These student loan repayment plans will help you pay back the debt without breaking the bank.

If you have student loans, and 44 million of Americans do, then you need to know your repayment plans.

Understanding the seven student loan repayment options WILL mean the difference between making your payments with cash to spare or being a slave to that debt for the next 20 years.

Not only am I detailing these student loan options but I’ll reveal three questions to ask to find the one that works for you. It’s a can’t miss video for anyone with student loan debt and could potentially save you thousands in interest.

We’re building a huge community of people ready to beat debt, make more money and make their money work for them. Subscribe and join the community to create the financial future you deserve. It’s free and you’ll never miss a video.

Join the Let’s Talk Money community on YouTube!

The Problem with Student Loan Debt

Ah college. That four years of undergrad, two years of graduate school and three years for a professional charter to find your calling doing something for which you need no degree at all.

But now you’re out in the rat race and whether you’re using that degree or not, those student loans are coming due. Americans owe nearly $1.6 trillion dollars in student loans with the average burden over $37,000 per student and 44.2 million with loans.

How you repay that debt is going to be one of the biggest financial decisions you’ll make. Whether you find a way to make your payments work, finding the plans that keep more cash in your pocket, or whether you just go with the standard repayment plan can mean the difference between having the cash to invest for your financial future or being trapped by the debt for the next 20 years.

When I finally got out of deferment on my student loans, I had over $69,000 in debt. That’s from undergrad, graduate school and the interest during a three-year certificate program. Without finding the repayment option that worked for me, there is no way I could have made those monthly payments while still having the money to invest to get my business off the ground.

That’s why, in partnership with Splash Financial, I’m revealing the seven student loan repayment options. We’ll look at the best repayment option for every situation, the one that will work for you, and how to repay your loans without feeling like you’re a slave to this debt.

After we look at those loan repayment plans, I’ll show you three questions to know which option is the best for your needs.

Splash Financial is a leading, tech-driven student loan refinance company that works with you to consolidate all your loans into one monthly payment. Qualify for lower rates on your loans to put your payments within your budget and the process to check your rates takes less than three minutes.

Check your rate on student loan refinancing with Splash Financial – won’t affect your credit score.

How to Repay Student Loans

So most borrowers will have six months from the time they graduate, drop-out or drop below half-time enrollment before they have to start repaying their student loans. This is true for anyone with direct subsidized or unsubsidized loans, federal Stafford loans and even some private student loans. There’s no grace period on PLUS loans and the grace period on Federal Perkins loans depends on the school.

How much you pay when you start repayment is the big question mark though. I’ve seen a lot of people just go into that standard repayment option, that repayment plan you’re put in if you don’t pick another plan, and it just destroys them. Trying to pay back $34,700 in student loans on the standard plan will mean monthly payments of $350 every single month for 12 years and that’s on an interest rate of just 3.9% if you can get it.

Let’s look at those seven repayment options, the scenarios when they work the best and then those three questions you need to ask before repaying your student loans. Each of the repayment options has its pros and cons so watch through each before locking down which would be right for you. I’ll also show a side-by-side comparison graph after we look at each plan.

Student Loans Standard Repayment Option

The standard repayment option calculates your loan payments like any other loan based on the balance and the terms. Your loan term, how long you can take to repay, is determined by the loan amount shown here from ten to 30 years. For example if you have between twenty and about forty-thousand in total student loans, you’ll get up to 20 years to repay.

The standard plan is usually going to mean the highest monthly payment but will also save you the most interest because you’ll pay the loan off faster. This option usually works best if you don’t qualify for an income-based repayment plan or you just want to save that money on interest and you can manage the payments.

For each of the repayment options, I’ll use the repayment estimator on studentaid.ed.gov. This calculator will estimate your monthly payments under each of the options depending on your marital status, household size, loan amount and annual income.

For all these payment estimates, I’ll be assuming a married borrower with two kids and a 3.9% interest rate on student loans of $34,722. That’s the average loan balance for someone out of a private, for-profit school. Now your own loan repayment is going to be different here because of your interest rate, marital status and loan amount but this estimator will give you an idea of how the repayment options differ.

