- Prioritize your financial goals – debt payoff, emergency savings, short-term savings and retirement savings

Budgeting Questions for Saving Even More Money

Financial success is like a drug…once you’ve got a taste, you’re going to want more. After getting started budgeting and saving money, you won’t be satisfied with your old goals anymore. You will make new financial goals and realize that the sky’s the limit on what you can achieve.

It’s a great feeling and here’s two ideas for your new financial success.

J. Money, Budgets are Sexy & Rockstar Finance

The question I probably get asked the most is how to better their financial situation as a whole. It’s always hard to answer since we’re all in different phases with different goals. But there’s one thing that applies across the board – and that is that you have to CARE ENOUGH to want to change your situation in order for anything to be done about it.

There’s a reason it takes us so long to accomplish stuff – they’re not priorities until the day they are! So the best advice I can give anyone is to really just want it bad enough so you start taking action.

Whether that’s starting to stash some savings aside, killing your debt, or going after the holy grail of them all – financial freedom. Lots of ways to get there, but you have to care enough to make it happen.

Let’s face it, changing your lifestyle and spending habits is hard work. It’s even more difficult when you’re living paycheck-to-paycheck. Try planning your budget and saving strategy out for just three months. It’s a lot easier than just planning on budgeting forever. It takes between seven and ten weeks to form a new habit so make it through a couple of months and you’ll have built some great spending habits.

It was only after I destroyed my credit that I realized I needed to take control of my financial life. I qualified for a debt consolidation loan to put my credit back on track and got serious about improving my score. I then learned everything I could about budgeting and saving money so I wouldn’t be in the same situation again.

Qualify for a personal loan up to $35,000 – Click to check your rate, won’t hurt your credit

Andrew, Listen Money Matters

How do I manage money with my spouse? The most important thing is to communicate often. Sit down once a month to go over your budget and goals.

Don’t stop at just talking finances with your family. Recruit a friend as you budgeting confidant. I spent years on the financial equivalent of a yo-yo diet without even knowing it. It wasn’t until a friend helped me figure out where I was going wrong that I was able to turn my life around.

Questions about Budgeting and Family Money

Budgeting and saving money can lead to a lot of family arguments. Studies show that budgeting and money is the #1 reason couples argue and one of the biggest causes of divorce. Check out these answers to creating a budget and getting the family on the same page.

Kayla, KaylaSloan.com

The most common question I get is how I keep my grocery budget so low. It’s at $120 for the month. My response is that I have amazing parents who provide all the beef and pork I eat for the year in exchange for helping them on the farm. Because we raise beef and pork it’s not too expensive for them to provide this either. I also shop sales, use coupons, and try to eat cheap, but healthy, meals.

Pauline Paquin, Reach Financial Independence

The basic question I get is “wow, you’re doing so great but I don’t know where to start” followed by excuses about how complicated or expensive life is and how there is never enough. I tell readers to just get started with $10 here and $10 there, instead of having take-out or going to the movies, does add up over time.

I tell them to have their savings account automatically filled with a transfer on payday so they don’t notice the money is missing and they are not tempted to spend it. That and a thorough review of every line of spending.

Start asking the important questions about spending and your money.

Do we really need this?

Do we really get value out of that?

More often than not, you will find out there is some wasteful spending in your budget. Too much food that you end up throwing away, magazine subscriptions you haven’t read in months… cutting on that won’t affect your lifestyle, and it will boost your savings.

Still having trouble saving money? Check out these 20 money saving tips that can save you more than $7,500 a year!

Gary Weiner, Super Saving Tips

Readers ask me what’s the best way to make a budget.

- Set your goals.

- Track your current income and your current spending down to the penny, including everything from rent/mortgage to snacks.

- Use the information to categorize and make a realistic budget, prioritizing your goals (include savings, emergency fund, and occasional expenditures).

If any category is much higher than you want, month by month start lowering the amount and find ways to save gradually. Monitor your income and spending during the month and adjust as needed to meet your budget.

Rocky Lalvani, Richer Soul

The biggest questions that I seem to get is focused around teaching kids the value of money. My answer is basically that they need to have money in order to learn how to use. The reality is our money habits are created between the ages of 5 to 13 years old. Parents have a tendency to screw up their kids habits based on their own.

We did another roundup just for this topic. Check out this post for 30 expert ideas on teaching kids money saving tips.

I get a lot of questions about raising kids on a tight budget. The biggest is probably to know what you need and what you don’t. Parents are marketed to incessantly, and it can be easy to fall prey to all the voices telling you to buy, buy, buy, or else your kids won’t have a good childhood.

We’ve found that in reality, we’ve been able to get away with not purchasing everything from a rocking chair to excessively expensive, branded toys. What our kids truly value is our time, and that doesn’t cost a cent.

That wraps up our post on budgeting questions and how to save money with some great tips from the experts. We covered 30 questions and got 30 great answers about debt, investing and making money that are sure to help meet your goals and reach financial independence. Don’t stop there, check out some of the other posts on the blog or ask your money question below.