Learn to understand your credit scores and reports using this helpful tool. This myFICO review will give you an overview.

Are you curious about the world of credit scores and reports? There are so many terms that may overwhelm you, but myFICO.com makes it easy to understand what these all mean.

For instance, if you hear “credit score,” do you know what a FICO score is? How does your credit score affect your life especially in the financial aspect? It affects whether or not loans, cars, rentals and insurance policies are automatically given to you at a price that you can afford. If this information were made public, would it help or hurt your financial situation? These are questions that must be answered for those looking into their credit reports.

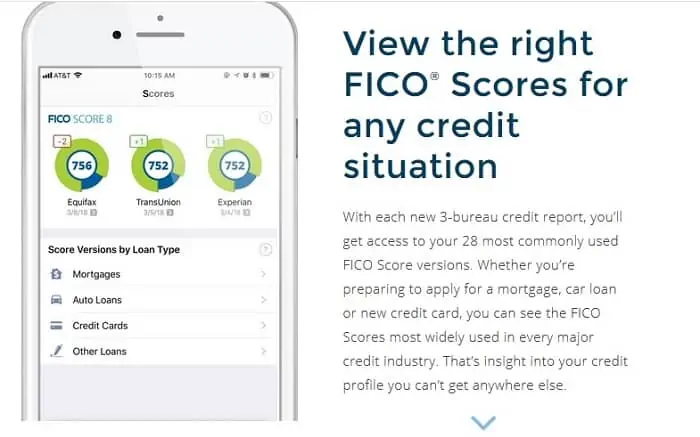

myFICO offers an analysis of your report from all three bureaus: Trans Union, Equifax and Experian. This analysis helps tell you what’s affecting your credit score and how to improve your credit standing. It also shows the source of every negative item on your report.

You can choose from three different plans and decide which option best suits you: Basic, Advanced, and Premier. If you’re just beginning to look into improving or checking your credit reports, take a minute and sign up in their subscription plans and you’ll know how helpful this tool is.

What is myFICO?

myFICO is a website dedicated to helping Americans understand their credit scores and reports, as well as improve their credit standing.

The site also offers tools that allow users to monitor the three bureaus’ information on them. Many who use this service have seen their credit score rise within 60 days of using myFICO.com. People from every state can benefit from the analysis offered through this company’s services. The customer service staff maintains an office in San Jose, California with additional employees located throughout the US, including Puerto Rico and Canada.

How Does myFICO work?

myFico works by notifying you when something happens to your credit report that may decrease your score, such as an increase in debt usage, new accounts opened (especially if there are many opened within a short period of time) or delinquencies.

Additionally, you can receive discount offers based on your credit score if you choose to join their program once your trial is over. You can also opt to not be included in this program and continue to monitor your credit reports at no additional cost.

Subscription plans offered by myFICO include:

- BASIC: 1-bureau (Experian) coverage that offers monthly updates

- ADVANCED: Complete 3-bureau coverage that updates every three months

- PREMIER: Complete 3-bureau coverage that updates every month

How Much Does It Cost?

Each option has a different price range, but they are all affordable. Basic is $19.95/month, Advanced is $29.95/month and Premier is $39.95/month. All annual plan prices are half of that, with six months being the same price as monthly plans.

- myFICO Basic: $19.95/month

- myFICO Advanced: $29.95/month

- myFICO Premier: $39.95

How does myFICO affect businesses?

myFICO helps businesses understand consumers better by giving them insight into your past credit decisions and how they may affect the financial future of that consumer. Keeping up with business trends and understanding purchasing patterns is vital for large corporations.

They have several different membership options, so that each consumer can find one that fits his or her price range and needs.

myFICO is an effective way for businesses to market themselves while still ensuring user privacy. By providing valuable insight on consumers’ past purchasing decisions, this company offers companies more room for growth.

With this information, they can create more effective marketing campaigns aimed at specific groups of people.

What About Privacy?

myFico has committed itself to safeguarding customer’s personal information. They also do not sell or share any information with outside parties.

myFICO is a great resource for consumers who are looking to improve their credit scores and reports. Their easy-to-use website makes it convenient for people who want to stay on top of their credit status but don’t have the time to spend hours surfing the web for this information.

Who is myFICO best for?

myFICO is best for consumers who are looking to improve their credit score and reports, as well as businesses looking to better understand the behavior of potential clients.

Through myFICO, users can monitor their credit history through an online account system. The monitoring service includes updates on your identity theft protection, early warning scores and virtual alerts. It also provides discounted offers based on your current FICO score. Customers have access to all of this information without ever having to enter financial or personal information.

Users can create their own login so that no one else can access their account. This way they don’t have to worry about someone finding out what kind of offers they’re receiving. Plus, myFICO won’t spam you or share your information with any outside parties.

Get your three credit reports and all your credit scores now

Pros and Cons of Using myFICO

PROS:

You have the option of signing up with or without entering any personal information, so if you’re uncomfortable sharing this kind of data, you can still access myFICO’s offers.

They offer a wide range of services suitable to anyone from beginners to advanced users.

CONS:

They no longer offer free trial periods. However, I still think myFICO is great for everyone in search of credit monitoring services.

- Price Review – 9/10

- Ease Of Use Review – 10/10

- Customer Service Experience – 9/10

- Overall Rating – 9/10 *All ratings are out of 10*

In conclusion, myFICO is a great way to monitor your credit score and report online. I’ve been using it for the past couple months and have seen a rise in my credit score as well as an increase of offers which are better suited to the spending habits I’ve shown through previous purchases.

The best thing about this service is that anyone can sign up – there’s no eligibility requirements other than having a few minutes free each month! The ease of use makes it simple enough for beginners while still offering a wide range of services for those who want more control over their accounts. This company really has something everyone, which is why it’s my top pick for credit monitoring services.

Read the Entire Credit Score Series

- Is 602 a Good Credit Score?

- Which Factors Most Influence Credit Score?

- How Your 640 Credit Score is Holding You Back

- Proof You Don’t Need the Highest Credit Score for Great Rates

- 11 FICO Credit Score Myths that Will Change Your Financial Life