Make sure you have all the facts about loans for medical bills before you sign and avoid falling into a debt trap

There’s no doubt that medical costs are skyrocketing. According to the Bureau of Labor’s Consumer Price Survey, healthcare costs have jumped almost 5% a year since 1985. That’s more than twice the increase in other prices.

Combine that with the fact that two-in-three Americans say they don’t have enough saved to cover a $500 emergency expense, and it sets a lot of people up for a dangerous situation.

Unlike other spending, medical bills aren’t usually something you can just cut back on. In fact, for a lot of people, not being able to afford regular checkups means bigger bills in the future on emergency visits.

To pay for healthcare, Americans are turning to medical loans advertised at special rates or offered directly in their doctor’s office.

The problem is that these can often come with hidden fees and interest rates that make it impossible to pay. It’s a debt trap few see coming and the only way to avoid it is to know the facts.

What is a Medical Loan?

There are all kinds of websites and companies offering medical loans but the truth is, these are all nothing more than unsecured personal loans. The loan goes on your credit report like any other and usually has fixed monthly payments and a fixed rate.

Those are the good ones anyway.

The problem is that a lot of shady companies are taking advantage of doctors and patients to sneak in bad deals.

Doctors are in the business of providing healthcare. So when they’re approached by a credit company to offer loans to patients that can’t immediately pay their bill, they don’t always look at the fine print.

That means a lot of the medical loans offered directly through your doctor’s office, where people think they’re being protected, include interest rates that jump after the first six months and fees as high as 10% on top of the loan.

A medical loan is just any personal loan you use to pay off medical expenses. Since personal loans are unsecured, you don’t need collateral and don’t have to worry about losing your home if you can’t pay. You can borrow as much as $40,000 on most sites at rates from 6% and make fixed monthly payments.

Going directly to these personal loan sites means you can shop your loan around and get the best rate available instead of just taking the first loan offered.

Can You Get a Medical Loan with Bad Credit?

Unfortunately for many people that can’t afford health insurance or the medical bills on top of insurance, getting a loan to cover these expenses can be tough. If you have bad credit, usually defined as a credit score under 680 FICO, then you’ll need to look around for companies designed for bad credit loans.

“The U.S. Department of Health & Human Services reports that families with income between 20% to 30% of the poverty threshold spend an average of $6,000 a year on medical costs, twice as much as those living between 40% to 50% of the poverty threshold.

The problem here is that many of these people that would need a medical loan have bad credit.

The upside is that you don’t have to go into bankruptcy if you have bad credit and you don’t have to be happy with high-rate loans. There are some things you can do to improve your chance of getting a medical loan even on bad credit.

- Apply on at least a few peer-to-peer websites to see which ones approve you and offer a lower rate. They’ll run a soft-pull on your credit so it won’t affect your credit score.

- Try paying what you can with other sources and apply for a lower loan amount. It’s much easier (and cheaper) to get a smaller loan on a shorter-term.

- Ask the doctor to postpone payments for two months while you improve your credit score to get approved for a loan.

What Types of Medical Expenses Can You Pay with a Loan?

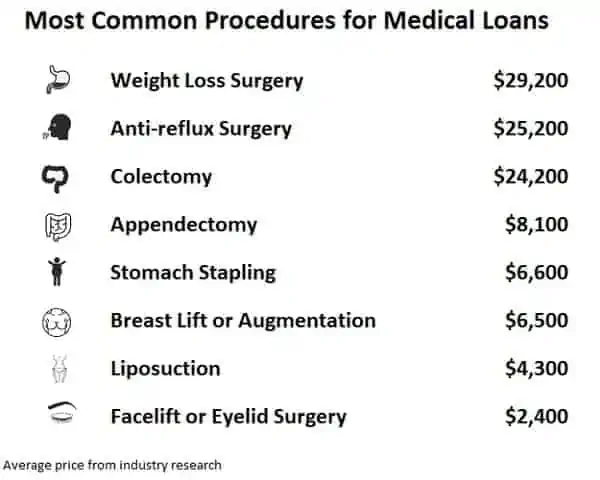

Even if you have insurance, there are some medical procedures that you’ll have to out-of-pocket most of the costs. This includes any cosmetic surgery or weight-loss surgery not deemed necessary by your doctor.

Even if your health insurance picks up the tab for a medical procedure, you’ll be on the hook for the deductible and other expenses. The out-of-pocket cost of weight loss surgery with a high-deductible health plan can easily reach $5,000 or more.

