Level up your investing strategies with ideas you will get from this Motley Fool review.

There are so many investing myths out there that it’s hard to keep track. But don’t worry! By learning the truth about stocks and making your own decisions, you can beat any goals in this game of finance. This Motley Fool review will give you eye-opening ideas that will help you get started with what has been holding back growth financially.

What Is the Motley Fool Stock Advisor Program?

Motley Fool is a website dedicated to giving financial advice and information. Since it started in 1994, they have grown from zero subscribers to over one million as of 2013. They pride themselves on the simplicity of the advice and ease-of-understanding that they provide their customers.

One aspect of their company is their stock analysis program, which has been reviewed by many different sources including Kiplinger’s Personal Finance Magazine, Forbes, The New York Times, and CNN Business. It has also been featured several times on The Oprah Winfrey Show for good reason: It works.

The company offers two options for this service: You can either sign up for an individual or a family package. Even though the prices may seem high compared to other options, it is well worth the money. It can easily help you determine what stocks are good investments and has several interesting features that even seasoned investors may find helpful.

Some of these features include an online day trading game, which allows you to apply your knowledge in a virtual world, daily market review videos, and the ability to download data, which makes stock comparisons easier than ever before.

This analysis program does come with a price: $14.95 (individual) or $24.95 (family). However, there is always a free trial option available for new customers so they can test out the service and see if it fits their needs.

Overview of The Motley Fool’s Performance

When the company started out in 1994, they had zero subscribers. Even though it was not initially popular, The Motley Fool’s commitment to providing easy-to-understand information allowed them to garner one million subscribers by 2013. Their service has also been featured on Oprah Winfrey several times for its ability to help people make wise investment decisions.

The service also works very well for experienced investors who want to make comparisons of companies and market trends. One feature that seasoned investors may find helpful is the ability to download data, which can help them compare different stocks without performing complicated online searches.

This program does come with a high price tag when compared to other options; however, if you sign up for the free trial, you can test out all of its features before paying the subscription fee. This makes it an ideal option for anyone who wants more information on what type of investments are best for their financial situation.

Who Should Subscribe to The Motley Fool Stock Advisor?

The service is ideal for anyone who wants help making wise investment decisions. Since the company’s mission statement involves keeping things simple, it makes sense that they have gained one million subscribers by being uncomplicated in their approach.

For those who are looking to test out this program before subscribing, there is always a free trial option available where you can try out all of the features without paying anything.

Who Should Not Subscribe to The Motley Fool Stock Advisor?

Since this service offers so much information on how to make good investment choices, it might not be appropriate if you want something more simplistic or less expensive – especially when there are other options with lower price tags. However, most people say that these cheaper services do not live up to the hype, so it might be worth it to pay a little more for a high-quality service.

People who do not want a lot of information might also not find this analysis program to be satisfactory. That being said, there is always a free trial available if you know that you have become comfortable with all of the features and services offered before subscribing.

Pros and Advantages

There are plenty of advantages to having an account with The Motley Fool’s services. The company offers a large amount of information on any topic related to investing. One cool feature is the “Foolish Four” portfolio, which can give your insight into how other customers are making investments that have worked well for them.

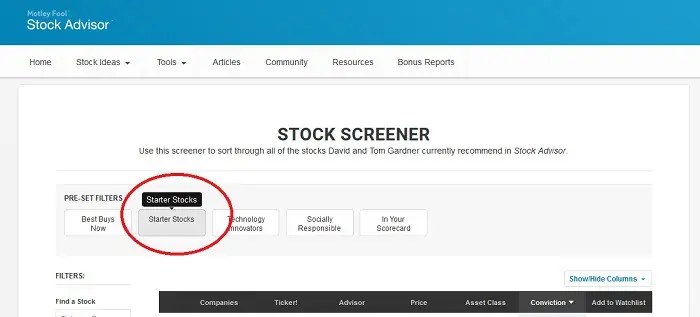

Check out that stock screener on The Motley Fool to get you started.

They also offer ideas based on other customer’s portfolios, so if you want assistance in creating your own investment strategy, this service could be helpful. Another interesting aspect is the virtual day trading game where you can apply all your knowledge about stocks to see how it would work out in a real-world situation.

Cons of Using Motley Fool

Although this company does have many positive aspects, there are some disadvantages that may be deal breakers for some people. For example, most of the information offered is general rather than specific, so if you want to know about certain details, you would have to look elsewhere.

Another downside is that they do not offer any tools or spreadsheets for helping with investing. There is no way to download data or anything like that which would make it more difficult if you wanted to compare different investments or markets in your area.

Additionally, they do not give personalized suggestions on what kind of portfolio might work best in your situation. Since their focus is on simplicity and keeping things uncomplicated, there are some features that seasoned investors may find missing when trying out this service.

Key Takeaways on Using Motley Fool

Overall, The Motley Fool has a lot to offer if you want help with making wise investment choices. However, the company also has some disadvantages that may make it unsuitable for some people’s needs. If you are looking for something more basic and less expensive, there are other options out there.

On the other hand, most of these cheaper alternatives have complaints about receiving bad information or not being able to provide all of the detailed planning that is offered by this service. Since they do have a free trial option, anyone willing to commit for a week can see how valuable their services really are without paying anything at all. Once you decide whether it is worth your time and money, you can accordingly so every subscriber benefit from a free two-week trial every quarter.

The company offers a large amount of information on any topic related to investing. One cool feature is the “Foolish Four” portfolio, which can give you insights into how other customers are making investments that have worked well for them.

They also offer ideas based on other customer’s portfolios, so if you want assistance in creating your own investment strategy, this service could be helpful. Another interesting aspect is the virtual day trading game where you can apply all your knowledge about stocks to see how it would work out in a real-world situation.

Do I Recommend Using the Motley Fool?

I would recommend this service to both experienced and inexperienced investors who are looking for something that provides personalized advice while also giving them the opportunity to explore different options before committing to one.

This program is easy-to-use, has high quality information, and you can always try it out for free for a couple of days if you are unsure about paying the subscription price. I hope this Motley Fool review gave you the go signal to realign your investing strategies with your investment goals.

Read the Entire Investing Strategy Series

- How To Declutter Your Investing Strategy

- The Perfect Sleep at Night Investing Strategy

- Why Is Diversification a Recommended Investing Strategy?

- BlockFi Review: Investing in Cryptocurrency the Right Way

- How to Make a Step by Step Investing Strategy [Simple Steps]