Stop obsessing about getting the highest credit score possible and focus on how to use it

After destroying my FICO during the housing bust, I became obsessed with getting the highest credit score possible. I was getting denied loans and only being offered unaffordable rates and I knew a higher credit score was the only solution.

Learning how to increase my credit score, both with legitimate fixes and any dirty trick I could find, became my singular focus.

It worked. I now have a credit score of 760 and can get just about any loan I need but I also learned that you don’t need the highest credit score to open the door to cheap credit.

What you need is a good credit score and the know-how to get the best rates from loan officers.

What is the highest credit score you can get?

Your credit score is based on items in your credit report, a collection of everything lenders say about you including how much you owe and if you make your payments on time.

When someone calculates your credit score, they are using a computer program to analyze everything in your report and then come up with a number that is supposed to represent how likely it is that you’ll pay your bills.

You’re probably most familiar with the FICO score. It’s the one most widely used and ranges from 300 up to 850 representing a perfect credit score.

There are also other credit score companies including some that just calculate your score for membership services like the free credit score you get with your credit card. Ranges for credit scores vary but are all similar.

- FICO 300-850

- VantageScore 300-850

- Experian PLUS Score 330-830

- TransUnion 300-850

- Equifax 280-850

This means that your credit score may be different depending on who you ask but they will all likely be close since it’s based on the same information in your credit report.

How long does it take to get the highest credit score?

There are a lot of factors that go into your credit score. The most important are payment history, total amount owed and length of credit history. These three factors account for 80% of your credit score.

- Payment history on your credit report can stretch back as far as 10 years and list out any bankruptcies, missed payments and judgements against you.

- Total amount owed is not just how much you owe but how much credit you have available.

- Length of credit history is the time since you first started using credit cards and loans.

How long it takes to get a high credit score will depend on what’s in your credit report and how well you’ve kept up with payments in the past. FICO estimates that it can take as much as seven years to recover your credit score after a bankruptcy and three years just to recover your score after being 90-days late on your mortgage.

Even with perfect payments, it can take a lifetime. A Cleveland paper reported in 2012 that a 58-year old resident had a credit score of 848 on the FICO scale, thought to be the highest credit score at the time.

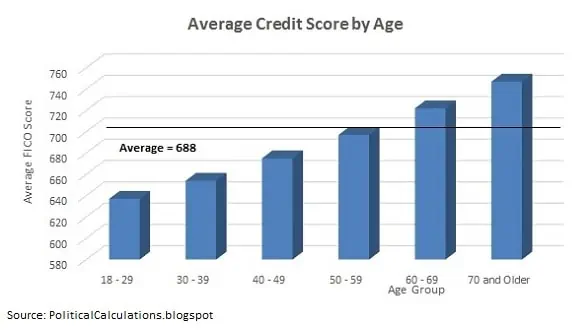

This is one of the reasons you shouldn’t obsess about getting a perfect credit score. Your age and length of credit history is going to play a big role and you can’t do anything about that. The average credit score for people under the age of 60 is less than 700 on the FICO scale.

Fortunately, you don’t need the highest credit score to get the best rates on loans.

What credit score do you need for the best rates?

When I got seriously behind on mortgages for rental properties in 2008, my credit score plunged. At one point, I think it was below 600 on the FICO scale and I couldn’t get a loan for a pack of gum.

Learning about credit scores, I realized that you don’t need a perfect score to get all the credit you need. There’s really one score you need to focus on increasing your FICO above, the score for prime lending.

A credit score below 660 FICO is considered sub-prime by most lenders. Anything below that and you’ll be considered a high credit risk. You’ll be turned down for most loans and pay super-high rates on others.

Get your credit score above this and you’ll be in ‘prime’ territory. You’ll be able to go to traditional banks for loans instead of cash advance and sub-prime lenders.

How to Use Your Credit Score

Your credit score is just a tool. Having the highest credit score doesn’t mean anything if you don’t use it to improve your life.

One of the best ways to use your credit score is for debt consolidation. With a higher score, you’ll be able to get rates in the single-digits for personal loans and can save thousands in interest on higher-rate cards.

Of course, this doesn’t mean you should rush out and max out your credit cards again after paying them off. A debt consolidation loan is only a good idea if you use it to pay off debt and save on interest, not as a way to get more money to spend.

I’ve reviewed several peer lending sites on the blog after taking out personal loans over the years. With your higher credit score, you’ll qualify for the lowest rates on sites like Upstart and PersonalLoans.

Another great use of your higher credit score is called travel hacking. Credit card companies are always offering juicy rewards incentives to borrowers with high credit scores. I opened three credit cards last year for a total of 70,000 airline miles and 35,000 hotel points that I used to save $486 in plane tickets and hotel stays.

Just as with debt consolidation, you have to be careful with your travel hacking strategy. Make sure you cancel any cards before they start charging an annual fee and always pay off your balance each month. Carrying a balance and paying interest will mean you lose more than you gain with the reward points.

The ultimate use of your near-perfect credit score is that home you always wanted. The rate on a 15-year fixed mortgage is just 2.98% right now. That’s only about a percent above the rate of inflation!

At that interest rate, you pay an average of just $231 a month in interest on a $175,000 loan. Even adding in property taxes and maintenance costs, that’s still way under the cost to rent.

You don’t need the highest credit score possible to get great rates on loans. Focus on increasing your FICO score to above 700 as quickly as possible and build on it from there. Increase your score to 740 and you’ll be in better shape than the majority of borrowers. Then you’ll be able to use your high credit score to get the best rates and save money.