Finding the best retirement plans is about knowing where to get free money with special retirement accounts

This post is a transcript from a video course I am putting together for investing. What do the best retirement plans have to do with investing?

It turns out that taking advantage of the best retirement accounts and options may just be the best investment you ever make.

What if I told you a secret to getting a 20% to 50% instant return on your investments? You’d be excited, right?

On the average 8% annual return the stock market has produced over the long-run, it would take you more than five years to see a 50% return on your investment. Getting an instant 50% return means you double your money in four years and an investment of just $50 a month can turn into more than $100,000 in 30 years, that’s on an investment of just $18,000 over those three decades!

This secret isn’t some scammy stock trading strategy or get-rich-scheme. Actually, most people know about it but it feels like a secret because so few people take advantage of it.

The secret is in those special pre-tax savings accounts and retirement accounts. Plans like a Health Savings Account (HSA) or a 529 account that can save you up to 35% depending on your tax rate or retirement accounts that offer a guaranteed way to beat the market.

This guide is all about getting free money through the best retirement plans and savings programs. We’ll cover five programs, how to set each up and how to get the most out of your money.

During my time as an economist for the State of Iowa, I was always amazed at how many people didn’t max out their 401K contribution on their retirement plan even up to the point to get their 50% match. If your employer matches your contributions, even just half of your contributions, that is an instant 50% return on your money. Plus, your investments grow tax free for decades.

No stock picker or financial advisor I’ve ever met can touch these kinds of returns. These types of retirement programs we’ll talk about in this guide are the easiest and best investment decision you will ever make.

It’s a monster guide, over 70 pages and everything you need to know to get the most out of your retirement planning as well as special savings on education and healthcare. I recommend you bookmark the page to use as a reference. Feel free to use the table of contents below to jump ahead but make sure you understand how to use each retirement account to reach your financial goals.

Why the 401K is the Best Retirement Option

IRA Retirement Account Facts

Why Roth IRA Retirement Accounts are for Everyone

Comparing the Different Retirement Plans

I had originally planned on running this as one article but the blogging software I use was having trouble handling the 17,000+ word guide so I had to split it into two posts. Come back tomorrow for everything you need to know about tax-free investment options for education and healthcare.

The Best Investment You Will Ever Make

So maybe when you signed up for an investing course, talking about tax savings and 401Ks isn’t what you had in mind. You probably were looking for how to pick stocks or a super investing strategy to beat the stock market, right?

Consider that few money managers are able to beat the stock market return even by a few percentage points a year. That means most top advisors are happy with a nine or 10% return on their clients’ money.

Now compare that feeble return with someone in the lowest tax bracket, 15%. They can invest $50 a month but that $50 was actually $58.82 before taxes got taken out in their check. If instead of investing through a regular account, they invest through a 401K, IRA or other retirement account – the money gets taken out of their check before the income tax deduction.

That means they can invest the entire $58.82 instead of the $50 they would have gotten after taxes. They have almost 18% more money invested, immediately and they did nothing other than taking their money out of their check before taxes instead of afterwards.

They still get a return on their investment throughout the year, say that average 8% market return so their investment is $63.50 at the end of the year for a 27% return on what would have been a $50 investment. No financial advisor or hot shot money manager will ever be able to get you 27% consistently each year.

It gets even better with a company match on a 401K account. Say your employer matches 50% so they add $29 (50% of your $58 pre-tax investment). Now you’ve got an investment worth $88 for an immediate 76% return!

I’ve advised wealthy clients and worked for money manager firms. This is how the rich invest and make most of their gains. It’s not with complicated trading schemes but by paying as little as possible to the tax man.

Get started investing with this special offer from Motif Investing, up to $150 cash back

We’ll start by looking at the different types of retirement accounts and how most people miss out by only having one account. After walking through how to get the most out of these, we’ll cover a couple of other special savings accounts that will save you big money every year.

Why the 401K is the Best Retirement Option

Let’s start with the most common type of retirement account, the 401K plan sponsored by your employer. We’ll cover the basic 401K facts here and why it’s your first choice in retirement accounts but understand that 401K plans differ by employer. These basic facts will hold up but your employer will give you an enrollment guide that will contain all the details for your specific plan like matching, providers and available investments.

What is a 401K and what are the benefits?

A 401K is a retirement account set up by your employer that allows you to automatically deduct money from your paycheck before taxes are taken out. This is different from some of the other retirement accounts we’ll talk about because the others require you to deposit money from your paycheck after taxes have already been taken out.

Your plan may differ but generally most employees scheduled 30 hours a week or a certain number of hours per year, considered full-time employees, are eligible to participate in the 401K plan. Most employers set a period of six months employment before you’re eligible to enroll in the plan.

You still get the same great tax benefits on those other retirement accounts and we’ll talk about why you should have both a 401K and at least one or two other retirement plans but the difference is you have to report how much you paid into the other accounts when you do your taxes to get the benefit. A 401K plan just makes it easier by automatically taking the money out before taxes so you don’t have to do anything.

You’ll get tired of me repeating it but that tax benefit is huge. By investing your money in a retirement account before taxes are taken out, or by deducting the money off your income when you file, you are getting an instant return that’s way above anything you could make in a year in the stock market. You also see your money grow every year tax-free.

I’ve spent most of my professional life advising wealthy clients and money manager firms, these special retirement investing tax breaks are the #1 strategy the rich use to lower their taxes and make more money on their investments.

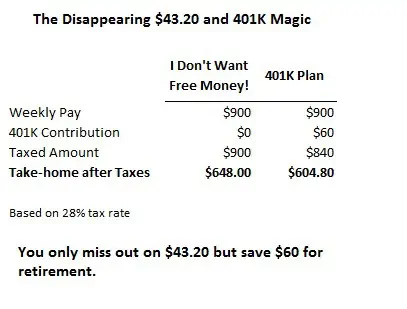

You don’t have to participate in your company’s 401K plan but you’ll be missing out on a huge opportunity. Consider this example.

Over 20 years, the 401K participant is going to see their retirement account grow to almost $154,000 assuming an 8% annual return while not contributing to the 401K plan would leave the account with just $111,000 over the same timeframe.

Your employer will also set the vesting rules for your 401K plan. Vesting rules are the period of employment you need to meet to keep the money from your company’s match. You will always own all of your contributions. All the money you contribute from your paycheck will always be 100% yours for retirement. The money your company matches in your 401K may be locked up for a period.

For example, your 401K plan may require you to work for the company for two years before you have the right to 20% of the company’s match. Work two years and you’ll get to keep 20% of all the money the company has put into your 401K account. The percentage you keep will go up from there, maybe stay five years and you keep 40% of the match.

Kind of sucks that you don’t get to keep all the company’s match immediately, it’s just a way for the company to keep employees around. It’s important to understand your plan’s vesting rule, how long you need to stay and how much of the match you’ll keep.

One last detail about 401K retirement accounts. The IRS sets an income limit on how much you can make and still contribute to your 401K plan. Currently this limit is $270,000 in annual income but there’s a very important catch. You are allowed to put money in your 401K plan until your annual compensation reaches that limit. That means even if you plan on making more than that a year, you can still get those tax benefits and employer match by making your contributions early in the year before you’ve reached the limit.

