Peer to peer loans are a new type of online loans to get you money you need even on bad credit

I was working as a labor economist for the State of Iowa during the Great Recession. I saw first-hand how bad the recession was for people across the country, the double-digit unemployment and how banks shut everyone off from getting loans.

A decade later and the economy has rebounded but a lot of people are still shut out of the financial system. Credit scores have increased but banks still aren’t lending to a lot of people.

Enter peer-to-peer lending and a new way to get online loans.

Peer lending, or p2p, has been around since before the financial crash but it’s become a critical piece of the loan market since. In this article, I’ll start by showing you how the peer to peer loan system works and then how to get the money you need even with bad credit. I’ll also reveal the p2p sites I’ve used and compare online lenders.

What is Peer to Peer Lending?

Peer to peer (p2p) lending is simply a website for individuals to request a loan from funding sources outside of banks. Lenders and p2p investors are made up of everyday people throughout the United States who are willing to assume a portion of the loan.

For example, say “John” wants to borrow $10,000 dollars. He fills out an application on a peer-to-peer site like Prosper. The application is seen by thousands of p2p investors, regular people that want to invest in this new type of lending.

Money is pooled from various individuals, each assuming a percentage of the loan. Say 20 people each agree to loan $500 at an interest rate of 14%, then Prosper combines the money and issues the loan. Individuals are then paid both interest and principal monthly based on interest rate and their percentage of the loan.

For the borrower, peer to peer lending works exactly like any other type of loan. You fill out an application and usually receive money in your bank account within a week. You make monthly payments on the loan, usually from three- to five-years. The loan and payments are reported on your credit to help increase your score.

How to Get a Peer-to-Peer Loan with Bad Credit

The reason why I say peer to peer lending is becoming the best way for people to get a loan is because it’s much easier to get than a traditional bank loan.

Banks and credit unions have strict lending policies so they can resell the loan to an investment broker. These policies lock out a lot of good people trying to get the money they need. Since peer-to-peer loans are directly between investors and borrowers, credit score requirements are much lower and relaxed.

That means more people can get a peer to peer loan than the old way of begging at the bank.

Some other advantages of peer-to-peer loans over other types of loans include:

- Since p2p lending sites don’t have all the costs of running a bank, there are fewer loan fees with online loans.

- Since peer to peer lending is between investors and borrowers, interest rates are lower than at a bank where everyone (investment brokers, investors and the bank) want to make a profit.

- Peer to peer lending is completely online. No more running back and forth to the bank.

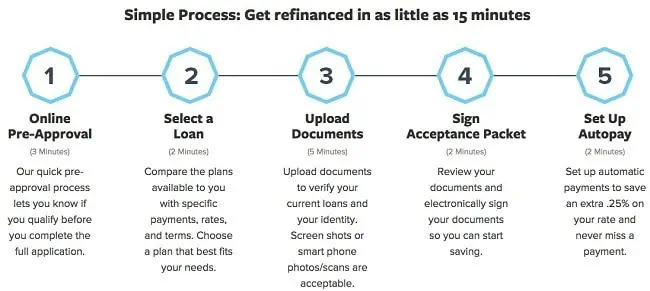

Getting an online loan through a peer to peer lending site is pretty easy. I’ve used three p2p loans over the last decade from several different websites.

- Click through to one of the peer-to-peer websites in the review below. I’ve used and recommend PersonalLoans.com

- Check your rate on a loan up to $35,000 with terms between three- and five-years. Checking your rate doesn’t affect your credit score. It’s like getting pre-approved for a loan.

- By law, the online lender has to show you all loan details before you accept. This means you’ll see monthly payment, interest rate and total interest paid before you have to make a commitment.

- If you accept the loan, you’ll enter information like employment, contact details and link your bank account.

- I’ve seen loans made within one day though most will take about two- to three-days with money deposited directly into your checking account.

There are a few tips you want to follow, especially if you’re trying to get a peer to peer loan on bad credit.

