Penny Stocks That Will Give You High Dividend Returns

How do you get penny stock returns but still cash in while you wait? In this video, I’ll show you how to create a list of penny stocks that pay dividends. We’ll use a simple penny stock screener then narrow our list. Then I’ll reveal seven penny stocks to watch that pay you while you wait!

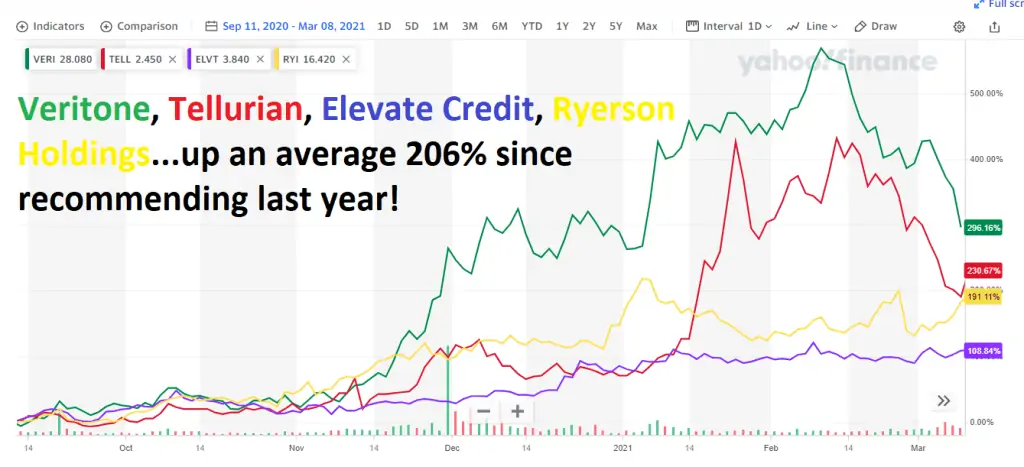

Nation, you know we love those penny stocks here on the channel! From Veritone to Tellurian and Ryerson…even lagging Elevate Credit has produced a 100%-plus return in less than a year.

But we also love us some dividends and when your holding period for a penny stock is three to five years…that’s a long time to go without getting paid.

But while most penny stocks don’t pay dividends, you can get both if you know where to look!

In this video, we’ll start with a simple stock screener to start our penny stocks dividend list. I’ll then show you what to look for to narrow your list and how to pick the best for return AND cash flow. Then I’m going to reveal the seven penny stocks to watch for the best of both worlds!

I want to get started and jump into those penny stocks but stick around because after those seven stocks, I’m going to highlight three dividend penny stock traps that you need to avoid!

I’ll start my penny stock list with the screener on Webull and we’ll be using the app for research into each stock later. I’ll start by filtering for stocks with a market cap under $500 million but you can play around with this, really anything under a billion-dollar market cap.

Now I want to address this because I know I’m going to get comments. There is NO official definition for a penny stock. The unofficial, accepted basis is a company under a billion-dollar market cap. Those are the kind of small companies with the flexibility and that potential for growth we’re looking for.

What to Keep in Mind in Choosing Penny Stocks

What a penny stock DEFINITELY is NOT, is just a stock under $1 or even under $5 per share. You see Nation, stock price means absolutely nothing for the value of a company or its potential growth. It’s simply a function of the market cap of the company and the number of shares issued. For example, Sirius XM is a $26 billion company…absolutely huge and nobody would consider this a penny stock, but since it has 4.1 billion shares issued…each one trades for just $6.32 each. Compare that with tiny $98 million Webco Industries, a steel maker out of Oklahoma with shares up 37% in the last year and that penny stock potential for growth. But because the company only has 887,000 shares issued, each one trades for $110 each!

So don’t think penny stocks have to be low price. Low price stocks aren’t cheap and high price stocks aren’t necessarily expensive…to find that you need to look at things like price-to-earnings or price-to-sales.

Back to the screener though and next we’re going to make sure our list only includes dividend-paying penny stocks so we’ll move the slider to include stocks that pay at least a one-percent yield.

Penny Stocks That Pay Dividends

Now that’s the basics but I like to use this Return on Equity filter and the Return on Assets filter to find companies producing a positive return on assets and equity. It’s just a quick way to narrow your list to only the top performing penny stocks so we’ll move the sliders on both of these to at least a positive return.