For example, say you make $30,000 a month (hey, we can dream right?). That means you’ll make $360,000 for the year which is way over the income limit. If you wanted to max out your 401K contribution and put in $18,000 then you still could if you contributed to the account in the first nine months of the year. You’re making $30k a month so you’ll reach that $270,000 limit in nine months and can contribute during that period.

Getting the tax savings with these retirement plans is easy with TurboTax software. It’s the tax software I use and makes it easy to find all the deductions and credits you’re owed. Best yet, it’s free to use and file if you file the standard tax form. Click to file your income taxes for free with TurboTax.

How do I set up a 401K?

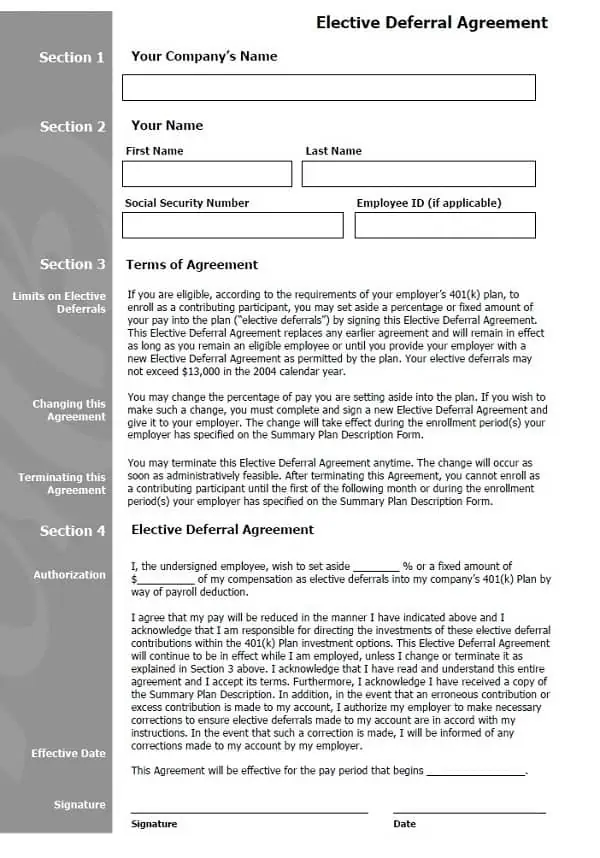

Employers contract with 401K providers, investment companies, to offer you the plan. You’ll usually be able to select from a list of plan providers and a representative will help you fill out the paperwork.

Your plan provider will ask you what percentage of your income you want to put into the 401K plan. You might also have a few options like contributing from each paycheck or once a month. You can do a little planning here, for example if most of your bills come out early in the month then have your 401K contribution taken from paychecks later in the month.

Most important though is that you set your contribution percentage to the max matched by your employer. Your 401K plan will say something like, the employer matches 50% of your contributions up to 10% of your income. That means you can contribute up to 10% of your paychecks and your company will match it with another half of what you put in.

For example, if you make $900 a week and contribute 10% then you would be putting in $90 per week. Your employer would match that by contributing $45 into your retirement account.

You can contribute more than the company’s match percentage, say contributing 15% of your income, but the example plan above means the employer will only match the amount up to your 10% contribution. You still get the tax benefits of the extra money you put in, you just won’t get the free money from your company.

If there is one thing you get from this section of the course, just one thing, it’s that you absolutely need to contribute the maximum percentage matched in your 401K plan. Whatever you need to do to not need that money right now, do it and get all the free money your company is offering!

Back to how to set up your 401K plan. Your plan provider is going to show you investments available, usually mutual funds offered by their investment company. We’ll get to which investments to pick for your retirement account in a bit.

Enrolling in your 401K plan is easy, you just need to get an enrollment form from your Human Resources department. The representative from your plan provider will probably do this for you.

How do I choose a provider for my 401K?

While I love 401K plans and all their benefits, I’m not a big fan of 401K plan providers. The problem is the fees charged and the investments offered by the plan providers.

Fees for 401K plans include a percentage fee on your investment in each mutual fund, operating expenses paid by your company to the plan provider and even fees each time you invest. It’s why I usually recommend only contributing up to your company match and then saving the rest of your retirement money in an individual retirement account (IRA) but more on this later.

Unfortunately, all of this can’t be avoided but you are still getting a great benefit through your 401K with company match.

Picking a provider from your company’s list comes down to a few questions:

- What are the investments available and fees for each? Look through some of the providers’ available investments. What are the fees for the ones in which you might invest?

- Does the plan provider charge a fee each time you invest or sell an investment in the account? These are typically called load fees and can really hit your account.

- Does the 401K provider offer funds from different companies or just one? Only offering investment options from one mutual fund company may mean that’s the one giving the provider the biggest kickback.

- Does the provider offer non-mutual fund investments such as access to ETFs? This could mean much lower fees compared to mutual fund investments.

Don’t just go with the first 401K provider that shows up at your work. Talk to a couple and ask your co-workers why they chose their provider. Just a 1% difference in the fees you pay can mean tens of thousands more in your account later on.

What investments should I pick for my 401K plan?

We’ll cover a lot of this in the Investor Policy Statement (IPS) section of the course. Your IPS is an investing roadmap that helps you decide what investments to pick depending on your age and other needs.

Most 401K plans will offer a range of mutual funds in which you can invest. Some of these will probably include:

- A total market fund that invests broadly in the stock market

- An international market fund that invests in stocks or bonds of international companies

- A small-cap and large-cap fund that invests in either small companies or very large companies

- A bond fund that invests in different types of bonds including U.S. treasuries and corporates

- A value fund that invests in stocks that are thought to be inexpensive on some kind of measure

- A growth fund that invests in companies with faster sales or earnings growth rates

- Several ‘horizon date’ funds that invest in a variety of assets depending on how long you have to retirement

You can split your money to invest in several of these much like you would to build an investment portfolio. All portfolios should have a combination of stocks and bonds so make sure you are investing in at least one stock fund and one bond fund or that you get exposure through a fund that holds both.

There are a few things you need to look for when picking your 401K investments:

- Check the expense ratio for each mutual fund. This is the annual percentage fee charged on your total investment in that fund and usually your biggest fee. Try to find funds with expense ratios of 1% or less but lower is better.

- Check if there are any 12b or load fees for each fund. This is money taken off the top each time you invest or when you sell a fund. Do not invest in mutual funds with load fees.

- Ask if the mutual fund is actively or passively managed. Active management means the fund manager is buying and selling investments in the fund based on their analysis and can mean higher fees and taxes for investors. Passive management means the fund investments are determined by an index or group of stocks and will usually change much less frequently.

Don’t be fooled by the reported historic returns for each fund. These really don’t mean much of anything and can be manipulated by the plan provider. Rather than past returns, it’s much more important to invest in funds that meet your long-term needs. This means investing in asset classes (stocks, bonds and real estate) and within each asset class to fit your need for return and your tolerance for risk.

