A 650 FICO score isn’t quite enough to get you the best loan rates but I’ve got a strategy to get you there!

The world of loans revolves around your credit score and it can be agony trying to understand what score you need to get rates you can afford. Whether you’re building your credit score back up or just don’t have much of a credit history, a 650 credit score isn’t quite where you want to be but it’s getting close.

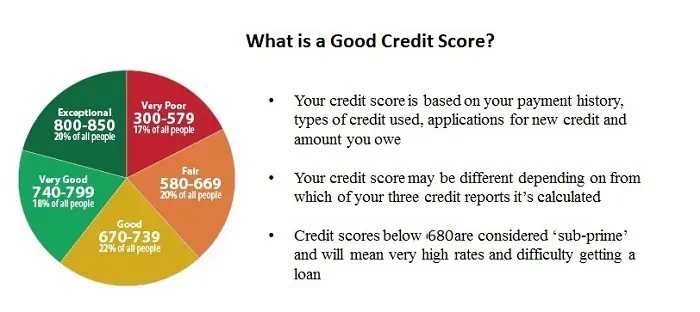

A 680 FICO is generally considered the boundary for good credit and the point where you’ll start getting loan offers at lower rates. That last 30-points though can seem like torture as you get denied the money you need or rates you can afford.

Let’s first look at why a 650 FICO is considered ‘bad credit’ and some loan options if you’re stuck. Then I’ll show you how to boost your credit score fast to get any loan you want and the money you need.

Is a 650 Credit Score Good or Bad?

I hate when people get labeled as ‘bad credit’ borrowers or when the banks say you need a certain FICO score to get a loan. There is no good or bad credit score!

There is though a point where it begins to get easier to get a loan and that’s where most people will tell you the difference is between good or bad credit. This is the point where banks and credit unions will approve your loan.

Around a 680 credit score, your loan qualifies for certain government programs that guarantee some of the repayment. When a bank makes a loan to someone with a FICO score above this point, it knows the loan can be sold quickly to investors for cash to make more loans.

Not being above that ‘prime lending’ rate means a 650 credit score will be considered bad credit by most banks. It’s not right because as you’ll see next, millions of Americans are stuck with that 650 FICO or even lower. That’s just the way the financial system is set up.

How Many People Have a 650 FICO Score?

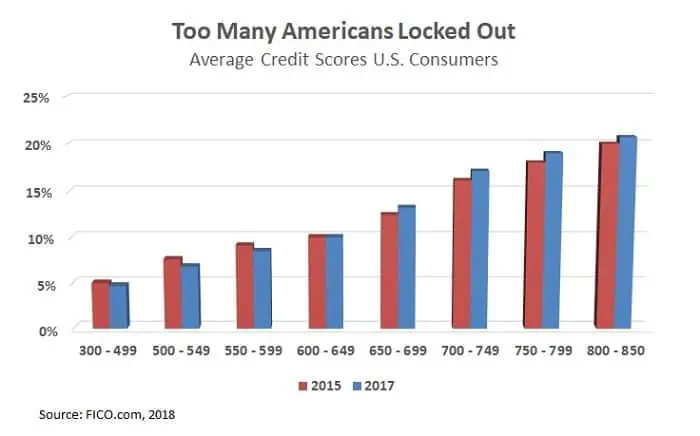

I created this graph from credit scores by U.S. population, comparing scores in 2015 with those two years later. Although it seems credit scores for most Americans are increasing as we get further out from the Great Recession, people with low credit scores are actually seeing their score decrease.

That’s a huge problem. Not only are these people already locked out of the financial system and can’t get the money they need, but it’s getting worse.

One-in-three Americans have a credit score under 650 FICO. That’s more than 74 million Americans that can’t get a loan from a traditional bank or can’t get a rate they can afford.

Can I Get a Mortgage with a 650 Credit Score?

Most banks will require a credit score around 700 FICO before considering your mortgage loan. If you’ve been a customer for a while and repaid other loans, you might be able to get a loan on a lower credit score but rarely will they go down to 650 FICO.

There are a few alternatives to a mortgage and we’ll talk about the best loans for the credit score below. You might try getting a personal loan for the down payment and ask for seller financing on the rest. If you can wait a few months, you might be able to increase your credit score enough to be approved for a lower rate mortgage. This can give you the opportunity to refinance the home to pay off the personal loan.

650 Credit Score Rates for a Car Loan

You’ll have better luck getting a car loan with a 650 credit score though the rates are going to be quite a bit higher than you see advertised. On a new car loan, you can get an interest rate around 13% on a 650 FICO. Used car rates are a little higher, upwards of 18% for that level of credit.