Shop your loan around on a few sites. Since checking your rate doesn’t affect your credit score, there’s no harm in checking it on a few peer-to-peer sites. You’ll make sure you get the best rate on your loan. It’s one of the reasons why I like PersonalLoans.com because the website shops your loan automatically to the lenders it works with in peer-to-peer, personal loans and even traditional bank loans.

Get started now, check your rate on a loan up to $35,000 – instant approval

You can play around with the loan terms to change the interest rate and monthly payment. Shorter-term loans of 36-months and lower loan amounts will usually get you a better interest rate. Stretching your loan out to five years will lower your payment but might cost a little more on the rate.

Make absolutely sure you can afford the monthly payment before you accept any loan. Just like bank loans, online loans go on your credit report and missed payments will hurt your score. These are unsecured loans so you don’t have to worry about losing your house or car if you miss a payment but it will still affect your credit.

Possible Risks of Peer to Peer Lending

P2P lending can be risky for several reasons. It’s useful to understand the risks and provide fast solution on paying off the loan. The person or business you lend money to might not be able to pay it back or what is referred to as “defaulting”. If the default rate on a P2P website is higher, then obviously a higher chance of more people or businesses that are unable to repay their loans. Unlike bank and building society savings, the money you lend via a peer to peer website is not covered by the Financial Services Compensation Scheme. But, some P2P websites have provision or contingency funds designed to pay out if a borrower fails to fulfill their loan. These funds differ widely though depending on the site, so you have to know the facts and everything it entails if you want to be a lender yourself.

Another risk to consider is the risk of early or late repayment because you could actually make less profit than you expect. If a loan is repaid earlier than its due date, then you can you can instantly lend out the money again for more returns. The only disadvantage is that you might not be able to lend out at the same interest rate.

Are Online Loans Safe?

I’ve been using online loans and peer-to-peer for more than a decade. One of the most common questions I get is, “Are online loans safe?”

I get it. It’s still a little scary to put your information online and trust internet financial companies.

Online loan sites like PersonalLoans, Lending Club and Prosper are all regulated by the same rules as the bank down the street. They’re required to use the highest-level of internet security to keep your information safe. They’re also required to keep all the records of your loan including all your payments, even after you pay off the loan.

Investors on peer-to-peer lending sites never see the borrowers’ personal information. The only thing they see is loan details and some credit information but they never see anything that could identify borrowers.

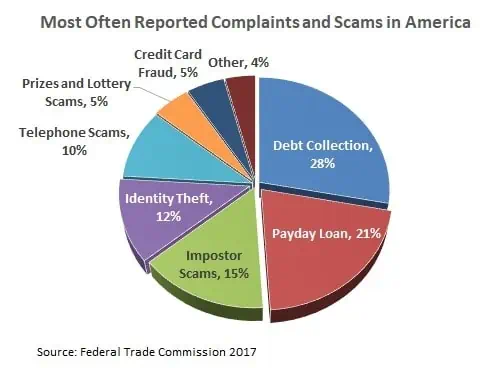

While peer-to-peer lending is safe, there will always be people out there waiting to steal your money. One of the most popular articles on the blog is a collection of personal loan scams and warning signs I’ve seen over five years of researching.

The problem is in the fake companies set up to scam people out of their money with scam loans and fraud. That’s why it’s so important to choose legitimate peer to peer lenders you know can be trusted.

Best Websites to Get an Online Loan with Bad Credit

I’ve used several peer-to-peer lending sites and have researched dozens more for the blog. Finding the best website for your online loan is about knowing which specialize in the loan you need.

There are a few websites like PersonalLoans.com and BadCreditLoans that specialize in helping borrowers with low credit score. These websites partner with multiple lenders to shop your loan around and make sure you’re offered the lowest possible rate. They also use unique credit criteria to accept applications from borrowers that would get denied by other p2p sites.