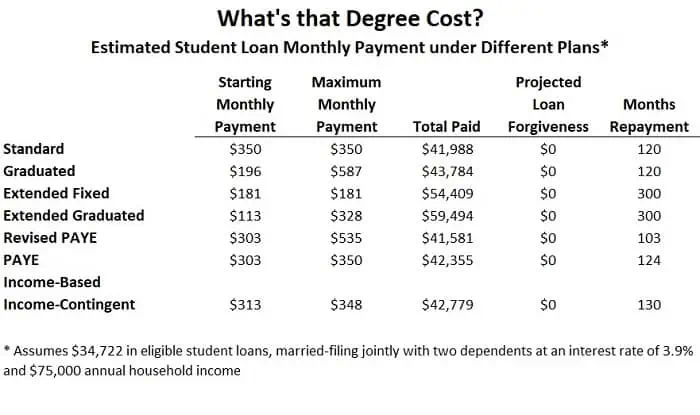

Under the standard repayment plan and our loan amount example, you’d be looking at a payment of $350 a month over 120 months.

Student Loans Graduated Plan Repayment

The graduated plan is similar to the standard but you only have to pay interest on your student loans during the first few years. That’s going to reduce the burden over that first period but will increase your payments later on since the term of the repayment is the same.

The drawback here is that since you’re only paying interest for the first few years, you’ll be paying more total compared to that standard plan. That loan amount you’re not paying off will still accrue interest in those first few years.

The graduated plan might be your best option if your income is too high for some of the income-based plans or if you expect to be making quite a bit in the future and don’t want to be in an income-driven plan but you still want that relief of lower payments for the first few years.

Under this standard graduated repayment option for our example, your payments would start at $196 a month and rise to $587 a month over ten years.

Student Loan Extended Repayment Options

The extended and extended graduated options are the same as the previous two except you get more than that ten years to pay off your loan. So these aren’t necessarily different payment options just more time to repay your loans according to how much you borrowed.

In our example, the extended repayment plan would give us 300 months to repay the loan with a fixed payment of $181 a month. That means we’d end up paying an extra $12,400 in interest above the standard plan but would get those lower payments throughout.

Under the extended graduated repayment plan, monthly payments would start at $113 and rise to $328 a month over the 300 month limit. Here you’d pay an extra $17,500 in interest above the standard.

Income Based Repayment Options for Student Loans

The income-based repayment option is one of the older income plans and has mostly been replaced by the paye and repaye options for benefits. That said, it’s still worth a look because there are some unique differences that might make it a better choice.

There are two classes of IBR plans here. For new borrowers with loans after July 2014, your payment is generally going to be about 10% of your discretionary income. We’ll get to how that’s calculated but it’s basically the amount of your adjusted gross income over a certain percentage of the poverty line. For borrowers paying on loans that were made before July 2014, the payment amount is around 15% of your discretionary income.

Under the income-based repayment plan, you get forgiveness on your unpaid interest over the first three years of enrollment. Since your monthly payments are less than what you’ll owe on interest during those first few years, if it were a normal loan, your loan balance would increase as unpaid interest accumulates. Under the IBR plan, that unpaid interest is wiped out so your loan balance doesn’t increase.

Like the other income-driven payment plans, you might qualify for no payments with the IBR plan. You’ll need to see exactly where your income puts you but it’s based off the federal poverty line for your family size. Your IBR payment is your adjusted gross income, so not your actual income but adjusted for deductions, minus 150% of the poverty line and your payment will never be more than 15% of your adjusted income over that poverty line amount.

I know it’s a lot of numbers but you’ll be able to use payment calculators to see if you qualify and how much your payment will be so don’t worry too much about it here. Just understand the basics of the option and if they apply to you.

The IBR is a good option if you have a very low or no income, so it’s going to give you some breathing room in your budget. The warning here is that if you see a big increase in your income in the future, so maybe you think you’ll start making a lot more at some point, then your payments would go up quite a bit and you might consider some of the other options.