Hopefully you already see the problem in this. Paying 18% on a car loan of just $10,000 means you’re losing $5,235 in interest over five years. Your payments are going to be just over $253 a month which works out to $15,000 for that loan.

So even if you’re able to get a loan from a car dealer, should you? Are there ways to get better rates and loans on a bad credit score?

Best Loans for a 650 FICO Score

Getting the best rates on a loan with a 650 credit score or lower is a matter of knowing which websites will approve your loan and shopping around. Because it’s a sub-prime credit score, you’ll need to find the personal loan and peer-to-peer websites open to less than perfect credit.

I’ll list out a few of these below but follow these three steps to get the best rate on your loan:

- Shop your loan around. Check your rate on at least two or three sites to see which offers the lowest rate. Personal loan sites do what’s called a soft-inquiry on your credit so this pre-approval process doesn’t hurt your credit score.

- Apply for the smallest loan amount and for the shortest term you can afford. Interest rates are partly based on loan size and how long it will take to repay so these two factors are your best bet on lowering the rate.

- If you’re having trouble getting approved for the money you need, consider applying for a smaller amount to be paid off within a year. These short-term loans are approved more often than larger, longer-term loans. Paying off this short-term loan will raise your credit score and help you get approved for a larger loan later.

PersonalLoans.com is the loan site most often recommended by readers and the one I’ve used most. I’ve borrowed twice on the website, first to consolidate my credit card debt and later for a home improvement loan. The website is actually a loan aggregator which means it helps shop your loan around to its network of lenders.

The website specializes in bad credit loans and can approve loans to borrowers with as low as a 580 credit score. It charges a 5% origination fee and rates generally range from 10% to 36% depending on your score.

Check your rate on a loan up to $35,000 – instant pre-approval process

BadCreditLoans is your best bet for a loan if you’re having a tough time getting approved elsewhere. This shouldn’t be a problem with a 650 FICO score but sometimes other factors on your credit report will keep you from getting approved on other sites. If there are judgements against you or a bankruptcy on your report, you might want to try BadCreditLoans first to check your rate.

The site will usually approve loans on a credit score as low as 520 FICO though first-time borrowers will get capped at $1,000 and on terms of less than a year. You’ll get larger and longer-term loans unlocked once you pay off this starter loan.

Upstart is another good choice for loans and you should be able to get approved with a credit score of 650 FICO. The lender uses a unique credit scoring system that takes into account other factors besides FICO and your credit report. Factors like formal education that other websites don’t consider may help you get a loan at a lower rate on Upstart.

Can You Get a Credit Card with a 650 Credit Score?

I also get a lot of questions about whether you can get a house or credit cards on specific FICO scores.

For getting the big loans, like buying a house, anything under a 680 credit score is going to be difficult. The banks and credit unions will hesitate even if they let you in the door. You might be able to get a personal loan for the down payment if you can get the seller to finance the purchase for a year or two while you boost your score to get a mortgage.

The credit card offers will start coming in with a credit score well below 650 and you’ll start noticing better rates as your score improves. The problem is that the rates will still be fairly high even for people with good credit.

Whatever you do, make sure you know the payday loan laws and regulations around types of credit in your state. This will help you avoid the email scams out there and the high rates that come with illegal loans.

How to Boost a 650 Credit Score

Taking the three months or so to increase your credit score isn’t usually an option if you need money fast but it’s definitely something to think about for the future. With a 650 FICO score, you’re on the edge of getting into prime credit where you’ll start getting approved at traditional banks and start seeing your rates go down on any loan.

Even if you do have some time before you absolutely need a loan, getting a short-term starter loan can be one of the best ways to build credit and lower your rates. Peer-to-peer loan sites build into their lending process a preference for second-time borrowers. Not only will paying off your initial loan help build a good credit history and increase your score, you’ll also get those few extra points in the lending process that can mean a lower rate on your next loan.

Increasing your credit score has to start with knowing what’s on your credit report. You can download your report free from each of the three credit bureaus once a year to check what’s going on your report.

- Check for any errors like missed payments or collections that are not supposed to be on your report. Getting these removed by writing the credit bureau is the fastest and easiest way to boost our FICO.

- Pay down any revolving debt on credit cards or pay it off completely with a consolidation loan. Creditors hate seeing credit card debt because rates are so high and you can borrow more on the card at any time. Wipe this off your credit report and your score is guaranteed to increase.

A 650 credit score will not get you the best loan rates but you’re really close to it. Just one loan borrowed and paid off can be enough to increase your score enough to bump you into the 700s and get any loan you need. Understand what’s on your credit report and how it might be holding you back from getting the best loans available.