Before you miss that payment, check out this list of things you can’t do with bad credit and get out ahead of your credit problems

Everyone takes their credit score for granted until they need a loan. The simple fact is there are things you just can’t do with bad credit.

The debt-free crowd will tell you it doesn’t matter, that you should strive to pay off all debt and not use borrowed money. It’s easy to think you won’t have to worry about your credit score but it’s not that simple.

I’ve been there. After destroying my credit years ago on a few missed payments. It felt like I was locked out of any important financial decision and there was nothing I could do about it.

It’s not a fun place to be.

Whether you are trying to keep your credit score strong or are already battling back from poor credit, watch for these five hurdles of bad credit.

What is Bad Credit?

I’ve created an infographic below for those five ways bad credit affects your life but first, what is bad credit?

Sometimes it might seem like you have good credit until you ask for a loan. A rejection by the bank or a super-high interest rate might be the first and only sign you see that you have bad credit.

There’s really no definition for bad credit but there are a few points that will determine whether you get the money you need and whether your credit score will start affecting your life in a negative way.

The first point is the difference between what’s called the prime credit score. This is around a 680 FICO score and is the point that banks will start refusing your loan application if you have a lower score.

The reason is because of government and other loan guarantee programs for borrowers with prime credit, or a score above that 680 FICO. These guarantee programs means the bank can sell your loan to investors to get cash for more loans.

So a subprime credit score isn’t necessarily bad credit but it will keep you from getting a loan at traditional banks.

According to FICO, about four-in-ten people have credit scores below that prime cutoff. A lower score is going to mean higher rates on the loans you can get but you should still be able to get reasonable rates from peer to peer loan sites and for car financing.

The path to a truly bad credit score is slippery though and you’ll slide down it from here if you’re not careful.

Once you pass a 600 FICO on the way down, that’s when you really start noticing that your credit score is affecting your life. Many personal loan sites will not approve applications for credit scores below 580 and you may even start getting rejected on rental and employment applications…more about that in the infographic below.

Now one-in-five Americans have a credit score below 600 FICO so don’t feel like you’re alone in your bad credit nightmare. Later on in the article, I’ll show you some tricks to boost your credit score fast and we’ll look at how long it takes to fix bad credit.

But first, let’s look at those five ways bad credit can affect your life.

Check out this infographic of how bad credit can affect your life. Make sure you scroll down further for details and how to improve your credit score fast.

Try Buying a House on Bad Credit

Trying to buy a house on bad credit has become nearly impossible since the housing bubble popped. Traditional banks and mortgage lenders all but cut off credit to sub-prime borrowers after nearly going bankrupt on foreclosures.

The lack of mortgage options for bad credit borrowers got so bad that the Federal Housing Administration (FHA) created a new program for people with poor credit scores. Borrowers with a credit score of 580 or higher on the FICO scale only need to come up with a 3.5% down-payment.

Miss that credit score cutoff though and even the FHA requires a 10% down payment on your loan. The FHA also requires a debt-to-income ratio of less than 43% meaning your monthly debt payments can’t be more than $4.30 for every $10 you make each month.

It’s a good program for bad credit borrowers but there is still a huge problem…it does nothing for the interest rate you get on your bad credit mortgage. Even if you are approved for a mortgage, the bank is going to calculate a rate depending on your credit score.

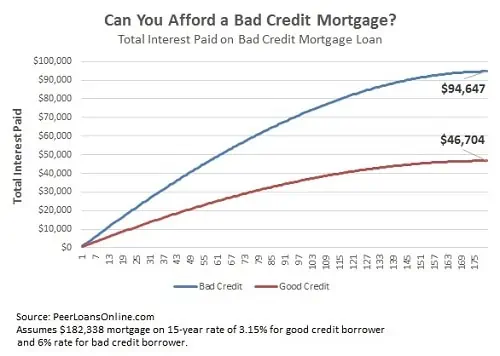

The median home price of $189,000 works out to a loan of $182k if you pay the 3.5% down. The monthly payment for good credit borrowers works out to about $1,424 for a 15-year mortgage at the current 3.15% rate and including mortgage insurance. That monthly payment rockets to $1,691 per month for bad credit borrowers on a 6% rate.

Besides the hundreds extra you’ll pay each month, you’ll pay double the amount in interest over the life of the loan…an extra $47,943 over 15 years.

On top of the higher monthly payment on the interest rate, you’ll have to pay mortgage insurance that can add hundreds a month to your payment on an additional rate of up to 1% your loan amount.

The most likely outcome is that the bank is going to look at the monthly mortgage payment amount, including insurance, and decide that you won’t be able to make payments. Even with the FHA backing, many bad credit borrowers just can’t get a mortgage because of sky-high interest rates.

Potential Landlords Will Check Your Credit

Ever wonder why you need your social security number in applications to rent a house or apartment?

