A good credit reference can help you get the money you need even with bad credit

People with good credit seem to have everything laid out for them, from easy access to money to low rates on loans. The other 90% of us with less than excellent credit don’t get the same privilege.

In fact, if you have bad credit or no credit history at all, good luck getting anything from a bank or most lenders. You might even have trouble renting an apartment.

There is one tool that can help you get the money you need and a little financial respect, the credit reference.

A good credit reference can mean the difference between getting your loan or being rejected, the difference between having to put down just a month’s security deposit or six month’s deposit.

What exactly is credit? Give me a refresh!

Credit is a simple concept. Credit is essentially what gives you the ability to borrow money from a private lender or service provider that you can receive instantly and just pay back later. Before you can access credit, the creditor who will be lending it to you will want to know your credit score. Your credit score is determined by a variety of factors including the following:

- Your credit types (credit cards, mortgages, student loans)

- The amount of new credit accounts you have opened

- Your payment history (do you pay your bills on time)

- Do you consistently stay under your credit limit?

- How long your credit history is (this builds trust)

If you have a clean credit score and are deemed to be “creditworthy,” which would be a score of around 660-780, you will more than likely be approved for the credit you require. People will generally take out lines of credit for large purchases that they cannot pay for all in cash such as cars, homes, renovations etc.

It’s also important to note that there are several different types of credit. These include the following:

- Revolving Credit

This is when you are given a maximum amount of money you can borrow. This will only allow you to make charges up to this set limit.

- Charge Card

Charge Cards aren’t so common anymore, but they used to be quite popular back in the day. You can think of a charge card just like a credit card except specific to retailers. You would have to apply for this card and once you had it you could make purchases on the card and pay it off at the end of each month.

- Service Credit

Any contract that you maintain with a service provider for things such as gas, hydro, cable, or internet all hold established credit agreements. These companies will csrry out their services for each month under the agreement that you will pay them for these services each month.

- Installment Credit

Installment Credit is where you can pay for something over a set period by paying installments of it monthly, yearly, or whatever the agreement indicates until it is fully paid off. With each installment you are also paying interest and fees on top of your regular payment. Examples of installment credit are car loans, student loans or mortgages.

What is a Credit Reference?

A credit reference is a letter that verifies your past credit history to a new lender or landlord. The reference comes from someone that has extended you credit or that has had some kind of financial relationship with you.

A credit reference usually includes any information about your credit or financial history with the person that might not be on your official credit report.

The three credit bureaus; TransUnion, Experian and Equifax provide credit references through the credit reports they keep. These reports are a record of your loans and payment history.

If you don’t know what’s on your credit report or it’s been a while since you checked, you should consider getting a copy from at least one of the credit bureaus. You have a right to check your credit for free once a year. Be careful though, there are all kinds of scam websites that look like the free credit report website but are there to charge you fees to see your report.

Watch this video for a step-by-step to getting your free credit report

Applications for most loans will pull your credit report from one of these agencies. If you don’t have more than a few years credit history or if you have bad credit from some missed payments, you might also be asked to provide a credit reference.

The emergence of peer-to-peer lending on the internet has made it easier to get a loan, even for people with bad credit, and credit references aren’t used quite as much. For example, I had to get a credit reference to get a signature loan in 2010 but didn’t need a reference for a personal loan I got later that year.

Check your rate on a personal loan for up to $40,000 in less than five minutes

Why is a Credit Reference Important?

If there isn’t much information on your credit report or you have a credit score that wouldn’t normally be high enough to get a loan, a credit reference can help support your application.

Remember, lenders are in the business of giving loans. They want an excuse to lend you money so they can collect interest. Offering a credit reference could be just enough to get them to overlook a few missed payments on your credit report.

Credit references can be critical for younger borrowers with limited credit history or bad credit borrowers that need extra proof of their credit worthiness.

Your credit report is almost always used when you apply for a loan but some lenders will also ask for other references from your bank or a brokerage account. A credit reference is most often ask for on unsecured loans like signature loans from your bank.

This is why it’s important to be on good terms with your bank and any local lenders. Having at least one account with a local bank can help make sure you can get a reference when you need it.

Some examples of credit references:

- Your bank might be asked to verify how long you’ve had an account, the average balance and if there have been any overdrafts in the last year.

- Your brokerage or investment account might be asked to verify your assets and how much money you’ve borrowed on margin.

- Previous landlords may be asked for a reference on any rental applications.

How Do I Get a Credit Reference?

The key to a good credit reference that will help you get a loan is to get one from a credible and impartial source. A letter of reference from your parents or friends isn’t going to influence a lender or landlord. The best credit references come from your bank or a previous lender.

