Learn how to do your own debt reduction program to save thousands and avoid the risks in debt relief

When you’re at your lowest and need help, that’s when the predators come.

It’s so easy to get into debt, like soul-crushing debt. I’ve been there and the average American household owes more than $50,000 in debt, not including mortgages.

When you absolutely can’t make your monthly debt payments, debt reduction services can sound like a great option.

Why not? Who doesn’t want to get some of their debt wiped clean? I’ve seen debt relief websites advertise clients that only had to pay $1,000 on a $10,000 debt…of course, that’s not including the fees owed to the debt service.

Professional debt reduction services come with some very high costs and even higher risks. Most of these risks, you won’t be able to see until you’ve already committed to the service.

Fortunately, you can have it both ways. You can reduce your debt without paying the high fees for debt relief and you can avoid the risks that will ruin your financial life.

Here’s how…

What Do Debt Reduction Services Do?

First, let’s look at what debt reduction services do to understand better how it can help you get out from under your debt and how you can do it yourself.

Debt reduction services are one-part credit counseling and one-part debt negotiators. Most services start with a phone interview where you lay out all your finances. The debt service will pull your credit report and you’ll look at everything together.

Your debt counselor is then going to help you make a debt reduction plan.

- You’ll create a budget to see exactly where your money is going and how much you can afford to pay on debt each month

- If you cannot afford your current debt payments then you will figure out exactly how much you can afford

- Using this amount, your debt counselor will determine how much debt you can pay off in five years

The goal will then be to get your debt reduced to this five-year amount. That might include a combination of consolidating some debt for lower rates and lower payments as well as trying to negotiate some of the debt with creditors.

So you see, there’s really nothing here in the debt reduction process that you can’t do yourself.

Why Debt Relief Services are a Rip-off

A lot of people are intimidated by some of the steps in the debt reduction process and figure it would just be easier to have someone else do it.

It ends up costing them thousands of dollars and, a lot of times, they’re in no better shape than when they started.

There’s a reason why debt relief companies have a reputation as scams. It’s because even some of the legit debt reduction services cost more than they’re worth and have all kinds of built-in traps to the process.

- Fees for debt relief are extremely high, easily costing a third of your debt

- Most debt reduction services will tell you to stop paying your bills. This gives them leverage to negotiate with creditors but puts you in the hot seat. Your credit score is going to be even worse than it already is and will take years to rebuild.

- The penalties adding up while the company is negotiating with creditors will eat into any savings from debt relief and there’s no guarantee you’ll get debt reduced.

- Debt reduction services take a minimum of three years and often five years or more. You’ll be locked out of getting any more loans in that time and it will be many more years before your credit score rebounds.

How Much Do Debt Reduction Services Cost?

Debt reduction services are required to be open and honest about their fees but that doesn’t mean they make it easy to understand. A lot of these fee disclosures come at you a mile-a-minute or in very small print on forms.

- You’ll pay between 2% to 5% of your total debt as a fee or an even larger percentage of any debt negotiated.

- The debt service will set up an account into which you’ll make payments, even before your debt is negotiated. This account usually charges a fee of between $15 to $50 monthly.

- If you’re ever late on a payment, fees are generally between $15 and $35 and may include a percentage fee of your payment.

- If you’re able to make it through the debt relief process, there’s usually a closing fee as well.

Remember, debt reduction can often take up to five years so that’s a long time and a lot of opportunities to rack up late fees and other penalties. Just the monthly fee alone can add up to a few thousand dollars.

Shown to you individually, these fees don’t seem like too much but it’s overwhelming when you look at the total cost. Debt reduction fees can easily amount to 30% of your total debt, or about $3,000 for every $10,000 in debt.

How to Get Free Debt Reduction Services by Doing It Yourself

Knowing how much debt relief costs and some of the other pitfalls, you can see why it’s smart to take control with a do-it-yourself solution.

And there is no reason why anyone cannot manage their own debt reduction program.

1) Download your free credit reports or get your TransUnion report

You first need to know what’s on your credit reports. Not only will we be working to reduce your debt with this process but we’re also going to work to increase your credit score at the same time.

Increasing your credit score can be just as important as debt relief because a higher FICO means lower interest rates. That will make it easier to consolidate debt and lower your payments.

We’ll be using these 5 Credit Score Hacks to boost your credit score fast so click through to watch the video and get started.

Get your free credit report and score with 24/7 access from TransUnion

2) List out your debts, monthly payments and interest rates

Take a hard look at your budget and try finding a little extra money to make your payments. We’ll look at debt consolidation next to get your payments under control but it all starts with a little spending discipline.

List your debt in order of interest rate, from highest to lowest. If you can find any extra money in your budget, you’ll want to make extra payments to the debts highest on your list. This is called the Snowball Method of debt repayment and it will save you thousands in interest charges.

3) Consolidate your debt to lower your payments

A debt consolidation loan is one of my favorite debt relief tools and I used it myself after destroying my credit in 2008.

A consolidation loan means you take out one large loan to pay off your smaller debts. Rates on personal loans vary from 7% to 36% so you’ll need to check your rate to see which loans you should consolidate.

You usually won’t consolidate your mortgage or student loans but paying off those high-interest credit cards are a great start to getting your debt under control. I’ve created a debt payoff calculator to help you estimate how much money a consolidation loan will save you.

Not only will a consolidation loan lower your monthly payments and save money on interest but it’s also part of our credit score rebuilding plan. Lenders hate credit card debt and it’s the worst for your score. Paying off this revolving-debt will instantly start increasing your credit score.