There are also some technical filters and sometimes I’ll use the RSI24 Oversold screener to find stocks with good technical upside but since I’m looking for long-term holdings here, I won’t worry about it. You can see how many stocks match the screener at the bottom and I can save my screen and it will keep updating anytime I click on it, so I’ll name this penny stock dividends.

I’ll be putting all seven of these penny stocks in my paper portfolio on Webull to follow. I like the research I get with Webull but I love the stock simulator feature. The app gives you a million dollars to use in a paper portfolio, to track your favorite ideas before you invest real money!

Now I’m going to show you those seven dividend-paying penny stocks next but what you’ll notice is it’s a lot of regional banks, asset managers and business development companies. These aren’t going to be the 10X kinds of penny stocks you might expect but they can still produce a high return and strong cash flow while you wait. In fact, the seven stocks I’ll show you averaged a 65% return over the past year and a dividend yield more than twice the market average.

The question is, and I want to get your opinion on this, would you rather have that higher potential growth in maybe a penny stock company that doesn’t pay dividends or still solid returns and the annual dividend?

7 Dividend-Paying Penny Stocks

Our first penny stock here, $377 million Mesabi Trust, ticker MSB, a steel royalty trust paying a 4.8% dividend and up 105% over the last year.

Mesabi is an amazingly simple investment. The company has a royalty investment in mines operated by Northshore Mining, a subsidiary of Cleveland Cliffs. Northshore mines the ore, process it into pellets and sends it off to Cleveland Cliffs and then pays Mesabi royalties based on the selling price. So Mesabi has no operational duties or costs here, it’s just a trust that receives the royalties.

That means the return here is going to be a function of iron ore prices which are at a multi-year high but still below the peak in 2008. Goldman Sachs believes we could be heading into a new commodity super-cycle and if we get even part of that proposed $3 trillion infrastructure bill, my guess is prices are going much higher and this stock will climb further.

Capital Southwest, ticker CSWC, is a $433 million business development company formed in 1961 and specializing in credit, private equity and venture capital to mid-market and late-stage companies.

So the business model for these BDCs is that there’s a funding hold for mid-size businesses. Small businesses can go to their local banks and the big dogs can get bond funding or issue shares in the market but for companies right around the sweet spot of twenty- to $40 million in annual revenues, they go to these business development companies for lending and equity investments.

Capital Southwest pays a great dividend of 7.6% and has a history of regular, supplemental and special dividends. Even last year, it was able to keep up the regular and supplemental dividends.

Shares have climbed 140% over the last year and the average debt yield on the company’s loans is 9.9% which, this is something you always want to check when your investing in BDCs. You want to compare the weighted average yield the company collects on its loans, 9.9% in this case, against the dividend yield because that’s your measure of dividend sustainability. Is the amount the company’s collecting above what it pays out.

Shares are trading at a price of 1.39-times book value so a little more expensive compared to some of the other financial companies we’ll see on the list but a solid dividend and price return.

Now you’re going to hear me use the price-to-book value ratio with a lot of these so I want to explain why. Most of you are more familiar with hearing price-to-earnings used to value a stock, the price per share investors are paying compared to the earnings per share a company generates. For financial companies though, so these BDCs and banks, the book value of all their loans and other assets is much more important so we look at the price-to-book value for a more accurate comparison.

Next on our penny stock dividends list is a popular one, Gladstone Investment Corporation, ticker GAIN. This is a $400 million private equity fund that also does some lending, so that BDC business model. The company focuses more on the equity investment side though with a target of 25% equity and 75% debt in the companies it works with.

Gladstone has a diversified portfolio across 28 companies in 13 industries, so good diversification that means trouble in one industry or company isn’t going to break the portfolio.

Shares pay a 6.9% dividend yield with annualized distribution growth around 2% not including the supplemental distributions it’s been paying. Even last year the company was able to pay the regular dividend plus a $0.21 per share extra dividend. Shares are up 71% in the last year and trade for a price of 1.09-times book value.

We’ve still got four more penny stocks to highlight but I want to personally invite you to join The Daily Bow-Tie, my free daily market newsletter with all the stock market news, strategies and trends you need to follow. It’s absolutely free, just something I like to offer for everyone in the community.

Free Webinar – Discover how to create a personal investing plan and beat your goals in less than an hour! I’m revealing the Goals-Based Investing Strategy I developed working private wealth management in this free webinar. Step-by-step to everything you need for this simple, stress-free strategy. Reserve your spot now!

Next on our penny stock list, $170 million regional bank Penns Woods Bancorp, ticker PWOD, with 27 branches in Pennsylvania under the JSSB and Luzerne Bank names.

