What do you do with the money you need in a few years? How do you invest that money for growth but still protect it so it’s there when you need it?

In this video, I’ll explain the risk-return trade-off with your near-term money. I’ll then reveal three short-term investments you can use to grow and protect your money.

We’re building a huge community of people ready to beat debt, make more money and make their money work for them. Subscribe and join the community to create the financial future you deserve. It’s free and you’ll never miss a video.

Join the Let’s Talk Money community on YouTube!

Biggest Mistake Investing Short-term Money

One of the most frequent questions I get here on the channel is how to invest money you need within the next year or two. In fact, the motivation for this video came directly from a conversation I had with someone in the community in the comments.

About a year ago, Paul wrote, “My wife and I have saved up $9,000 but need another five or six thousand to buy a house in a year. How do we invest this to grow it by that amount in a year?”

Paul was thinking of big returns, needing to grow that $9,000 by 60% for his down-payment and was thinking about bitcoin or other high-risk investments.

We talked about the risk-return tradeoff and how to invest money you need soon in short-term investments and safe investments. I tried to talk him out of bitcoin and some of the other ideas he was mentioning.

Unfortunately, it didn’t work out to well and I asked him if I could share his story for this video. He ended up putting some of that down payment in bitcoin and got hit hard when the price tanked. He had some investments work out and he’s looking into some side hustle ideas to make up the losses.

So I wanted to make a video about this because I know it’s a question many of you have from time-to-time. How do you invest money you’re going to need in less than five years?

How is Short-term Investing Different?

The problem is most investors don’t see it as a different question than that answered by some of our long-term investing videos. They look for the best investments for that 20- or 30-year time frame and assume it’s going to be the same for those near-term cash needs.

I’ll walk you through the risk-return tradeoff and why you absolutely need your short-term cash invested apart from long-term investments. We’ll talk about the dilemma people face in that short-term investing, then I’m going to reveal three short-term investments you can use for safety and growth.

Free Webinar – Discover how to create a personal investing plan and beat your goals in less than an hour! I’m revealing the Goals-Based Investing Strategy I developed working private wealth management in this free webinar. Step-by-step to everything you need for this simple, stress-free strategy. Reserve your spot now!

Are Savings Accounts a Good Short-term Investment?

So the first answer most people get when they ask, ‘How should I invest short-term money,” is just to stick it in a savings account.

That savings account is about as safe and short-term as it gets but the 0.1% average return on your money is a non-starter for most people. In fact, you’re actually losing money by sticking it in a savings account.

Inflation, the annual increase in prices, is running around 2% right now. That’s not bad but it means sticking your money in savings at near-zero rates loses value on your money every year. Over 20 years, your dollar would buy just $0.66 worth of the things it buys today.

Savings accounts are federally-insured so you’re guaranteed to get your money back in that year or two when you need it.

Why NOT Stocks for Short-term Investments?

But what happens when you go the other way, investing that money in riskier investments like stocks, real estate or even the supposed safety investment gold?

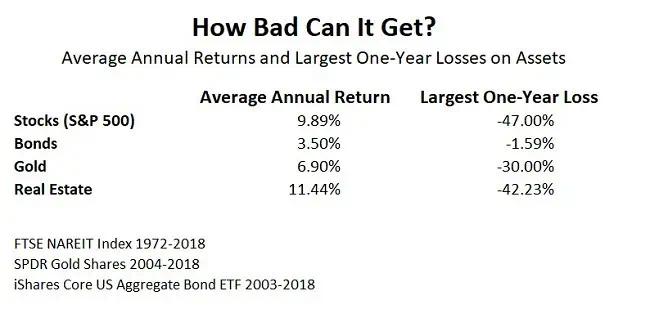

Stocks provide a solid 9.9% average return but can lose as much as half their value in any given year. That 47% loss was in 1931 but we saw two crashes that were just as bad in the last two decades.

One of my favorite investments, real estate produced an 11.4% annual return on the FTSE NAREIT Index over the last 46 years but plunged 42% in 1974.

Even gold, the investment that’s supposed to save you from a stock market crash, saw its price plummet in 2013. That’s a 30% loss on an asset that’s supposed to be a store of value.

I love stocks, bonds and real estate as a long-term wealth-builder. Combining these three give you smoother portfolio gains over decades and a lot of return…but in any give year, you just can’t bet on them.

