Making ends meet when you just don’t make enough money is frustrating and painful but you can beat it with these tips

The Census tracks household income and reports half of American households make less than $56,000 a year. Talking with a lot of friends and family about budget problems and just being flat broke, I think the estimate is a little high.

Worse still is that estimate for household income is below where it was in 2007 and even where it was almost 20 years ago. Wages haven’t budged in almost two decades…

But you better believe things are getting more expensive.

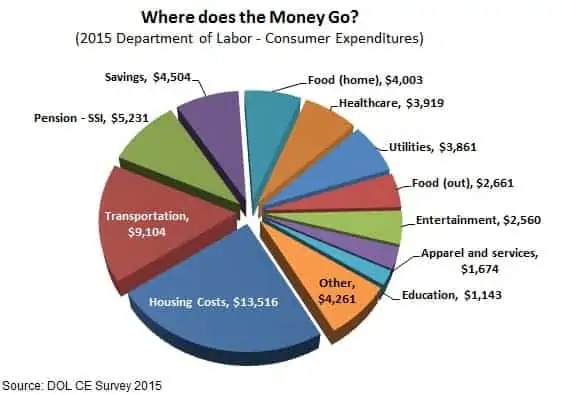

I looked at the consumer spending survey done by the Department of Labor. The average family spends just over $52,000 a year, almost all of total income.

These average numbers for all Americans hide a painful fact for many families. You hear all over that you need to budget and save your money but it’s impossible to budget when you just don’t make enough to cover your bills.

It’s frustrating and seems like there’s nothing you can do.

Don’t give up. There are ways to budget that will surprise you and help you get back on track…and even help you save money for emergencies and invest for the future.

I used some of these budget tricks after a medical emergency caused me to miss a few bills and high interest rates almost forced me into a debt trap. I was able to get back on my feet and create a budget even though I didn’t know where the money was going to come from.

Follow these steps to budget even when you’re broke and you’ll be back on track in no time.

Why are You Broke?

First you have to understand why you don’t have enough money. It’s ok to be broke. It’s not ok to lie to yourself and deny why you never have enough money.

Be honest with yourself. Understanding why you’re broke is important and will mean a big difference in how you budget your way out of it.

Did you have a one-time financial emergency? Did you lose your job, go through a divorce or have a medical emergency that set you back?

These one-time financial crises are tough but you can work through them. The most important thing is to take control as quickly as possible and not fall deep into a debt trap. Getting caught with high-interest loans or destroying your credit because of a financial emergency can cause it to be a life-long problem.

If it wasn’t a financial emergency, do you just not make enough money to cover your bills. It happens to a lot of people. Even two people making $12 an hour are bringing home less than $40,000 a year and we already saw how most families spend way more than that just to make ends meet.

If this is the problem, then it will mean taking a hard look at your expenses and a little budget magic to turn things around.

Get Started Facing your Budgeting Problems

Understanding where you’re starting from in your budget and why you don’t have enough money will give you more control of the situation. You know where your starting point is and what you need to do to win the race.

First off, stay positive. I know it sounds like cheesy advice that really doesn’t help but it’s true. I’ve been there and beaten my financial problems. You can get through it and the only thing that can beat you is giving up. Give up and you’ll get sucked into a debt trap that will only get worse.

Negativity is tough. It will weigh on you like a ton of bricks and it will seem easier just to give up and walk away from your problems.

You can beat it. Staying positive through something like this not only means a better financial situation but you’ll be a stronger person, ready to face anything in the future.

Make a budget plan. If your money troubles are from a one-time emergency then you just need to figure out how to get out and then start saving enough for an emergency fund.

Consider getting a debt consolidation loan to put everything together. It may seem backwards taking out another loan to get out of debt but it works. I did it and lowered my monthly payments by $50 and saved thousands on interest.

By taking out one large loan to pay off all your high-interest loans, you save on interest and give yourself a little breathing room with payments. You don’t have to worry about missing one of your payments because it’s just one check a month instead of many. Most peer lending websites will let you check your rate without hurting your credit score.

