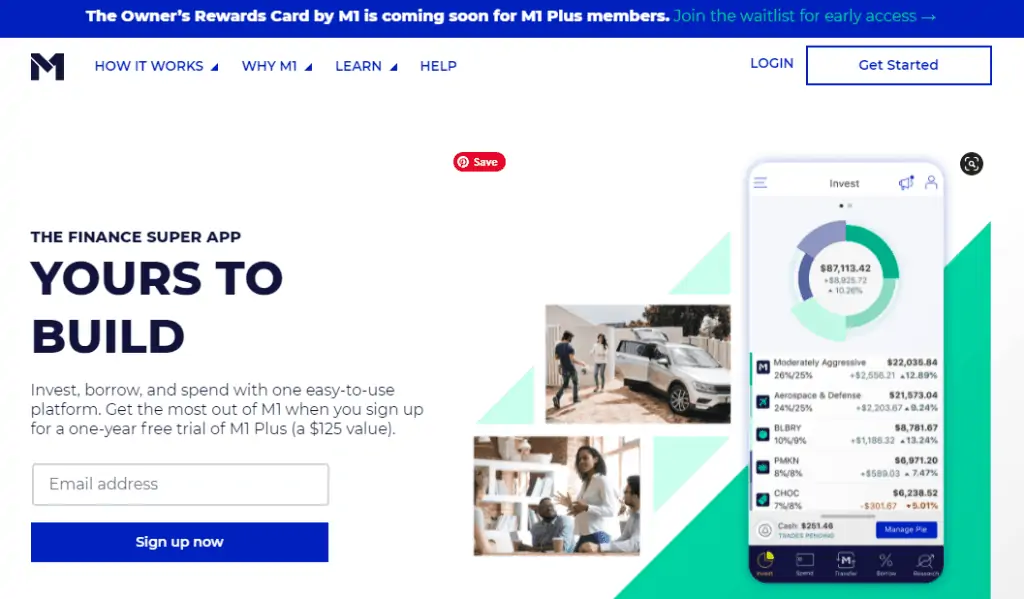

Start tracking your online portfolio using this free investing platform with no minimum deposit. This M1 Finance review will give you an overview about this super app.

M1 Finance is an online, automated investing platform that seeks to provide users with a simple method of setting up their own accounts. More about my experience using this platform in this M1 Finance review.

The best way for me to describe M1 finance would be to compare it with other similar services, because the fact is that there are tons out there nowadays. It has grown in popularity due to its ease of use and allowance of free investing with no minimum deposit needed. There are also M1 Finance alternatives you can choose from if you’re not happy with this broker’s offering, but before we go ahead, I’m going to cover some general information about what exactly is M1 Finance.

M1 Finance Review – Overview

Basically, M1 Finance aims to make managing your portfolio as easy as possible by allowing you to view all of your accounts and investments in one place. You can customize your profile, choose from a variety of different investing tracks, and compare your progress over time.

M1 Finance is not as well-known as other brokers out there, but it does have an interesting history behind it that you may be interested to know about if you plan on using its service. M1 Finance was started by a group called Betterment LLC back in 2010 with the goal of providing everyday investors access to products they would usually find only among high-cost financial institutions such as hedge funds or private equity companies. In other words, they wanted to democratize finance by making it affordable for almost anyone who desired this type of platform to use it – which brings us back to M1 Finance.

For a start, there is no minimum amount needed for you to open an account or make any trades. This means that it’s free to get started, and you can begin building your portfolio right away after signing up. Accounts are also automatically enrolled in reinvesting, which means that you don’t have to manually invest every time you make a trade – a feature that can be considered both a pro and a con depending on the type of investor you are.

M1 Finance Review – Security Features

As far as security goes it’s great because your information is held behind layers of firewalls and protected servers with multiple layers of network security systems. Your data is completely safe from external threats since everything runs through a secure connection.

You also have a great deal of control over your account, because it uses a system where you can decide exactly when and how you want to invest. Spending limits allow you to restrict the amount of money that an individual may withdraw in a single day, which means that there is less chance for someone to deceive or hack into your security information.

M1 Finance Customer Support Experience

Another aspect I liked about M1 Finance was their customer service department, because all it took was one phone call to get my questions answered quickly and efficiently.

The reps were courteous and professional, and they seemed happy to help me set up my trading accounts with ease. They provided clear instructions on to make trades online, but I did not like how they use a system where you have to press one key several times in order to find out the information you need.

M1 Finance Review – User Experience

I use M1 Finance for my dividend stocks and I liked that it offered such an easy way of tracking your portfolio, but there were some things about it that I didn’t like. For example, its website can be somehow confusing because it takes forever just to get from one page to another. It also can be difficult to read and understand important information when everything is displayed in tiny text and mixed up with other useless data.

When it comes down to it it’s just the interface that makes it quite uneasy to navigate, but I believe it can improve over time. It also doesn’t provide enough helpful tools for beginner investors who don’t know how to manage their own accounts properly. That being said though, if you are looking for a way to track all of your investments in one place, then this might be worth taking a look at as long as you feel comfortable navigating through its website.

What are Ways to Invest with M1 Finance?

M1 Finance lets you make trades in a variety of ways, which include:

- Buying and selling stocks individually or through a watchlist.

- Creating a custom portfolio made up of ETFs, individual stocks, bonds and REITs from different companies around the world.

Advantages of M1 Finance:

- Customers can purchase fractional shares

- Dividend reinvesting is automatic for accounts enrolled in the service

- Unlimited free trades if you sign up for $100,000 minimum account size

Disadvantages of M1 Finance:

- Its interface is cluttered and confusing to navigate

- Doesn’t provide enough helpful tools for beginner investors who don’t know how to manage their own portfolios

Is M1 Finance Reliable and Trustworthy?

M1 Finance is reliable and trustworthy, because all of its transactions are handled securely using the latest technology available.

Since it was established in 2014, they have processed nearly $2 billion worth of trades for their customers at a low cost. So far there haven’t been any major issues regarding security or privacy that would raise red flags to make people question its reliability as an investment trading platform.

In conclusion, M1 Finance is not as well known among investors as other brokers out there but it can be useful to consider if you want to save money while also having access to high-quality products that usually only big financial institutions have. Its security features are some of the bests around so your information will always remain private no matter what.

I recommend M1 Finance because it keeps my investments on track, they are improving as time goes by and listen to users’ feedback. And the best thing for me about it is that we can purchase fractional shares seamlessly.

Read the Entire Investing Series

- What is the Right Age to Start Investing in Stocks?

- BlockFi Review: Investing in Cryptocurrency the Right Way

- How to Get Rich in a Year: 7 Things Worth Investing Your Time

- Cryptocurrency Risks: The Do’s and Don’ts in Cryptocurrency Investing

- Fundrise Review: How It Boosts Your Real Estate Investing Opportunities