That’s the dilemma you face with investing money you need in a year or two. That risk-return tradeoff means for a higher return, you have to be able to accept more risk to the downside.

In a savings account, there’s no risk but no return. In stocks, the return is there but also the possibility of losing half your money in any given year. No matter how good of an investor you are, how much the analysts and pundits on TV think the next year will be a good one for stocks, you just can’t risk that short-term money.

Safe Short-term Investments for Higher Returns

Now I’m going to reveal three safe, short-term investments you can use for the money you need in a few years or less. Before that, there are two ways you want to think about this money and how you invest it.

You want to think about the reason you need the money and how important it is that you can afford it. Whether it’s buying a house, retiring in a few years or whatever your goal may be.

Now I want to you score this on a scale of one to ten, how bad would you feel if you didn’t have the money and if there are any alternatives to the goal.

So something like your kid not being able to go to college would be really bad, especially if you’ve been planning on it for years. There might be less expensive colleges but is it a good alternative?

Conversely, if you’re saving up for a hugely expensive vacation and fell short a little, maybe that wouldn’t be so bad. You could probably still afford a nice getaway so no big deal.

This is going to guide you in the types of investments you need for that money. If it’s absolutely critical that the money be there in a year and there are no good alternatives, you want it in the safest investment possible.

If on the other hand your big money goal is more of a wish than a need, then maybe you can go for a little higher return and a little more risk.

For that money you absolutely must protect and you need it within a year, I’d still go with a savings account but make it an online account instead of a traditional bank. I use Capital One 360 which pays rates as high as 2% on some accounts. There’s no minimum balance on 360 savings or Kids accounts and all are federally-insured so you have that ultimate safety.

I’m not including this one in the three short-term investment ideas because it’s still a savings account but getting that extra 1.9% return on your money is huge and will protect you from inflation. In fact, carried further over 20 years and that simple 2% return grows a $10,000 account to almost fifteen grand versus a traditional savings account that goes nowhere.

I use the Capital One account for my regular monthly savings, emergency fund and that short-term money need we’re talking about. Use the link I’ll leave in the description and the bank will give you a $20 bonus when you open an account.

Capital One 360 is offering a $25 bonus for opening new accounts. Use the link below to get your $25 bonus.

Open an Account in less than 5 minutes and get your $25 bonus

Holding Short-term Cash for a Higher Return

Our first short-term investment is going to be similar to holding cash in a savings account but will get you an extra half a percent on the money you can’t do without.

Most investing platforms and robo-advisors pay an interest rate on the money sitting in your account, cash uninvested. What most investors don’t know is these rates are as high as 2.5% on some platforms. Even better is that some of these websites like Ally Invest and ETrade will pay you a cash bonus depending on how much money you start with. The bonus on Ally works out to around half a percent and you get as much as 0.8% on ETrade.

The risk here is you can’t be tempted to invest the money in risky investments. We’ll look at two more short-term safety investments next but if this money is absolutely critical and you need it in a year, just keep it in cash and collect that interest each month.

Short-term Investing in Bond Funds

Next here is the Vanguard Short-Term Bond Fund, ticker BSV. The fund holds thousands of bonds which means no single company puts the returns at risk and it pays a steady 2.15% annual dividend.

Bonds in the fund have maturities of less than five years and 65% of the holdings are in US government bonds with the rest in investment-grade companies. This fund is ultra-safe and has produced an annual return of 2.8% since its inception.

Since the bonds are short-term, they won’t be affected much by changing interest rates. You see, the biggest risk to bond prices is when interest rates increase. That means even some safe bond funds may see their price drop when rates move higher but short-term bonds aren’t affected as much so you’re still pretty safe in this fund.

You’ll get a higher return for just a little more risk in a longer-term bond fund like the Vanguard Long-Term Bond ETF, ticker BLV. This one pays a 3.5% dividend yield and has produced an annual return of 7.6% over the last decade.

This one is only slightly more risky and still has 43% of the holdings in government bonds with the rest in safe investment grade company debt. The risk here is those longer-term bonds are affected by rising interest rates. If the Federal Reserve were to change its mind and start hiking rates, this fund could take a percent or two hit.

I know it sucks to watch your money sit there only making maybe two or three percent but this is the kind of strategy you need to use for money needed within a few years. Use those questions we talked about to decide which of the three short-term investments you need and protect your money!