A LendingTree survey of more than 2,000 Americans found a pretty pessimistic view for 2016 but home buying may just be the bright spot

Online mortgage leader Lending Tree completed an annual New Year’s Resolutions survey among Americans age 25 and up. Most people reported a pretty dire hindsight on 2015 and the outlook didn’t improve much when asked about 2016. The one bright spot was the 2016 home buying market with demand looking to overcome supply.

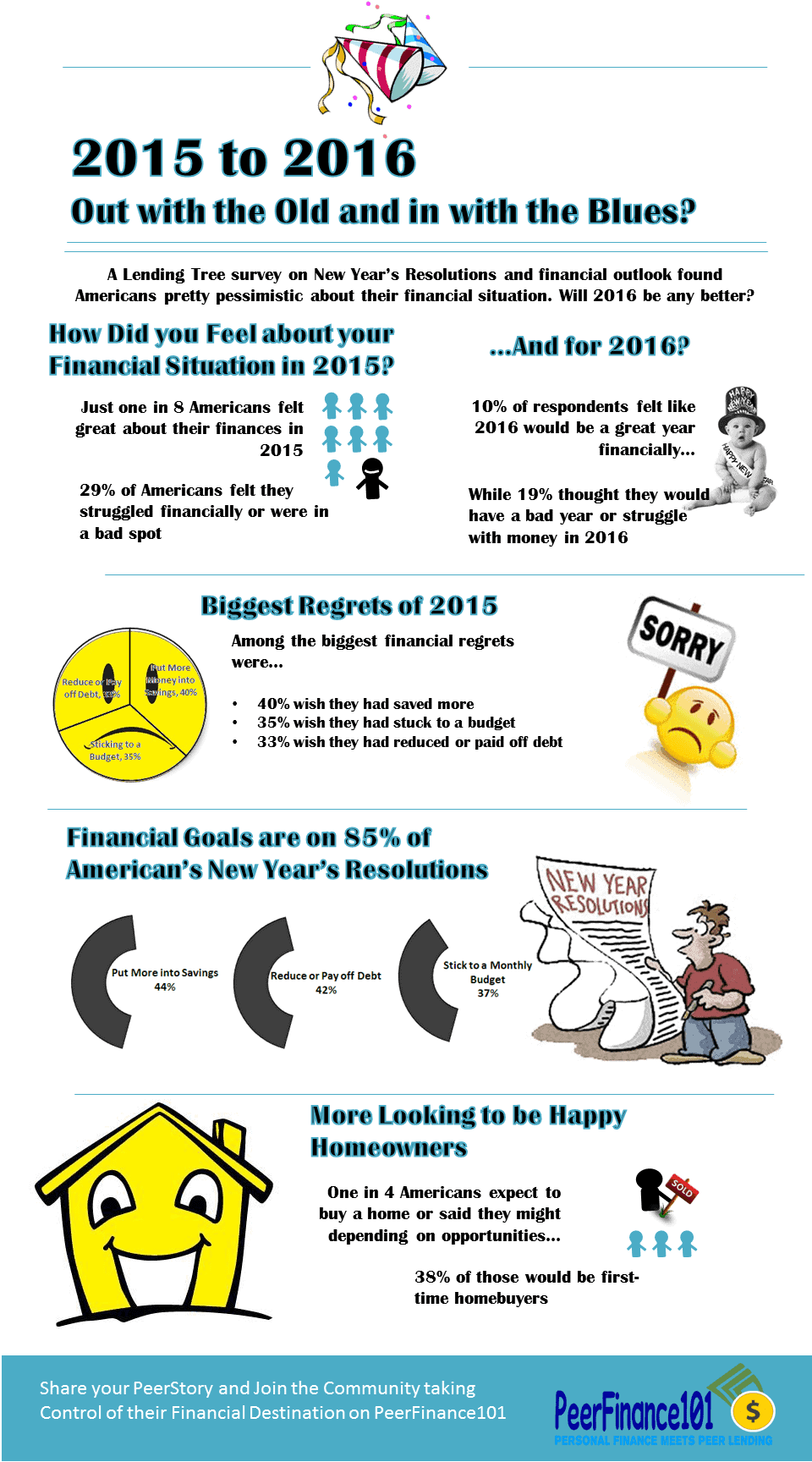

Check out the infographic for some of the highlights and scroll down for more detail on Americans’ 2015 financial regrets and 2016 financial resolutions.

