One of my favorite aspects of the BRRRR strategy is that it does not leave capital to languish. Employing the strategy means constantly recycling your initial capital.

Using leverage and sweat equity gained through forced appreciation, not necessarily swinging a hammer, you are able to continually grow your portfolio from the same initial capital. It is a similar concept to how Warren Buffett was able to grow his portfolio through his focus on capital allocation.

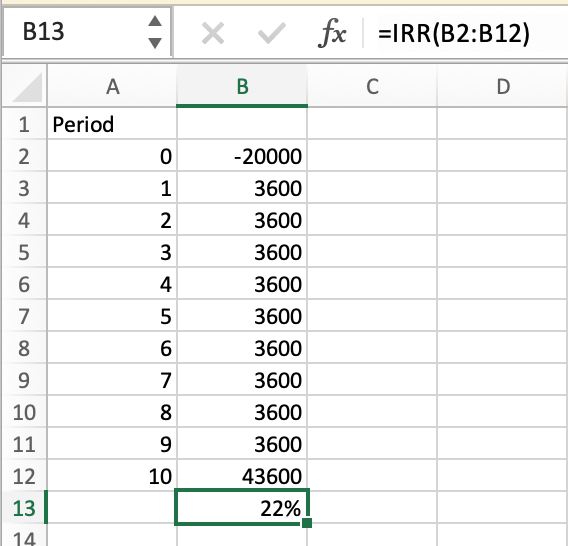

The best way to see the benefit of BRRRR on your returns is to compare the IRR (internal rate of return) on a few scenarios. The calculation of an internal rate of return is fairly simple using the IRR formula in excel. To do this we will use a set of assumptions.

Why Maximize IRR

The IRR is the discounted cash flow of all the future income streams of an investment. It is used primarily by commercial investors, though its applications are helpful for residential real estate investors as well.

Inside the IRR number, you will see all the benefits from capital gains, rental income, and any other income streams of the investment. You will also see the effects of cash outlays and operating expenses.

The IRR is not direclty impacted by net operating income, as it is concerned with cashflow.

Lets get to the IRR Calculations

In this calculation. I will also be ignoring potential benefits from appreciation, rental appreciation, principal paydown, and tax benefits.

Purchase Price: $80,000

Renovation: $20,000

Down payment: $20,000

ARV: $120,000

Rent: $1,200

Initial cashflow: $300

Initial mortgage: $400

Rental Property IRR

Over a 10 year hold, the total net cashflow is $56,000. That is pretty good cashflow on an initial $20,000 investment.

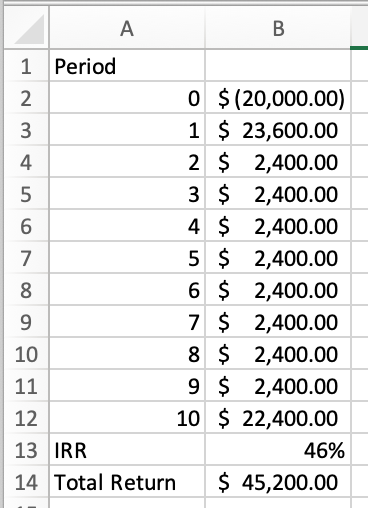

Rental Property IRR with Refi

In this scenario, we will do a cash out refinance at the end of period 1. The monthly payment will go up to roughly $500. This will reduce the cashflow to $200 a month.

The IRR went from 22% to 46%. This is because the principal was returned much faster. Having the additional cashflow events after the return of principal really adds up.

As you can see, the total return went down about $10,000. If you just let the money from the refinance sit, it would end up actually costing you money to employ this strategy.

By using IRR as a decision making tool, you need to be able to invest the cashflow into another project with similar return. If you are not re-deploying the capital, there is little benefit to getting it back faster.

IRR with Repeat

Now we are talking! The total return is 178k on a 20k investment. Of course, with 10 of these houses, 100k of that revenue was through active forced appreciation.

Mix of Active and Passive Investing

The selection of new assets, the renovation to make them rent ready, and the refinance process make this style of investing something outside of what could be considered “passive investing.” That can be the benefit rather than a con for this style of investing.

The number of hours spent acquiring and managing the renovation should be obtainable for a person maintaining a full time job.

The Assumptions Left Out

Appreciation: It is a good practice to think of appreciation as icing on the cake. It is hard to project, and depending on the market it could go the other direction over time. Especially in markets that do not have job growth.

With a 2% appreciation per year, the value of the rental property will increase from $120,000 to $146,000. With 3% per year, it would be worth $161,000. This could represent another $40,000 cashflow at sale that was not calculated into the original IRR model.

Rental appreciation: Rental appreciation is a bit more predictable and usually trends along with inflation. In certain markets where job growth is strong, there is a potential for a stronger appreciation in market rent.

With a 3% rental appreciation per year, in 10 years the monthly rent will be $1,600 a month rather than the $1,200 it started at. A good portion of this will go towards cashflow since the mortgage will remain the same. However, taxes, maintenance, and property management expenses will likely go up in a similar proportion to rent. Over the course of 10 years, this could represent an additional $26,000 in cashflow.

Principal Paydown: The effects of principal paydown are much more reliable than appreciation. It is a fairly easy number to reference an amortization schedule. On an $80,000 fixed rate 30 year mortgage with a 4.3% interest rate, the balance after 10 years is $63,491. This represents a paydown of $16,509 for an average of $137 a month. Kind of acting like a forced savings plan.

Wrapping it up

Hopefully by now, you can see the power of the BRRRR strategy. It is a no nonsense approach to leveraging forced appreciation to build wealth. By refinancing after the renovation, you are allowing your equity to exit, similar to house flipping, while still continuing to receive the rest of the benefits of a buy and hold investment. These are:

- Cashflow

- Appreciation

- Rental Appreciation

- Principal Paydown

The BRRRR strategy really compounds your growth by letting you earn from equity creation. It can be a great method for achieving financial independence.