You can change your 401K investments and how much you invest in each fund but this should be very rare. Your investing needs might change every ten years and maybe you’ll invest a little less in stocks and more in bonds or other safe assets. Don’t worry about timing the stock market or other nonsense, just invest according to your long-term plan we’ll talk about in the IPS. When you do need to change your 401K investments, the representative for your plan provider will help you.

How much should I invest in my 401K plan?

You should always contribute at least the max match percentage to your 401K plan. Again, this will be spelled out by your company with something like the company will match 50% up to 10% of your income. This means you can put up to 10% of your income into your 401K and the company will contribute another share.

There are dollar amount limits you can contribute to a 401K plan. Through 2017, the most you can put in is $18,000 a year but this will increase each year on a cost-of-living adjustment. If you’re over the age of 50, you can invest an additional $6,000 (2017) as well.

I’ve always said the best strategy is to invest up to your company’s match first. So if your employer matches your contributions up to 10% of your income, then contribute 10% of your income to the plan.

If you can save more of your money for retirement, put the rest in an individual retirement account (IRA) up to the contribution limit. We’ll talk about these next and advantages over a 401K plan. I like IRAs because you have more control and options for your money. 401K plans usually only allow you to invest in mutual funds which are an expensive way to invest. You’re still doing great because of that employer match but it’s better to put your additional money in lower-cost exchange traded funds.

Now, if you’ve contributed up to your employer match and maxed out the annual limit on your IRA (that’s $5,500 currently) and still have money you want to save for retirement. Then you can put more into your 401K plan or one of the other retirement accounts we’ll talk about. You won’t get any more employer match on this extra money but you will get the tax savings.

How do I know how much money I have in my 401K and how my investments are doing?

Your plan provider will give you a login and password to access your account online. You will also be sent a statement every three months and every year summarizing your account.

You shouldn’t need to check your 401K account often, maybe every three months or even once a year. These are very long-term investments and you shouldn’t worry about day-to-day changes in the stock market. Just invest regularly with contributions from your paycheck and enjoy the free money from your employer and huge tax savings.

What happens to my 401K if I leave my employer?

You’ve got three options with your 401K when you leave your employer.

You can keep your account with the plan provider. Remember, your money is invested with the plan provider’s investment company and not with your employer. Your old company doesn’t have access to the account.

You also have the option of transferring your 401K account from the plan provider to your new employer’s 401K plan. Most employers will allow this type of transfer, called a rollover, but check with your new employer. If they allow it, most plan providers will help you fill out the forms. Transferring your 401K account does not incur any withdrawal penalties but make sure you ask if there are any fees.

Finally, you can also transfer your 401K account into an IRA that you control. I like this option the best because you have more investment options with an IRA and the fees are usually much lower. You do this by first setting up an IRA account with an online broker or other service. The new account will give you the forms to make the transfer and customer service can guide you through the process. It’s usually as simple as filling out your account numbers and sending the form to your old 401K provider.

Can I have more than one 401K?

You can have as many 401K accounts as you like, leaving each account with former plan providers each time you leave an employer. It might make it difficult to track where all your money is invested but it’s your choice.

As mentioned, I recommend transferring old 401K plans into an IRA. The fees are lower and you have more options for investment. Your old employer isn’t going to be matching anything anymore so you have nothing to lose by transferring the account. It also makes it easier to see the big picture for your investments if it’s all in one place.

Can I take money out of my 401K plan?

401K plans are different from other retirement accounts in that you usually cannot withdraw your money while still working for the company. If you leave the company, you can transfer your account to another retirement plan or take a distribution, but you usually can’t access the money otherwise.

Some 401K plans will give you the option of taking a loan out on the money you have invested. This is a terrible idea though because you lose a lot of the benefits and make it harder to meet your investing goals.

- Most 401K plans won’t allow you to make contributions until the loan is repaid. That means no employer match and no tax benefits.

- You are losing out on making money by not being invested and not being able to make contributions. Most 401K loans allow for up to five years on the loan, that’s a long time to not be making returns.

- If you can’t repay the loan, it’s treated as an early withdrawal. You’ll have to pay a penalty of 10% of the loan plus you’ll pay income taxes on the amount.

- If you quit your job, you’ll have to repay the loan immediately.

- You have to repay the loan with after-tax money from your paycheck. This means you’re putting money back in your 401K account with earnings after taxes have been taken out, then you’ll have to pay taxes when you withdraw the money in retirement. It’s a tax nightmare!

Your 401K money is there for your future. Keep it that way and don’t take the money out or take a 401K loan.

Is there a way to avoid the 10% withdrawal penalty if I take my money out?

If you take money out of your 401K account, usually after leaving an employer, before you are 59 ½ years old, you will have to pay a 10% penalty plus income taxes on the amount. Besides this hefty fine, you’ll also make it more difficult to reach your retirement goals.

There are a few ways you can withdraw money from your 401K account and avoid the penalty. You’ll still have to pay income taxes on the amount.

- If you leave your employer at or after 55 years of age and retire

- You can retire from a public safety occupation, i.e. police or fire, at age 50 and take 401K payments

- If you become ‘totally and permanently’ disabled and are not able to work

- You can pay unreimbursed medical expenses with 401K money

- If the IRS issues a fine against your account for unpaid taxes or other issues

- Divorce proceedings can divide a 401K account and split the amount penalty-free with a Qualified Domestic Relations Order (QDRO)

- You can transfer your 401K to a Roth IRA or a Roth 401K in a conversion

What happens when I retire and start taking money out of my 401K?

When you retire and start taking money out of your 401K account, it is taxed as regular income. You pay your income tax rate on all distributions including the amount you put in and any earnings you made over the years.

It’s important to estimate the sources of income you might have in retirement. Distributions from a 401K and IRA along with any jobs you work will all be counted as income and might push you up into a higher tax bracket.

What happens if there is money in my 401K when I die?

You can name someone as a beneficiary to your 401K account or you can just leave it to your estate. If no one is named as beneficiary, your 401K money will just go to whoever gets the rest of your assets. Understand though that if the money goes to your estate, your heirs won’t be able to access it until all the estate legal work is final. This is called probate and can take years.

Any money your heirs get from your 401K will be taxed as income and they may have to pay an estate tax as well. There is one exception. Your spouse may be able to transfer the amount into their 401K or IRA and not pay taxes until they start withdrawing in retirement.

IRA Retirement Account Facts

The Individual Retirement Account (IRA) is just like a 401K but you set it up yourself, apart from your employer. There are actually two types of IRA accounts, a traditional account and a ROTH IRA. We’ll cover the traditional account here and then the ROTH version in the next section.

What is an Individual Retirement Account (IRA)?

IRAs were created so that people that didn’t have access to the tax benefits of a 401k at work could still save money for retirement. An IRA works just like a regular investing account and can take less than ten minutes to set up through just about any online investing website.

Like a 401k plan, you put money into your IRA and can deduct that money from your income so it’s like getting an instant return. Anyone with employer income can put money in an IRA. If you work for yourself then you’ll be eligible for a different type of retirement account that we’ll talk about in the next section.

Think of it this way. Let’s say you put $100 in a regular investing account. You’ve already paid taxes on that money from your paycheck, let’s say you pay 20% income taxes. Whether you have your taxes withheld directly from your paycheck or send in a payment when you file each year, that $100 actually cost you $125 before taxes (that’s $125 * 20% for $25 in taxes).

