Learn how to protect your money with these stock market crash strategies

We opened May with a warning about stocks and why I was selling. We closed the month with the stock market down 7% and no bottom in sight.

It’s not quite a stock market crash but warning signs for stocks are flashing red. If you don’t protect the money you’ve earned, you could end up giving it all back.

Today I’m going to show you five strategies you can use to survive any stock market crash and make money.

We’re building a huge community of people ready to beat debt, make more money and make their money work for them. Subscribe and join the community to create the financial future you deserve. It’s free and you’ll never miss a video.

Join the Let’s Talk Money community on YouTube!

Will the Stock Market Crash in 2019?

After ten years of straight-up stock prices, everyone likes to pretend a stock market crash can’t happen. Everyone wants to chase returns for just a little longer before they start protecting their money.

Well, I’m going to let you in on a secret of making money investing. Anyone can make money investing in a bull market. Returns fall from the sky like mana during a bull market. Creating long-term wealth, I mean really growing your portfolio is about not losing money when the crash comes.

I’ve been pointing to the downside for the last few months and we updated our 2019 Stock Market Challenge portfolio at the beginning of May with my strategy for safety. One month later and the S&P 500 just had it’s worst month since December and it’s worst May in years.

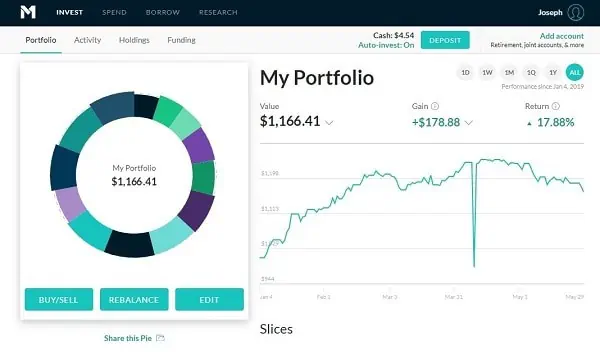

I’m not going to tell you we completely avoided the selloff. Our dividend portfolio fell just under four percent but is still at a 17.9% return so far this year. That’s more than 8% higher than the return on the S&P 500 and seven percent above the Vanguard dividend appreciation fund.

So that end-April repositioning helped save us from some of the losses and it’s hard to be anything but happy with an 18% return less than half way through the year. I’m going to update on the dividend stocks and funds in the portfolio then reveal five strategies you can use to survive and even thrive during a stock market crash.

I’m putting this video into our 2019 Stock Market Challenge playlist so if you haven’t seen the other updates, check those out. Along with some of the biggest investing channels here on YouTube, I created a $1,000 portfolio in January and will be tracking it all year. To track my portfolio of dividend stocks, I’m investing $1000 on M1 Finance, a no-fee platform that lets you pick your stocks and automatically invests any new deposits across your group.

M1 Finance

Best Stocks to Avoid a Stock Market Crash

So here’s our portfolio as of last Friday, 7 dividend stocks and 5 stock funds and a bond fund. I want to get to those five strategies for a stock crash so I don’t want to spend too much time here but I wanted to point out a few of these. And I’ve added a column here to show where the return was last month to give you an idea of which investments have protected our portfolio and what I’m looking at for opportunities.

So you see the top four performers in the portfolio; Hanesbrands, General Mills, Bank OZK and ConAgra are all still above 30% on the year though they’ve all come off their high quite a bit. You notice though that General Mills is only off its peak return by 2% so definitely representing the safety you get in consumer staples stocks.

These next five is where I think a lot of the insight we get from over the last month. You’ll see China Life Insurance, ticker LFC, was up as much as 37% but has fallen to a return of 21% for the year. That’s still not bad but yeah, this thing has plunged on the trade war with China and we’ll see it again in our China fund.

I’ve talked about this in other updates and I think the recent weakness in Chinese stocks is an excellent opportunity, if you missed that first big jump, to start buying some of these names. IF YOU ARE A LONG-TERM INVESTOR, and I know a lot of you are, YOU ABSOLUTELY MUST have some exposure to these domestic Chinese companies. It’s not enough to own shares of US companies doing business in China. You need to own some of the Chinese names as well so I think you can get back into the market after this recent selloff and pick up some of these names.

These next two investments are a golden lesson in diversification. We see that the Vanguard Real Estate Fund, that fund holding real estate companies, ticker VNQ, was all but immune to the selloff we saw in May. At just over 8% of the portfolio, that was a big help in protecting our gains.

Everyone likes to talk about moving money to bonds or even cash in market weakness but don’t overlook the power of diversification by holding some of these real estate assets in those REIT funds as well.