It’s because landlords check your credit before they sign that rental agreement. Besides your credit score, they’re looking for how you pay your bills and how often you miss payments. Most potential landlords won’t come right out and tell you they are checking your credit or say they denied your application because of a bad credit score but it happens all the time.

And because it is impossible to prove that you were denied a lease because of your credit, there is really nothing you can do about it. Property management companies don’t want to take the risk that they will have to chase after tenants for rent so they won’t take a chance on you if your credit history isn’t stellar.

In fact, I’ve heard of landlords denying rental applications and saying it was because of bad credit or other factors when in fact it was because they didn’t want to rent to the tenants in the first place. This is the world we live in. People can use your bad credit problems as a reason to discriminate with absolutely no fear of the law.

Even if you manage to squeak by with less-than-perfect credit and rent a place, you may be required to put down a higher security deposit or even pay more in rent.

Can’t buy a house on bad credit, can’t rent a place…can bad credit make you homeless?

Start improving your credit now with a debt consolidation loan. Get one loan to pay off your high-interest debt. You’ll save on interest payments and start building your credit score.

Click to check your rate on a loan up to $35,000 – won’t affect your credit score.

Want a Good Job? Get Good Credit First

Employers aren’t legally allowed to make a hiring decision on your credit score but they can look at your credit report.

Potential employers are looking through your credit report to get a sense of your financial responsibility. If you’ve missed payments or haven’t followed through on your credit agreements, will you follow through with your responsibilities at work.

Just as with renting a place, most employers won’t come right out and say that they denied you an interview based on your credit report. It leaves them open to too many potential legal problems so instead they will just say they found someone more qualified.

A history of not making payments or bankruptcy can sink your chances especially for management jobs and anything in finance. Even in jobs that you wouldn’t expect to care about your bad credit, employers won’t hire you if they think your money troubles could start causing problems at work.

Dealing with bad credit is just another one of those areas where most people won’t give you any help. Potential employers, landlords and loan officers aren’t going to give you the benefit of the doubt. They don’t know you and only see you as a score.

Getting a Cell Phone Contract with Bad Credit, or Not

Are you starting to see a trend? Basically, any time you go to sign a long-term contract that requires monthly payments, you probably are not going to be able to with bad credit.

The cell phone companies give juicy rebates to retailers like Best Buy and WalMart for those free or discounted phones you get when you sign up for a long-term contract. Verizon doesn’t want to be out the money if you don’t keep up with your monthly payments though so isn’t likely to extend those sweet deals to people with bad credit.

You can still get a pay-as-you go plan with poor credit but get ready to pay hundreds for that new smartphone.

Besides just not giving you the best deal on contracts if you have bad credit, cable and other companies are allowed by the Federal Trade Commission to charge more for what they call risk-based pricing. This is going to be an additional fee they charge because of your credit report. Sprint charges an additional $7.99 on this risk-based pricing and I’ve seen companies charge up to $15 extra a month on this bad credit fee.

Fair? Hell NO! But it’s all completely legal as long as they send you a notice about the additional fee.

Your Bad Credit Will Cost You Higher Insurance Premiums

Insurance companies use a study from the 90s to justify charging more to people with bad credit. Nearly all of auto insurers (95%) and 85% of homeowner insurers use what is called credit-based insurance scoring to determine your premiums.

According to the National Association of Insurance Commissioners (NAIC), insurance companies look at five areas in your credit report to calculate your credit-based insurance score.

- Payment History (40%) – How often you make on-time payments

- Outstanding Debt (30%) – How much debt do you owe

- Credit History (15%) – The length of time you’ve had credit accounts

- New Credit (10%) – Applications for new loans you’ve made recently

- Credit Mix (5%) – The type of credit you owe including mortgages, credit card, car loans

These factors are basically the same as those used to calculate your credit score. Insurers are not allowed to discriminate based on your credit score alone so they’ve found a way around it by saying they look at the factors instead of your FICO score.

Either way, it means you won’t be getting the cheapest premiums on insurance with a sub-prime credit score. Worse still is that you are required by law to carry some types of insurance so you really have no choice but to pay the higher bad credit fees.

As bad as all those financial things you can’t do with bad credit…there’s one more reason to protect your credit score.

Relationships and Bad Credit

Money is the single biggest cause of stress and arguments in a relationship. A survey by SunTrust Bank found that 35% of couples list money as the primary reason they argue.

That’s for all couples in general. Things can get even worse for families where one partner has bad credit. That bad credit score is going to hang like a noose around your neck and will follow you every time you try to get a loan together.

The problem is that most lenders will use an average of your scores when a couple fills out a loan application. Even if your partner has a stellar score of 750 FICO, your score of 550 will drag the average down to 650 FICO and you might not get the loan. That’s a hard blame to bear every time you get into an argument about money.