Now instead, let’s say you put that money in an IRA account. You can put the full $125 in the account. When you file your income taxes next year, you deduct that $125 off your reported income and don’t have to pay taxes on it. It’s a huge instant return and only part of the benefit to investing in an IRA.

Besides the instant return, your investments in an IRA grow tax-free until you withdraw the money. That makes it an excellent investment account for dividend-paying stocks and bonds that provide constant cash. Get those dividends in a regular investing account and you’ll pay taxes each year whether you withdraw the cash from your account or not. In an IRA or one of these other retirement accounts we’ll talk about, you pay no taxes on your dividends and get the opportunity to make more money.

There are some drawbacks to IRA investing that we’ll talk about more in this section. You won’t be able to withdraw your money until you reach a certain age or you might have to pay a penalty and taxes on the returns. It’s not really a drawback though because you’re going to need money set aside for retirement.

Whether you have your retirement investments in a regular investing account or in an IRA, you need money saved so why not get an instant return and tax-free growth?

What are the benefits to having an IRA?

So we’ve already talked about some of the benefits you’ll get investing in an individual retirement account. They’re mostly the same as those you get in a 401k plan except you won’t get a company match on your investment. This is why you should always put your money first in a 401k if it’s available and your employer matches some of your contribution, it’s really the most powerful retirement investing option.

To recap those benefits of an IRA,

- You get to invest pre-tax dollars. The money you invest is deducted from your income when you file taxes. Don’t worry, it’s really easy to do and most tax software will ask you explicitly how much you invested in your IRA and do the deduction for you. It’s like an instant return on your money.

- Your IRA money grows tax-free while in the account. Investors don’t realize how much of an advantage this is but taxes on your investment gains take a huge bite out of your returns over the years. In a regular account, anytime you sell a stock or receive a dividend, you are going to be losing some of that money to taxes. In an IRA, you get to keep all that money.

- It’s not a benefit you’ll hear often but the fact that your IRA money is locked up might mean it’s a stress-free way to invest. I’ve noticed, for myself anyway, that I don’t worry about my retirement investments as much as I do the money in other investing accounts. I’ve got the money in stocks and bonds that I’ll hold for decades and I don’t even think about it.

Can I have an IRA and a 401K?

Yes, you can contribute to both an IRA and a 401k at work. There are some limits on how much you can contribute and it depends on your income but it’s still a great way to save on taxes and get an instant return.

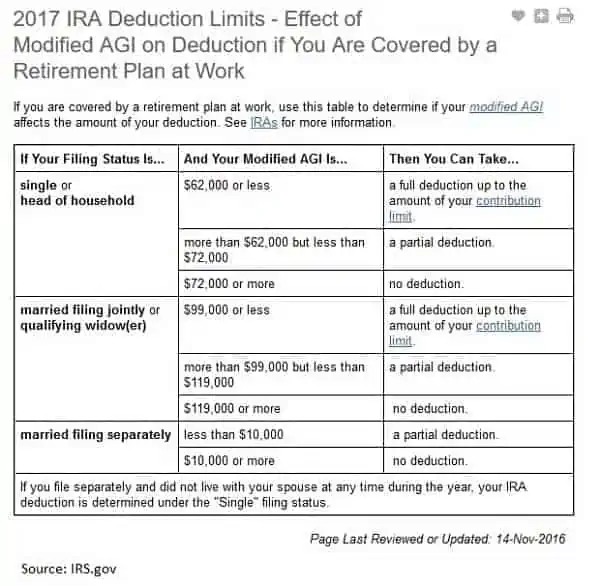

Here’s the table to determine how much you can contribute to both an IRA and a 401k plan at work. It’s for tax year 2017 so the amounts will adjust a little each year after that.

If you file jointly with your spouse and you make less than $99,000 a year, you can contribute the full amount to your 401k (currently up to $18,000 a year) and the full contribution to your IRA account (currently $5,500 a year). Contributing the max in both these retirement accounts can save you thousands of dollars every year!

Don’t forget, that income limit is your modified adjusted gross income and not your actual income. Your modified gross income is lower than how much you make because you can deduct a lot of things. To find your modified adjusted gross income, take the total amount you are paid before taxes and subtract:

- How much you contributed to retirement accounts

- Student loan interest

- Tuition

- Self-employed health insurance

Even if you make over $100,000 jointly or over $62,000 individually, you can still contribute the max amount into your IRA account and take some of that money off your taxes. Because all the money grows tax-free while it’s in your IRA, you should always contribute as much as you can.

Why should I have both an IRA and a 401K?

You may not need both an IRA and a 401k if you are not able to max out your contribution to either. There are some big advantages to having both retirement accounts though.

Most 401k plans restrict the investments you can make to mutual funds offered by whoever is running the plan. I’m not a fan of mutual funds because they cost more in fees and taxes. Having an IRA account means you can invest in exchange traded funds, which are like mutual funds but with lower fees. We’ll talk more about ETFs versus mutual funds later in the course but the idea is that you have many more investing options in an IRA versus a 401k plan.

Use the steps below to determine how much to invest in your 401k and an IRA:

- Try to invest at least the full amount for your company match in your employer’s 401k. If your company matches a certain percentage, usually 100% or 50%, up to a certain contribution then make sure you invest at least that amount. For example, if your company matches 50% up to a contribution of 10% of your salary then invest at least 10% of your salary to get that full match.

- After you’ve invested the maximum for your company’s 401k match, invest up to the annual limit into an IRA account.

- If you are able to save more, use the rest of the money to invest the limit in your company’s 401k plan even if you don’t get matching funds.

This will max out the employer match for your 401k plan and give you maximum flexibility with more investment options in an IRA account.

How much can I put in my IRA each year?

The maximum amount you can contribute to an IRA changes each year but is easy to find. Type in Google, IRA contribution limit, and the first result is usually the IRS government page with the answer at the top.

Currently, you can invest up to $5,500 each year in an IRA or up to $6,500 if you are age 50 or older. If you didn’t make that much money during the year, you can only invest up to the amount you made.

You can always invest up to these limits. The only thing that changes is how much you can deduct from your income to save on taxes. If you also contribute to a 401k plan and you make over a certain amount individually or as a household, then you might not be able to deduct your full contribution. We covered the deduction limits in the section on whether you can have a 401k and an IRA.

Even if you can’t deduct the full amount off your income because your income was too high, your contributions in an IRA will still grow tax-free so it’s always a good idea to max out your contribution every year.

How do I set up an IRA?

It is super easy to set up an individual retirement account. All the online investing sites love IRA accounts because they know you’ll be a customer for decades. That means these investing sites almost always offer cash back or some other perks when you open an account.

I’ll post a few of the special offers for new retirement accounts below. Don’t pass up the chance to get even more from your IRA by getting all the free perks offered.

