Whether your goal is being debt free or just free of bad debt, this process will help you get there.

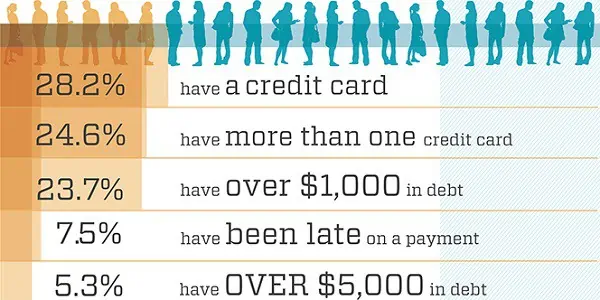

I read a shocking statistic the other day. While only about 27% of Americans carry credit card debt, more than half of lower-income households have more debt than they make in a year.

Worse still is that debt payments account for a dollar in every five earned by the average American household. It’s not just the debt people hold but what it keeps them from doing. Being burdened by those monthly payments on credit cards and other debt means you aren’t able to save as much as you should for your financial goals.

But is all debt the same? Should you avoid debt completely or just the worst kinds of debt? Is there a way to use debt that makes financial sense?

Good Debt, Bad Debt and being debt free

A lot of personal finance bloggers may be annoyed at my reference to ‘bad debt’ instead of just ‘debt’. My view is there’s a difference between good debt and bad debt even though it’s not talked about much on personal finance blogs.

Debt is like any tool and you can use it to help us make great things. It can be used to put a roof over your head and to get an education that helps you break your own reliance on credit.

The problem is that bad debt looks a lot like good debt. Like any tool, use it wrong and it can smash things up pretty badly.

Good debt is money you borrow for long-term assets, things that will grow in value or from which you can make money.

- Buying your home means you enjoy appreciation on the value while saving money versus renting

- Business owners often borrow to finance equipment and materials.

- Taking out a student loan to pay for college can yield a salary much higher than would be possible otherwise.

Bad debt can also come from sources of good debt. Taking out a mortgage for a house is fine until you start thinking about the maximum size of house you can get with an available line of credit.

How many episodes of House Hunters have you watched where the couple is approved for a loan of up to $300,000 so the real estate agent pushes them to houses at that price or even higher? Debt should be used for what you need, not for the McMansion you want.

There’s also nothing wrong with using a credit card to build your credit or for rewards programs. The problem is when you think of your available credit balance as money to spend on things you don’t really need.

Bad Debt can be a Generational Oppressor

The problem with even taking on good debt is that it can get out of hand quickly. We think of debt as being a personal problem but it can burden families and the effects can even be felt through generations.

My mom filed bankruptcy twice before I was in my teens and she regularly had to work two or even three jobs to make ends meet. Between a mortgage payment, credit cards and high-interest loans used to get us to the next paycheck the amount of bad debt was just too much.

If not for a scholarship from the Marine Corps to attend college, higher education would have been a pipe dream and I would probably be stuck in that same cycle of debt myself.

Bad debt is truly a generational oppressor. The same studies where I found the above statistics also show that only 37% of those without a high school diploma are able to save money regularly. They are stuck in a cycle of bad debt, living paycheck to paycheck and most of their kids will never know anything else.

The pain debt can cause is why so many people recommend being completely debt free, even avoiding good debt. It’s so difficult to control debt that it’s easier just to pay it off and avoid it altogether.

Whether you’re trying to be debt-free or just free of bad debt, try out the six steps below to make sure you don’t fall into the debt trap.

My Process for Being Free of Bad Debt

Before you can tackle your bad debt, it helps to know where you’re starting in terms of your credit and how much debt might be weighing you down. I use TransUnion, one of the three credit report companies, to check my credit report and monitor for changes in my credit score.

Once you have a better idea exactly how much debt and what kinds you owe, you can start planning to get free of the burden.

1) Define Bad Debt and Don’t Stray

Because it can be so easy to justify overusing debt, you need to start with a commitment to not using bad debt.

