A new study questions whether you can trust financial advisors but change isn’t likely to come around soon

We had a huge discussion within a financial bloggers group on Facebook last week about changes in the financial advisor industry and whether you can trust advisors. An article in Bloomberg about misconduct by advisors caught me by surprise and I had to bring the question to PeerFinance101.

Can you trust your financial advisor?

The answer should be an easy yes. These professionals are tasked with your financial future. Beyond your doctor, I’m not sure there’s any professional as important as your advisor. It might surprise you that up to one in five advisors at some very reputable companies have been disciplined by regulators for misconduct with their clients.

Misconduct Among Financial Advisors

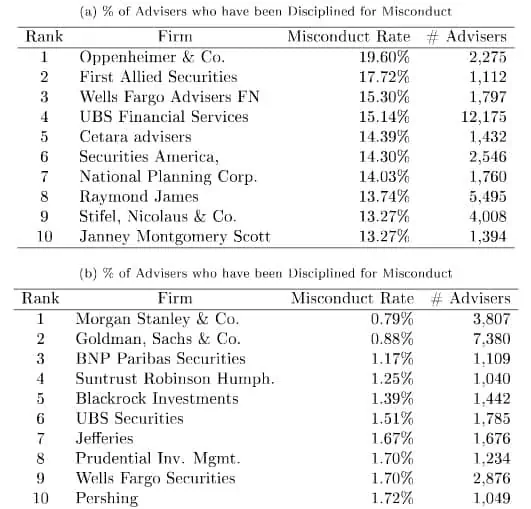

Professors at the University of Chicago and the University of Minnesota recently found that 7% of financial advisors have been disciplined by regulators for misconduct from buying or selling investments without a client’s permission to pushing people to inappropriate investments.

About one in fourteen advisors having a problem with misconduct may not sound like a huge issue but that’s just the average. Up to one in five advisors (20%) at Oppenheimer & Co. have been disciplined and 1,843 of the financial advisors at UBS Financial Services have had a problem with misconduct.

Even if you don’t hold your money with any of the firms with the highest percentage of misconduct, it may not matter much if you’re being taken advantage of by your advisor. Nearly half (44%) of advisors that leave a job because of misconduct are hired by another firm within a year and are up to five times more likely to engage in financial misconduct again.

Check out the BrokerCheck system run by the Financial Industry Regulatory Authority (FINRA) to see if your financial advisor had a problem with misconduct in the past.

Is Trust in Financial Advisors where it should be?

President Obama tasked the Department of Labor (DOL) to come up with new rules to protect investors in retirement advice over a year ago. The DOL just recently proposed rules that require financial advisors to act in their clients’ best interest, called a fiduciary standard.

Right now, you’re probably thinking, “But I thought my advisor was already acting in my best interest. What’s going on?”

Financial guru Dave Ramsey recently came out against the proposed advisor rules saying that it would limit the ability for middle-income investors to get advice. The complaint is that the fiduciary rule would shut down a lot of the stock funds that charge commissions as well as a lot of the advisors that make their money off them. Ramsey’s opinion set off a firestorm on Twitter and in a financial bloggers group in Facebook.

The fiduciary standard is already a requirement for the Chartered Financial Analyst (CFA) designation, an industry group of investment analysts to which I belong. I’ve believed that there should be a higher standard for all financial advisors to act in their clients’ interests for years but there’s little chance that the new DOL rules will be passed.

The current leadership at the Department of Labor has less than ten months to pass the new rules and it’s not likely to happen in an election year. I don’t think it’s likely the next President will take up the charge. Higher standards for financial advisors puts the trillions of dollars in retirement and financial planning at risk for some companies and they’ll use every bargaining chip they’ve got to keep it from happening.

Fortunately, you don’t have to trust financial advisors with your financial future. Getting started with your personal finances and investing is easier than you may think. You’ll start with putting together a personal investment plan, looking at your retirement goals and how much money you need to meet those goals. Once you know the annual return you need to meet your goals, putting together an investment portfolio of stocks, bonds and real estate is pretty easy.

Check out my Step-by-Step Investing series of books to build an investing strategy around your needs. You’ll get the complete process from creating your personal investment plan to picking the stocks and bonds that will help you reach your goals. Take control of your own financial goals and you won’t have to worry if you can trust financial advisors.