Banks are asked to provide credit references all the time so it’s fairly easy to get one, just ask the bank manager. They will usually have a standard template reference they can print out quickly.

If you’ve had any loans from local businesses, from car dealers or store credit, these can also make for good sources of references.

An employer can be a source for a character reference but usually doesn’t know enough about your credit to vouch for your finances.

Credit Reference on Rental Application

You might also be asked for a credit reference when filling out a rental application. Since most landlords are individuals or small companies, they might not want to go through the expense of checking your credit report. This means offering a credit reference and a character reference could get your application approved even if you have bad credit.

The best reference will be from a previous landlord. If this isn’t possible, get a reference from your employer and your bank.

Credit Reference Example

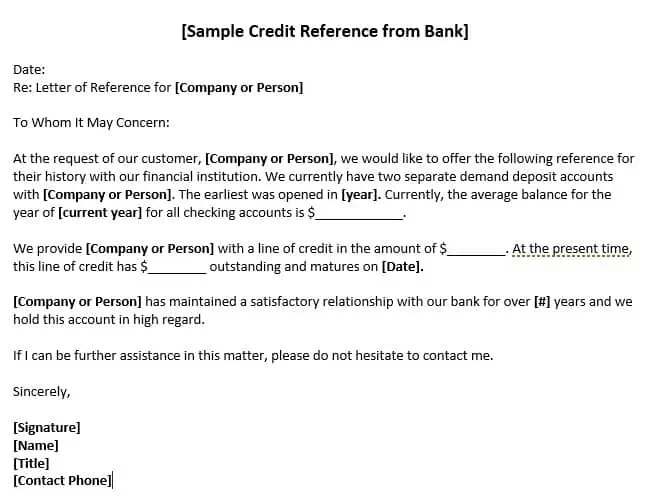

There is usually a standard template for credit references, especially at financial institutions which get asked often to provide a letter. Credit references usually start with the referring contact at the top, followed by the receiving party.

References should be short and to the point. They need to list dates over which you’ve had business with the reference and any relevant numbers like average account balances.

The example credit reference below is from a bank but most will look the same whether from brokerage or other financial institution. Personal character references won’t have the numbers but will speak to how many years the reference has known the person.

What Do I Put for a Credit Reference

Most rental applications will ask for your previous landlord’s name and contact information as a credit reference. The new landlord might not contact them but will want it on file just in case. You might also need to list a credit card account though the card company usually won’t be called as a reference.

If you’re going to be listing a previous landlord as a reference, it’s always good to contact them first to let them know. Hopefully you left on good terms. Landlords don’t have the same legal responsibility as a company when providing a reference. If your landlord has a grudge against you for not paying rent or something else, they might just tell the new landlord when they call for a reference.

Understand that while an application might ask for your most recent landlord’s contact information, you can always give a previous landlord’s contact and just say you lived with family after that.

How is a Character Reference Different from a Credit Reference

If you don’t have a credit reference, you might be asked to provide a character reference on an application. This is usually from a friend or family member instead of from a landlord or someone that knows a part of your credit history.

Character references aren’t as strong as a credit reference. You would expect friends and family to say good things about you, especially if you’re listing them as a reference. They can still help though and you should have the information for one or two available if the application asks.

Having trouble getting a credit reference? Some landlords and rental applications will accept a few months extra security deposit as collateral instead of a reference. If you’re short on cash, consider a personal loan to cover the difference. You can check your rate here.

Can Being a Reference Hurt Credit Score?

There’s another side of the credit reference question, being a reference for someone else. Here the most common question I see is, “Will being a credit reference for someone else hurt my credit score?”

Being a credit reference for someone isn’t an official matter. You’re not signing anything and it doesn’t go on your credit report. This is different from co-signing a loan where you are legally responsible if the borrower doesn’t make payments.

Being a credit reference for someone in now way affects your credit report or score. You won’t be responsible or liable in any way if that person doesn’t pay rent or any of their actions.

Credit references are not as important for people with good credit or long credit history but could mean the difference for bad credit borrowers. If you’ve got bad credit or no credit at all, keep a list of people or financial institutions that might be able to offer you a credit reference. Keep an account open with a local bank even if you don’t use it much so you can ask for a reference when you need one. Try to stay on good terms with landlords or others that have extended you credit to use them as a reference in the future.

Read the Entire Peer Lending Series

- Best Peer to Peer Lending Sites Reviewed

- How to Get Peer-to-Peer Online Loans with Bad Credit

- 3 Steps to Fit Peer Lending Into a Diversified Portfolio

- Personalloans.com Review: Peer Lending for Bad Credit Loans

- Peer Lending vs Personal Loans: Better Rates and Best Deals