Same story with the Alerian MLP fund which holds those shares of master limited partnerships. Even on the weakness we’ve seen in oil prices over the last couple of weeks. The Alerian fund, ticker AMLP, has only lost about a percent from its peak return there. Another example of diversifying your portfolio into different assets for protecting your money when stocks drop.

This bond fund, the Vanguard Long-Term bond fund, ticker BLV, is a position we added last month and did it’s job well to protect the portfolio. So that was 10% of the portfolio that saw no loss over the month.

This iShares European Financials fund, ticker EUFN, is the biggest disappointment so far for the year with the total return dropping to just under 4%. I still think there’s some opportunity here but it might take a year or two for Europe to clear some of its structural problems to the financial sector.

The iShares China large cap fund, ticker FXI, is another one I wanted to point out. Just like China Life, this one has seen the return drop hard over the last month and I think it’s a huge opportunity for new investors to step in and pick up shares. Now this fund is a little more heavily weighted to financial companies in China so you might also consider the SPDR S&P China fund, ticker GXC, which owns Chinese companies but is a little more spread out across sectors.

The SPDR Utilities fund, ticker XLU, is another safety play we put on last month and this one hasn’t done much but it did protect our money like it’s supposed to.

Investing Strategies for a Stock Crash

Now May was bad for the market but it probably isn’t the worst we’ll see for the year. The administration is fighting two trade wars simultaneously, U.S. economic growth is slowing and there’s a very real possibility of an earnings recession this year.

You cannot avoid these stock market crash strategies I’m going to show you now.

These five investing strategies will not only help you avoid the worst of a crash in stocks, they’ll help keep your sanity when everyone else is freaking out and can even help you make money.

How to Create a Goals-Based Investing Strategy

The first strategy here is that your investing plan has to start with your goals. Now I know this doesn’t seem like a strategy but it’s going to be vital to not stressing out when stocks crash and committing some of the worst investing mistakes people make.

When you start with your goals, and I’m talking really sitting down to create a mental picture around your money goals, it takes the pressure off getting those double-digit returns every year. You start to see the long-term picture and how your portfolio is getting you there, even if returns in an individual year fall short.

This is something we talk about in that Goals-Based Investing strategy I created while working for private wealth managers. Creating that mental picture around your WHY of investing so every time budgeting gets tough, every time the market gets nasty, you can take that picture out and let it motivate you to stick to your plan.

I’ll link here to a free webinar where I lay out the entire goals-based strategy and how to use it for stress free investing.

Dollar Cost Averaging in a Stock Market Crash

The next strategy you need to be using in a crash is called Dollar-Cost Averaging but that doesn’t mean just chasing your losses with more stocks.

Now dollar-cost averaging is just buying into your investments at different prices. The most common form of this is say you buy a stock at $100 a share and the price falls to $80. If you still like the company and think it’s a good investment, you can buy more shares at $80 and that makes your average price between the two at $90 a share.

With this new, lower average cost, you’re still losing money on each share but you don’t need the price to go up too much before you’re back in a profit. You only need the shares to go up 12.5% to $90 instead of up 25% back to $100 a share.

There are two problems with dollar-cost averaging though that make it impractical or even dangerous for investors. First is that you need extra money to invest, right? You can’t buy in at that lower price unless you have money to buy in. Because most investors are fully invested all the time, they never have the option to take advantage of these lower prices.

I’ll show you how to fix that problem in the next strategy. The second problem with dollar-cost averaging is that investors never have a plan for truly taking advantage of the selloff in stock prices.

What I mean here is even if an investor has a little extra money to invest at those lower prices, they go all-in after a five or ten percent correction. Stocks fall just a little and they put all their free cash to work. It’s a little like investing in early 2008 after the market had it’s first big drop, about 15% below its peak but then being fully invested and not having anything left to dollar-cost average lower.

