Following Graham’s three rules to an expensive stock market can help you avoid high investment fees and bad stock market timing

Is there anything more frustrating than trying to tell if the stock market is expensive or cheap?

Turn on CNBC or click to any investing website and you’ll hear a hundred different opinions every day about timing the stock market. Half will scream that stocks are heading for a crash while the other half will warn that if you’re not ‘fully-invested’ you will miss out on a terrific bull run.

But what can the ‘intelligent’ investor do to avoid expensive stocks and market crashes?

This is the third in our Intelligent Investor series, a 20-part series reviewing each chapter of the definitive book on value investing. These posts aren’t meant to replace the book but just to add some clarification and to help with more actionable advice based on the readings.

Did you miss last week’s review? Find out why your investments are worth half as much as you think and how to invest to beat inflation.

“By far the best investing book ever written.” Warren Buffett.

Click to get The Intelligent Investor on Amazon Kindle or paperback

We review Chapter Three this week, “A Century of Stock Market History”

- Understand how long-term stock market returns can help you avoid bubbles

- The price-earnings ratio and what it means for stocks

- Three simple rules to timing the stock market

Is Stock Market Timing a Fool’s Game?

Chapter three in the book paints a picture of stocks over a hundred years to the early 1970s. Jason Zweig extends the timeline in his commentary to add history through the early 21st century.

While the general theme to the chapter is that nobody can predict where stock prices are going over a short period, even up to ten years, having a little stock market history seems to help do two things.

- Understanding that the stock market generally rises around 7% annually over the very long-term gives you a rational idea of what to expect. This helps put things in perspective when stock pundits promise huge returns on individual picks or the market itself.

- Knowing the modest long-run return on the market helps investors put huge bull markets in perspective and may serve as a warning to start rebalancing wealth away from stocks.

You get different results depending on whether you adjust for companies that have fallen out of the market or not but generally the stock market has returned an annualized 5% to 8% over the very long-term.

Is the Stock Market Expensive?

Understanding this long-term return, you should start to wonder when TV pundits talk about double- and triple-digit potential returns in picking stocks. Chasing these irrational expectations means taking on a ton of risk and usually results in the investor losing money while their broker gets fat on fees.

The idea that the market return usually reverts to this long-run average also helps as a warning to investors. If stocks have jumped 10%+ over several years through a bull market, there’s the chance we could be ready for a few years of losses.

This is where it gets a little tricky, playing the stock market guessing game and trying to time the market. Even Graham himself points out several sections in prior editions that warned of expensive levels in stocks and ended up seeing the market bound higher.

Timing the stock market hasn’t worked for one of the most respected investors…think twice about making big changes on your own market timing guesses.

The most popular measure of value in stocks is the price-earnings ratio. On a market-level, is the price of the S&P 500 index divided by the earnings of the companies in the index over the last 12 months.

It’s intuitive since investors have a right to a company’s earnings. How much are they willing to pay for those earnings?

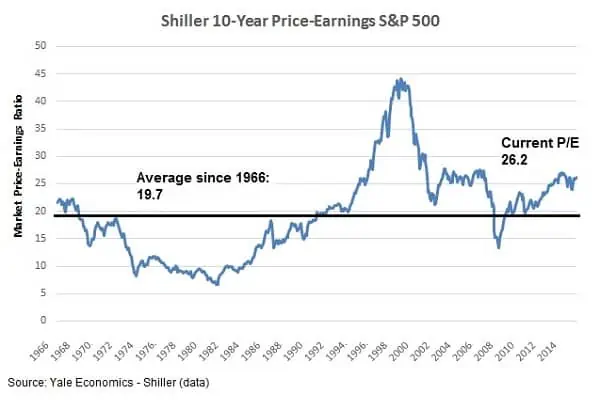

To adjust for the ups and downs of the business cycle, Robert Shiller has developed the cyclically-adjusted price earnings ratio (CAPE). I’ve graphed out the P/E of stocks for the five decades to 2016 below.

We see that the long-term average price-earnings for stocks is quite a bit higher than the 16-times multiple quoted so often in the media. The average moves closer to 17 if you use data going back 100 years but is the stock market of Alexander Graham Bell really the same market we see today?

The problem is that the average price of the market has been creeping higher for decades. Trying to time the stock market and investing only when the market P/E was below even 25-times would have meant staying out of stocks for the better part of the last 20 years.

The answer lies in asset allocation and rebalancing.

Timing the Stock Market with Rebalancing

Just because stocks get a little expensive relative to their long-term average doesn’t mean you should start selling and head for cover. Pessimists are constantly preaching an imminent stock market crash and following their advice usually means missing out on years of higher prices.

The better strategy when stocks start looking expensive is a simple three rules Graham outlines in the book.

- No borrowing to buy stocks. This is called buying on margin and should never be done anyway. It’s one of our eight stock market basics – don’t borrow to invest!

- No increase in the proportion of funds held in stocks. This doesn’t necessarily mean you stop investing in stocks, just that you invest in other asset classes. More on this below.

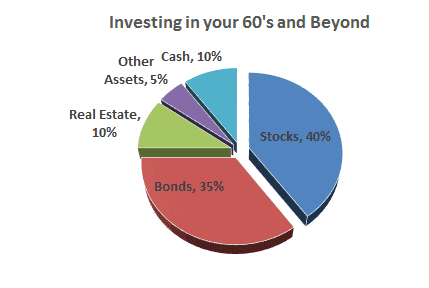

- A reduction in holdings to bring stocks down to a maximum of 50% of your wealth. This 50% number seems very arbitrary, especially considering investors have different needs according to age.

The first point is pretty easy. I would say never borrow on margin but certainly don’t do it when everyone else is buying stocks.

The second point is one of asset allocation. Investors need a mix of stocks, bonds, real estate and other assets. It’s a critical step in reducing your risk and why I don’t worry about a stock market crash. Growing stock prices when times are good have the effect of distorting how much you have in the different asset classes.

You might have started with 65% of your wealth in stocks but booming stocks and more modest returns in bonds might mean you now have 75% of your wealth in the market. Rebalancing your portfolio doesn’t have to mean you sell stocks to buy bonds which would incur expensive fees and taxes. Instead, just start investing a greater proportion in bonds or other assets.

Please read those last two paragraphs again! Ten years working as an investment analyst have taught me that investors are horribly under-diversified in other assets, especially bonds. Now is a great time to start putting less money in stocks and building your safety cushion in bonds and other assets.

The third point and its arbitrary 50% for stocks ignores the need for investors to hold different levels of assets according to their age and specific needs. We started our investing by age series with a great infographic to show about how much you should have in stocks.

Besides holding to a different percentage in stocks, I would say avoid selling stocks and rather just invest your money in other assets until you reach your target percentages in assets. It shouldn’t take more than a year or so to rebalance your portfolio and you’ll save on fees and taxes.

Don’t forget to check out the next chapter and How to Create a Portfolio for the Lazy Investor. I’ve teamed up with a great investing website Investing to Thrive to help review the chapters. Chapter four really gets into the meat of The Intelligent Investor with how to put together your investing policy.

Trying to not time the stock market and making investing as easy as possible is one of the core tenets on my investing blog, My Stock Market Basics. Too many investors try to ‘beat the market’ and end up missing their investing goals because of bad timing and high investing fees. Using a simple process of rebalancing when stocks start to look expensive can help avoid the fees and losses that come with jumping in-and-out of the stock market.