Don’t miss your chance to save money on taxes with this year-end tax planning checklist.

The end of the year is approaching, and it’s time to make those last-minute changes to save money on taxes. While tax planning should run throughout the year, there are still some powerful moves you can make in your year-end tax planning to save big come April.

Last Monday, we covered a few year-end tax planning moves in our year-end financial checkup. We covered the decision to itemize your deductions or take the standard deduction and how to spend down the rest of your flex spending accounts. Click through to check out the rest of the checklist to get your finances back on track heading into 2016.

For year-end tax planning specifically, there are three areas where you want to focus—tax planning around your investments, retirement, and your small business.

Year End Tax Planning for your Investments

The market has been flat all year, but a significant drop in August might have produced some losses if you sold stocks before the rebound. If you’ve been thinking about selling some of your stocks that have done well, you might be able to offset some of your taxes with the losses you booked.

The first step is to look at all the stock selling you’ve done over the year. Download the information from your online account or ask your broker for a copy. Reviewing the gains and losses will give you an idea of how much tax you might owe for the year.

If you’re sitting at a loss, you can sell some stocks that have increased and protect those gains from taxes. Remember, you can use a loss of up to $3,000 in investments to offset against regular income, so don’t offset all your losses.

This year-end tax planning should only be part of your long-term investment strategy. If you’re selling a stock to take the loss or gain but still want it as a part of your long-term strategy, you’ll need to invest in a similar company so you don’t miss out on any near-term gains. The IRS says you can’t buy the same stock within 30 days after selling it and still take the capital gain or loss, called wash-sale rules, so you’ll have to wait a month before repurchasing your stocks.

If the tax planning advantage around selling a stock is minimal, it may be easier to keep it instead of incurring trading fees. If you decide to sell a stock but still want exposure to it, find another company that operates in the same industry and has similar fundamentals.

Mutual funds may surprise you at the end of the year, distributing significant capital gains to investors and causing big tax bills. This happens because the fund manager has bought and sold shares all year. This hits two ways you owe taxes on the distributed amount, and shares usually fall by the amount of the distribution.

Donating stock to charity is always a popular year-end tax planning move. Depending on your tax bracket, you can donate up to 30% or 50% of your adjusted gross income. You get to deduct the current value of the shares and avoid paying taxes on the capital gains. It’s only applicable if you itemize your deductions, so check your standard deduction against how many allowed itemized deductions you can take.

Don’t miss The 10 Most Overlooked Tax Deductions

Year End Tax Planning and Retirement Planning

I sound like a broken record on this one, but why are you not getting all the free money you can by maxing out your retirement contributions? You will need money in retirement and need to save anyway. Why not take advantage of employer and government giveaways on the money?

If your employer has a 401k match, invest at least up to the match limit, even if they’re only matching a quarter for every dollar you put in. It’s an instant return on your money. The IRS allows you to contribute up to $18,000 into your 401k though your employer may impose a lower limit.

For your retirement account (IRA), outside of work, you can contribute up to $5,500 or up to $6,500 if you are 50 years or older. You are allowed to contribute to both an employer 401k and your own IRA and can take both contributions off your income.

If you don’t have an IRA, set one up before the end of the year. Scottrade offers a cashback bonus of up to $2,000 for new retirement accounts.

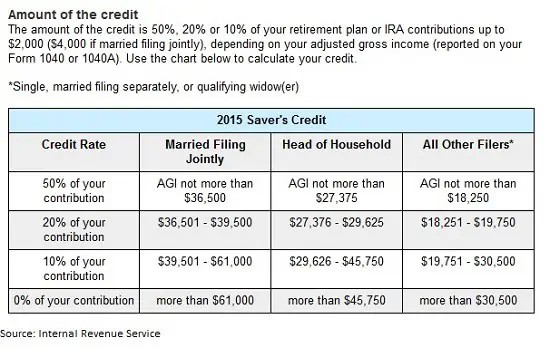

If your adjusted gross income is less than $61,000 (married, filing jointly) or $30,500 for single filers, you can get a tax credit for the amount you contribute to your IRA. The Retirement Savings Contribution Credit may be worth more than $5,000 in tax credits! Since it’s a tax credit instead of just a deduction, it’s worth big money against your taxes.

You’ll need to take your required distribution if you’re older than 70 ½ and have money in a retirement account. You don’t need to take a distribution from a Roth IRA, but just about any other account requires an annual distribution or face a 50% penalty on the amount not withdrawn by year-end.

Year End Tax Planning for Small Businesses

Planning out your sales and expenses for this year and next is a massive part of year-end tax planning for any small business. It’s tough enough being a small business owner, don’t pass up the chance to save thousands on your taxes.

There are two ways to save on the taxes for your business. If you had a good year and will need to pay taxes on sales for 2015, consider making any big purchases before the end of the year to offset your earnings. If you need new equipment or other significant expenses, try paying for them now.

Conversely, if you expect to book higher sales next year, you might consider holding off on those last-minute purchases. Holding as many expenses off until the new year means you can take them against next year’s income.

Even if you don’t consider yourself a business owner, there are year-end tax planning moves that will save you money. Anyone can start their own business and be a sole proprietor without formally creating a corporation. You can take any business expenses off your income taxes, but you must keep receipts. Check out our earlier post on how to make money freelancing to start your small business and enjoy the benefits of deducting expenses.

Easy tools for year-end tax planning with these Free tax calculators and tools!