On the other side of this are the websites that focus on higher credit score borrowers like SoFi. These lenders are able to offer lower rates because they only accept borrowers with an excellent credit history and low defaults. While it might be harder to qualify on these sites, I still recommend applying because the lower rate is worth it.

Remember, it doesn’t hurt your credit score to shop your loan around to a few websites.

Still another group of websites focuses on specific types of borrowers like college graduates. Upstart uses a special credit program that gives extra points to people with a bachelor’s degree or higher and paying off student loan debt. That means graduates can usually qualify with a lower FICO score than other borrowers.

Websites like Payoff specialize in borrowers with a specific type of debt, credit card debt in this case. Payoff only offers loans to consolidate and pay off credit card debt. With this model, it knows borrowers are paying down their debt instead of using the loan to buy more stuff.

| Peer to Peer Lending Site | P2P Borrower Fees | Minimum Credit Score | Loan Rates | Notes |

|---|---|---|---|---|

| Personal Loans Click to Check Your Rate | 5% | 580 | 9.95% to 36.0% | Three options including P2P Loans, Bank Loans and Personal Loans. |

| BadCreditLoans Click to Check Your Rate | No Fees | 520 | Vary by state | No fees and lowest credit requirements with p2p lenders. |

| Payoff Click to Check Your Rate | 2% to 5% | 660 | 6% to 23% | Specializes in loans to payoff credit cards. Low origination fee and no hidden fees or charges. |

| Upstart Click to Check Your Rate | 0% to 8% | 620 | 5.67% to 35.99% | Best for graduates and no credit peer loans. |

| SoFi Loans Click to Check Your Rate | No Fees | N/A but probably around 680 FICO | 5.99% to 16.49% (fixed rates) 5.74% to 14.6% (variable rates) | Low student loan refinancing rates. |

| Lending Club Click to Check Your Rate | 1% to 5% | 640 | 5.95% to 32% | Best combination of low fees and low rates. |

Understanding which peer to peer lending website is best for your needs means a better chance at getting approved for a loan even with bad credit. You’ll get lower rates and monthly payments along with features that are designed specifically for you.

Credit Score for a Bad Credit Loan

Understanding which peer to peer loan sites specialize in bad credit loans will give you a better chance of getting approved…but it will only take you so far. Your credit score is the #1 factor in getting a peer loan and there is a cutoff point on scores.

We’ll look at that minimum credit score needed for a peer to peer loan but I don’t want you to think it will be impossible to get a loan if your score is below this point. If there is one thing I want you to get from this article, it’s that applying for a loan will not hurt your score and there’s no loss in trying.

If you apply for a loan on a few websites, the chances are really good that you’ll get an offer from at least one. Even if you get denied on all the websites, it won’t hurt your score and now you know you need to improve your credit score a little.

For most peer to peer sites, the minimum credit score is between 640 to 670 FICO. That is right around the cutoff for prime lending where banks will approve your application. Most p2p websites go a little below this score to help the people getting turned away by the banks and credit unions but they won’t go much lower.

Then there is another group of online lenders that will approve loan applications from borrowers with a 600 credit score or higher. These are usually the sites with specialized credit scoring programs that give certain borrowers extra points like graduates or veterans.

Finally there are the bad credit loan sites like PersonalLoans and BadCreditLoans, that will generally approve applications with scores as low as 540 FICO or higher. These lenders know they will see higher defaults on bad credit loans but they make it up through a higher volume of loans, reaching the millions of people shut out because of their credit score.

Unfortunately, if your credit score is below 520 FICO, it’s going to be difficult getting any type of online loan. Here is the process I recommend to boost your credit score fast and get a loan.

- Pay off as much of your credit card debt as possible. This is the worst kind of debt and the one that hurts your score the most. Paying down your balances alone can bump your score 20 – 30 points higher.

- Try getting a few of the bad marks or accounts wiped off your credit report. This involves writing the credit bureaus to contest a missed payment or other bad mark on your report.