Feel free to share the infographic on your blog with attribution and a link back to this page.

Not much to be cheerful for as we ring in the New Year

Most people didn’t feel too jolly about how their finances worked out last year with nearly 30% claiming that they struggled financially or were in a bad spot. Just 12.6% of Americans felt great about their finances over the year.

Regrets weren’t hard to come by among respondents with close to half (40%) sorry they didn’t put more money into savings. Another third of Americans wished they had stuck to a budget or made a little progress on their debt.

Are people really this pessimistic? I would count myself among the few that feel great about their finances. I don’t have everything I want but I’ve seen the alternative and am super-glad for what I’ve got. Rather than regrets, I’m most thankful that I put myself on a path to enjoy life and to enjoy the job I do every day. It wasn’t always easy or fun working through my 12 steps to financial freedom but I no longer spend my days dreaming about early retirement or longing for some future happiness.

Millennials are a Gloomy Lot

Among Americans between 24 and 34 years of age, hindsight was even more dismal than the overall population. Just 6% of millennials felt great about their finances and 17% thought they were in a bad spot financially.

Millennials looked back on the year with more regrets as well. The majority (57.8%) said they regretted not putting more in savings while half wished they had followed a budget and 43% wished they had paid off more debt.

Is it just that millennials are still in that hard-charging stage of their life where they want to take on the world and anything less than global domination is a disappointment? I remember when I was starting out (Ok, so it wasn’t that long ago) and can remember a few New Year’s moping over missed goals.

Is 2016 to Bring Financial Doom and Gloom?

If you thought the gloom looking back on 2015 was bad, it’s about to get worse according to a great many respondents. Just 10% thought it would be a great year financially while 19% looked into their crystal balls to see a bad or very bad 2016.

Financial goals topped the list of resolutions, on 85% of American’s New Year’s list of things to accomplish. Putting more money in savings topped the list but was closely followed by paying down debt and sticking to a budget.

Looking at the stock market over the first week of 2016 and I get the feeling many of the gloom-and-doom crew might not be far off. Slowing economic growth in China is threatening to pull the rug out from under the global economy and rising interest rates here in the United States won’t help.

Times like this, it becomes increasingly necessary to have more than one source of income. Starting up your hobby-job or investing for passive income will not only help meet your long-term financial goals but will help diversify your income risk.

2016 Home Buying Promises to be the One Bright Spot

In all the pessimism and regret, home buying may actually be an economic bright spot in 2016. One in four people said they expected to buy a home or might buy one depending on their financial situation. More than a third (38%) of these would-be home buyers will be buying for the first time, bringing needed demand to a still recovering housing market.

Contrast the potential for higher home buying demand with the fact that just one in five people (19%) said they expected to sell or might sell their home in 2016. Home prices could continue their multi-year trend higher if more people turn out looking for homes than there are homes available for sale. Against a struggling stock market and higher interest rates, a healthy housing market will be a needed driver for the economy.

While higher interest rates might make home buying marginally more expensive, higher borrowing costs could be the incentive needed to keep people from waiting to come back to the housing market. With the rest of the economy stumbling, I doubt that rates will go up so dramatically as to make home loans unaffordable. Rates are still at historic lows with the 30-year conventional mortgage around 4% and credit standards loosening among lenders.

Compare offers from up to 5 Lenders at LendingTree.com.

The Lending Tree 2016 New Year’s Financial Resolutions Survey was conducted online among U.S. respondents between December 14th and 17th and surveyed 2,008 Americans age 25 and up. LendingTree is one of the largest online loan matching services, helping connect borrowers and lenders for home loans, auto and personal loans. LendingTree doesn’t make loans itself but acts as the virtual marketplace to help you get the best rate as lenders compete for your loan.