myFICO offers credit monitoring and ID theft protection but the website does much more to help you track and plan your credit

More than 15.4 million Americans were victims of identity theft in 2016 according to Javelin Strategy Research and that doesn’t count the 145 million that saw their personal information compromised in last year’s massive data breach of one of the credit bureaus.

In fact, identity theft strikes a new victim every two seconds in America according to Javelin.

In the time it took to read this article so far, five more people have had their identities stolen and credit destroyed!

Where it was once safe to gamble, and say, “It probably won’t happen to me,” the reality is that now there is a good chance most Americans will be the victim of hacking or ID theft at some point in their lives.

It’s just a fact of our digital world.

With an average cost to victims of $1,343 for each data breach, according to the Department of Justice, that means credit monitoring is now something that everyone needs. Credit monitoring and ID protection has become the insurance of the 21st century.

What is Credit Monitoring and ID Protection?

Credit monitoring and ID theft protection are actually two services but usually bundled and sold together.

Credit monitoring will watch your credit reports continuously to alert you when changes are made to your credit. This is the fastest way of seeing if your identity has been stolen and is being used to apply for loans or new credit cards.

Beyond watching for identity theft, credit monitoring can be important for people trying to track their credit score and planning to apply for a loan.

Identity theft protection is the shield and services companies can put up in case your identity is stolen. If your identity is stolen, ID theft protection helps you quickly stop the thieves from doing further damage and will help you restore your identity. It may even carry an insurance policy that reimburses you for losses.

What is myFICO?

myFICO is the consumer division of FICO (the Fair Isaac Corporation) and the first company to directly provide consumers with their FICO scores. myFICO is the only credit monitoring service that can provide you with all three of your FICO scores from the three credit bureaus; Experian, TransUnion and Equifax.

FICO has been the leader in credit scoring since the 1960s and is the industry standard used by lenders whenever you apply for a loan. Since myFICO uses in-house data directly from FICO, it’s the only monitoring service to offer the genuine score.

myFICO offers two programs to help you monitor and protect your credit: a one-time report and ongoing monitoring.

myFICO Programs and Prices

The one-time credit report is useful for preparing to apply for loans or checking for mistakes on your credit score. By law, you’re allowed to see your credit report free from each of the three credit bureaus once a year, but this might not be enough if you’re trying to plan for a loan.

The one-time credit report includes the FICO score simulator and score analysis to help understand how different items affect your credit. You’ll also be able to see the different credit scores lenders use for different types of loans.

The myFICO one-time report is usually $19.95 for each credit bureau but you can get a 20% discount through this link.

More importantly for continuous protection is the on-going credit monitoring service and ID theft protection. myFICO can monitor your credit report from a single bureau or from all three bureaus to provide a range of professional credit services.

- Instant access to all three credit reports and your FICO scores

- Track your FICO score on a historical tracking graph

- Monitor all three credit reports and get instant alerts when something changes

- Restore your identity with professional services and cost reimbursement

By keeping an eye on all three of your credit reports, myFICO can send an alert within 24 hours of any change. That gives hackers very little time to open new accounts or destroy your credit. You’ll be able to notify lenders immediately to denounce the scammers and keep yourself from getting stuck with the loans.

myFICO goes a step beyond reactionary monitoring of your credit and surveils black market websites that buy and sell personal information. This puts them ahead of the hackers to stay alert for potential ID theft.

If your identity is stolen, myFICO steps in with industry-leading ID protection that helps you recover your identity and stop losses. Here are some of the benefits of myFICO’s ID protection:

- Lost Wallet Protection helps you immediately cancel and replace missing items including credit cards, debit cards, checkbooks, driver’s license, social security cards, insurance cards and passports.

- 24/7 Identity Restoration has a U.S.-based certified resolution specialist on-call to help you recover your identity and get through the ordeal.

- $1 million ID Theft Insurance reimburses covered restoration expenses including legal fees, lost wages and other costs for up to $1 million.

Get your credit reports and scores every month from all three credit bureaus with FICO® Ultimate 3B

myFICO is More than Just Credit Monitoring and Protection

What I like about the packaged services on myFICO is that it goes beyond simple credit monitoring and ID theft protection with a suite of tools to help understand and use your credit score.

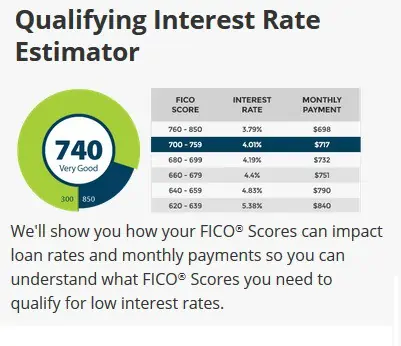

The interest rate estimator tool shows you comparative loan rates and monthly payments for different FICO scores.

The company uses its database to estimate rates on different types of loans so you know what score you need to qualify and what to expect when talking to a lender.

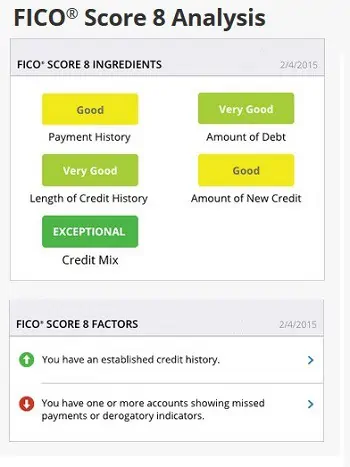

The FICO Score 8 Analysis tool studies your credit reports and shows you the top factors that affect your credit score.

This is an invaluable tool for building your credit and comparing your score with others to create the credit you need for a new loan.

Even those just reading through the blog on myFICO will find a library of articles on understanding your credit score, why it’s important and the factors that matter most to lenders.

myFICO Review Summary

Identity protection and credit monitoring is the cost of living in a digitally-connected world. It’s modern-day insurance to combat the rising identity theft and hacking crime rates.

With its unique insight as the creator of the FICO score, myFICO can offer unmatched monitoring and insight into your credit score. Only a few insurance companies even offer identity protection or credit monitoring services.

Beyond credit monitoring and protection, myFICO offers many of the tools you need to manage your credit score and be ready the next time you need a loan.

This is going to help you be proactive to get the money you need at the best rates available. Find more about these tools and credit monitoring to protect your identity on the myFICO website.