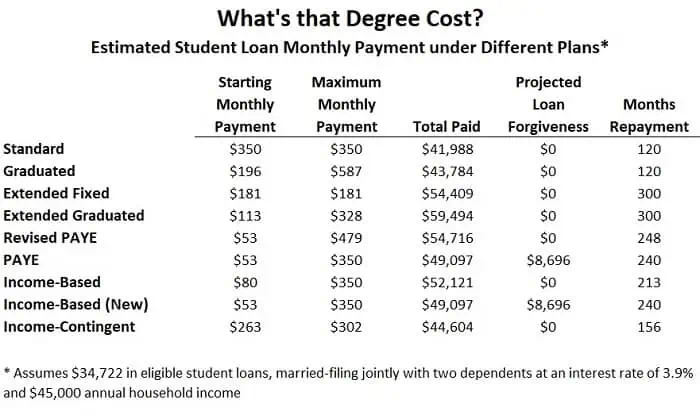

We’re not eligible for the income-based repayment option with that $75,000 annual income but if we drop it down to $45,000 a year we can select the payment plan. This gives us a first payment of $80 and then rising to $350 a month for 213 months or just under 18 years. Payments are more manageable but you do end up paying over $10,100 more in interest compared to the standard repayment option.

For newer borrowers eligible for the income-based repayment plan, our example would mean payments start at $53 a month, rising to that same $350 monthly payment but for 240 months. You would end up paying about $7,100 in additional interest over the standard plan and might be able to get about $8,700 of the loan forgiven.

Pay as You Earn Repayment Options for Student Loans

The pay as you earn repayment option or paye, was created in 2012 and is available to new borrowers that received loans after October 2017 and have some kind of financial hardship that makes their payment lower than on the standard repayment plan.

So with the pay as you earn option, your monthly payment will never be higher than the standard plan but you have to qualify for it by income. Your monthly payment will either be 10% of your discretionary income or the amount you’d pay under the standard plan, whichever is less.

If you start out on the paye option but then your income grows above the threshold, you’ll still technically be on the plan but your payments will be equal to what they would have been on the standard option.

The revised pay as you earn, repaye, is the newest of the income repayment plans, created to address some of those negatives in the paye option. The repaye payment option caps your monthly payment at 10% of discretionary income and provides loan forgiveness after 20 years of payments for undergrads and 25 years for graduate loans. With the repaye option, you don’t have to qualify by income so that’s the biggest benefit with the new plan.

There is one huge negative to the revised paye option for married couples because your spouse’s income is used in calculating the payment. Some of the other income-driven loan repayment options only take into account the borrower’s income if they file taxes individually, even if they’re married. The repaye option uses your spouse’s income whether you file jointly or individually.

One way to choose between the pay as you earn options is the standard pay as you earn plan is better for married borrowers where both have an income and the repaye plan is better for single borrowers. Also some people might not qualify for the standard pay as you earn option so the revised paye would be the only option.

Looking at our example, on the pay as you earn plan at that $75,000 annual income, your first payment would be $303 and slowly build to the $350 monthly payment you’d pay under the standard plan. You’d make end up making 124 payments so not really different from the standard for higher income. Under the revised pay as you earn option, your payments start at the same $303 a month but rise to $535 towards the end of 103 months of payments.

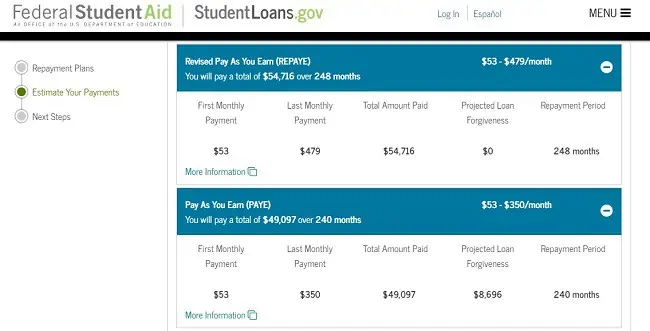

If we change the annual income though to $45,000 a year, this is where the paye and repaye options make more sense. Here your monthly payment would start out at $53 a month and rise to either $350 a month under that pay as you earn plan or $479 a month under the revised pay as you earn. You’d pay the full amount under the repaye plan over 248 months, just over 20 years, but under that pay as you go option, you would pay for 20 years and may be able to get some of the debt forgiven.