Penns Woods has a net interest margin of 2.9% which is just under the peer average of 3.2% and remember, that’s the core profitability measure for a bank. The net interest margin is the difference a bank collects in what it charges on loans and what it pays out on savings so I think there’s room to increase this for Penns Woods. The loans-to-deposits ratio is also a little lower at 90% loans to deposits, under the peer average of 93% so some potential there to make more loans and at higher profitability.

Those of you in the nation know, stocks in the financials sector are some of my favorite this year because as those long-term interest rates rise, banks will make more money on their new loans. Shares here pay a 5.4% dividend yield and are up 20% but still only trade for 1.04-times on that price-to-book value.

This next penny stock gives us a little diversity from the banking and BDC theme, $212 million Weyco Group, ticker WEYS.

Weyco is the company behind the Florsheim, Nunn Bush, Stacy Adams and BOGS brands of footwear selling through its own stores as well as other retailers. Florsheim is one of my favorite brands for shoes and with the retail spending boom coming this year, sales should do really well.

Shares of Weyco pay a 4.2% dividend yield and are up 20% over the last year but trade at just 1.1-times trailing sales which is a good value for a retailer.

LCNB Corporation, ticker LCNB, is a $224 million regional bank with 33 branches across Ohio formed in 1877.

Now if you’ve been following the channel, you know one of the things I’m tracking in bank stocks this year is the amount the company set aside last year in its loan loss provisions. This is like a cash reserves account the company creates just in case loan defaults get bad in a recession. The company takes money out of its operating profits and sets it aside on the balance sheet.

Well what we’ve seen is that loan defaults haven’t jumped like banks thought. All that stimulus money saved small business from the worst of the pandemic so banks have billions set aside in this rainy day fund when everything looks bright and sunny.

LCNB set aside more than $2 million in 2020, nearly ten-times what it had set aside the year before so if it now decides it doesn’t need all that money set aside, even if it moves just $1.5 million back to earnings, that could be an extra $0.12 per share for distribution.

Shares pay a 4.24% dividend yield and are up 62% in the last year. LCNB is also one of the least expensive stocks here, trading at just 0.93-times on a price-to-book value.

Topping out the list before I share those three penny stock dividend traps is $129 million Union Bankshares, ticker UNB.

UNB runs 20 branches in Vermont and New Hampshire and despite the pandemic, reported record earnings last year to net income of $12.8 million.

Loan loss reserves increased here as well, up $2.1 million which if released back into earnings would be another $0.47 per share in profits. The shares pay a 4.6% dividend yield and are up 40% in the past year though this is one of the more expensive stocks in the list at 1.59-times on a price-to-book value.

Now don’t click out! I want to show you those three penny stock dividend traps because I see so many investors falling for these and they will destroy your returns.

Penny Stock Dividend Traps You Should Watch Out

First is only looking for the highest yielding dividends. Nation, we’ve tried to juggle our dividend cash flow and the penny stock returns with these seven stocks but there is a trade-off. If a company is paying out an 8%-plus dividend then there’s a good bet it’s not saving much left from earnings to fuel that stock growth.

With any company, management has to make the decision between returning cash to shareholders or investing for the future. We’ve seen with this penny stock list that you can find a happy middle ground for both.

Next here in our penny stock traps is investing only in banks or BDCs. The majority of dividend paying penny stocks you’re going to find are from those two industries, either banks or business development corporations. Investing just in these sets you up for a fall if interest rates fall or the economy tanks so make sure you look for other types of companies like we did in the list.

This next one is a trap for dividend investors, stocks that offer higher yields only because the price has fallen. Now the penny stocks in our list have seen higher stock prices but you’re going to see some tempting dividend yields out there. You absolutely have to check a graph of the stock price here. For example, shares of The GEO Group here look great with a 12% dividend yield until you look at the chart and see the stock has dropped 32% in the past year, wiping out your dividend return and then some! The dividend is probably unsustainable and could be cut so make sure you’re investing in strong companies, not just high dividends!

Track your entire portfolio, see the gaps in your investments and compare two stocks instantly with my Portfolio Tracker spreadsheet.

Download this Portfolio Tracker and Stock Comparison Tool! [Use this Coupon Code for 57% Off]

There is a middle ground between return potential and dividend yield that you need to find. Too high a yield and the company won’t grow. Too low a yield and it’s not much of a penny stock! Have you decided on which penny stocks to buy?