- Ask any real estate agent how much house you can afford and they’ll start with how much money you can get from a mortgage. Don’t start there! Ask yourself how many bedrooms and bathrooms you need for your family. Understand that you’ll probably spend most of your time in a few rooms so be critical on how much space you really need in the rooms you won’t be using much.

- Credit cards are a killer. The average person with a balance has more than $15,000 in debt at a rates well into the double-digits. That means they are spending nearly $2,000 on interest every year. I use two credit cards. One is only for absolute emergencies. I’ve only used it rarely when we had a family emergency and I didn’t have enough cash in my emergency fund. The other credit card is for normal daily purchases but gets paid off every month and earns cash back for my son’s 529 college fund.

2) Budgets are something everyone talks about but nobody actually follows. Even if they do start a budget, many people end up following it for less than a month.

- Instead of starting your budget with your expenses, only to find that you’ve got no money to save at the end of the month, start by budgeting how much you want to save. You should be saving at least 5% of your income but a better goal would be 10% or more. Take this amount out first and then budget out your most important expenses. This will help make sure you always have something to save and can help with a little financial discipline if you have to cut some of the less important expenses.

- Try to follow your budget for at least three months. Keep track of your expenses by putting all receipts in one place. If you can do it for three months, you’ll have built some good habits that will seem natural going

forward.

3) Earning a little extra may be a quick way to get out on top of your bad debt or a way towards longer-term goals.

- Technical skills and workers were the first to go online but just about anyone can find freelancing jobs online these days. Consider freelancing for a little while to make extra cash or starting a side hustle to pay off your debt faster.

- Bought more house than you need? AirBnB lets you rent out rooms to short-term or long-term renters. A renter rating system and other feedback helps to get to know the renter before you meet them and you’re never under an obligation to let someone stay.

4) Consolidate your Debt– Online lending through sites like PersonalLoans.com and SoFi have gone from the alternative to mainstream lending over the past year. Check out my peer lending sites review for a comparison of the largest peer lending sites.

- Like credit card debt, peer loans should not be used for just anything but they can help build your credit and pay off high-interest credit card loans. Rates can be as low as 6.7% and you can borrow up to $35,000

- Since peer loans are for a fixed-rate and a fixed amount of time, you have a clear path to being debt free unlike credit card debt that seems to continuously pile higher.A little known bonus is that peer loans are considered installment loans by the credit score agencies. The credit score agencies negatively rate your credit card debt, classified as revolving debt, more because it has no maturity. Consolidating your credit card bills with a peer loan can help increase your credit score. Check out an earlier article on other credit score factors and how to improve your score before applying for a loan.

5) Saving all your money will do you no good if you lose it all in the next market crash. Investing your money in a diversified portfolio is key to having the money you need in the future.

- The amount you hold in stocks, bonds and real estate will depend on your age, investing needs and other factors. Spread your wealth between stocks, bonds, real estate and alternative investments like peer loans.

- Anyone that guarantees you a certain rate of return is probably planning on stealing your money. The only investments that can guarantee a return are treasury bonds and some annuity insurance products. Aim for a modest return of about 5% to 10% for your portfolio and be cautious of investments that seem too good to be true.

- Resist the temptation to check the value of your investments more than once every few months. Following the financial pundits on TV or watching the short-term fluctuations in investments too closely will only lead to panic selling when prices are low or euphoric buying when prices are high.

6) Enjoy Life – Being debt free or free of bad debt does not mean a lifetime of sacrifice and hardship. Besides understanding the importance of breaking the cycle of debt oppression, you also need to understand that it’s a lifelong process. Taking on three jobs and sacrificing all your time will just leave you burned out and lonely. Make sure you set realistic goals that can be kept while still enjoying time with your family and getting you closer to financial well-being and debt free.

Being financially free doesn’t have to mean being completely debt-free. There is a difference between bad debt and good debt. Knowing that difference will help you use debt as a financial tool, get everything you can out of it and avoid being trapped in a debt cycle. Learn how to use good debt and how to pay off your bad debt.

forward.

forward.