Check your rate on a loan up to $35,000 – instant approval

Whatever you do, don’t go to payday loan or cash advance stores. The $15 fee per $100 borrowed may not seem like much but it’s actually as high as 500% annual interest. The payday lender is hoping you have to take out another loan in two weeks and pay more fees…pretty much forever. This kind of debt trap will turn your one-time financial emergency into a lifetime of poverty.

If you just don’t make enough money to cover your bills, it’s time to use a little budget magic.

- My favorite budget trick is turning your budget upside-down. Instead of taking expenses out of your income first, plan on saving a $100 out of each check or each month. Saving $100 is a bare minimum so try to work up to at least a few hundred if you can. Then take your expenses out of the remaining income. If you don’t have enough then it forces you to cut expenses instead of not saving any money. This method will make sure you have something saved when a financial emergency hits and you won’t be scrambling to cover regular bills.

- If you can’t figure out which expenses to cut, try listing them out by importance and need. Don’t list out the monthly cost. When I did this, I found a lot of monthly expenses that were not that important to me but I was still paying for them because they were just a few bucks a month. Understanding what you have to pay and what expenses are just optional will help find places to cut.

- Try a monthly spending challenge! These are month-long challenges where you cut something out of your spending…or cut a lot of things. I know people that like to cut all optional spending out for a month but I like smaller challenges like just cutting one thing. Plan on doing this when your cable contract comes up for renewal. Cut your subscription for a month. You’ll save a lot of money and the cable company will usually come back with a great deal to get you back.

Sometimes it’s tough cutting entire expenses so check out this list of 20 money saving tips that save $7,500 a year but cutting back instead of cutting out entirely.

Why You Should Maintain a Budget

Having a fixed budget is one of the best things you can do when it comes to money management. It is a good thing because it will help you to decide how much budget needs to be allotted for every category or expense in your household.

By having a set amount that you spend on certain categories, such as groceries and entertainment, for instance, you will be able to save more money and have some left over even if something unexpected happens. This shows that maintaining a budget can really help out your finances in the long term–no matter what age range you are currently in.

If people were not aware about budgeting, they might have ended up spending too much on unnecessary things while thinking that their expenses are just regular monthly bills. But by setting aside an allocated amount for each category every month, you will be able to stick with your budget and not go over the allotted amount.

When it comes to budgeting, people usually think that it is a really tedious thing to do. But actually, all it takes are some worksheets or spreadsheets — or better yet, apps and then you can easily keep track of how much money is left in your pocket at the end of every week. Through this app or spreadsheet work that most people prefer nowadays, they would also know whether their expenses have exceeded their income limit or not. If there was an excess from the income compared to the expense, they could put this money into savings so that it would become another investment for them.

Quick Ideas to Make More Money

It’s tough to budget and find expenses to cut when you’re living on the basic needs. For a lot of people, the only solution is just to make more money. You might not be able to walk into the boss’ office and ask for a raise (and would 2% really mean enough money anyway?) so the real solution is to get a side-hustle.

I started freelancing and making money online nearly a decade ago. It was slow going but so worth it and I’ve turned it into a full-time, work from home job. I love it and make more money now than I ever did at a 9-to-5 job.

I’ve got a whole blog about making money from home and it’s really too big an idea to do it justice in a paragraph or two. You might be surprised at all the different ideas you can make money on and you don’t have to work a part-time job each week to do it.

The Work from Home blog offers all kinds of ideas on ways to make extra money so your budget isn’t so stretched. If you want the complete process of how I turned my websites into a $5,000 a month income stream, check out my new book Make Money Blogging: 9 Proven Strategies to Make Money Online.

Budgeting when you don’t make enough money in the first place can be frustrating and many people put it off all-together. Ignoring your money trouble won’t make them go away and you’ll probably just find yourself in deeper debt. Spend a couple of minutes understanding why you’re broke and some possible solutions and you might find that budgeting your way out of it isn’t so hard after all.

Read the Entire How to Budget Series

- How to Create a Family Budget [How to Get EVERYONE Involved]

- Budgeting Help and Tips I Used to Save $54K in Interest

- The Un-Budgeting System that Makes Budgeting Easy

- 5 Budget Tricks You Won’t Believe Actually Work

- Easy Budget Strategies to Fix 3 Financial Problems You Didn’t Know You Had