Student Loan Income Contingent Payment Plans

The income contingent plan calculates your payment two different ways then gives you the lower of the two. The first method is 20% of your discretionary income, so that’s your adjusted gross income reported on your taxes minus the poverty line for your family size.

For example the poverty level for a family of four is currently $24,600 so if your adjusted income, that’s your income minus deductions, is $35,000 then your discretionary income would be $10,400 and 20% of that would be $2,080 for the year. That means student loan payments of about $173 a month. So an important point here is this method doesn’t take your loan balance into consideration.

The other way your ICR payment is calculated does use your loan balance. It uses an income factor determined by the government so we won’t go into the calculation but you’ll always get the lower payment of the two methods.

Payments under the income contingent plan would start at $313 per month and rise to $348 over 130 months for our $75,000 income example.

On our alternative scenario of $45,000 income, that income-contingent repayment would mean a payment of $263 to start and rising to $302 per month over 156 months. You’d pay more monthly than some of the other plans but still less than the standard plan and would only pay about $2,600 in additional interest.

Student Loan Repayment Options Comparison

Let’s look at a side-by-side comparison of the repayment options for our two income scenarios. You see here with the high-income scenario where we’re making $75,000 a year, a lot of the income-driven options aren’t that much different from the standard plan. You pay the most interest in the extended graduated plan because payments start out lowest and go that full 300 months. Your total repaid amount is actually lower under the revised pay as you earn plan because of those higher payments towards the end of the plan.

So here if your income is fairly high to start with, you might just pick the standard plan. You’ll save on interest compared to most of the options and don’t have to worry about the monthly amount going up. If you expect your income to jump pretty quickly but it’s just kind of low now, you might go with the graduated plan or one of the income-driven options.

The decision is hugely different for lower income households and you might not be able to make payments on the standard plan. Again, you pay the most interest on the extended graduated but the revised pay as you earn and income-based aren’t far behind. If you don’t expect your income to increase very much, you might consider that pay-as-you-earn or the income-based plan for new borrowers to take advantage of the loan forgiveness program.

Make sure you check this on the estimator to see your own payment amounts and if you qualify for the loan forgiveness programs. I really like the income-driven payment plans because you can use some tax tricks to lower your reported income.

If you own your own business, your income is deducted by all your business expenses so you might be able to get reported income low enough to all but eliminate current student loan payments. Understand that if your income really jumps with your business though, you could be looking at much higher loan payments.

I know this is a lot to take in but the decision could save you thousands of dollars. Not only that but it could free up cash to really start focusing on your financial future and keep you from being held back by that debt.

How to Pick a Student Loan Payment Option

Choosing between the options can usually come down to three questions.

First, are you expecting your income to increase and how sure of it are you? Some of those income-driven options get expensive as your income increases but they can give you the breathing room you need in those early years.

Another question is whether you can even afford the payments under the standard plan. This is where I see the most people get in trouble. They don’t spend the time to look at each plan and estimate their payment. They go with that standard plan because, well…it’s just the standard. Then the payments are too much, they have nothing left and even get behind which just sends them into a downward financial spiral.

Finally, is refinancing a better option. We haven’t really talked about it much in this video but getting a lower rate by refinancing can save you thousands on your loan AND make your payments more affordable. I would look through the repayment options to see what you’d be paying and the total amount paid, then check your rate on student loan refinancing to see how it compares.

Check your rate on student loan refinancing with Splash Financial – won’t affect your credit score.

Understanding and comparing the different student loan payment options can free you from the huge burden. Not only can it lower your monthly payments and put the repayment within your budget but you might be able to get some debt forgiven. Don’t forget to check your rates on a student loan refinance too, it could save you even more money. Checking your rate on a student loan refinance won’t affect your credit score and Splash has terms from five- to 15-year repayment plans.