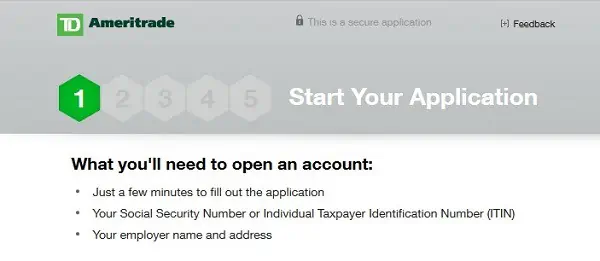

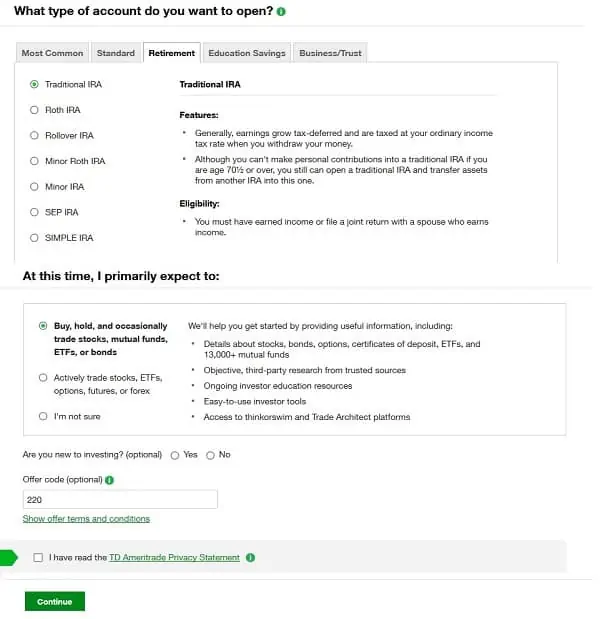

I’ll walk through how to set up your retirement account on TD Ameritrade but the process is almost identical on any investing website.

- Clicking through the link to TD Ameritrade will take you to their $600 offer page and a “Open New Account” Button.

- The application process took me less than 15 minutes. It starts with basic contact information like name, email address and what kind of account you want to open. The application offers all kinds of help to make it easy to get started.

- The next screen will ask you for a social security number, address and employment information. TD Ameritrade uses the highest level of security software to protect your personal information and you get a protection guarantee that protects your money in the case of hacking.

- The application will also ask you a few questions whether you are an investment professional, work as a political figure or are an insider at a publicly-traded company. These just protect investors against insider trading. You’ll know if you need to mark Yes on any of these but most people will just check No.

- The next page is just a check on all your answers and then the last page is the verification page. Once you’ve done this, you can create a User ID and password along with your security questions.

- TD Ameritrade offers five ways to fund your IRA account including rolling over from other IRA accounts, personal check, wire transfer and an express funding option from your bank that can get you started in as little as 30 minutes.

I like TD Ameritrade because of its easy-to-use platform for investing and great customer service. They also offer one of the best retirement account bonuses among stock investing websites. That doesn’t mean you have to open up an IRA account on TD Ameritrade or that you can’t take advantage of other offers with more than one retirement account.

I have retirement accounts on three different investing websites (Lending Club, TD Ameritrade and Motif Investing). Lending Club is the only one that offers investing in peer lending, a great investment for monthly cash, and the other two offer good signup bonuses and other advantages.

Lending Club – Get up to $3,000 Cash (limited time)

Betterment – One Month Commission Free

TD Ameritrade – Get up to $600 and Trade Free for 60 Days

Motif Investing – Get up to $150 Cash

We’ll talk about specific investments for your retirement account when we cover how to create your investment policy statement (IPS) in another section of the course. Within your retirement account, you’ll want a mix of different investing assets like stocks, bonds, and real estate.

These are investments you’re going to hold for decades and won’t have to worry about a stock market crash so the actual investing part is surprisingly easy. The most important point is just to get started opening a retirement investing account to get that instant return and tax savings, it’s the best way to invest your money.

How do I pick a broker for my IRA?

A broker is someone that actually has access to buy and sell stocks and other investments. When you open an online investing account or talk to a financial advisor, they work through a broker to give you access to the market.

There are hundreds of brokers but most are pretty much the same. Competition is so intense for your investment account that most brokers offer very low fees, investing tools and all kinds of free perks.

For a retirement account, you are not going to be buying and selling investments frequently but you still want to make sure you aren’t paying a lot every time you do. Most people don’t need a lot of the research provided by online investing sites either.

For opening your IRA account, compare brokers on these points:

- How much does it cost each time you buy or sell an investment?

- What kind of tools or retirement calculators do they offer?

- Are there minimum account balances for an IRA?

- Are there fees charged if you do not make a certain number of investments each month or year?

- Do they offer any kind of bonus for new accounts?

Again, there’s nothing saying you can’t have several IRA accounts and there are benefits to having more than one. I like Lending Club for getting access to p2p investing while Motif Investing is one of the lowest-cost options for investing in a group of stocks. I also invest on TD Ameritrade for their tools and calculators.

How do I put money in my IRA?

Once you open a retirement account, you can use a number of ways to fund it. The easiest and cheapest way is usually through a direct transfer from your checking account. The online investing site will allow you to link up your checking account with your ABA and account number.

Direct transfers are usually available to invest immediately or within a few days. This also makes it easy to put money in your IRA regularly. I like to max out my IRA contribution in January each year because it gives me all year to make money tax-free.

For IRA contributions, you can put money in your account as late as the due date for your federal income taxes the next year, April 15th for most people. That means you can actually put money in your IRA account and take the tax deduction for the prior year. It makes for a great way to get a little more tax savings if you find out that you’ll owe more when filing your taxes.

If you have a regular investing account, you can move money from it into your IRA account each year. It will count against your contribution limit so don’t go over the $5,500 limit but it’s a great way to get your retirement money working earlier without having to wait to invest each month from your paycheck.

You can also put money in your IRA account through a personal check by mail or through a wire transfer. There might be fees with a wire transfer and the mailed check takes longer so I almost always recommend a direct transfer from the bank.

What investments should I make with in my IRA plan?

So we’ll talk a little about what investments to make with your IRA account here but will leave some detail for the section on creating your Investment Policy Statement (IPS). The IPS is a personal investing plan that looks exactly at how much you need in retirement, how much risk you can tolerate and special considerations. It truly makes investing about you with a customized plan and is an absolute critical step in meeting your investing goals.

The thing to remember about your IRA and retirement investments is that this is money you need to be there when you need it most. Your retirement account isn’t the place to bet on penny stocks or other risky day-trading investments.

I recommend the core-satellite approach to investing for retirement. This means having most of your money, between 60% and 75%, in a few investing funds that give you exposure to a broad investing theme or asset class. That’s the core of your portfolio.

The remaining part of your IRA account is invested in individual stocks or investments. The idea is that the core investments, those broad funds, gives you safety across a lot of stocks while the individual investments gives you the chance to make a higher return. Since you’re only investing a small portion of your account in individual stocks, you don’t need more than five or ten that you really like.