Check your rate on a consolidation loan up to $35,000 – instant approval

4) Debt negotiation as a last resort

If you still cannot make your monthly payments even after looking at a consolidation loan then it might be time to consider debt negotiation. It might seem like a great idea to get some of your debt wiped clean but this process comes with a lot of risk, even if you do it yourself.

Go back to your budget and determine how much you can afford to pay each month on debt. Then call each creditor and tell them you are not able to make your monthly payments.

Most creditors will offer some kind of extended payment plan rather than reducing your debt. I know you would rather reduce your debt but this might be the best option to keep from ruining your credit score.

If you can go on an extended repayment plan while rebuilding your credit score with some of the hacks I talked about in the video, it won’t be more than a year before you can get cheaper rates on a consolidation loan.

If you’re decided in reducing your debt and creditors will not agree to it, you may have to go the nuclear option. This means you stop making monthly payments on your debt until creditors agree to reduce the amount and accept a new payment plan.

This is going to absolutely ruin your credit score but it might be worth it if you can get several creditors to reduce your amount owed. It will take between three to six months to convince them you are serious about negotiating so be prepared for the calls from collection agencies.

Negotiating your debt like this is still better than filing bankruptcy and you can rebuild your credit score within five years.

It’s extremely important that you get all agreements in writing. You can negotiate and come to an agreement over the phone but you need a signed letter from each creditor before starting the payment plan.

How to Negotiate Credit Card Debt for Less

The general process above for negotiating your debt reduction will work but I wanted to share a few specific tips for negotiating credit card debt.

- Don’t just negotiate for a reduced amount. Getting a lower interest rate, even if it’s only for a year can save you thousands and lower your monthly payments.

- Be flexible and truly try to work with your creditors to come to a fair agreement but be tough and let them know you are talking to all your creditors.

- Get a mailing address for debt workout programs at the creditor and send letters as well. Many phone service reps won’t have the authority to negotiate but the person in charge of reading letters will be able to resolve the matter.

- Reducing your debt doesn’t happen overnight. You will likely need to make several phone calls and mail several letters over at least three months to come to an agreement.

This debt reduction example letter will get you started. Fill out some of the details and how much you are able to pay each creditor. The amount you have available will determine how much you can pay but try offering at least 65% of what you owe on the account.

Your creditors may come back with a counter-offer or may just ignore it completely. If a counter-offer is made, you can accept it or make another offer. You may have to call and write several times before they are willing to negotiate.

How Does a Debt Relief Program Affect Your Credit?

Using a debt relief program can affect your credit score in both good and bad ways.

If you are able to start making on-time payments to your creditors or get some debt reduced, that’s great. Building a good credit history through monthly payments is the best way to increase your credit score. Owing less debt will also positively affect your FICO score.

If you are forced to play hard-ball with your creditors and stop making payments, that’s going to ruin your credit score. Just one missed payment can reduce your FICO by as much as 50 points and the longer it goes, the worse it is for your credit.

This might not be such a big deal if you already have bad credit so the prospect of a lower score while saving thousands on debt reduction might be a good thing. If you’ve already missed payments or let some debts go to collections, then you might as well try reducing your debt and negotiating.

It’s going to take a few years to rebuild your credit score after a debt workout program so it’s important to plan ahead. If you can go a few years without needing another loan, you can focus on increasing your score and get a lower rate.

Debt Reduction Services Websites

I hope it’s clear just how easy it is to do your own debt reduction plan. If you have any questions, just ask them in the comments below.

That said, I know there will be people that just want a little professional help reducing their debt. That’s fine as long as you know the costs and potential problems. I just want you to know that finding a debt reduction company should be your absolute last resort.

I’ve reviewed some debt relief services below but your first step should be to call your State Attorney General or visit their website to find out if there have been any complaints about debt reduction companies in your area. You can also call your local consumer protection agency.

Accredited Debt Relief is one of the most popular debt relief services because they offer several different options including credit counseling, debt consolidation, debt settlement and bankruptcy services.

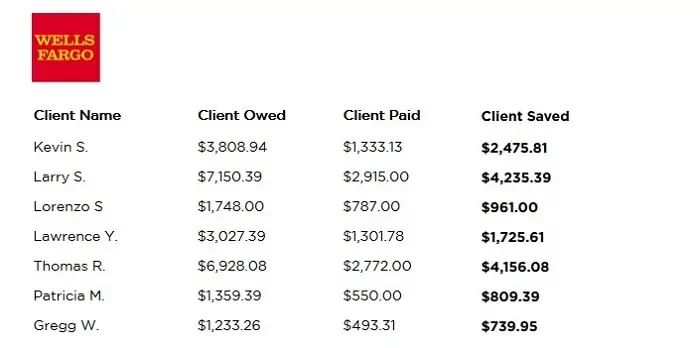

There is no advance fee for their services and they have an A+ rating with the Better Business Bureau. Over 20 years of settling debts, they’ve worked with every major lender including Wells Fargo, Bank of America and Sears.

Lexington Law is another well-known company in debt reduction and credit repair, and one I recently reviewed in more detail. With over seven million negative items removed from credit reports since 2016 and 24 years in business, it’s more of a credit repair company but also offers other debt relief services.

Compared to debt reduction services, Lexington Law is much less costly and will help improve your credit score rather than destroy it. Increase your score just a few dozen points and you’ll be able to get a consolidation loan at a much lower interest rate and you won’t have to wait months negotiating with creditors.

It’s easy to get buried under a mountain of debt and sometimes debt reduction services are the only option left. Understand that you have choices and can save thousands by negotiating with creditors directly. Learn how debt relief services work and what you can do to put your finances back on track.