Use this list of best peer to peer lending sites for investors to break into the new asset class of peer loan investing

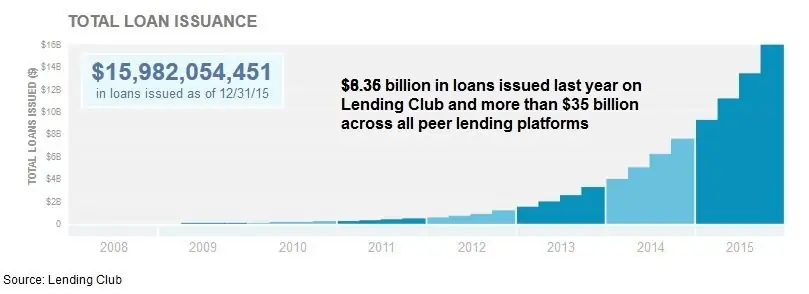

The big news lately in the peer lending industry has been the slowdown in loans but the media has missed the fact that it’s all part of the growth process for the new peer loan asset class. Even at a slower rate, demand for peer loans jumped 91% last year and the best peer to peer lending sites are still posting strong growth.

As the asset class matures and becomes a main street way to reduce risk and increase returns from a stock/bond portfolio, it’s only natural that growth will slow a little. This shouldn’t affect the returns investors see because rates are based on borrower credit and loan factors. In fact, interest rates on loans and investor returns may increase as the Fed raises rates.

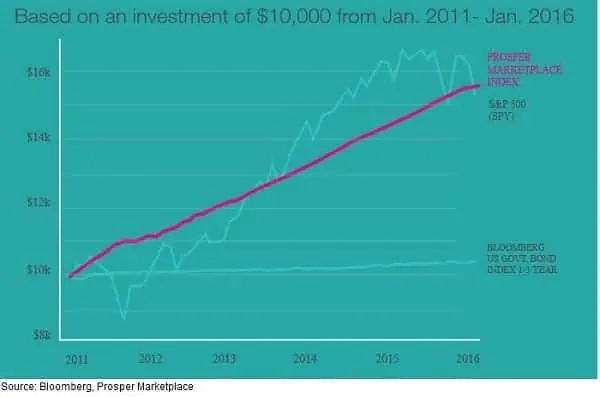

Investor returns on peer to peer lending sites have been strong since 2009 at nearly four-times the return on comparable maturity corporate bonds and even edging out the longer-term return on stocks. I interviewed a peer loan investor last year that has beaten both the stock market and average peer lending returns with an annualized 12% return over the last six years.

The graphic below shows average rates on loans and the average investor returns on the Lending Club platform. While lending to the safest borrowers has returned over 5% annually, even the bad credit borrower loans have returned upwards of 9% after accounting for defaults. But higher returns aren’t the only reason to invest on peer to peer lending sites. Getting the most from this new investment vehicle means understanding your options and picking the best peer lending site for your investing needs.

Why do You Need Peer to Peer Lending as an Investor?

One of the biggest benefits to investing on the peer to peer lending sites is the opportunity to diversify your risk away from stocks. The market crashed more than 50% on two occasions since 2000 and the current bull market is the second longest in history. The correlation of returns between peer loans, stocks and bonds is negligible, meaning investors don’t see a drop in value in both peer loans and other investments at the same time. This will help smooth your losses next time Mr. Market decides to take a tumble.

Defaults on loans may increase if we head into a recession but looking at average borrower statistics and debt statistics provided by the Federal Reserve, loan defaults won’t be anything like we saw in the last recession. Household debt payments as a percentage of disposable income has fallen to just 10%, the lowest on record. Consumers aren’t overextended on their credit and there’s no reason to believe they’ll start defaulting on loans.

If you’re looking for safety and yield from your investments, you won’t find it in bonds. Locking your money up in ten-year bonds will get you just 2.8% annually and five-year bonds are paying nothing after accounting for inflation. Bond prices may start to tumble as the Fed increases interest rates, something that isn’t an issue with shorter-maturity peer loans.

On historically-low interest rates, investors have fled low bond yields to supposedly safe stocks like consumer staples. The sector pays a 2.4% dividend but now trades at 22 times earnings, nearly 16% more expensive compared to the general stock market. If stock prices start to come down, investors will have to reevaluate the idea of safety in consumer staples and the sector could drop quickly.