An example of this core-satellite strategy would be investing 65% of your money in the following exchange traded funds:

- SPDR S&P 500 ETF (SPY) – the largest companies based in the U.S., basically giving you access to ‘the stock market’

- Vanguard MSCI Emerging Markets (EEM) – invests in stocks based in growing countries with faster growth than in the United States

- Vanguard REIT ETF (VNQ) – invests in companies that manage real estate investments and provides excellent cash flow

- US Bond Index ETF (AGG) – invests in a variety of types of U.S. bonds including government, corporate and mortgage bonds for safety and income

If you had $5,000 total to invest in your IRA, you would invest $3,250 across these four funds. You could choose to invest in each equally or customize your investment according to your IPS. The idea here is that you get exposure to three different asset classes; stocks, bonds and real estate so your risk is spread out.

With the rest of your retirement money, that 35% remaining or $1,750 of the $5,000 example, you might invest in five or ten stocks that you really like. I talk more about picking individual stocks in the stock investing course and offer another course that shows you exactly how Wall Street analysts pick stocks.

What are self-directed IRAs and are they a good retirement plan option?

Most IRA plans set up with an online stock investing site or another investment broker only allow you to invest in stocks, bonds and funds. A self-directed IRA is a special account set up with a company, called a custodian, that will allow you to invest in other assets like buying real estate property, private equity and tax lien certificates.

For the vast majority of people, a traditional IRA is all they need. You get access to all the asset classes you need to reach your financial goals. A self-directed IRA can open up your investment options a little but it also comes with some complications.

When you open a self-directed IRA, you’ll be given a checkbook you can use to make investments. You’ll be able to write your own checks that will take money out of the account and the investment will be held in the account name.

There are a lot of drawbacks to a self-directed IRA. First, the fees are much higher than traditional IRAs. Instead of paying one low fee to buy or sell an investment, you’ll be charged every year on the total amount you have in the account. There will also be fees for buying investments.

You’ll still have to pay any penalties and taxes on money from your self-directed IRA if you take the money out before a certain age. If the money isn’t transferred or managed correctly, you may get hit with a tax bill as a withdrawal.

How do I know I can deduct my IRA contributions on my taxes?

Your full IRA contributions can always be deducted from your income for tax purposes if you are not covered by a retirement plan at work. Remember, this only applies up to the maximum IRA contribution limit (currently $5,500).

If you or your spouse is covered by an employer retirement plan, then you can deduct the full amount of your IRA contribution only if you make less than a certain amount income. If you have a 401k plan at work and file jointly, you can make up to $99,000 and still take the full deduction. If you make more than that in a year then you might still be able to take some of your contribution off for taxes.

These limits are always easy to find by searching in Google for “IRA deduction limits” and looking for the IRS website.

Can I have more than one IRA?

You can have as many IRA plans as you want. You are only limited to how much you contribute each year. However many accounts you have, you can only contribute up to the limit to all of them. You can contribute equally to each, so for example the current $5,500 contribution limit divided by three or about $1,800 to three accounts, or split it up with more to some accounts and less to others.

We’ve talked about setting up multiple IRA investment accounts and the benefits.

- Get special bonus offers from companies for starting an IRA account like cash back

- Get access to special investments not available on other IRA accounts

- Get access to tools and calculators that might not be available on other accounts

Can I transfer my IRA investments to a different type of retirement account?

Yes, you can transfer your IRA account into another retirement account like an employer 401k or even a Roth IRA. For transfers to a Roth IRA, called a conversion, you’ll have to pay taxes on the original investment amount but you’ll get the benefits of a Roth plan which we’ll cover in the next section.

You can also transfer your traditional IRA investments into another traditional IRA account. You might do this if you just want to consolidate everything into one account or to get the bonus perks on a new account. Just make sure you transfer the money directly so you don’t have to pay penalties for early withdrawal.

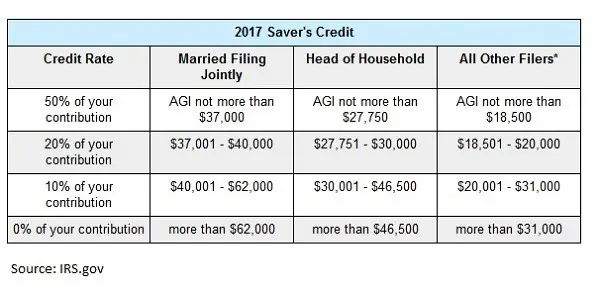

What is the Retirement Saver’s Credit?

The Retirement Saver’s Credit is one of the least used but best tax benefits of retirement account investors. It’s an additional tax break to encourage low-income families to invest money for retirement.

The retirement savers credit allows people or families that make less than a certain amount to take a tax credit for their retirement savings.

A tax credit is different from a deduction. You deduct the amount you invest in your IRA from your income so you don’t have to pay taxes on it. A tax credit means you can reduce your tax bill by exactly that amount and might even mean you get a huge refund.

I’ve copied the rules for the retirement saver’s credit from the IRS website below.

If you file taxes jointly and made less than $37,000 last year (2017) then you get a tax credit for half the amount you put in your IRA. If you contributed the full $5,500 then you get a tax credit of $2,750 that you can use to lower your total tax bill.

Even if you made a little more, you still might be able to get a partial tax credit from your contributions. This is a huge benefit even beyond the tax deduction and tax-free growth on your investments in an IRA plan.

When can I take money out of my IRA plan?

Unlike some retirement plans like a 401k, you can always take money out of your IRA account but you may have to pay a penalty if you are not 59 ½ or older. This is the age that you can start taking money out of your IRA without any penalties.

The penalty for taking money out of your IRA before you reach 59 ½ is currently 10% meaning if you withdraw $1,000 you’ll have to pay $100 to the IRS when you file your taxes. We’ll cover some ways to avoid this penalty in the next section but the best strategy is just to leave your IRA money alone until you retire.

When you do start withdrawing money from your IRA plan, whether you have to pay penalties or not, you will have to pay income taxes on the amount. For a traditional IRA, you pay income taxes on the full withdrawal which means your contributions plus earnings on investments.

If you contributed to your IRA and were not able to deduct the full amount from your taxes, for example if you made too much money that year and only were able to deduct part of your contribution, then the contribution you didn’t deduct can be withdrawn tax-free.

What happens if I need my retirement money early?

There are a few ways to take money out of your IRA early without paying the penalty. These are generally for financial hardships or other rare circumstances including:

- First-time home purchase

- Qualified education expenses

- Unreimbursed medical expenses

- Disability or death

- Health insurance premiums while unemployed

Even if you avoid the penalty, you’ll still have to pay taxes on the money you take out of your retirement account. You’ll also lose the power of tax-free growth on those investments.

Taking money out of your retirement account early is a slippery slope. Do it once and it becomes easier to justify taking more money out later. Soon you’re left with no money for retirement and miss out on all the benefits. If at all possible, consider your retirement money sacred and don’t touch it.

Do I have to take money out of my IRA plan?

One of the drawbacks to a traditional IRA plan is that you are required to start taking money out once you reach 70 ½ years of age. The IRS sets the minimum you have to withdraw based on the last year’s ending account balance and depending on your age.

You can always take more than this minimum required distribution (MRD) but if you withdraw less, you might have to pay a penalty. It’s a huge penalty, currently 50% of the amount you should have taken but didn’t so you definitely want to take out at least the minimum.

How are my IRA investments taxed when I retire?