- Apply for a smaller loan with a shorter-term. You’re much more likely to get approved on a loan for a few thousand dollars with a one-year or 24-month payment term than a much larger loan. Getting a smaller loan and paying it off early is not only going to increase your credit score but lenders are much more likely to approve loans to repeat customers.

Click to shop your loan around and get the best rate possible

Peer-to-Peer Loans FAQ

Over five years running this blog and using peer to peer loans myself, I’ve seen several questions come up most often. These are the common questions everyone has about peer lending and that really help you understand the basics.

What would you suggest to borrowers who are trying to get a peer to peer loan funded?

For borrowers, it’s always smart to start out with a small loan, like in the $3,000 dollar range, pay that loan off over a period of a year or two, and then apply for a bigger loan the second time around. Lenders like to see an established payment history with large loans (all the way up to $35,000) having a much greater chance of being funded.

Can I get a personal loan with a 500 credit score?

A 500 credit score is deep into bad credit but doesn’t necessarily mean you can’t get a personal loan. Apply on a few of the bad credit loan sites but make sure you can afford the payment before you accept any loan. If you are denied a loan, you likely only need 30 or 40 more points on your credit score so focus on paying down credit card debt and disputing bad marks on your credit report.

Can I get a personal loan with a 660 credit score?

Yes! A 660 credit score is right at the cutoff for prime lending, the score at which banks and credit unions start lending to customers. It’s at this point that you’ll notice more offers for loans and credit cards because you’re breaking into that ‘good’ credit range.

How do I increase my credit score for a bad credit loan?

I share five credit hacks I used to boost my FICO by hundreds of points in this video but there are a few things you can focus on.

- Pay down credit card debt. That might mean getting a debt consolidation loan now, to pay off your cards and increase your score. Then getting a loan for the rest of the money you need in a few months.

- Get an increase in your borrowing limit. This sounds weird at first but makes total sense. By increasing your borrowing limit on credit but not using it, you’re lowering your credit utilization ratio. It’s an important measure in your credit score and can boost it by a few dozen points fast.

- Change the reason you’re borrowing money. This won’t increase your credit score but using the ‘debt consolidation’ reason in loan applications usually means faster approval compared to other loans.

- Don’t fill out traditional applications for a loan or credit card. Applying on peer to peer sites won’t hurt your credit but other types of loan applications get reported on your credit and can hurt your score.

What are the best peer to peer loan sites for really bad credit?

Applying for a P2P loan may be a little more involved than other lending platforms due to proprietary grading systems for borrowers. Moreover, peer-to-peer networks often use in-house underwriting systems that look at more than credit scores to get a better idea of your financial risk. You may be required to answer specific questions such as what you plan to do with the money and some information about your educational and employment background.

While specific credit requirements and underwriting methods will vary by lending platform, I’ve seen the highest approval rate for really bad credit from two websites, PersonalLoans.com and BadCreditLoans. There are other websites that approve bad credit loans but these have stuck out as most recommended by readers.

What is the easiest loan to get with bad credit?

If you’re struggling to get approved for a loan, there are three changes you want to make that will improve your chances.

- Ask for a lower amount. Even if it’s only enough to get you through the next six months, getting a small loan and paying it off will help your chances getting a bigger loan.

- Ask for a shorter-term. Lenders will approve a one-year loan before they’ll consider a 5-year term.

- Change your loan purpose to ‘debt consolidation’. You can use the money for whatever you like but many investors only put their money in loans that are used for paying off other debt.

Peer to peer lending has opened up credit to millions of Americans since the financial crisis. Getting an online loan is no longer something only people with perfect credit can do. With an easy online process, now anyone can get a peer to peer loan even with bad credit. Understand how these websites work and how to use the process to get the money you need.

Read the Entire Peer Lending Series

- Free Video: What is Peer Lending?

- Best Peer to Peer Lending Sites Reviewed

- Personalloans.com Review: Peer Lending for Bad Credit Loans

- 3 Steps to Fit Peer Lending Into a Diversified Portfolio

- Best Peer to Peer Lending Sites for Investors