What to Do with Bad Credit

Having bad credit isn’t the end of the world. We already saw that one-in-five Americans has a credit score below 600 FICO and one-in-twenty people have a disastrous score below 500 FICO.

If you have bad credit, the first thing to do is just be honest about how you got there. You don’t have to confess it to anyone else, just be honest with yourself.

Some common problems that lead to bad credit:

- Overspending

- Not being organized and paying bills on time

- Using payday loans that trap you into a cycle of fees

- Simply not paying your debts, letting them go to collections

Most people with bad credit fall into more than one of these. For me, it was getting in over my head with real estate loans plus overspending.

Simply correcting the problems will help but there are some things you can do to improve your credit faster.

- Pay off high-rate loans – this not only saves you money on interest and gives you a little wiggle room but it also looks better to creditors.

- Keep your balances low on revolving debt – this is credit card debt. It’s called revolving because it has no payoff date or fixed payments. It’s like a revolving door that keeps you in debt and the credit score people hate it.

- Don’t close unused credit cards and don’t open new cards. Changes like this in your credit report scare lenders. You don’t have to close credit cards, just don’t use them.

- Get a copy of your credit reports and dispute any bad remarks on them. Start with any errors but you can even try to get a few legitimate bad marks off your report.

| Peer to Peer Lending Site | P2P Borrower Fees | Minimum Credit Score | Loan Rates | Notes |

|---|---|---|---|---|

| Personal Loans Click to Check Your Rate | 5% | 580 | 9.95% to 36.0% | Three options including P2P Loans, Bank Loans and Personal Loans. |

| BadCreditLoans Click to Check Your Rate | No Fees | 520 | Vary by state | No fees and lowest credit requirements with p2p lenders. |

| Payoff Click to Check Your Rate | 2% to 5% | 660 | 6% to 23% | Specializes in loans to payoff credit cards. Low origination fee and no hidden fees or charges. |

| Upstart Click to Check Your Rate | 0% to 8% | 620 | 5.67% to 35.99% | Best for graduates and no credit peer loans. |

| SoFi Loans Click to Check Your Rate | No Fees | N/A but probably around 680 FICO | 5.99% to 16.49% (fixed rates) 5.74% to 14.6% (variable rates) | Low student loan refinancing rates. |

| Lending Club Click to Check Your Rate | 1% to 5% | 640 | 5.95% to 32% | Best combination of low fees and low rates. |

Bad Credit Problems

Bad credit problems go way beyond just these five things that become more expensive with a low credit score. People look at your credit and they judge you, even if they’re not usually the kind of prejudicial person.

While there’s protections for people against prejudice based on race, ethnicity and sex, there is no law saying you can’t prejudice against people with bad credit. It’s one of the last -isms that traps people and there’s nothing you can do about it.

Really the only thing you can do is to fight back and fix your credit score as fast as possible.

What to Do if You Have Bad Credit

There are some ways to fight back against bad credit. Some work within a month to increase your credit score while others will take a while.

The first thing you need to do is understand why you have bad credit and keep from making it worse. This means taking an honest look at your credit report to see what’s on there including late payments and loans that went to collections.

If you’re having trouble paying the bills, you need to do something to plug the gap fast. The more debts you get behind on, the worse your FICO score will get.

- Sell what you can to pay off debt

- Consider getting a side hustle to make extra money

- Get a debt consolidation loan to pay off the high-rate debt and lower your monthly payments

How Long Does it Take to Fix My Credit?

More than a third (35%) of your credit score depends on the credit history on your report and 15% of your score is from the length of credit history. The fact that these two pieces contribute half of your credit score and can’t be changes means it can take a long time to fix your bad credit.

The good news is that you can change the other 50% of your score by consolidating into non-revolving debt, getting your credit limit increased and removing bad remarks from your report.

If you have bad credit because of very little credit history, you should start building a score within six months of opening your first credit accounts. Since you don’t have bad remarks like missed payments on your report, it won’t take long to build good credit.

Often, someone with very little credit history can get a 700 FICO score within a couple of years if they are using credit and making payments regularly.

Fixing a bad credit score will take longer because you have to wait for those bad marks to come off your report. It doesn’t mean your score won’t increase with some of the fixes we talked about but those missed payments and charge-offs will hold your score back.

Most bad marks clear off your credit report within three to five years so you’ll notice a big change in your credit in a few years. Other marks like bankruptcies can take as many as 10 years to come off your report but I’ve still seen borrowers rebuild to a 700 FICO within five or six years of good credit history.

The good news is that bad credit isn’t forever. Monitoring your credit score and making on time payments can help you improve your score in less than a year and even people with bankruptcies can get approved for some loans within a couple of years. Try not to focus on what you can’t do with bad credit if you’ve already missed a few payments. Do what needs to be done to fix your credit score and get out from the bad credit trap.