Your IRA money continues to grow tax-free until you withdraw it. Even if you are retired and taking the minimum required distributions, the investments in the account still do not count against your taxes until you take the money out.

When you do take money from your IRA, it is counted as income. If you are retired then your total income from these withdrawals and other sources might be low enough that you don’t have much of a tax bill.

This is part of the reason why I recommend everyone contribute to both a traditional IRA and a Roth IRA. Roth retirement accounts are funded with after-tax dollars but grow tax-free just like a traditional IRA. When you take money out of a Roth account in retirement, you pay no income taxes on the amount. Having both a Roth and a traditional IRA account means you can take some tax-free money in retirement and maybe a little less from your IRA to manage your overall tax bill.

What happens to my IRA investments when I die?

You can name a beneficiary for your IRA investments just like you do a life insurance plan. This will help your IRA investments go directly to someone without having to pass through your estate.

If you don’t name a beneficiary then your IRA investments will just go to whoever gets the rest of your assets, generally your spouse and immediate family.

Your spouse may be able to roll your IRA investments over directly into their retirement account and not have to pay taxes. The investments continue to grow tax-free until your spouse starts withdrawing them and then just pays ordinary income taxes on the money they take out.

If your spouse doesn’t roll the money into their retirement account or if your IRA money goes to another beneficiary, they will have to pay taxes on the money. Beneficiaries can usually take the money all at once or over a number of years but it’s all taxed when received.

Why Roth IRA Retirement Accounts are for Everyone

Most people think a Roth IRA is only for rich people. It’s a completely false myth and a Roth IRA offers a lot of benefits for any investor, whether you’re Warren Buffett or Warren from down the street.

What is a Roth IRA?

When you put money into a traditional IRA, you get to take that amount off your income when you file taxes. You don’t get this immediate benefit with a Roth IRA. When you contribute to a Roth IRA, you still have to pay the income taxes on that money.

There’s a powerful benefit to Roth IRAs though that make up for this difference. When you take money out of a traditional IRA in retirement, all the money is taxed as income. That can get expensive if you have a lot of investments and are in a high income tax bracket.

Money you take out of a Roth IRA in retirement is tax-free. That includes all your earnings as well. Since the money in your Roth IRA grows tax-free while in the account, just like a regular IRA, it means you never have to pay taxes on your returns.

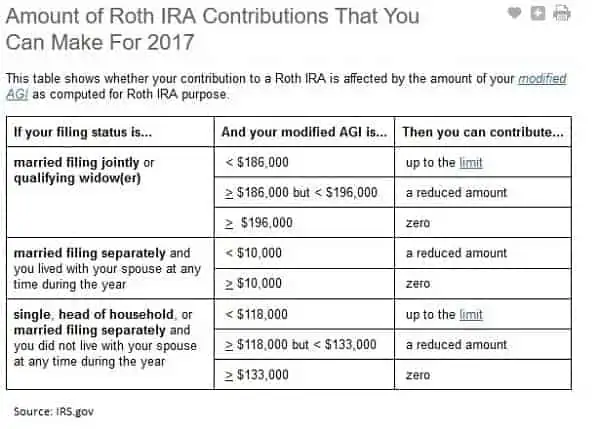

Do I qualify for a Roth IRA?

The IRS sets income limits on eligibility for a Roth IRA account. The limit is based on your modified adjusted gross income (modified AGI), not the amount paid by your employer.

If you are married and filing jointly, you can make up to $186,000 a year and contribute the full amount to a Roth IRA each year. If you and your spouse make up to $196,000 then you can still contribute a reduced amount but you are not allowed to contribute if you make above $196k in annual income.

There is a way to still contribute to a Roth IRA if you earn too much money. It’s called an IRA conversion or sometimes referred to as a Backdoor Roth IRA.

Anyone can transfer the money from a traditional IRA into a Roth IRA. You won’t pay any penalties and there is no limit to the amount you transfer. There’s no income limit on eligibility so it’s a great way for high-income earners to get access to a Roth account. You can convert an entire IRA account into a Roth or just a portion of it.

Since you didn’t pay income taxes on your traditional IRA contributions, you’ll owe taxes on any conversion. This means you’ll need to do a little planning because the money transferred could push you into a higher tax bracket for that year.

Doing a conversion is also a great way to get around contribution limits. Normally, you could only contribute the annual limit (currently $5,500) to both a traditional and Roth IRA each year. Conversions don’t count against that limit so you can transfer as much as you like into a Roth IRA and still max out your contribution to a traditional IRA.

Why should I have a Roth IRA if I don’t get the immediate tax benefit?

The old rule was that you contributed to a Roth IRA if you expected your tax rate to be higher in retirement than it is now. For example, if you have other investments or a business that will pay out lots of income when you’re older. Since money from your Roth investment account is tax-free in retirement, it provides a source of income without adding to your taxable income and pushing you into a higher bracket.

On this thinking, there are a few types of people that benefit most with a Roth IRA:

- If you are just starting working and don’t make much money, you’re not going to pay much in income taxes. You might as well pay the lower taxes now and take the money tax-free in the future when your income might be higher.

- Entrepreneurs that might have high business income later in life

- If you expect an inheritance later in life to boost how much investment income you receive each year

I’d argue that everyone can benefit from a Roth IRA and should have an account. First, you never know what the future will bring in terms of your income so it’s best to be prepared. You might just have some financial success, boosting your retirement income and your tax rate. Having a Roth IRA means you can take some tax-free income and maybe withdraw less from your other accounts to lower your income and taxes.

There are income limits on your ability to contribute to a Roth IRA. It makes sense to contribute to a Roth account while you can just in case you start making too much money to take advantage of it later in your career.

Roth IRAs also have a huge advantage against traditional IRAs in the required minimum distribution (RMD). With a traditional IRA, you have to start taking money out when you reach 70 ½ years. This isn’t the case with Roth IRAs and you can keep the money in your account as long as you like.

Finally, it just makes sense to diversify your retirement income. Having a Roth IRA account gives you more flexibility and options to manage your taxes.

Can I have a Roth IRA and a traditional IRA?

Yes. You can have both Roth and a traditional IRA but the IRS sets a contribution limit for both accounts. That current $5,500 contribution limit applies to both accounts, so you will need to split the amount if you want to put money in both each year.

How do I set up a Roth IRA?

Setting up a Roth IRA is exactly like the process for a traditional IRA (see above) and most online investing accounts will offer it. Generally, the account signup incentives are just as sweet for Roth IRAs so make sure you get everything you can when opening an account.

How do I put money in my Roth IRA?

Money contributed to your Roth IRA can come directly from your bank account or you can transfer it from your traditional IRA in a conversion. We’ve already seen how a conversion can help you contribute more than the annual limit on both accounts, making it a great way to put money in your Roth.

The only difference in how you fund your Roth IRA versus a traditional IRA is that you don’t deduct the amount from income when you file your taxes. Remember, with a traditional IRA you tell your tax person or software to reduce your income by the IRA contribution and that lowers your tax bill. With a Roth IRA, still report how much you contributed to your account but it doesn’t affect your current income taxes.

What investments should I make with in my Roth IRA plan?

Investments you make in your Roth IRA account are the same as those you make in a traditional IRA. Any earnings and dividends still grow tax-free so there’s no change.