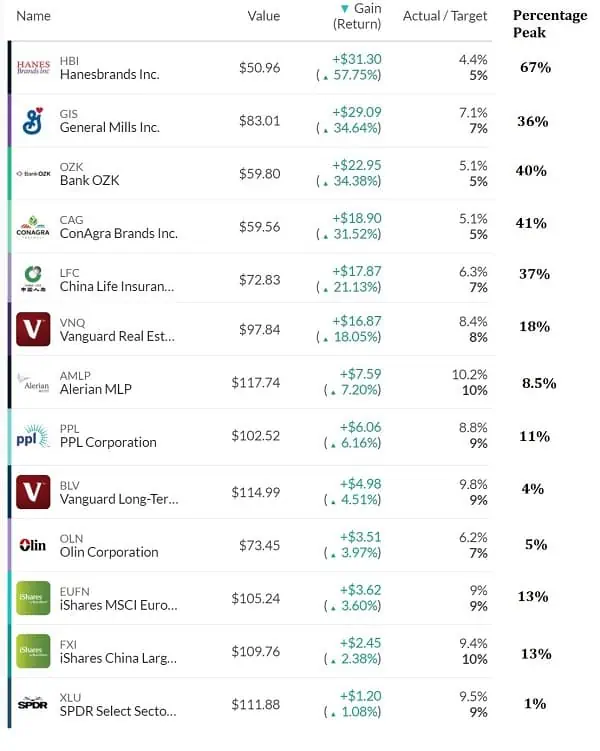

Instead, what you want to do is make a plan to invest in increments. The specific points you invest at are up to how far bad you think a selloff might get, the depth of the recession. Looking at this graph of the last 22 bull markets and market crashes. You see that the average crash has been 27% from the peak and lasted 14 months.

So if I were expecting an average recession, maybe like the signals we’re getting now but not the huge bubble excesses we saw in 2008, then you might plan on saving money for investing when the market hits 10%, 20% and 25% lower. That’s not going to save you from the big market crashes of 50% like in 2001 and 2009 but it will save you a lot of losses and prime your portfolio for when stocks rebound.

Rebalancing Stocks before a Crash

Our next strategy and this is going to help solve that problem of not having the cash is regular rebalancing your portfolio back into bonds and real estate.

You saw in our dividend portfolio how that real estate fund and the bond fund didn’t lose anything in the May selloff. In fact, the bond fund gained 4% on the month. That 20% of the portfolio really saved us from the worst of the losses and could be used as a source for cash to buy stocks at lower prices.

This rebalancing, so taking some profits out of your stock gains and getting that position in bonds and real estate, it doesn’t have to happen only when you’re worried about a stock market crash. It’s something we’ve talked about on the channel and this is something you should be doing every year or two.

Part of that goals-based investing strategy is having a target for how much of your money should be in stocks, bonds and real estate. So you start off with that amount in the three assets but after a few years of a bull market in stocks, that portion of your portfolio starts getting ahead of the others. So now instead of having maybe 60% of your money in stocks, you’ve got 75% and much less in the other two assets.

That’s the time you need to rebalance back to those original targets and it’s going to do two things. First, when stocks do weaken, it’s going to make sure you have the cash available to take advantage of those lower prices. Second though, it’s also going to give you that peace of mind. Your portfolio matches those goals and has that diversification in the three asset classes. You’re not seeing the value jump up or down with big market swings and you have the confidence to know that your money will be there when you need it.

Using Alternative Assets before a Stock Crash

Fourth strategy for surviving a stock market crash, and I love this one, is having different income sources and investments.

So we talked a little about having different investments in our last strategy and to this you might also add alternative investments like p2p lending and crowdfunding. Those other assets are going to make your portfolio just a little more diversified for less risk and higher total returns.

I think having the other income sources is even more important though and way underappreciated. By putting together just a couple of side hustles or some passive income sources, you not only give yourself income insurance and never have to worry about a paycheck, you’re also going to be adding to that extra cash you can use to take advantage of the lower stock prices.

In fact, there comes a point, where your income is high enough from your work and those side hustles, that you’re actually hoping for a stock market crash because you’ve got so much cash coming in to invest and your excited about getting in at the lower prices.

Using the Business Cycle to Invest

Our fifth market crash strategy is something we’ve been talking a lot about on the channel over the last few months. Using the big macro trends and analysis to reposition and business cycle investing.

This one is probably the hardest of the five and, while the others should all be used together, this is one that doesn’t have to be in everyone’s toolkit. If you just want to use the other four strategies, you’re going to be very well prepared to protect your money and even grow it through a stock market crash.

Using this strategy though is going to take another level of analysis. It’s about watching the business cycle, the economy and the market. Now a lot of people are going to say that you can’t time the market, you never know when the economy is about to turn lower and lead to a crash. And I’d agree. You’ll never time the market crash down to the day or even the month. What you can do is watch the longer-term signals, the signs of a bubble in stocks with price multiples, the signs of weakening profit margins that could lead to an earnings recession.

It’s these financial signals that you can spot and can tell you when to adjust your investments to safety sectors like utilities, consumer staples and healthcare like we’ve done here with the portfolio.

These five stock market crash strategies are all easy enough even beginning investors can take advantage of them to help protect their money. Use them in your portfolio and you’ll not only keep the money you’ve earned but will have the opportunity to grow your portfolio when the rest of the market is running scared.