Since it’s a personal loan, you can use the money for any purpose. There are no restrictions on using the money and you can even use it for something else if you end up not going through with the procedure.

The medical loan segment of the market is only going to get bigger. Research reported by The New York Times shows that rising deductibles and other costs could force many of the 250 million Americans with health insurance to use loans to pay for healthcare. That’s on top of the 47 million without health insurance.

Compare Medical Loan Websites

I’ve never used a medical loan but have used personal loans for debt consolidation and home improvement. I can tell you, the #1 thing to remember is to shop your loan around applying on different sites.

When I was looking for a debt consolidation loan after destroying my credit in 2008, I got offers from three different websites. Because of my bad credit, rates on two of the loans would have been 28% or more.

It was only because I applied on that third website that I was able to find a loan at a 14% APR that saved me thousands of dollars.

As mentioned, since these personal loan websites do a soft-pull on your credit report to pre-approve and offer a rate, it will not count against your FICO as an inquiry.

This means even if you aren’t sure you qualify for a medical loan based on your credit score, you should check several sites to make sure you’re getting the best interest rate possible.

The table below shows personal loan and peer-to-peer loan websites I’ve used or reviewed. Each offers medical loans as an option with differing credit score and income requirements.

| Peer to Peer Lending Site | P2P Borrower Fees | Minimum Credit Score | Loan Rates | Notes |

|---|---|---|---|---|

| Personal Loans Click to Check Your Rate | 5% | 580 | 9.95% to 36.0% | Three options including P2P Loans, Bank Loans and Personal Loans. |

| BadCreditLoans Click to Check Your Rate | No Fees | 520 | Vary by state | No fees and lowest credit requirements with p2p lenders. |

| Payoff Click to Check Your Rate | 2% to 5% | 660 | 6% to 23% | Specializes in loans to payoff credit cards. Low origination fee and no hidden fees or charges. |

| Upstart Click to Check Your Rate | 0% to 8% | 620 | 5.67% to 35.99% | Best for graduates and no credit peer loans. |

| SoFi Loans Click to Check Your Rate | No Fees | N/A but probably around 680 FICO | 5.99% to 16.49% (fixed rates) 5.74% to 14.6% (variable rates) | Low student loan refinancing rates. |

| Lending Club Click to Check Your Rate | 1% to 5% | 640 | 5.95% to 32% | Best combination of low fees and low rates. |

While you’ll want to apply on at least two loan sites to make sure you’re getting the best rate available, different credit score borrowers will want to focus on different sites.

Bad credit borrowers will have the best luck on PersonalLoans.com and Upstart while good credit borrowers may find better rates on SoFi or Lending Club.

Alternatives to Loans for Medical Procedures

Interest rates on medical loans can be expensive, especially for bad credit borrowers, so I always recommend you look for other ways to pay for medical bills. Rates on personal loans generally range from 6% to 36% on terms of 36- to 60-months.

There are some alternatives to medical loans you should consider,

- Mortgages or HELOC – Getting a loan on your home will put it at risk if you can’t make payments but the rate will usually be much lower than a personal loan. The risk here is if your surgery keeps you out of work for an extended period.

- Car Refinancing – refinancing the value of your car is similar to getting a mortgage and you’ll need to make sure you can afford payments. It might not be an option for a lot of people that already have a loan on their car or don’t have equity.

- Get a Side Hustle – this is my favorite solution because it involves making a little extra instead of going into debt. It might not be an option if you need the surgery now but you can always use a side hustle to help pay off your loan faster.

The average amount borrowed on a medical loan is just over $8,000 and at a 14% rate on 36-month fixed payments. That means a monthly payment of $273 for three years and just over $1,800 in interest.

If you do decide to apply for a medical loan, remember these points to get the lowest rate possible:

- Only borrow as much as you need. The lower the amount you borrow, the lower your rate will be.

- Borrow on the shortest-term you can as long as you can afford the payment. Payments on a 36-month loan will be higher than the same amount borrowed over 60-months but the interest rate will be lower and you’ll end up saving a lot in interest.

- Prioritize your loan payoff, unless you have higher interest credit card debt, so you pay your medical loan off early and save interest.

You can get a medical loan on bad credit but understand it’s a slippery slope to getting trapped in that debt hole. Make sure you get the facts behind paying medical bills with a loan and don’t fall for the scams offered by some loan sites. If you are considering a medical loan to pay for surgery, make sure you know the facts and shop your loan around to get the best rate.