Again, if you have other investing accounts (taxable accounts) besides your retirement accounts, then put your dividend stocks and any other income-producing investments in your retirement accounts. Any investment that pays a cash dividend or interest needs to go in your retirement account so you can avoid paying taxes on that payment every year. Put other investments like low- or no-dividend stocks in your other investing account.

Are all Roth IRA withdrawals always tax-free or are there limits?

There are two requirements to taking money out of your Roth IRA and keeping all the tax benefits:

- You must be at least 59 ½ or become disabled

- The withdrawal must be at least five years after your first Roth IRA contribution

You can always withdraw your Roth IRA contributions without a penalty or tax. If both of these conditions are not met, you may have to pay a 10% penalty and income taxes on any earnings you withdraw.

There are no limits to how much money you can withdraw in retirement though you want to make sure your investments last. There are all kinds of strategies and rules of thumb for withdrawing retirement money. For most people, it will be your expenses that dictate how much you need though you may be able to withdraw a little less by watching what you spend.

How long can I contribute to my Roth IRA?

This is one of the big advantages of a Roth IRA versus a traditional IRA. You can continue to contribute to a Roth IRA for as long as you like while you have earned income.

When do I have to start taking money out of my Roth IRA?

Rather than being forced to start withdrawing money at 70 ½ as with traditional IRAs, you can keep your money in a Roth account for as long as you like. This makes it a great tool for estate planning and passing your money on to heirs.

What happens if I need my money before retirement?

You can always withdraw your contributions from a Roth IRA without taxes or penalties. You already paid income taxes on the amount so there’s nothing to worry about but you may have to pay a penalty and taxes on any earnings.

The rules for withdrawing earnings from a Roth IRA are reaching 59 ½ and that you’ve had the account for at least five years. The circumstances where you can avoid the 10% penalty on early withdrawal of earnings are the same as those with a traditional IRA, i.e. first-time homebuyer, disability, qualified education expenses or for medical expenses.

What happens to my Roth IRA when I die?

When you open an account for a Roth IRA, you’ll name a beneficiary if something should happen to you. You can name as many beneficiaries as you like. Your beneficiary gets all the tax benefits from the money that you would have received.

Your spouse can rollover the Roth IRA into their account or take the money tax-free. If your beneficiary is other than your spouse, they may be required to withdraw a certain amount each year but they’ll still get the money tax-free. Taking the money over many years continues to let the earnings grow tax-free and increases the amount your heirs will get.

Comparing the Best Retirement Plans

Too many people think that you only need one type of retirement account or that there’s no advantage to having more than one. They miss out on some great savings and benefits to having multiple retirement plans.

There are advantages and limits to each type of account but using them all together gives you the best each have to offer.

You are not limited to how many retirement accounts you have or even having multiple accounts within the same type. I transferred my old 401K from an employer to an IRA but at one time, I had a 410K, three IRAs and a Roth IRA.

Having multiple accounts of the same retirement account type, i.e. multiple IRA accounts, gives you more flexibility in investments and can take advantage of special bonus offers companies provide. I have an IRA with Lending Club to get access to peer loan investments and other IRAs with online investing sites for bonds and stocks. With each account, I got cash back or no-fee trades as a bonus offer.

If your employer offers a company match on their 401K program, that should be your priority. That company match is free money and the best return you’ll ever make investing. Max out the company’s match percentage.

If you have money left to invest then put it to an IRA or a Roth IRA, or both. Investing in an IRA will give you immediate tax benefits but your taxes might be higher in retirement. The best strategy may be to split your allowed retirement contribution between both an IRA and a Roth account.

If you still have money available to invest, then max out the contribution on your 401K plan. You might not get the company match but you’ll still get some great tax benefits.

Best Retirement Accounts Review and Action Steps

That is a lot to work through but each of these retirement accounts and savings plan opportunities is so important. You will never find a better return or the kind of investment opportunity like these we’ve covered.

Look at the track record for even the most famous investment managers. Warren Buffett has led his investment company Berkshire Hathaway to a 22% annual return over more than 50 years and none of the money managers I know are even close to that.

But even Buffett’s investing genius isn’t close to the return you can get through these retirement investment accounts through free money in a company 401K match and tax benefits.

These special savings and retirement accounts are the ‘loopholes’ that everyone is always talking about, the secrets the rich use to get richer and avoid taxes. The accounts are super easy to set up and will save you thousands of dollars a year.

Your first step is determining your eligibility for each type of retirement or savings account. Most people will be able to open any of the accounts, usually income limits are the biggest factor.

- If your company offers a 401K, then you are most likely eligible

- If you have a 401K at work and make less than $62,000 as an individual or $120,000 as a household, you can contribute to an IRA. If you do not have a 401K, there is no income limit to contribute to an IRA.

- If you make less than $133,000 as an individual or $196,000 as a household, you can contribute to a Roth IRA. Even if you earn too much, you can convert your traditional IRA money into a Roth IRA.

Once you know which accounts you want to set up, and I hope you take advantage of as many as possible, you need to determine your maximum contribution each year. Most of these change each year according to an inflation measure so make sure you check the most recent number.

- The max contribution to an IRA and Roth IRA is cumulative. That means the annual max you can put in one account is the same you can put in both together. You can put more in one than the other but make sure you put some money in each.

- If your income is below a certain point, make sure you take advantage of the Saver’s Credit to get an even bigger tax savings for your IRA contributions. The credit could mean a tax refund that is boosted a few thousand dollars.

Talk to your employer to see when you can enroll in employer-sponsored accounts like the 401K or an HSA. Employees generally have to be working for six months before contributing to a 401K plan. Many employers designate a two- or three-week period towards the end of the year when you can enroll and make changes to your HSA plan.

Open your retirement accounts now, even if you don’t think you can contribute very much. Even $50 a month can grow to over $200,000 if started in your 20s. It’s too easy to forget to open an account or to put it off until later. You’ll miss out on years of tax savings and returns.

This is going to be a controversial recommendation but I would say prioritize funding your retirement accounts even at the expense of paying off debt. That instant 50% return on your company’s 401K match plus the tax benefits is going to be higher than even some of the rates on your credit cards.

I’m not saying don’t worry about budgeting and living within your means but don’t put off getting this free money and huge returns for retirement because some yahoo said you needed to be debt-free.

Take advantage of this special offer from TD Ameritrade, Up to $600 Cash Back

Click here to open an account on Lending Club and get Cash Back

So your action steps for this lesson are just that,

- Find out if you have a 401K at work and how much the company matches

- Revisit your budget and see how much you can save, if it’s tight then try cutting a few expenses.

- Enroll in your 401K and max out the company match percentage

- Open at least an IRA account and set regular deposits or contribute your max for the year. Making your max contribution now instead of over regular deposits means all the money starts growing tax-free instead of waiting through the year.

- Consider opening a Roth IRA account for tax-free income in retirement

Click through for the second part of the guide, a look into special savings accounts for healthcare expenses and education. The best retirement plans listed here will get you some great returns and even free money but they each have their limitations. Using special savings accounts along with your retirement account options can help you get as much as possible from your money.