It’s not to say that there aren’t risks to investing in peer loans. I highlighted the top three investment risks in peer lending in a prior article. Risks include the need to hold a portfolio of 100+ loans for diversification and chasing the higher rate categories. Make sure you understand the risks involved before jumping on one of the peer to peer lending sites below.

Best Peer to Peer Lending Sites for Regular Investors

P2P lending sites for investors can be broken into two groups, one group allows investment by anyone while the other only allows investors with certain income or net worth qualifications. In my opinion, there really isn’t much that separates the best peer lending sites as far as return and portfolio diversification but there are some features that you may prefer on a particular site.

Lending Club is the largest peer to peer network in the world with more than $16 billion loans originated since 2009. The p2p lender issued shares in the stock market in 2014 and has been able to fuel huge growth in its platform. The site charges investors a 1% fee on each payment received, meaning you only pay the fee if a borrower pays their loan. If the loan defaults and goes to a collection agency, Lending Club charges an additional 18% on payments to cover collection fees.

Lending Club requires a minimum credit score of 660 FICO for its loans so borrowers tend to be good credit risks. The peer loan platform makes no sub-prime loans and the average borrower has an average 699 FICO, 16 years of credit history and makes $75,055 per year.

The site offers manual investing where you select criteria for the loans in which you’ll invest and then pick each loan. You can also select the popular robo-investing option where you select criteria for loans and the peer lending site automatically invests your money. I posted a detailed review of Lending Club in a previous article, outlining how to use the platform.

Click here to open an investor account on Lending Club

Prosper also allows anyone to invest in peer loans on its platform. The company was one of the first peer to peer lending sites on the scene, founded in 2005. The p2p platform has originated more than $6 billion in personal loans on three- to five-year terms for up to $35,000 each. Prosper accepts borrowers with a FICO credit score as low as 640 and as low as 600 for repeat borrowers. This may explain why average investor returns are a little higher on Prosper versus other lending sites though loan defaults might be slightly higher as well.

Prosper charges an investor fee of 1% on the remaining loan principal each year. It’s a slightly different way of collecting the fee compared to Lending Club but it works out to approximately the same amount. Prosper also charges an additional fee if the loan goes to a collection agency but doesn’t charge a fee if funds aren’t recovered.

Since 2011, returns on Prosper have matched those for the stock market but at much less volatility. This is one of the most overlooked advantages of investing on a peer to peer lending site, that returns are much smoother. You don’t have to worry about freaking out the next time the market takes a nose-dive.

Best Peer to Peer Lending Sites for Accredited Investors

The other group of peer to peer lending sites restricts investment to only those that qualify under federal rules as accredited investors. An accredited investor is someone with a net worth of at least $1 million, excluding the value of their home, or an income of $200,000 or more over the last two years. The sites limit investment to accredited investors so they don’t have to deal with state regulatory requirements though they still are subject to federal securities regulations.

Upstart is one of the larger peer lending sites for accredited investors with more than $100 million in originations. One unique feature of Upstart is that its credit model favors borrowers with college degrees. Over 90% of borrowers are college graduates and the average borrower has a 692 FICO with $102,584 in annual income.

The platform runs a proprietary credit model which simulates 50,000 scenarios to assign an APR for loans. Besides the traditional loan filters, investors can also choose borrowers by GPA, type of degree and even SAT percentile. The site does not charge an investor fee.

ApplePie Capital is an interesting twist on peer lending, offering franchise business loans on terms between five- to seven-years. The average loan is for just over $400,000 and at 8.6% for 67 months. The average borrower has a debt-to-income ratio of 23% and a 739 FICO score.

The p2p company only makes loans for franchises at approved franchise partner brands. This helps the lender understand the business and specific risks better to assign a rate and model credit risk. The credit model evaluates both the borrower and the business proposal and targets returns between 7% and 12% on loans. I interviewed CEO Denise Thomas in 2014 on the company and its unique lending model to small business franchisees.

Finding the best peer to peer lending sites for investors is a matter of knowing for which ones you qualify and the features available on each. Regular investors will be well-served on either Lending Club or Prosper while accredited investors have a little wider selection on other p2p lending sites. Most peer loan sites offer some form of investing automation and the tax advantages of investing in a retirement account. Be sure to check out our ultimate resource guide of peer to peer online sites for borrowers.